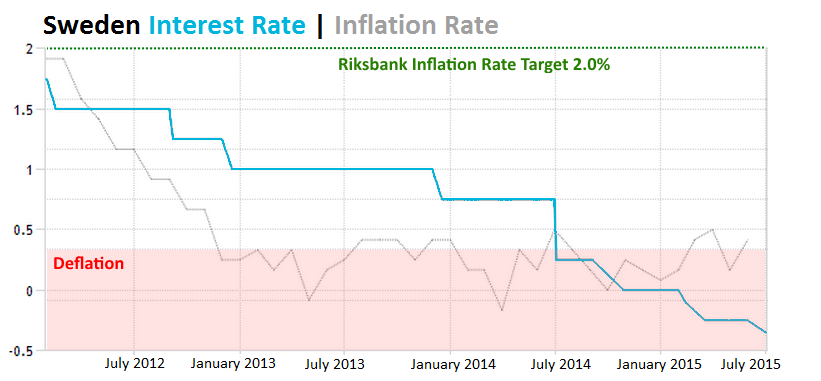

The Swedish Krone plunged more than 0.5% against the greenback after the Riksbank surprised with a rate cut to the record low of -0.35% from -0.25% before, to boost its Inflation rate, a move that the central bank did repeatedly over the last years. This rate cut was the third in 2015 after February’s and March’s. The Swedish Inflation rate picked up considerably in May but stills far below the Central Bank’s Target of 2.0%.

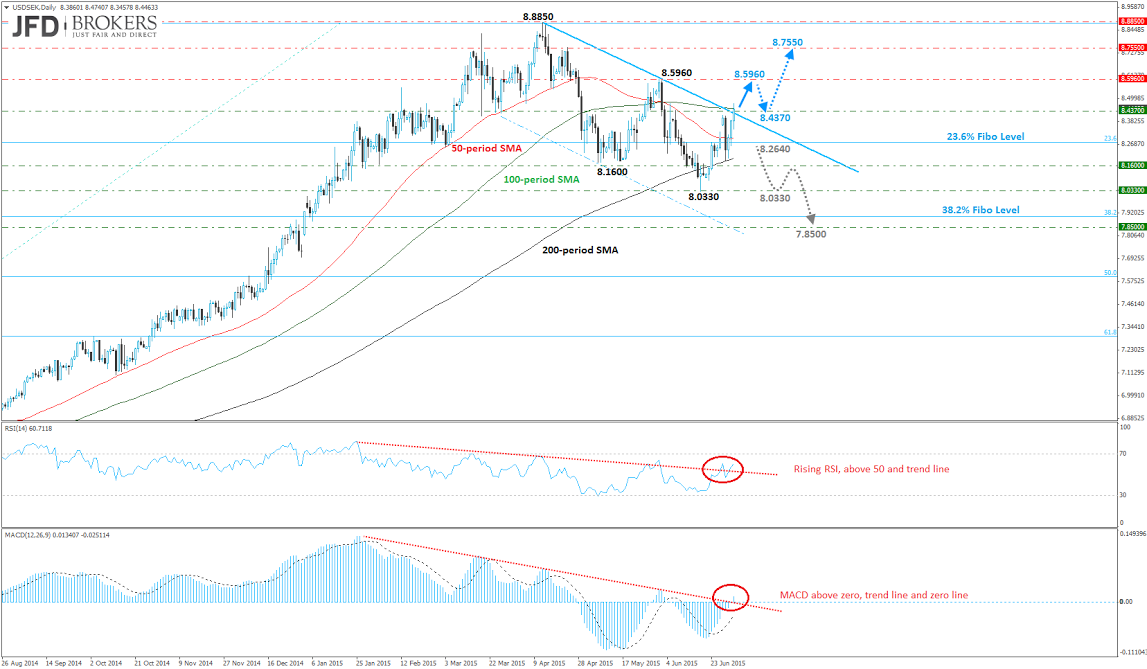

Despite seeing plenty of volatility in the USD/SEK pair few days ago, which saw it break below the 50-period SMA and the 23.6% Fibonacci level, the pair found a strong support from the 200-period SMA near the 8.1600 level and is now back trading near the 8.4370 area, where the 100-period SMA and the descending trend line, which started mid-April, combined to provide a significant resistance to the bulls. There’s clearly still a lot of indecision in the pair with traders still appearing to favour a break above than below, especially if we also consider the response to the massive support level of 8.0330 as well as to the 8.1600 level. c

Following the cut from the Riksbank the dollar surged above the 8.4370 barrier and it seems that there is a clear battle going on slightly above the upper boundary of the sloping channel, which could be translated as a flag formation, even though it appeared in the daily chart. This is typically a bullish continuation pattern. The case now is if the pair could sustain its gains above the 100-period SMA, the 8.4370 level and the descending trend line. A break above these would be very bullish, initially prompting a move towards the previous highs of 8.5960, followed by 8.7550 above this. Both oscillators violated their downward sloping resistance lines and alongside with the bullish cross of the mid-levels it increases the probability of further upward movement.

On the other hand, if the pair turns lower, support should be found around 8.0330 and then at 7.8500. A close below here would have suggested that the pair had entered a new downtrend.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD comes under pressure near 1.0630

Further gains in the Greenback encourage sellers to maintain their control over the risk complex, forcing EUR/USD to retreat further and revisit the 1.0630 region as the US session draws to a close.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.