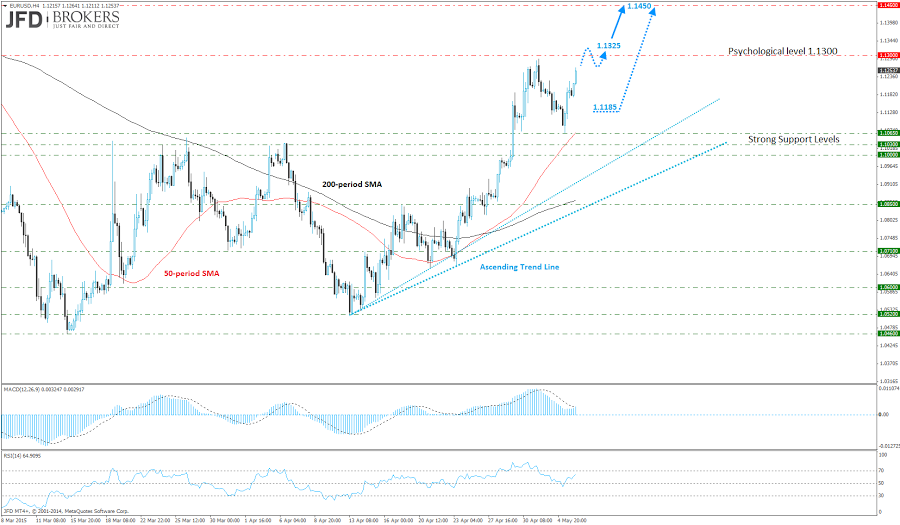

The euro rebounded from the 50-period SMA, slightly above the key support level of 1.1030 as investors looked ahead of the US ADP Employment Change report and the all-important NFP report, as well as some mixed European data, including today’s Retail Sales and tomorrow’s German Factory Orders.

The EUR/USD pair has been in an upward trend for more than weeks now, following the strong rebound around the psychological level of 1.0500. Since then, the euro is rising, taking out some important obstacles including the key level of 1.0850, the psychological level of 1.1000, as well as the 50-period and the 200-period SMA on both timeframes, the 1-hour and 4-hour charts.

The daily chart as well as the weekly chart shows that the bulls are under strong momentum driving the price back towards the psychological level of 1.1300. Technically, we have said that a close above the psychological level of 1.1300 would be a very bullish development for the euro, as we have not seen a daily close above that level since March. With the US ADP coming later in the day, we could expect any kind of reaction as the US employment change, including the NFP report on Friday, will determine the pair’s move and trend direction.

Bearing the above in mind, if we see a close above the key resistance level of 1.1300, then we could see a bigger retracement, following three positive weeks for the euro, prompting a more aggressive move towards the 1.1450 level. The former level is significant as it includes the 23.6% Fibonacci retracement level. However, for confirmation of the trend reversal, we will need to see a break above the key resistance level of 1.1500.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.