The week keeps the investors’ attention as it is crowded with important economic data. The dollar climbed higher against the other G10 currencies on the first trading day of the week ahead of the Non-Farm Payroll scheduled for release on Friday. The euro is exposed to Greece discussions and ECB Monetary Policy Statement.

The British Pound remained stable against its major peers on Monday’s trading session in the absence of important UK news, and on the back of the BoE Meeting on Thursday. The Gold recorded a fresh session high while WTI Crude Oil ticked higher but remained in a downward slope.

Euro under Pressure as Greece is near a strict Loan Repayment Deadline

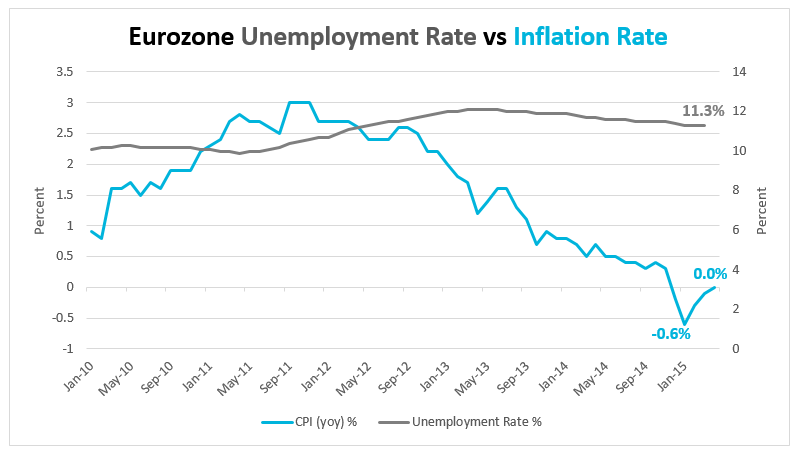

Greece representatives negotiate for another one rescue package from their creditors and if the discussions cannot reach an end, Greece will face bankruptcy. On Friday, Greece must pay 300 million euros debt repayment to IMF which is the first and the smallest payment of a number of payments in a row scheduled in June, a total of 1.6 billion euros. As the discussions are facing a strict deadline, hopefully, they will reach a result soon, since the temporary solutions that announced once in a while, were denied one by one shortly afterwards without any final official confirmations. However, the euro is extremely volatile on each official or leaked comment about Greece, with German Chancellor Angela Merkel, IMF chief Christine Lagarde, ECB President Mario Draghi, French President Francois Hollande and European Commission President Jean-Claude Juncker to pressure the situation in order to help Greece to end with a plan that averts default in the next days. The upcoming ECB Monetary Policy Statement tomorrow is unlikely to have major changes, but the investors will keep an eye on the ECB President Mario Draghi Press Conference to draw their next Euro trades. It’s worth noting that Eurozone’s estimate for Consumer Price Index in May may have a positive impact on the shared currency if the market forecasts come real. The year over year Inflation Rate is expected to have increased to 0.2% from a flat performance before. In addition to today's CPI release, May's unemployment rate announcement tomorrow is expected to show a slight decline to 11.2% from 11.3% in April. However, the impact is difficult to foreseen, as the CPI release may disappear among the Greek updates.

From a technical point of view, the single currency has been holding a side trend against the greenback since the May 25, hovering roughly around the 1.0950 region, whilst moving down to the key support level of 1.0820 and up to the psychological level of 1.1000. The EUR/USD has been firmly capped below 1.1000 but remained above the previous low of 1.0820 as negotiations with Greece continued to drag on over the weekend with no prospect of resolution in sight. On the longer term picture, the euro confirmed the bearish bias against the dollar, following the break below some significant obstacles, including the 1.1300 and 1.1130 levels, as well as below the 200-period SMA near the 1.1020 level, which includes the 23.6% Fibonacci retracement level. Overall, we continue to consider that the longer-term picture for the EUR/USD pair is weaker, although the fundamental developments this week, including the ECB policy meeting on Wednesday and the Greek debt payment (€300 million to IMF), may end up being EUR positive.

For today, we are expecting further sideways price action, ahead of tomorrow’s ECB meeting between the 1.0800 – 1.1020 levels. Bearing the above in mind, I remain bearish on the EUR/USD pair, however, considering that a sharp volatility is expected within the upcoming short period (ECB and NFP), I will adjust my levels from a higher timeframe. Therefore, I will await for the price to retrace towards the 1.1020 area (probably triggering some stops) before getting short in the market. From thereon, I would expect the sellers to push hard, and if they manage to win the battle of the 1.0820 – 1.0850 zone then they could send the price aggressively lower towards the key support level of 1.0650. Alternatively, if the key resistance level of 1.1020 level is broken, it would suggest that the pair is looking a lot more bullish (for further correction), prompting a more aggressive move towards the 1.130 – 1.1150 zone, which coincides with the 100-period SMA on the 4-hour chart.

Dollar prepares for NFP!

An important week for the dollar as we head in the first week of the month and the Non-Farm Payroll report is due. In the week ahead all the US economic indicators will be examined cautiously from the market participants for any references what to expect from the NFP report. The ADP Employment Change in May is expected to return in 200k after it softened for the fifth consecutive month in April, coming out 169k. The forecasted number raises some hopes among the investors for the NFP report which is expected to have advanced at a steeper pace of 227k in May from the healthy number of 223k the last month. Meanwhile, the unemployment rate is projected to have remained at the seven-year-low level of 5.4%. In the most probable case, that the scheduled news came in line the expectations or even better than projections, the Fed will receive a sign for the right timing for the first interest rate hike in nearly a decade. Thus, the NFP report has a double meaning for the future of the economy.

Pound ahead of BoE & CPI Expectations

The main Sterling drivers of the week are the Bank of England Interest Rate Decision along with the Asset Purchase Facility as well as the release of the Consumer Inflation Expectations. The Central Bank is not expected to change their policy but to maintain its Interest Rate unchanged at the record low of 0.5% for more than five years. The market also expects the amount of money the Bank inject into the economy through the bond-buying program every month to be kept at £375 billion. However, BoE event may prove to be a non-event as the BoE is likely to keep the monetary policy stance unchanged.

Bears knock Gold Prices back below $1200

The precious metal had climbed to a session high on Monday on the mixed US data releases at $1,204.35, however, it was unable to hold on to the gains and closed once again below the psychological level of $1,200. Gold - the most active futures contract - has been hovering around the $1,200 level for last three months, but has not been able to break clearly higher, stymied by a strong dollar.

At the end of last week it looked like selling pressure on the yellow metal had increased, however, the bulls managed to maintain the price above the key support levels of $1,178 and $1,184. To start to get bullish on gold in the short term we will need to get above $1,200 (4-hour close). Above here opens the way to $1,260, which includes the descending trend line that started back in August 2013. If the NFP report meets expectations then we could see further downward pressure and we may fall back below $1,180.

WTI muted above $60.00 ahead of OPEC

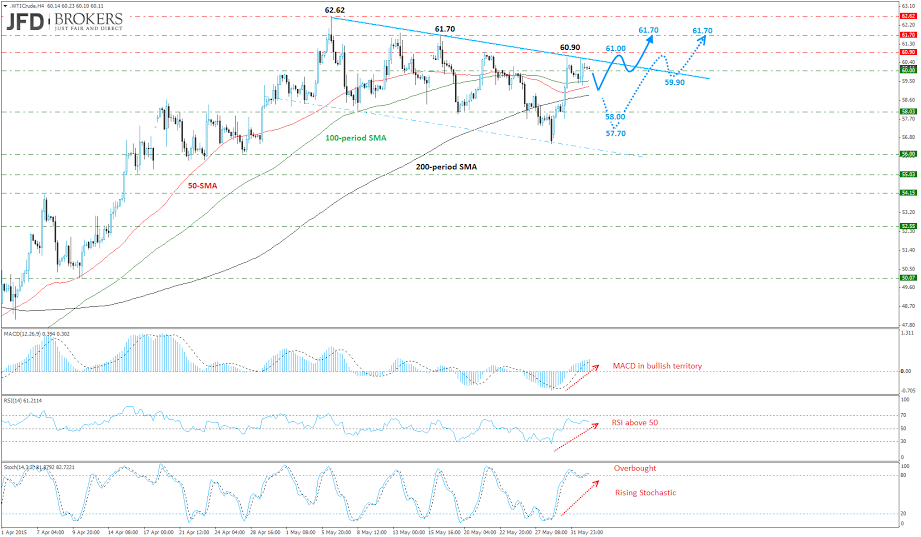

WTI Crude oil moved higher the last couple of weeks, while remaining in the downward sloping channel as you can see on the 4-hour chart. This channel, can be translated as a flag formation on the daily chart as well as a technical correction of the trend in the medium-term. Currently, WTI is trading above the psychological level of $60.00 and is increasing the rate of attempts to reach the $60.90 for a retest, ahead of OPEC’s meeting.

The 4-hour chart shows price limitation above a slightly bullish 50-moving average, near the $60.00 level, while momentum indicators are moving upwards, keeping the pressure to the upside. That being said, if the bulls manage to drive the battle towards the $60.90 barrier, which includes the upper boundary of the formation, then I would expect extensions towards the $61.70 barrier. Alternatively, given how aggressive the rally has been over the last five days, following the strong rebound from the $56.50 level, we could see a brief period of consolidation, before a continuation of the move towards 6 May highs, around $62.60.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.