The Dollar Came From a Strong 2014; Should it Keep the Positive Momentum?

The greenback has reasserted itself on the global stage the past few weeks following the recent aggressive sell-off against its G10 currencies. The dollar was trading -4.60% lower in April against the euro, slipped -3.60% against the pound and plunged -0.65% against the yen. The greenback also sold-off heavily against the commodity currencies. The CAD gained +4.82% in April, the NZD edged +1.97% higher and AUD added +3.90% to its value.

Conversely, the gold was reversing its March’s losses as it closed slightly higher on April +0.07%, and now is in the process of closing positive for a second consecutive month.

US Dollar is Coming From a Strong 2014

However, looking at the bigger picture, the greenback’s upward movement has been widely anticipated as the dollar have had the strongest year against most of its G10 peers in 2014, followed by a good first quarter in 2015.

The U.S Dollar index (DXY), a measure of the greenback’s strength against a basket of widely traded currencies, rose more than 10% in 2014, closing the year above the psychological level of $90.00, the highest since September 2003. However, the dollar bulls did not stop there, as they won the battle vs. the bears above the latter level and surpassed the psychological $100.00 mark, in mid-March 2015.

The dollar touched a fresh 12-year high against the euro and gained versus the pound recording a five-year high. The buck rose more than 2.5% versus the Japanese yen in May, surging above the psychological level of $120.00, which added more than 13% in its value in 2014.

Conversely, the XAU/USD weakened -1.5% in 2014, however it’s now trading near the psychological level of $1,200 with the gold bulls to be up almost 1% year-to-date. Despite the recent gains, the precious metal soared in value and is currently struggling near $1,200 as market participants looked for alternative stores of value or ‘safe-haven’ assets.

Meanwhile, the commodity currencies (AUD, CAD, and NZD) have also been weakening, with the former one plunging more than 4.50% year-to-date. Commodity producing currencies typically have been impacted by falling oil prices. WTI Crude oil, one of the main benchmarks, fell from $100 last August and hit lows of $42 in mid-March; it has recovered to around $60 per barrel today.

Furthermore, in emerging markets the drivers of dollar strength are somewhat similar to those in developed markets. Since mid-2014, the greenback has surged nearly 15% against the Brazilian Real (BRL) as the Brazil economy is being hurt by slow growth and high inflation. The Russian Ruble (RUB) also suffered against the dollar in the back of falling oil prices and a series of economic sanctions imposed by Europe and US. Since the mid-2014, the USD has nearly doubled in value against the RUB.

Very impressive performance from the dollar and an outstanding financial asset to have had in your portfolio in 2014.

Positive Start for US Dollar in 2015

Going forward, in the first quarter of 2015, market participants rushed into the greenback, confident that stronger U.S. economic data would persuade the Federal Reserve to hike interest rates from near zero for the first time since before the financial crisis.

While the picture was improving in the U.S., especially in the first quarter in 2015, the rest of the world’s economies and particular the Eurozone’s outlook, was facing economic hardships in various sectors. Back in June 2014, the ECB cut its deposit rate for banks from zero to -0.1%, to encourage banks to lend to businesses and consumers rather than hold on to money. Furthermore Eurozone’s economy was slowing; +0.3% in the last quarter of 2014 and +0.4% in the first quarter of 2015, and inflation was declining; four negative months, two main reasons the ECB recently pumped €1 trillion into eurozone economy.

It was at this time, both the euro and the pound recorded a fresh 12-year low and 5-year low against the dollar, respectively.

Fed Stopped Dollar’s Appreciation

However, the aggressive dollar sell-off started on March 18 after the Federal Reserve removed the word ‘patient’ from the FOMC statement. Federal Reserve’s April meeting revealed officials doubt that the economy is not ready for an interest rate increase this year.

The drop in the greenback has surprised investors who were most bullish on the dollar as most headline in the financial magazines were addressing for EUR/USD to reach parity in the mid-2015 and some others the cable to plunge further and to test the historical level of 1.4000.

The euro and the pound, both recovered aggressively against the dollar with the EUR/USD correcting itself above the psychological level of 1.1000; it has dropped below 1.1000 few days ago, while the GBP/USD added more than 1k pips, surging above the psychological level of 1.5500; also the cable dropped below 1.5500 a several days ago.

Dollar Bulls are Back!

By the time the dollar bears thought that they had dominated the market, the dollar bulls have come back to prevent any further dollar depreciation.

The dollar covered immediately some of its recent losses and extended its gains the last couple of days after the US CPI ex Food and Energy posted its largest gains since January 2013.

Now, with the correction to be in an end, as the dollar aggressive pullback dominated the market in the last couple of days, the market participants hang on every word that comes from the Fed to decipher when Fed will start raising interest rates gradually. Higher U.S. rates would attract investors to the dollar, as they would boost returns on assets denominated in the currency.

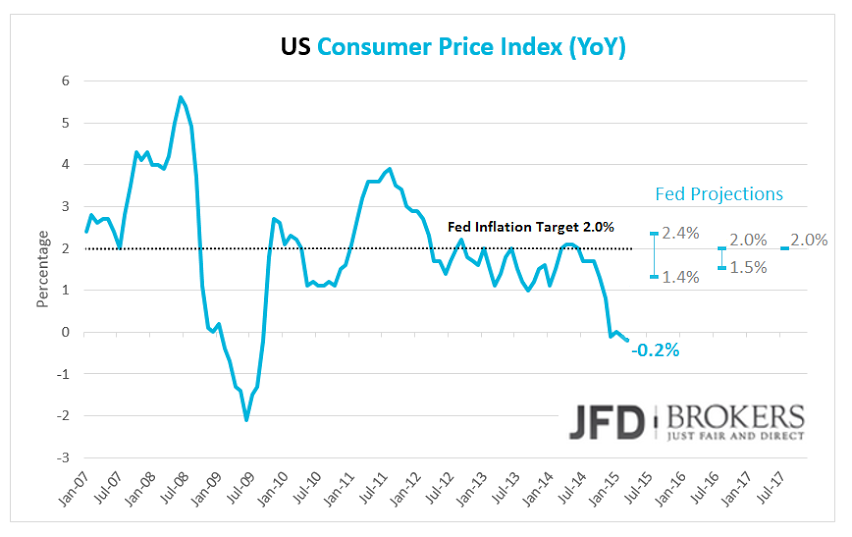

In the last FOMC minutes, Fed policymakers said that an interest rate in June will be a hasty move despite the moderate growth of the country. The latest CPI release confirmed that a June interest rate will not happen as US economy is officially on a deflation battle the last four months. In January the country’s Inflation rate dropped to -0.1%, a level we have seen since November 2009 after the global crisis, and in the next months declined further to -0.2%.

The Fed policymakers are very confident that the Inflation Rate will return back to 2%. Fed Chair Janet Yellen said that she expects proves for the Fed’s “reasonable confidence” stance that inflation will head back to 2% and another one goal is to see a continued improvement in the labor market conditions.

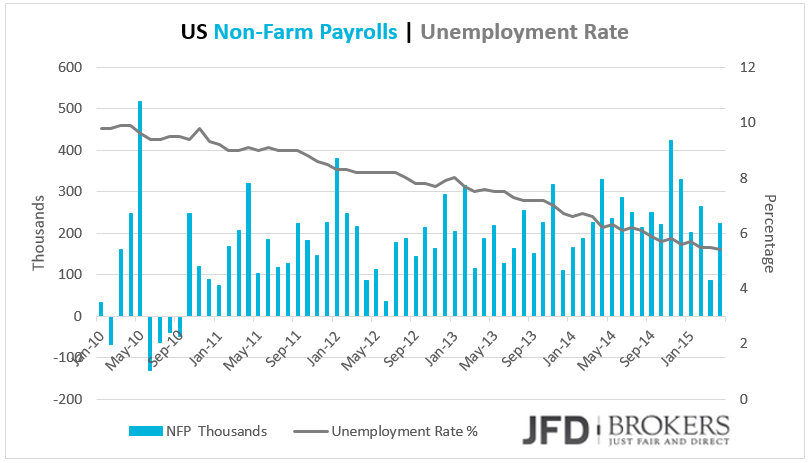

The country’s unemployment rate slipped to a seven-year low of 5.4% in April while the US economy added 223k jobs in April, returning above 200k, which is a considerable improvement from March’s number of 85k. Next Friday, the Bureau of Labor Statistics (BLS) will release its national jobs report, commonly referred to by its acronym, NFP (Non-farm Payroll). Next FOMC meeting will be on June 16- 17.

It’s worth noting that Yellen said that a rate hike later in this year it would be warranted if the economy continue its improvement like expectations as the first rate hike depends on the data, not on the date.

Greece Debt Crisis

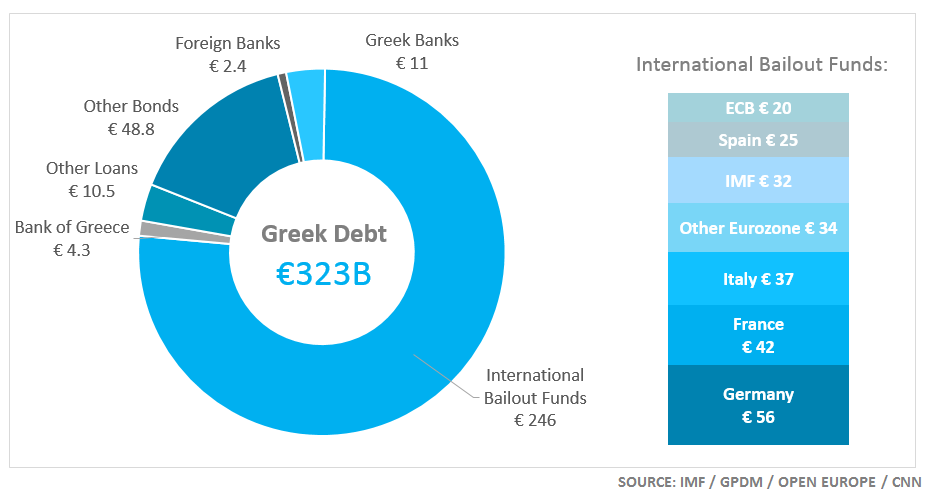

Another event that could have a significant impact on the EUR/USD pair is the Greek debt crisis. The euro has tumbled more than 20% against the dollar since May 2014, plunging from nearly the psychological level of 1.4000. The Greek financial crisis was one of the main drivers behind the recent EUR/USD drop.

Greece has been pushed a step closer to bankruptcy and a potential exit from the euro, as it has stopped receiving financial support from its creditors since August 2014. Each time Greece officials were founding a temporary solution to meet their debt obligations, the euro was retracing short-covering some of its losses, even though the medium-term outlook was remaining negative since the pair was traded below some significant obstacles, including the 200-period SMA as well as the descending trend line.

Now, the concerns are rising as Greece may default at the end of June. Greece had to pay €310M as the first instalment of its €1.6 billion IMF debt repayment in June but as the discussions couldn’t reach an end and Greece cannot afford the payment, Eurozone officials allowed Greece to avoid the next June IMF bills and to pay the total amount at the end of month.

Technical Analysis

EUR/USD Plunges Below 1.20 and 1.10; Finds Temporary Support at 1.0460

Looking at the monthly chart, the EUR/USD has plunged below to some significant obstacles, after its peak at the psychological level of 1.4000, including the 200-SMA and the key resistance zone of 1.1850 – 1.2040. Following the break below the psychological level of 1.2000, the sell-off was quite aggressive, which pushed the pair in territories not seen since December 2002. It is quite impressive that the dollar bulls rally has just run out of steam after having completed nine consecutive months of gains, as the USD bears rally halted by a new found support level at 1.0460. However, the pair is since risen and currently consolidates below the psychological level of 1.1000, following the sharp rebound nearly the psychological level of 1.0500.

On the weekly chart, the pair retraced some of its weekly gains as the dollar bulls took a breather slightly below the psychological level of 1.1500. Moving forward, the overall EUR/USD downtrend which started back in early May 2014, is weighted on the pair as the price is trading below the descending trend lines as well as below both, the 50- and 200-period moving averages.

The EUR/USD pair is still extending its downtrend from 1.4000 and more recently from 1.1465, however, a huge sell-off still persists. However, given how aggressive the market has been the last few months; EUR/USD bear market since it reached the 1.4000; we could see the market calm down for a while and trade in a range between the 1.0400 – 1.1500 for the next couple of months. Both of these significant levels will be my confirmation for any changes in bias in the market.

Therefore, a break above the 1.1500 barrier, would open the door for further correction, prompting a more aggressive move towards the 1.1850 – 1.2040 zone. On the other hand, a break below the key support barrier of 1.0460, should add further pressure for the pair to reach parity (1.0000).

GBP/USD Recovers Ground After Bouncing From 1.4570; is This a Temporary?

The pound also pared some of its weekly gains against the dollar after rallying earlier to its highest level at 1.5820 against the greenback since December 2014. The 200-period SMA is providing a significant resistance to the price action near the latter level while the 50-period SMA is ready to prevent any upside move near the psychological level of 1.6000. On the downside there isn’t any major support levels, within the 1.5820 barrier and the psychological level of 1.5000.

In the bigger picture, the GBP/USD pair is trading in a sideways channel roughly around the 1.6000 level, whilst moving down to the key support zone of 1.4560 – 1.4800 and up to 1.7200. Over the last couple of weeks, the pair has moved aggressively upwards, pushing through some significant obstacles, however, the pound bulls failed to reach and test the psychological level of 1.6000, as a result to plunged lower below the key 1.5500 level.

The same applies to the GBP/USD pair. I would expect the pair to move in a sideways trend for a while, before breaking above or below the significant levels of 1.5820 to the upside and 1.5000 (daily chart) or 1.4600 (weekly chart) to the downside.

Conclusion

Overall, a nation’s currency along with the Gross Domestic Product (GDP) is a comprehensive way to gauge the health and well-being of an economy and at the moment the US is setting the pace for the rest of the world. The US economy is the largest economy in the world in terms of nominal GDP. Even though the GDP in US expanded by 0.2% in the first quarter of 2015, the previous figures came in strong as the US economy grew at an annual rate of 5% in the third quarter of 2014 and 2.2% in the last quarter of 2014, with the former being the fastest pace in more than a decade. Furthermore, the labor market added more than 1.5 million jobs during the last six months.

The appreciation of the dollar is likely to continue due to numerous factors. In particular, this week will be pretty crowded with economic data, beginning with the OPEC meeting, which in turn comes ahead of Wednesday’s ECB policy decision, and then on Friday, the US Jobs data and NFP report. With the busiest week of the month now in front of us, it is time for the markets to try and absorb all of the information from the last few weeks, prepare of it and decide how they now position themselves going forward.

However, the key event for the markets will be the NFP report; the most widely anticipated report in the economic calendar; as a good figure above 200k could add further pressure on the Fed to raise interest rates sooner rather than later. Thus a positive NFP figure on Friday, could change the Fed’s language with the respect to the potential timing of US rate rises.

Whether, the demand of the dollar will boost in the FX market, will depend to a large extent on whether the Fed starts increasing its interest rates. A tighter monetary policy would tend to strengthen the greenback because higher interest rates will make the dollar more attractive to foreign participants, thus the demand for the dollar will be increased in the FX world.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.