US Indices Recovered Previous Sell-off as Greece Claims Deal is Close; Creditors Doubt; USD broadly higher

The market is very quiet since the start of the week with most of the currency pairs having low volumes. We are going through the week before the NFP release and market seems to take a break of high volatility, worrying the investors.

Even major events like US Durable Good and BoC Rate Statement which usually have a significant impact on the directly related currency cross pair left the market indifferent. The traders hope that important economic indicators come later in the week may move the market and help them with their trades. However, given how aggressive the market has been the last few months; EUR/USD bear market since it reached the 1.4000, GBP/USD bear market from 1.7200 to 1.4560 and the aggressive pullback to 1.5820, USD/JPY trending upwards from March 2012, USD/CAD bull market since June 2012, AUD/USD bear market after breaking below its parity 1.0000; we could see the market calm down for a while and trade in a range.

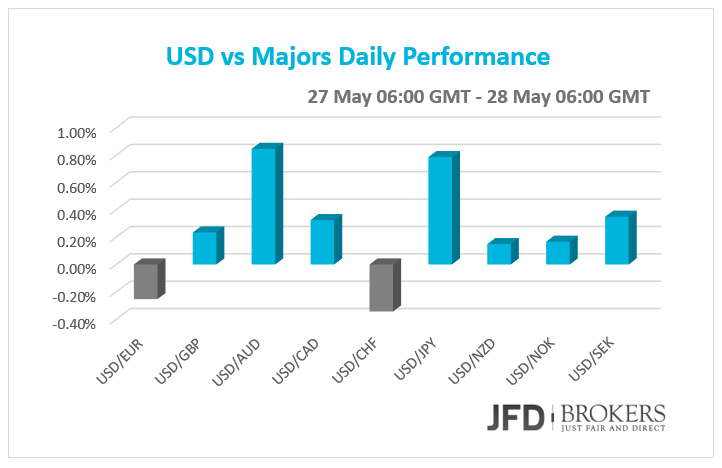

The greenback was higher against of its G10 counterpart during Wednesday and early Thursday trading sessions despite the absent of major market affecting events in US. However, we have seen high performance only against a few currencies and very slightly changes against the others. The dollar surged mainly against the Australian dollar and Japanese Yen ,and fell versus the euro and the Swiss franc. Going forward, EUR/USD survived another one drop after a draft deal announced. The GBP was traded mixed against the major peers. Furthermore, BoC remained stable at its monetary policy, keeping its benchmark rate unchanged. The U.S. indices closed higher encouraged by Greece news while the U.S. dollar index remained flat.

Greece says deal is close but creditors are uncertain

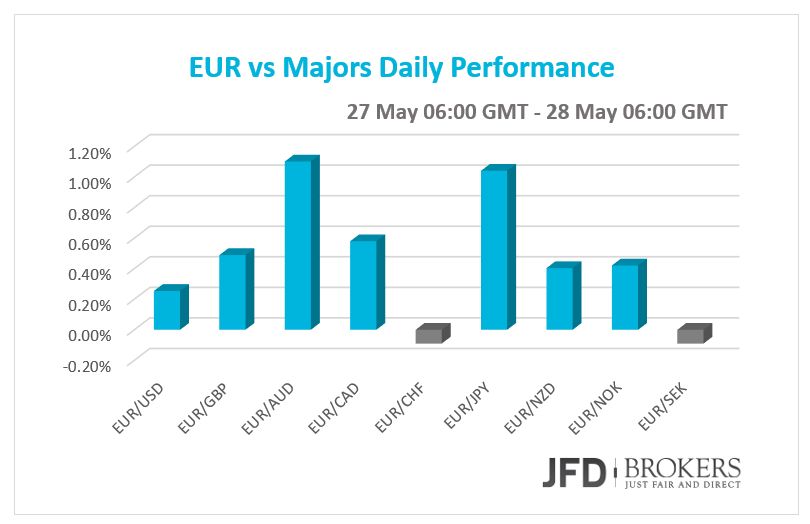

The shared currency rose against most of the other majors during Wednesday and early Thursday after the Greek Prime Minister Statements that Greece is very close to a deal with its creditors to unlock the needed bailout aid while the two sides cannot even agree on how much progress have done. The market relieved party, as investors were afraid that Grexit will be followed by impossible to predict consequences for neighbor countries.

EUR/USD pauses declines at 1.0820

EUR/USD found support near a new founder level at 1.0820 and slightly rose as Greece continues to dominate the headlines. Looking at the 4-hour chart, the recent pullback above the latter level, is confirmed by the 4-hour RSI, which is trending higher, away from its oversold area, and the MACD, which is holding in a bearish territory, however, is moving upwards above its trigger line.

Therefore, a near-term pullback back to 1.1000 is certainly in play heading into the end of this week, but as long as sellers step in to defend that level, the bears will remain in control. Beyond the psychologically significant 1.1000 level, the next resistance level to watch will be the 1.1070, which coincides with the 200-period SMA on the 4-hour chart. This level could easily come into play around next week where some significant events are coming for both, the US and Europe.

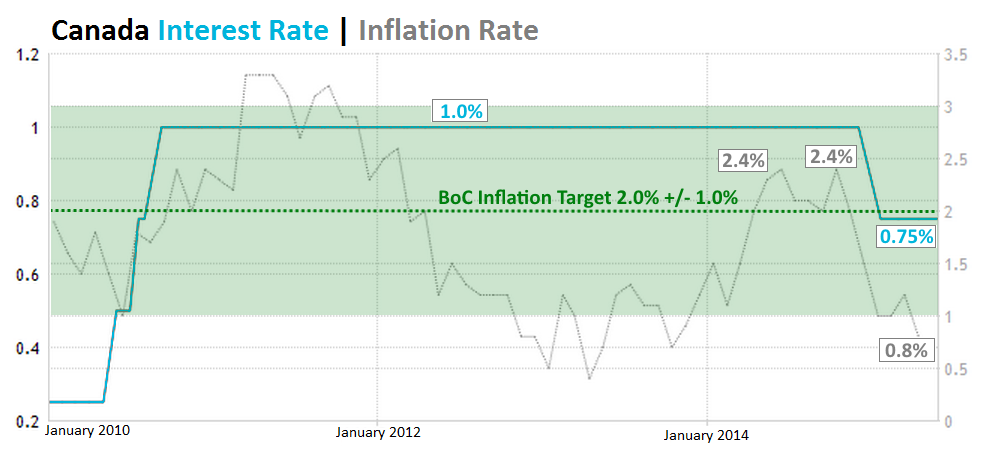

BoC had no particular interest from CAD traders

The Canadian dollar was traded slightly lower versus both US dollar and euro with the BoC decision to have a meagre impact of the nation’s currency. The USD/CAD rose up to +0.27% and the EUR/CAD ticked higher +0.38%. The Bank of Canada kept its benchmark interest rate at 0.75% as expected. The BoC Governor, in the statement accompanied the Interest Rate Decision, said that Canadian Economy continuous to be in line with April’s Monetary Policy Report. However, the economy is gloomy at the moment, but the Bank is confident that will rebound in the second quarter to 2015, leaving behind the need for further stimulus through further rate cuts. It’s worth noting that the oil low price impact didn’t fade yet and Canada is also affected from the weaker than expected U.S. economy as BoC said.

USD/CAD in a strong upward momentum

Technically, the Canadian dollar continued to weaken against the ever-stronger US dollar, following the strong rebound slightly above the key support level of 1.1900, which includes the 200-period SMA on the daily chart. The USD/CAD pair traded more than 500 pips higher at 1.2450 the last two weeks. It’s worth noting that the USD/CAD is in a process of closing for a second consecutive positive week. If the buying pressure continues to push the pair higher then we could see further pressure on the 1.2500 level. On the other hand, if we see a pullback in the coming days, the Fibonacci levels may be a key, in particular the 50% and 61.8% retracements, with the latter falling in line with a previous level of resistance.

EUR/CAD rebounded from 200-SMA

The euro continued moving higher as the CAD bulls lost the battle for third time around 1.3430 and slightly above the 200-period SMA on the 4-hour chart. In the past 3 weeks, the pair has been trading in a range between 1.3400 – 1.3700 and has recently retraced more than 23.6% of the move down from the March 2014 high to the April 2015 low. The psychological level of 1.3700 is the next barrier to the upside and a break above this would open the way towards the 38.2% Fibonacci at 1.4000. A daily close below the key 1.3400 level would weaken the bullish bias.

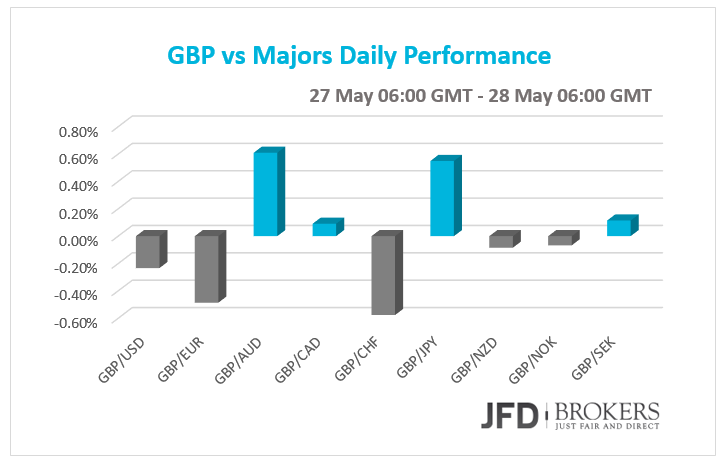

GBP mixed versus G10 ahead of the second flash GDP for Q1

The British Pound was traded mixed against its G10 counterparts on Wednesday’s and early Thursday’s trading session ahead of the second estimate of GDP for Q1. The main gainers against the sterling were the euro and the Swiss franc while the pound surged against the Aussie and the Yen. The second GDP estimate is expected to have grown up to 0.4% mom from 0.3% mom the first estimate but still below the last quarter performance of 0.6%.

EUR/GBP holds above 0.7100 but remains under pressure

The euro suffered yet another setback against the pound, this time below the psychological level of 0.7100. Although the single currency clawed back some gains against the pound, it is still flirting with the worst rates in 9 years versus its cross-channel neighbor. However, the volatility compared to just few days back after the EUR/GBP pair tested the 0.7485 level and more recently the 0.7280, is very mild, as the euro made a fake breakdown below the 0.7100 barrier and rebounded above that level during the Asian session.

If the bulls manage to maintain the EUR/GBP pair above the support of 0.71000, I would expect them to drive the battle higher and challenge once again the resistance of 0.7150. Alternatively, given how aggressive the rally has been over the last few weeks, we could see a brief period of consolidation, before a continuation of the downtrend below the psychological level of 0.7100 and the key support level of 0.7020.

Gold struggling to regain $1,200; WTI hovering around $58.00

The yellow metal is hovering around our buy recommendations area and the support level of $1,190. From a longer time perspective, the precious metal is stuck in a larger trading range between the $1,180 and $1,225 levels.

On the other hand, WTI crude oil price fell to a 4-week low, hovering around the $58.00 area. WTI is also trading in a tight range between the psychological level of $60.00 and the $58.00 barrier. Looking at the daily chart, the 50-period SMA is ready to provide a significant support to the bulls near the $58.00 barrier while the 200-period SMA is ready to prevent the WTI bulls for driving the price higher. The technical outlook is bearish on both, the 1-hour and 4-hour charts, but given the commodity’s aggressive gains the last few months, it would be hard to justify a long position from a risk/reward point of view.

U.S. Dollar Index testing a significant level

The U.S. Dollar Index closed exactly at its opening level, as the US dollar was mostly marginally changed against the basket of currencies the Index gauges the buck’s performance against them. However, the index fell sharply during early European session. The sell-off seen so far this morning has brought us back into a key support level at around 97.00. At this point, if the nearest support level doesn’t hold, we will see further deterioration and the next target will be around 96.70, which coincides with the 23.6% Fibonacci level, as well as the 100-period SMA on the 1-hour chart.

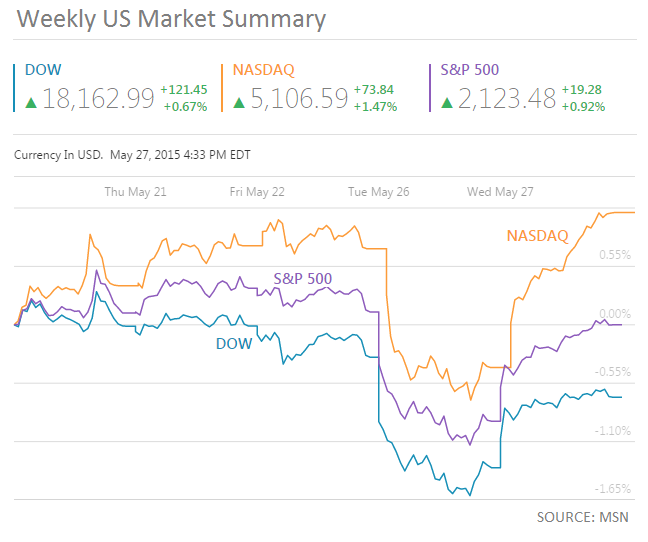

U.S. Indices higher after two straight declines; Nasdaq at a fresh record high

The three US Indices DJIA, S&P 500 and Nasdaq edged higher recovering Tuesday’s selloffs. The Nasdaq Composite Index climbed nearly 1.5%, +78.84 points, and closed at record high at 5,107 as Ceres In (NASDAQ: CERE ) and Delcath Systems Inc (NASDAQ: DCTH) soared. The blue-chip index, Dow Jones Industrial Average, increased by 0.67%, +121.45 points, with high gainer stocks the high tech companies Micorsoft Corp (NASDAQ: MSFT), Intel Corp (NASDAQ: INTC) and Apple Inc (NASDAQ: AAPL). The S&P 500 also edged higher by +0.92%, +19.28 points.

Economic Indicators

Today, in Eurozone various sentiment indicators (Industrial Confidence, Economic Sentiment Indicator, Business Climate, Services Sentiment and Consumer Confidence) will give us an overview of the confidence across the Eurozone about many sectors. In US, the weekly jobless benefits claims will be published. The Pending Home Sales are also scheduled to be released. In UK the Gfk Consumer Confidence, which is at a record high the last two months, will be announced for May. In Spain, the final GDP for the first quarter of the year is expected to be released. During the European night, in Japan there are important economic indicators scheduled. The National CPI along with the National CPI ex Food, Energy for April as well as, the country’s Unemployment Rate for April. The preliminary Industrial Production will be a first indication how the sector performed in May.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.