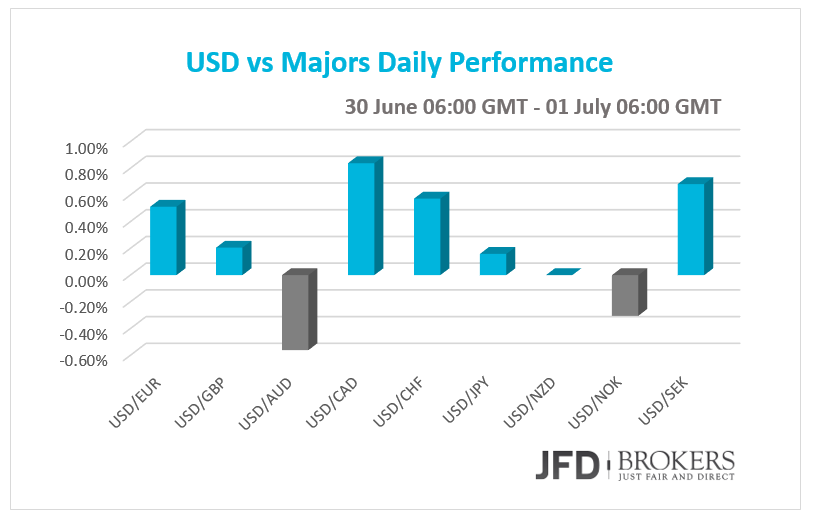

The dollar was traded higher against most of the major currencies on Tuesday and early Wednesday as the market expects the ADP Employment Change today and the NFP Report tomorrow.

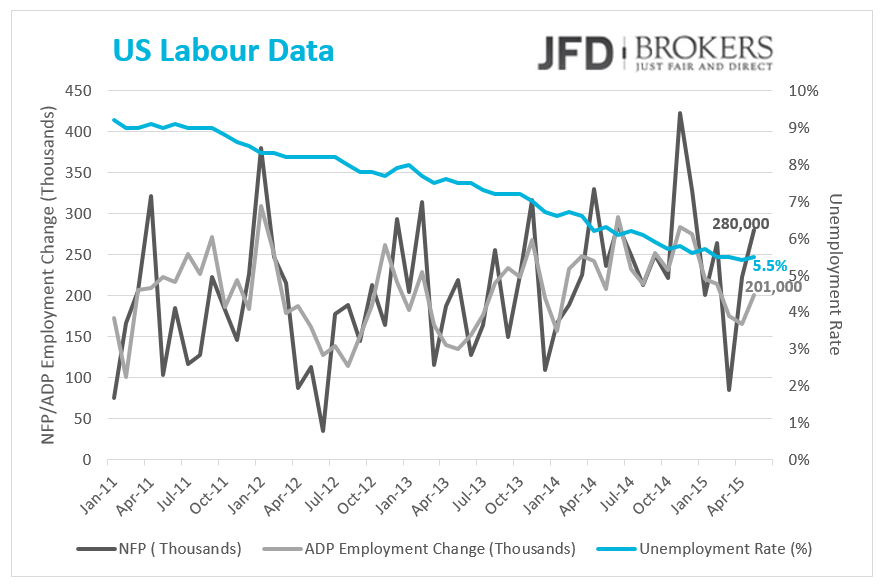

The CB Consumer Confidence released yesterday was better than anticipated in June, 101.4 vs 97.3 expected, witnessed the increased morale among the consumers. The ADP Employment Change, scheduled to be published today, is expected to have picked up in June to 218k from 201k before. The ISM Manufacturing PMI, which coincides with the number of jobs the US economy adds each month on the macro-view, is foreseen to have edged higher to 53.1 in June from 52.8 the month before. The labor indicators scheduled for tomorrow are expected to reveal a decreased unemployment rate, 5.4% from 5.5% before and a lower number Non-Farm Payrolls than in May. However, the 232k forecasted from 280k before is still a healthy number as it is above 200k.

Greece missed its IMF loan repayment, €3.5bn Bonds Payment is coming up

The euro continues to suffer losses against the majors due to the fears of Grexit as the Eurozone officials refused the Greek Prime Minister request for a bailout extension. The discussions for a possible deal continued until the last minute yesterday night, but they ended nowhere. Therefore, Greece officially missed the IMF debt repayment of €1.6 billion. The uncertainty surrounding as at 20th of July Greece has to pay €3.5 billion to bonds held by ECB. If Greece miss this deadline, the European Central Bank can rule out Greece from emergency loans. Fitch downgraded Greece’s rating to CC from CCC which means highly vulnerable.

GBP unchanged on the strong UK GDP

GBP/USD remained in a tight range despite that the UK economy advanced by 2.9% the first quarter at an annual rate, surpassing expectations to have expanded by 2.5%. The quarterly growth met market’s prediction of 0.4%. However, the market didn’t pay too much attention as the market participants globally are preoccupied with Greek Turmoil. Today, the BoE Financial Stability Report will be published.

Nothing changed to the GBP/USD pair as it remained trapped in a tight range, roughly around the psychological level of 1.5700, whilst moving down to the key support level of 1.5660 and up to the psychological level of 1.5800. Over the last couple of weeks, the pair has moved aggressively downwards, pushing through some significant obstacles, including the 50-period SMA, as well as below the psychological level of 1.5800. The pair has been in a strong upward trend since early-June and the bias will remain to the upside as long as the pair remains above the 200-period SMA near the 1.5550 barrier, which coincides with the 38.2% Fibo level and the ascending trend line which started back in mid-April. Therefore, the bears will need to go through these significant obstacles to turn the picture to negative. A break above the psychological level of 1.5800 should open the door for further pressure towards the 1.5900 level, then 1.5930 will be in sight.

NZD Profit Locked at 0.6800; CAD and AUD Surges

With oil prices sliding (WTI -1.4%) the New Zealand dollar has been sold off taking out the suggested target at 0.6800 (http://bit.ly/1GLE4uu). The NZD/USD fell for nine weeks out of ten on Monday, as traders remained cautious ahead of Thursday's US Non-farm Payroll report.

On the other hand CAD and AUD both surged against the USD, with the former recording its third positive day in a row. The USD/CAD is trading above both, the 50-period SMA and the 200-period SMA on the daily chart while the descending trend line as well as the 1.2500 level, will try to prevent the bulls to test the key resistance level of 1.2580.

In the same pace, the AUD/USD surged above the 50-period SMA on the 4-hour chart, however it struggles to break above the 0.7750, where the 200-period SMA is ready to provide a significant resistance to the price action. On the 1-hour chart, the 50-period SMA and the 0.7680 level, combined to provide a support to the pair in case of a pullback.

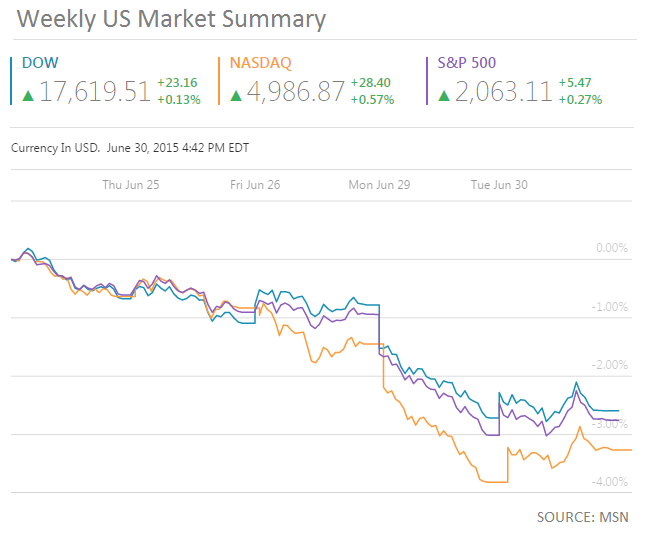

US Indices higher after four days of drop

The US stocks after a day of severe losses closed higher, trying to recover their losses. The Dow Jones Industrial Average closed 0.13% up, +23.16 points with top gainer stock the Walt Disney Co (NYSE: DIS), +1.07% up. The Nasdaq Composite Index ticked 0.57% higher, 28.40 points after four days of consecutive losses as well as the S&P 500 which also added gains of 0.27% after four straight days that depreciated.

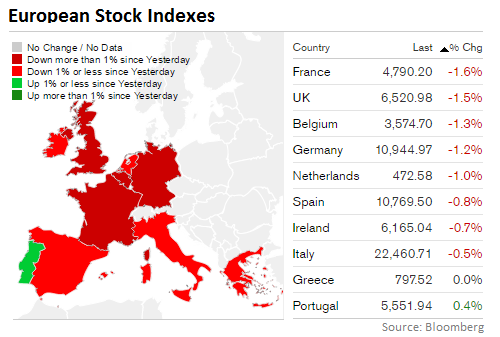

European Indices Analysis

Following the news out of Greece over the last few days, European indices closed negative yesterday, initially taking the French CAC40 below the key support level of 4880. Although the index did not reach the 4983 level, which coincides with the upper boundary of the sloping channel, it did still bounce from the bottom end of its downward channel of the past two months, with a first target of 4760, which the index retested yesterday. A clearance of the descending trend lines around the 4700 – 4710 zone would be a good first step to changing the direction of the trend, but a failure to maintain the move lower would see the index move further up and test 4880 and then 4983.

On Tuesday, we saw the UK100 breaking below the key support level of 6550 and post its fifth consecutive negative week in a row and is on track to record a sixth straight negative weeks. The index is looking very bearish in the short-term, having broken through the aforementioned support level yesterday, before also breaking through the 50-period SMA on the weekly chart. With the above in mind, if the selling pressure continues, I would expect the sellers to drive the index lower towards the key support level of 6300, which includes the 200-period SMA on the weekly chart. On the other hand, if we see a pullback in the coming days, the Fibonacci levels may be a key, in particular the 38.2% and 61.8% retracements, with the latter falling in line with a previous level of resistance.

DAX30 moved higher during yesterday’s session while remaining in the downward sloping channel on the 4-hour chart. This channel can be translated as a flag formation on the daily chart as well as a technical correction of the trend in the medium-term. Currently, the index is trading above the key support zone of 10800 - 10850 and is increasing the rate of attempts to reach the psychological level of 11300, which includes the 200-period SMA as well as the upper boundary of the channel. On the daily chart, the 200-period SMA is providing a strong support to the index slightly above the aforementioned zone. Therefore, if the index maintains its positive attitude above the aforementioned obstacles we could see a correction move towards the 11230 level, which coincides with the 50-perido SMA and the 200-period SMA on the 4-hour chart. However, with ADX being above 25 and curving downwards and the MACD in a bearish territory, we should be cautious for a pullback and a retest of the 10800 region, before it resumes upwards towards the aforementioned target.

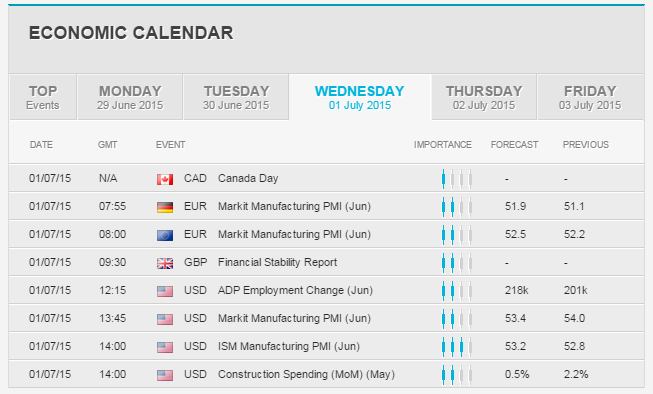

Economic Indicators

Today is a bank holiday in Canada. In Europe, we start the day with June’s Markit Manufacturing PMIs for Germany, UK, France, Italy, Greece and Eurozone as a whole along with the BoE Financial Stability Report. A while later, the traders’ attention will be turned in US where important labour indicators are expected the day before the NFP report as well as the ISM and Markit Manufacturing PMI for June.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.