Huge Profits on Euro after ECB Adjustments; Will NFP Report Complete Fed’s puzzle?

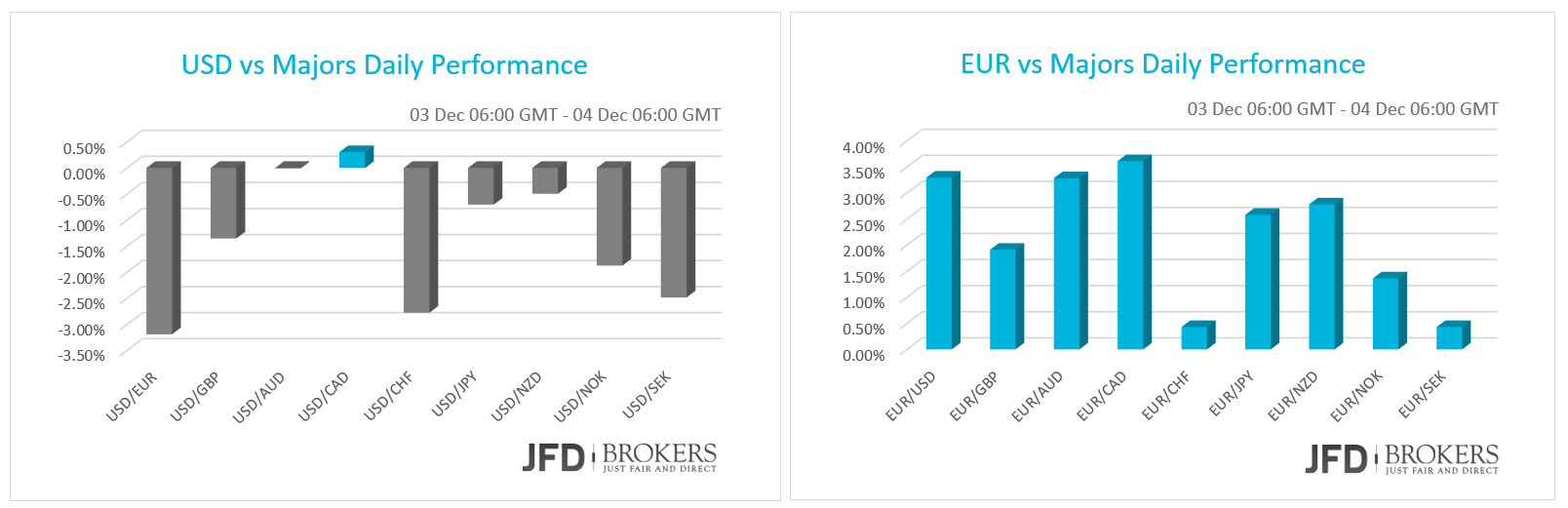

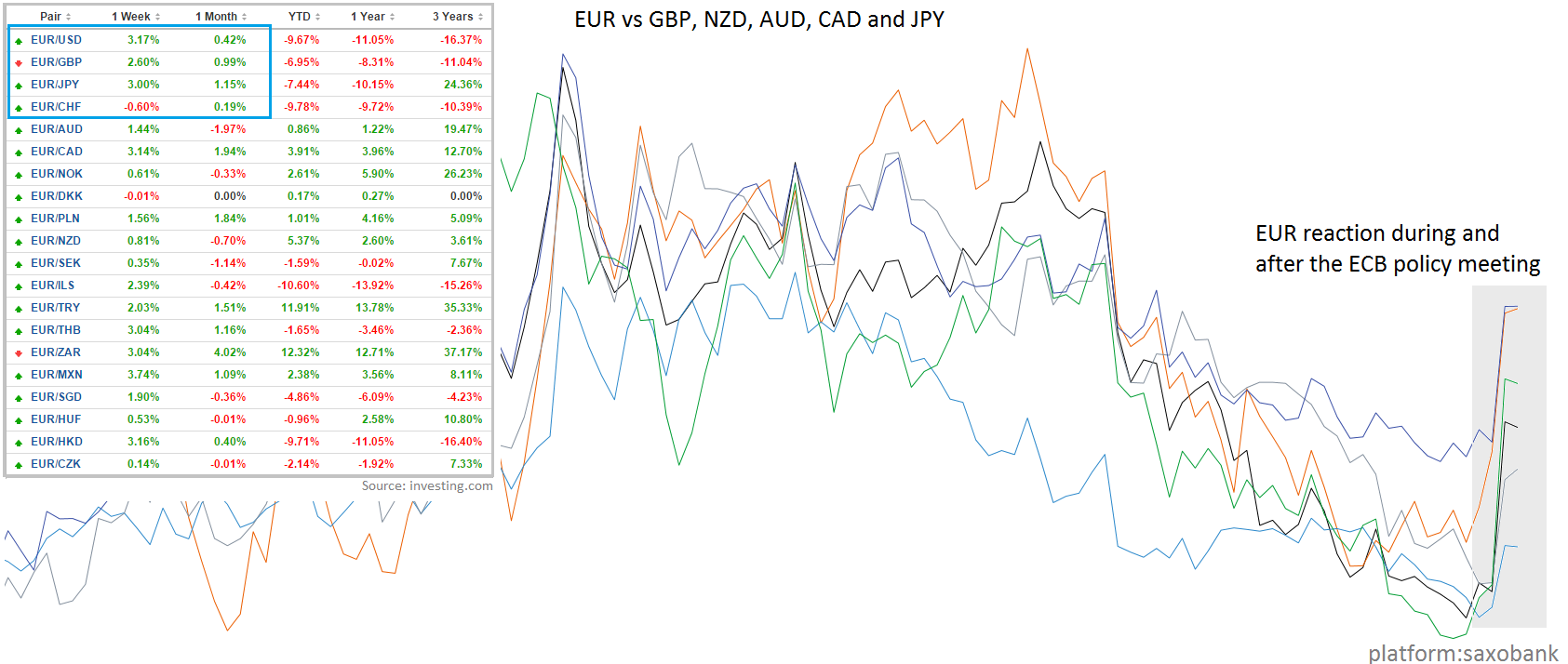

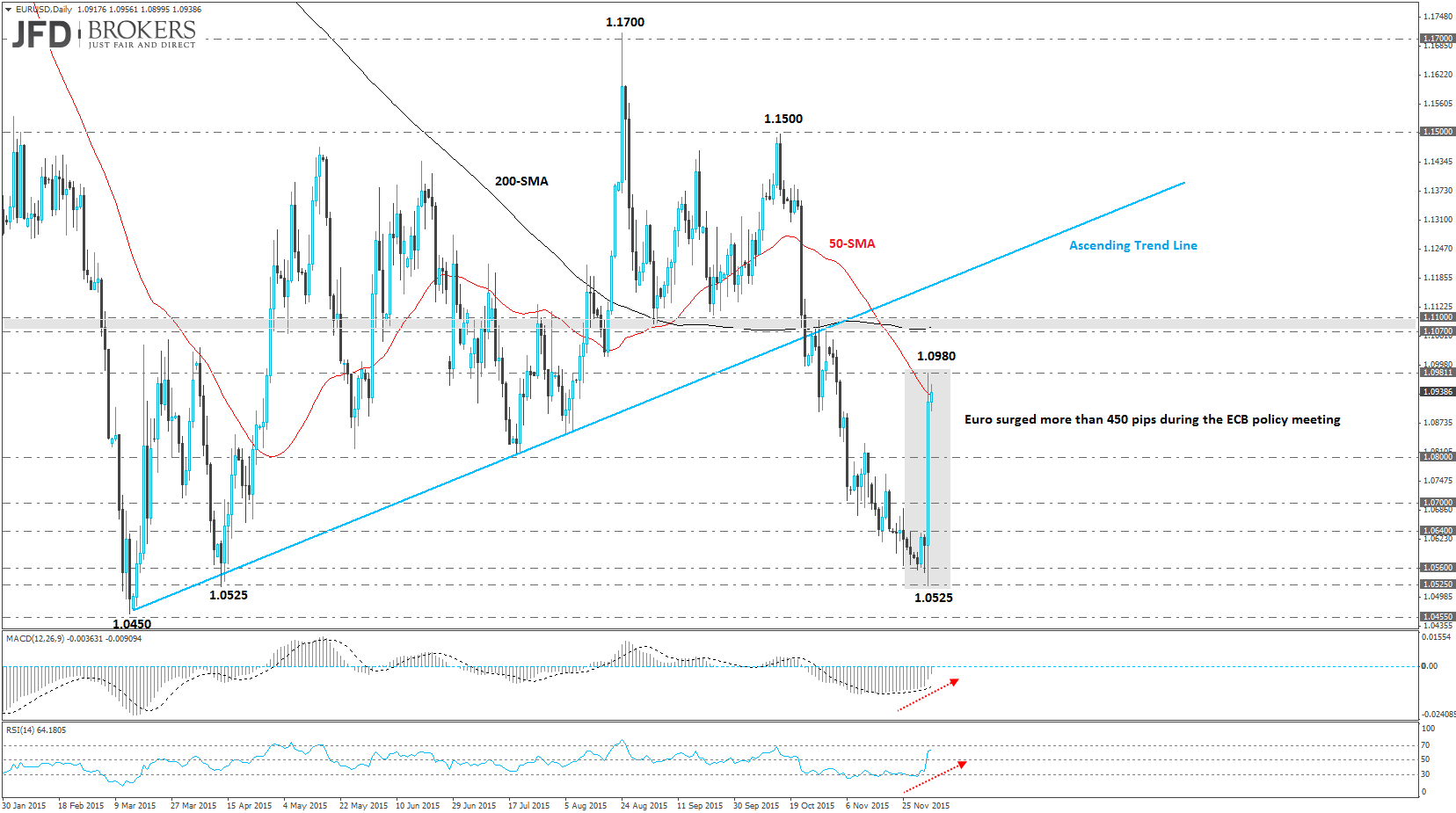

The euro shocked the markets on Thursday, recording unprecedented gains in a very short period of time following ECB’s decisions announcements. That was a painful trading session for the euro bears as the euro surged more than 400 pips against the dollar, touching a fresh-month-high, after testing the key support level of 1.0525. The EUR/GBP pair surged more than 1.5% following the announcement while the EUR/AUD rose more than 600 pips, to end the day slightly below the psychological level of 1.5000. A similar picture prevails in EUR/JPY as the pair soared above the key level of 1.3000, to close the day near the 1.3450 area. Technically, the euro indicators are now looking more positive although it is likely to be another highly volatile session with the NFP report coming up during the US session.

ECB Fresh Stimulus Measures! Draghi said: More adjustments if necessary

The ECB President Mario Draghi unveiled the new stimulus measures will be taken to boost inflation towards just under 2% and the Eurozone’s recession. The central bank cut further the deposit rate and extended the bond-buying program. The deposit rate, which banks use to make overnight deposits with the Eurosystem, decreased by 10 basis points to -0.30% from -0.20% before, where it was since September 2014. Moreover, the bond-buying program extended at least until 6-months to March 2017 and the range of the assets purchased broadened and further adjustments could be made if necessary. The ECB also raised its GDP forecasts for 2015 and 2016 and decreased the inflation forecasts to 1.0% from 1.1% in 2016 and to 1.6% from 1.7% in 2017.

NFP Report to hog the limelight! Will complete Fed’s puzzle?

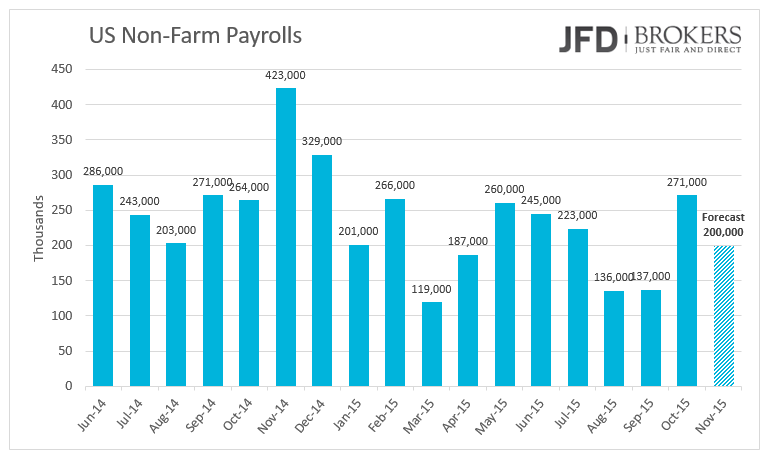

The Non-Farm Payrolls report today is equally important and will complete the Fed rate-hike puzzle. The market forecasted the economy to have added 200k non-farm jobs in November from 271k jobs the month before. The average hourly earnings are expected to have grown by 0.2% while no change is expected to the record low 5% unemployment rate. If an NFP number below 200k comes out a confusion will flood the markets, whether Fed will start raising rates in December or later in 2016. However, a number above 200k will culminate the odds for a rate hike at the next policy meeting starts on December 15 and ends on December 16.

EUR/USD – Technical Outlook

The single currency has appreciated more than 2.5% on Thursday following the ECB policy meeting. The euro surged from session lows of 1.0525 (suggested target) to overcome easily both the 4-hour 50-SMA and the 200-SMA, as a consequence to turn the negative outlook to bullish ahead of the US NFP report. The psychological level of 1.1000 remains under threat, as well as the 1.1100, which includes the 200-SMA on the daily chart. It’s remarkable that the euro has erased all of the losses made after the FOMC meeting, where the December US rate hike was strongly anticipated.

In the recent reports, we have changed our stance for the euro from bearish - 1.0525 recommended target before the ECB - to neutral bullish - 1.0700 and 1.0800. Both of the targets were reached!

"EUR/USD: Profit locked – waiting for Draghi’s speech"

The announcement of the ECB interest rate decision caused heavy and unprecedented volatility to the EUR/USD pair. The pair jumped 200 pips in matter of minutes reaching the target we suggested in an earlier report “EUR/USD remains under pressure!â€.

The central bank left the benchmark interest rate unchanged at 0.05% but cut the deposit rate to -0.30% from -0.20% was since September 2014. It is very likely more stimulus measures to be announced by ECB President Mario Draghi during his scheduled press conference at 13:30 GMT.

Economic Indicators

Today we will have another volatile day for the week due to the awaited US Non-Farm Payrolls Report. It will be the last employment report before the Decembers Fed’s rate decision so the figures are very important and will affect all the USD related pairs as well as the USstock indices.

The Canadian employment report is also coming out but will be overshadowed by US report again. The unemployment rate is expected to remain unchanged while the economy is forecasted to have added0.7k jobs in November from 44.4k in October.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.