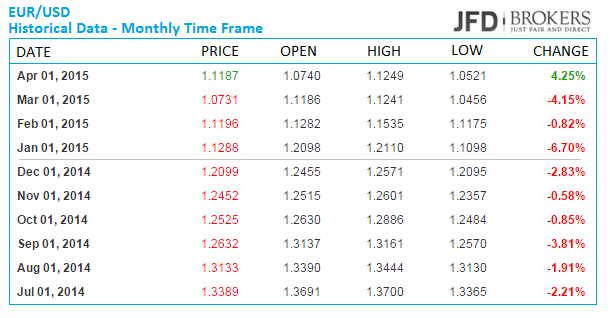

The euro has tumbled more than 20 percent since its peak near the psychological level of 1.4000 and nearly 12 percent since the start of 2015, hitting a 12-year low of 1.0460 against the strong U.S. dollar. It is quite impressive that the dollar bulls rally has just run out of steam after having completed nine consecutive months of gains. The euro recorded a 4.9 percent of gains in the month of April, which is the biggest monthly rise since Sept 2010 when the EUR/USD pair added 7.46 percent in its value.

Following the aggressive break below the psychological level of 1.1000 beginning on March, most famous newspaper headlines were addressing that the eurozone common currency could sink further and reach parity with the dollar by the end of 2015, something the market has not seen since 2002.

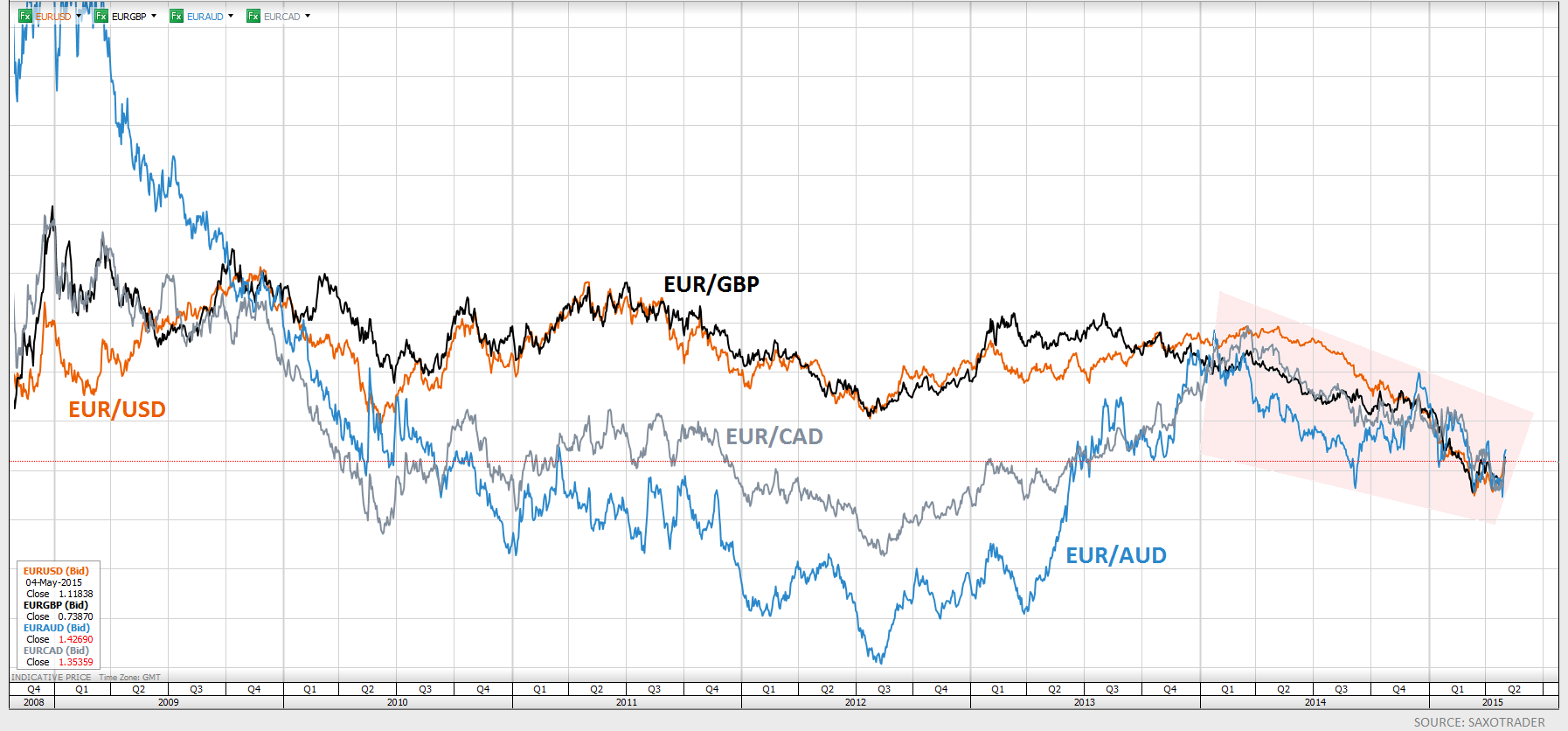

However, the euro is not falling only against the US dollar, in fact, it sinks against almost all of the major currencies. The euro lost more than 10 percent against the pound since January 2014 as it hit an 8-year low at 0.7010, slightly above the psychological level of 1.7000. The euro also fell below the psychological level of 140.00 against the yen and lost more than 10 percent from its value against the Swiss Franc following the SNB decision to remove the EUR/CHF floor.

The shared currency tumbled against the commodity currencies (AUD, CAD, NZD), falling 35 percent against the Australian dollar, since January 2009, with the EUR/AUD pair recording 14 negative months out of 15, a quite impressive rally by the Aussie bulls. Furthermore, the euro fell more than 7 percent against the Canadian dollar, recording seven consecutive negative months during 2014, and dropped more than 12 percent against the New Zealand dollar, both since January 2014.

The ECB’s Quantitative Easing Programme

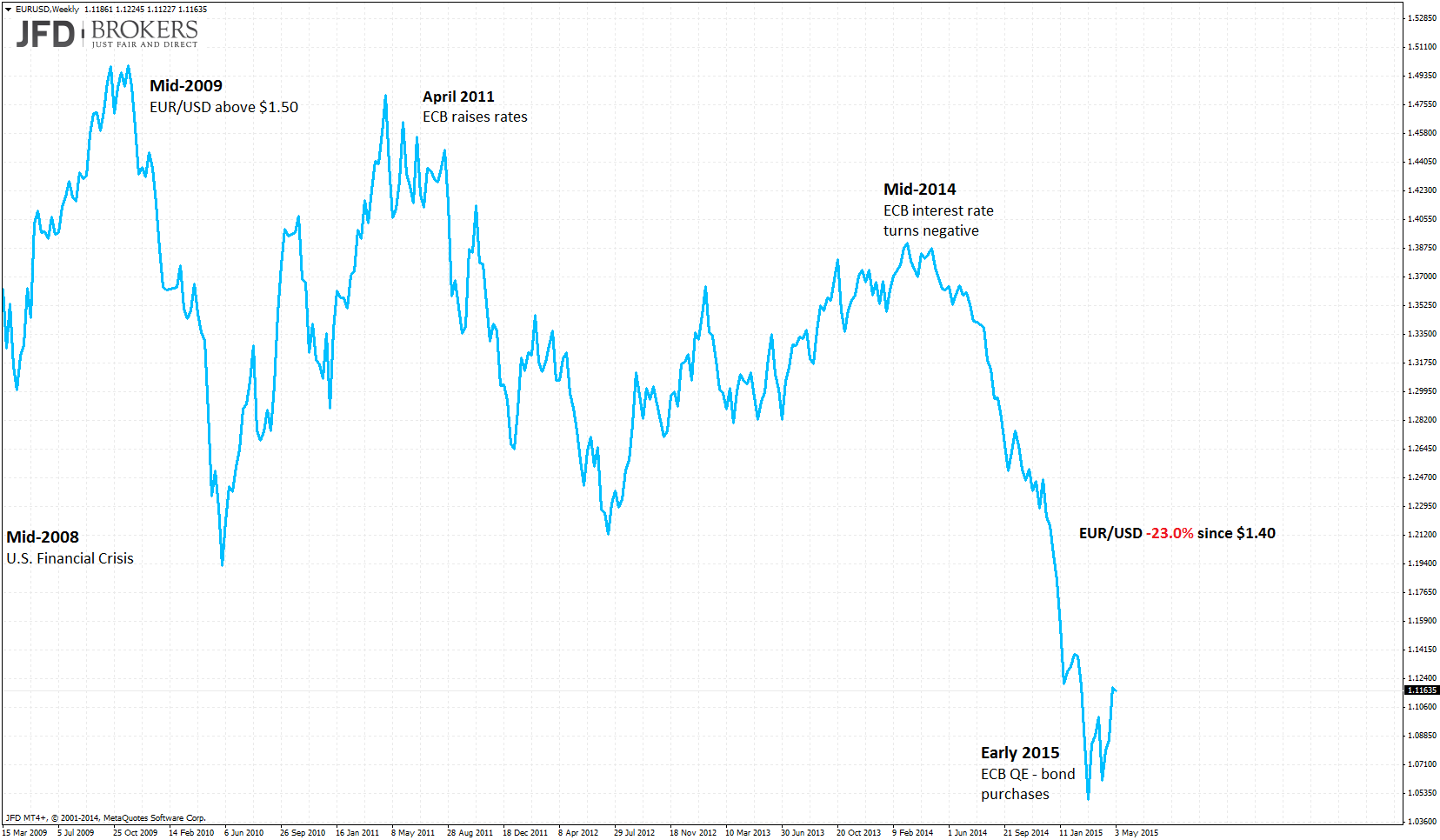

One of the main factors driving the value of the euro down was the European Central Bank’s (ECB) decision to pump 1 trillion euros ($1.1 trillion) into the euro zone economy. In other words, 60 billion euros, worth of bonds, will be injected each month in an effort to help boost economic growth and restore inflation. The program has started in March 2015 and the ECB expects the QE program to end in September 2016. It should be noted that the US dollar depreciated against the euro when the Fed started its QE programme following the 2008 financial crisis.

Euro Area GDP, Inflation and Unemployment Rate

Eurozone’s economy is barely expanded with GDP annual growth rate below 1.0% while it was negative for two years until the third quarter of 2013. Germany, France and Italy, the three largest economies of the Eurozone, started to expand gradually at the end of 2013 after they had recorded extremely low levels the couple of years before.

Unemployment Rates are increasing with continuing apace, surpassing 10.0% and some nations like Spain and Greece exceeding 20.0%. Although, Germany holds back the Eurozone’s unemployment rate as is decreasing sharply from 2009, being below 5.0% the last year.

Inflation Rate of all the countries mentioned above and the Eurozone's as a whole, entered a downward path at the start of 2012, ended up to face strong deflationary pressures at the end of 2014. The continuing rate cuts from the European Central Bank have not helped to break the deflationary risks.

The euro collapsed against the dollar after reaching the psychological level of 1.40, which has lost 14 percent after the European Central Bank introduced a negative interest rate of 0.1 percent.

U.S. Fed to Hike Interest Rates

Another important factor which contributed to euro depreciation was the prospect of the Federal Reserve to raise interest rates after ending its quantitative easing last year (October). However, following four monetary policy meetings, the Fed is still on hold. In its last meeting, the Fed signaled that it will not raise interest rates as it pointed to a slowdown in economic growth and weakness in the labor market, since the start of 2015. The next Fed meeting will be held on June 16-17 with the monetary policymakers to have a few more economic data to add in their assessment. Until then, the final GDP for the first quarter of the year, April’s Inflation Rate and Non-Farm Payrolls reports for the next two months will be available.

Investors are Turning Euros to Dollars

The last time the euro was worth more than $1.50 was all the way back in March 2008, just a few months before the Global Financial Crisis started. One of the main reasons the euro gained strength against the dollar at that time, was that the continent imported less and exported more. At the end of 2008, the crisis, which begun in United States, spread across Europe and affected much of the region main countries. The euro collapsed against the dollar falling for five consecutive months, while it recorded the biggest drop in October 2008 of -9.72 percent, following a -3.88 percent in September and -5.94 percent in August. Following the drop in the pair, the European economy started to get weaker. The ECB last year decided to move its interest rate in negative territory, as mentioned above, and few months later it decided to start buying bonds with newly printed money (1 trillion euros). On the contrary, we have a stronger dollar the last year and a half, as well as the Fed is getting ready to increase its interest rates in the next couple of months. As a result, the interest rates are falling in Europe while are rising in the US. Thereby, investors are moving their money out of euros and converting them into dollars. And boom, the euro has fallen more than 20 percent against the dollar since it reached the 1.4000 level.

Greece Dept Crisis

Another one reason that the euro depreciates versus the dollar is the Greek government-debt crisis as the European Central Bank and the International Monetary Fund have not reached a deal with the Greek government for the Greece’s bailout loan. In their last meeting, the IMF and the European Central Bank said that Greece needs to agree a package of measures before releasing 7.2 billion euros. On May 11, a Eurogroup meeting will be held in order to reach an agreement while on May 12, the Greek government is required to pay 780 million euros to the IMF.

Technical Analysis and Conclusion

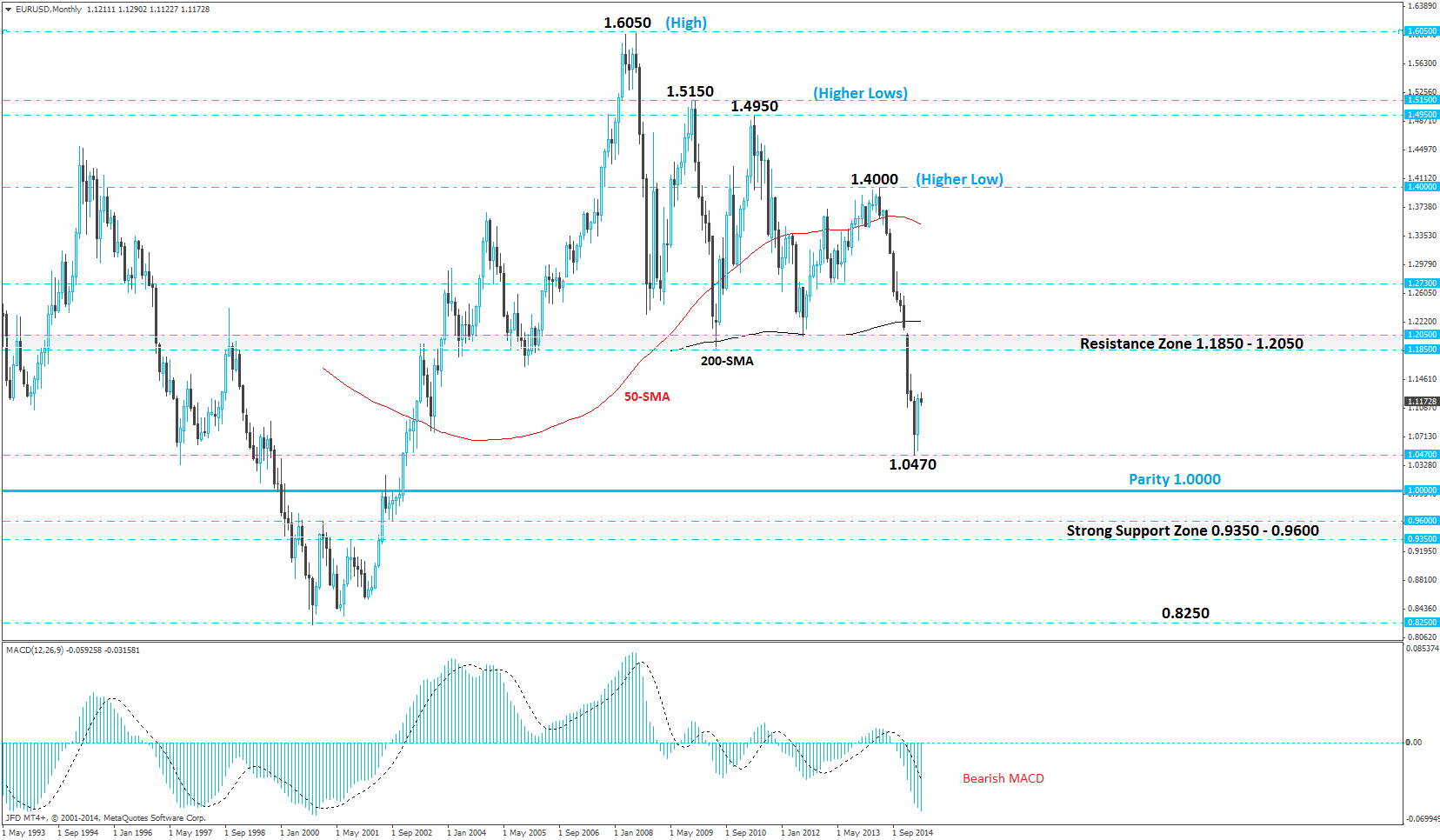

The EUR/USD pair slumped from nearly 1.4000 during the middle of last year to 1.0470 on March 13, 2015. The euro found a temporary support against the dollar around the strong support zone of 1.1850 – 1.2050, as well as the 200-period SMA back in September 2010 and May 2013, but the bulls failed to sustain the pair above the aforementioned obstacles. Following the break below the psychological level of 1.2000, the sell-off was quite aggressive pushing the price in territories not seen since December 2002. However, the pair is since risen and currently consolidates above the psychological level of 1.1000, following the sharp rebound from the psychological level of 1.0500, as the Fed delayed the first hike in interest rates.

Based on the assumption that the Fed will be hiking its interest rates in the next few months, which will drive a high demand for dollar since investors will be able to have a higher returns on their dollar-holding investments, while, on the other hand the ECB will keep its rates at record lows for at least the end of the QE, I therefore expect more downside in the long-term.

For the medium-term, I would expect the euro to gain some strength, for temporary at least, as I expect Greece to seal a deal with its eurozone creditors. Therefore, an agreement between Greece and its creditors could drive the pair back towards the 1.1850 – 1.2050 levels.

Whether EUR/USD weakens further and reach parity in some point, maybe end of 2015 or mid-2016, will depend to a large extent on whether the Fed starts increasing its interest rates. In currency markets, "parity" is when two currencies have the same value, or a 1:1 exchange rate.

Furthermore, dollar bulls should keep an eye on the US indices, as a stronger dollar could hurt the earnings of US multinational companies. Therefore, a strong dollar could punish the strong bullish rally, which started back in early 2009, of the US indices (Dow Jones, NASDAQ and S&P 500). A retracement more than 20 percent, could create panic in the markets and lead to a new global financial meltdown.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.