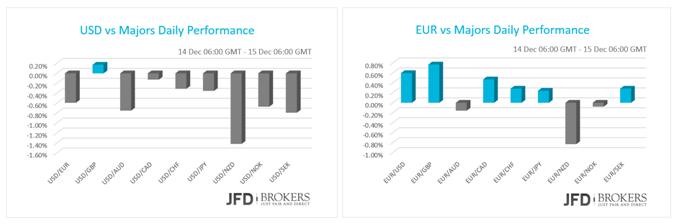

The U.S. dollar plunges ahead of the Federal Reserve’s decision which will be announced tomorrow while the inflation report will be published today will be keenly eyed. The shared currency rose on the back of ECB President optimistic comments and upbeat macroeconomic data.

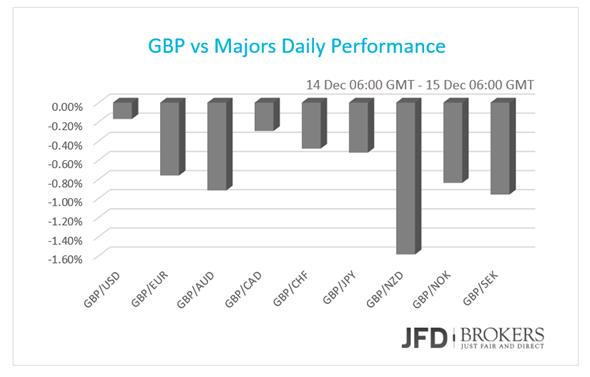

The British pound slumped against all the majors ahead of its inflation report while New Zealand dollar outperformed on the cementing dairy products auction later in the day.

U.S. Inflation Rate will be Eyed Ahead of Fed

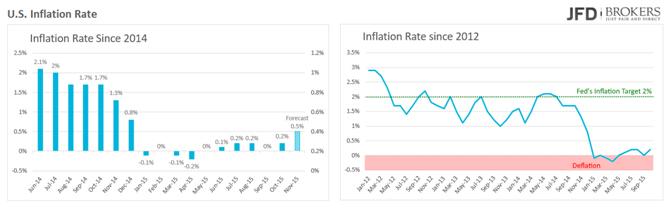

The greenback fell against almost all the other G10 currencies on Monday and early Tuesday as the two-dayFed policy meeting, that is likely to conclude with tightening measures for the monetary policy, starts today. On the second half of the trading day, the U.S. inflation rate for November will be out. The traders will pay significant attention to it as the Fed policymakers will include it in their data for their decision. The inflation has been below Fed’s 2% target the last years undermining Fed’s impetus to raise rates amid the other strong performed sectors of the economy. Even though the maximum level the inflation rate reached throughout the year is 0.2%, the forecasts for November’s consumer price growth is to peak at 0.5%. A hawkish perspective of the economists’ side.

Euro continues to rise

The euro ended the day with small gains against the majors as the dollar is falling ahead of the Fed and the single currency benefits from the macroeconomic data. The Industrial production in Eurozone rose by 0.6% in October after two consecutive months of contraction, on a monthly basis. By contract to the same month the year before, the production also was higher by 1.9%! The ECB President Mario Draghi said that, after the recent stimulus measures, inflation will reach the target of 2%, as well as that the expectations for additional measures in the next months decreased.

On the 4-hour chart, the EUR/USD pair is traded in a bullish fashion. However, the prices are close to the main resistance level at 1.1100. We do not expect any major moves until tomorrow when Fed is going to announce its main interest rate. Until then we suppose that the bulls will push to test the resistance and most likely the prices will rebound from it and head towards 1.1050.

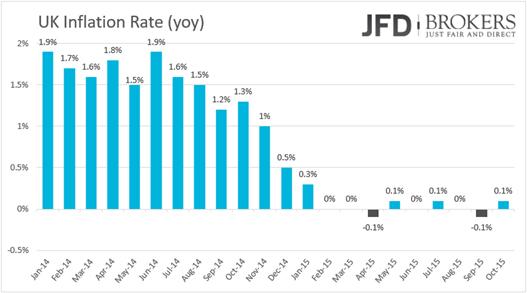

GBP traders expect UK Inflation Report

The sterling also faced a sell-off pressure on Monday but retreated some of its losses during the Asian session and the early on Tuesday. The GBP-traders are looking ahead to UK inflation report which is scheduled to be released early in the morning today. The forecasts want the year-over-year rate to grow by 0.2% to 0.1% while the on a quarterly basis, the consumer prices are expected to have contracted by 0.1%.

The GBP/USD pair continues to be traded in a downward channel. After the pair rebounded near the psychological level of 1.5000 and crossed above the 50-SMA on the 4-hour chart, it rose up to 1.5160 where is currently finding resistance on the 200-SMA. A decisive break above the 200-SMA would indicate a rally towards 1.5240 and further appreciation is likely, prompting a move towards 1.5330. Alternatively, the pair will decline to test again the support level of 1.5000.

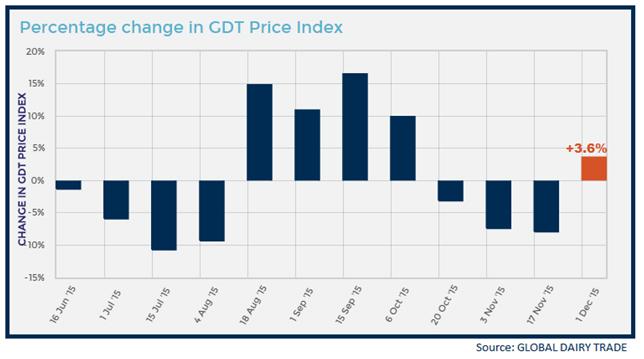

NZD Surged Ahead of the Dairy Products Auction

New Zealand dollar appreciated more than 1.40% against the US dollar, 0.80% against the euro and 1.60% against the pound in the time interval between 06:00 GMT on Monday to Tuesday. Today, the dairy product auction will take place, a significant economic event for New Zealand, as its economy is heavily based on dairy products exports. The last time on December 01, the dairy prices jumped by 3.6% after three times that declined.

On the 4-hour chart, the NZD/USD pair has been able to close above the 0.6800 resistance and in a short-term perspective the prices should continue their way up towards the 0.6850. Also, the price structure is bullish as we are seeing higher highs and higher lows. However, tomorrow’s Fed decision will be the main factor which will determine the future trend.

Gold is headed to fresh monthly lows

The price of Gold has been traded in a downtrend pattern and based on the price structure we expect the declines to continue. A 4-hour close below 1055.00 will be an indication that further the prices will continue to decline towards the 1050.00 support zone. On the other hand, if we see the commodity traded above 1065.00 this will be an indication that the bulls may have the upper hand.

Brent can fall even further

Even though the Brent Crude has been able to slightly rebound from the yearly lows around $36.20 per barrel the downtrend remains strong and we believe that the prices are headed towards new lows even below $35.00 per barrel. In a short-term perspective, we may see the prices to consolidate but there is no sign that the bulls are going to take the upper hand.

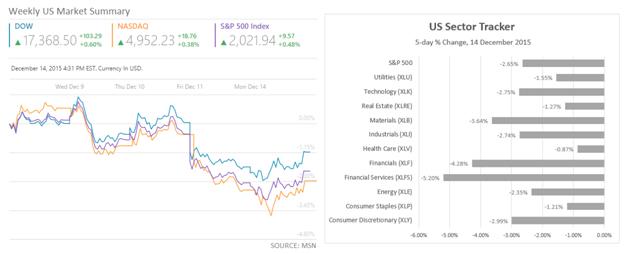

U.S. Indices Posted Gains after their significant fall

After considerable losses last week, the U.S. Indices closed the first trading day of the week in the green. The Dow Jones added 103.29 points, 0.60% on Monday while the week just past plunged 3.26%. The high-tech index recorded gains of 0.38% while the S&P 500 increased by 0.48%. The week before, Nasdaq posted more than 4% losses while S&P 500 was down 3.80%. As the oil bounces and the Fed is cementing, the stocks reaction is very difficult to be predicted. The week before, the stocks were down in all the sectors.

Economic Indicators

On Tuesday, there are important economic releases from UK, US and Eurozone as well. During the European morning, the UK National Statistics will release the inflation rate for November. The consumer prices are expected to have risen by 0.1% in November while are forecasted to decline by 0.1% for the third consecutive month if you compare with the corresponding months of the previous year. The producer price index and the retail price index will be out as well.

A while later, the German ZEW Survey is expected to show an improvement in the current condition and economic sentiment of Germany and Eurozone’s as a whole. The Employment Change in Euro Area for the third quarter of the year will be out.

On the second half of the trading session, U.S. will release its inflation rate for November. All the announcement will be closely watched as the two-day crucial Fed meeting starts on Tuesday, and all the latest economic data will be taken into account. The market consensus support that consumer prices remained flat in November versus 0.2% the previous month while they rose by 0.5% compared to November before. The NAHB Housing Market will be out as well.

In New Zealand, the current account for Q3 is scheduled to be released, as well as the Australian CB Leading Indicator. Overnight, the Reserve Bank of New Zealand will publish its Inflation Expectations for the next two years.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.