ECB to Ease Monetary Policy! Fed Yellen Testimony on Radar!

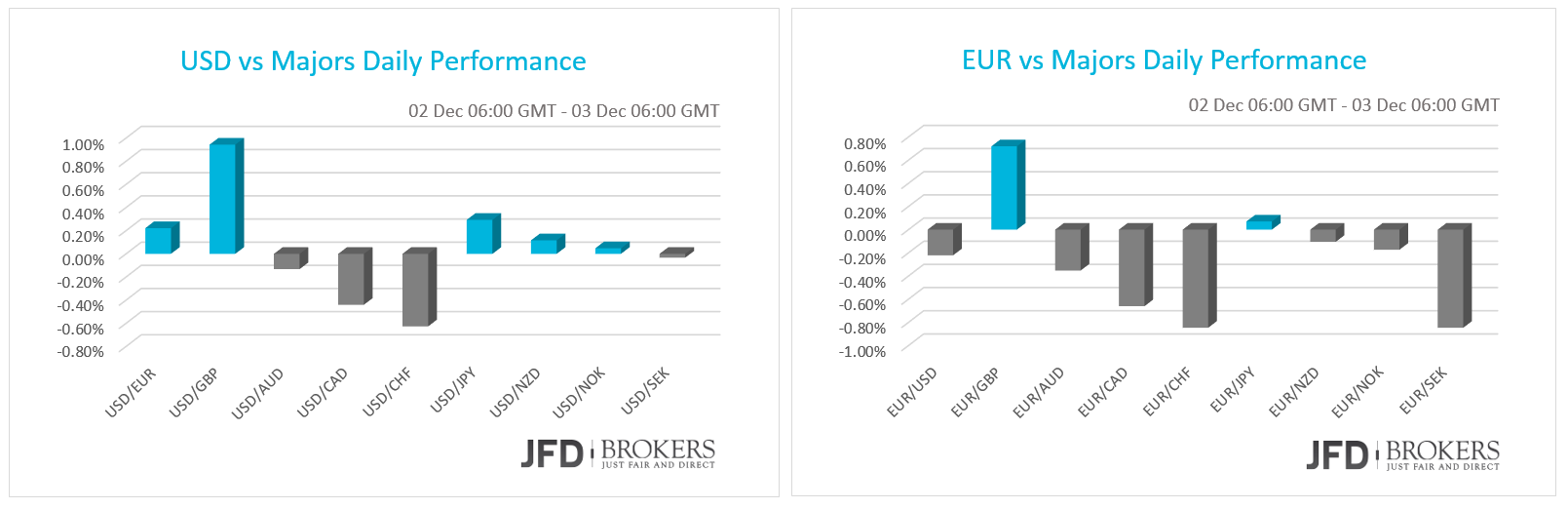

The greenback and the shared currency were traded mixed against the other major currencies on Wednesday ahead of Fed Yellen’s testimony and the ECB policy meeting that is widely anticipated to deliver measures and changes to boost the economy. Pound was the worst performed currency on the weakness in the construction sector. The Canadian dollar rose as BoC holds off interest rates at 0.5% and on the statement that the economy expands and develops as forecasted. The AUD held its gains against the USD following the GDP report. WTI and Brent remain under selling pressure ahead of OPEC meeting due on Friday. The yellow metal plunged to a six-year low in the face of a stronger dollar.

Fed Yellen: FOMC should not delay policy normalization

The US dollar had hawkish data to surge against the majors but didn’t as the traders are cautious ahead of today’s Fed Chair Janet Yellen testimony and November’s Non-Farm Payrolls report that is scheduled for release tomorrow. Both events will cause more volatility than usual in the markets as all the keys lead to the scenario that Federal Reserve will raise interest rates in the two-day policy meeting next week, December 15 to 16.

Fed Chair Yellen transmitted signals of confidence for the first rate hike in nearly a decade at her speech on Wednesday. She stated that “if the FOMC delay to start the policy normalization for too long, they would likely end up having to tighten policy relatively abruptly to keep the economy from significantly overshooting both of our goals”, and she added that “Such an abrupt tightening would risk disrupting financial markets and perhaps even inadvertently push the economy into recession.”. However, it’s worth mentioning that hawkish statements were not for December but she warned of the risks of delaying. Therefore, we could say that if Fed will not raise in December, she left the door open for a first rate hike in the first quarter of 2016.

The Fed’s Beige book published yesterday, encloses an overview of the economic situation over the states. It said the expansion is modest across most of the states, the consumer spending increased in nearly all districts while prices were generally steady. The labor markets continue to tighten modestly and the wages are generally stable to increasing. The ADP Employment change showed that the non-farm private employment rose by 217,000 last month, above expectations for an increase of 190,000.

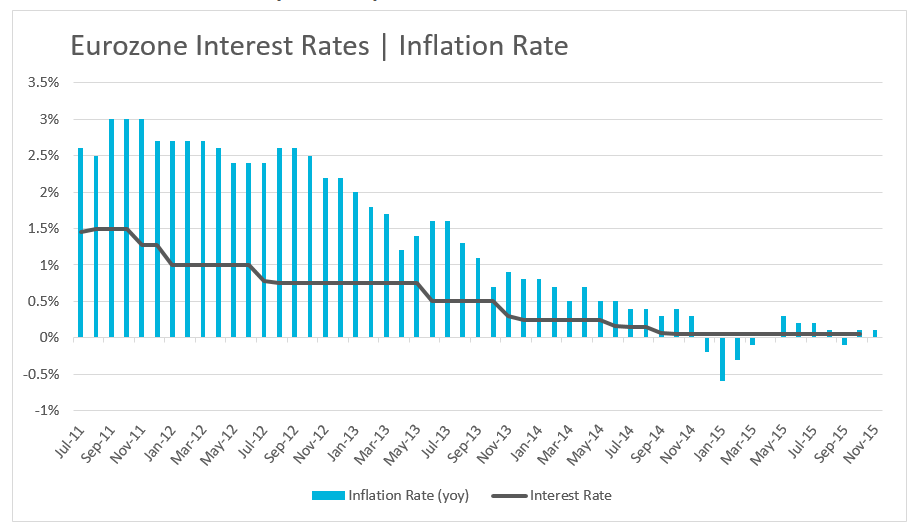

ECB to Unleash Stimulus Measures Today

A big day for Eurozone today, as the ECB President Mario Draghi is going to unleash a fresh wave of monetary stimulus measures which may impetus the consumer prices higher. The flash inflation rate for November announced yesterday, failed to increase as expected and remained at 0.1% on a yearly basis, keeping the euro subdues versus its counterparts. The measures that the central bank will apply are not known yet, however, a further decrease to the already negative deposit rate is possible, as well as changes to the asset-buying program.

The single currency remained under pressure ahead of today’s ECB Interest Rate Decision. During yesterday’s session, the EUR/USD pair plunged to a fresh 7 month low of 1.0549 following Yellen’s speech. The greenback received additional help from the ADP figures which came batter than expected ahead of the all-important NFP figures. However, the euro recovered all of the losses seen during yesterday’s session and currently sits slightly below the 1.0600.

Technically, a break below 1.0550 would see a run towards 1.0525 (13 April low), and beyond there at 1.0455. Below here, there aren’t any significant obstacles and a move towards parity would appear over the horizon (monthly chart). On the other hand, the 1.640 barrier will be the first hurdle for the buyers. A break above here, we could see a run towards the psychological level of 1.0700.

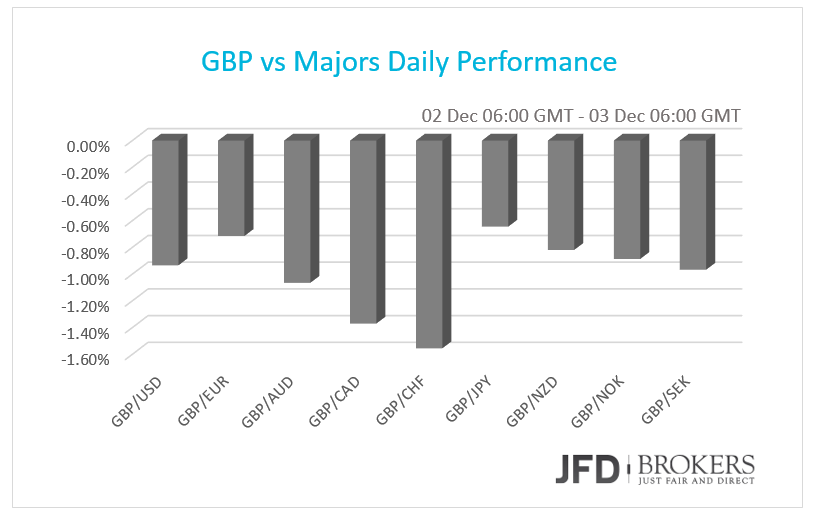

Pound plunged versus the majors on UK Construction slowdown and US data

The British pound plunged versus the major currencies on Wednesday and early Thursday as the construction activity grew at its slowest pace in 2 years according to the Purchasing Managers’ Index. The data followed for the US dollar sent the sterling even lower as the two economies were performing similarly in the past and now are diverging. The Markit Services PMI for the UK expected to come out today, for November is not anticipated to add further pressure to the currency.

The pound, which was the worst performer of the day, plunged more than 150 pips, breaking below the psychological level of 1.5000, as well as, below the lower boundary of the sloping channel. The GBP/USD pair following the positive ADP figures and then by the relatively hawkish comments from Federal Reserve chair Janet Yellen. Following yesterday’s rally below the 1.5100 hurdle, locked profits at 1.5030 and 1.5000), which we saw break the aforementioned obstacles, a neutral stance is required. However, the levels to watch remain pretty much as before. To the upside the 1.5000 and 1.5030 barrier while to the downside the 1.4890 and 1.4860.

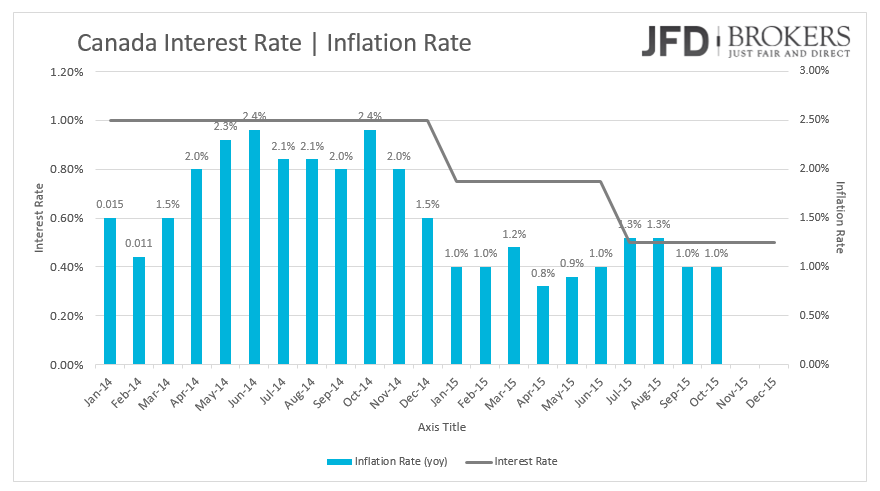

BoC holds off interest rates; Economy is developed as forecasted

The Bank of Canada met market expectations and maintained the overnight rate at 0.5% at its policy meeting on Wednesday. The statement released alongside bolstered that country’s economic growth is in line with the predictions provided in October’s Monetary Policy Statement. The consumer prices are increasing on the lower pace of the bank's 1% to 3% target range, but the deflationary risks are roughly balanced. Moreover, the risks to financial stability “are evolving as expected” as well, but the household sector is more vulnerable than before.

The Canadian dollar and the Swiss Franc were both higher against the USD despite the stronger dollar has seen elsewhere and suggests some caution ahead of the significant events mentioned above. The USD/CAD plunged below the key support level of 1.3330, as well as, below the ascending trend line which started back in mid-October. At the end of the US session, the pair is making a bit of a recovery and currently sits at 1.3320. The pair has bounced off the brief move to 1.3290, a level that I would expect the bears to retest in today’s session, however, I will remain USD-positive, with a stop loss below the 1.3280 level. If the pair gains momentum in today’s session then we could see it move above the 1.3330, prompting a more aggressive move towards 1.3360, which includes the 50-SMA on the 1-hour chart, as well as the aforementioned ascending trend line.

Australian economy grew by 0.9% in Q3

The AUD/USD pair gained momentum and held its gains after a report released during the Asian session which signaled the Australian economy grew 0.9% in the quarter through September, following a 0.3% expansion in the second quarter. The report helped the Australian dollar to remain above the key support level of 0.7280 and to remain solid vs the buck, which soared against some of the major currencies. The next test for the AUD bulls will come at 0.7340 (previous high) and then 0.7360 and 0.7380.

USD/CHF – Technical Outlook

A similar picture prevails in USD/CHF. The pair plunged below the 4-hour 50-SMA and the key level of 1.0250 during yesterday’s session. For this pair, a cautious stance is required, and while I would still be looking to trade from the long dollar side in the short-term ahead of Friday’s NFP report, I am wary that this pair might show some weakness over the medium term, such as correction (daily chart). Therefore, for intraday I will wait for a test of 1.0250 and then I will step aside for a further confirmation and a clearer directional bias.

USD/JPY – Technical Outlook

The dollar is continuing to push higher against the Japanese yen, although it’s continuing to struggle near the psychological level of 123.60. The channel that the pair has been trading since the end of October shows how cautious traders are ahead of some important data coming up, including the ECB policy meeting, Yellen’s testimony and the US NFP report. Within the sideways channel, the 50-SMA and the psychological level of 123.00 are ready for a retest in a case of a pullback, which I do not foresee for now. If the MACD fail to move in a bearish territory then I would expect the bears to also fail the 123.00 level. On the upside, back above the 123.60 high would see a run towards 124.50, and above there at 125.30.

Gold has fallen for the sixth week

The precious metal has fallen for a sixth week with the sellers finding a temporary support at a six-year low, near $1,050. The yellow metal slipped -0.1.45% (XAU/USD) in the face of the stronger dollar. The markets are anxiously anticipating Yellen’s testimony starting later in the day. Investors are on the watch for any indications as to whether the central bank could begin raising its interest rates in its mid-December meeting. That being said, I think we could see the metal continue pushing towards the $1,000 level. The MACD oscillator indicates negative momentum, but a correcting wave in the near future should not be ruled out. In addition, the Relative Strength Index alongside the Stochastic oscillator fell in an oversold territory, suggesting further weakness.

Oil plunged ahead of OPEC meeting

WTI and Brent Crude oil both plunged on talk that OPEC will resist production cuts at Friday’s meeting. The WTI is now trading above the $40.00 level, at $40.50, while the UK Brent is trading slightly below the $43.00 barrier. Further losses look likely for both commodities and below the session lows could then see an acceleration towards, $41.60 for Brent and $37.75 for WTI.

U.S. Indices fell on Energy sector weakness

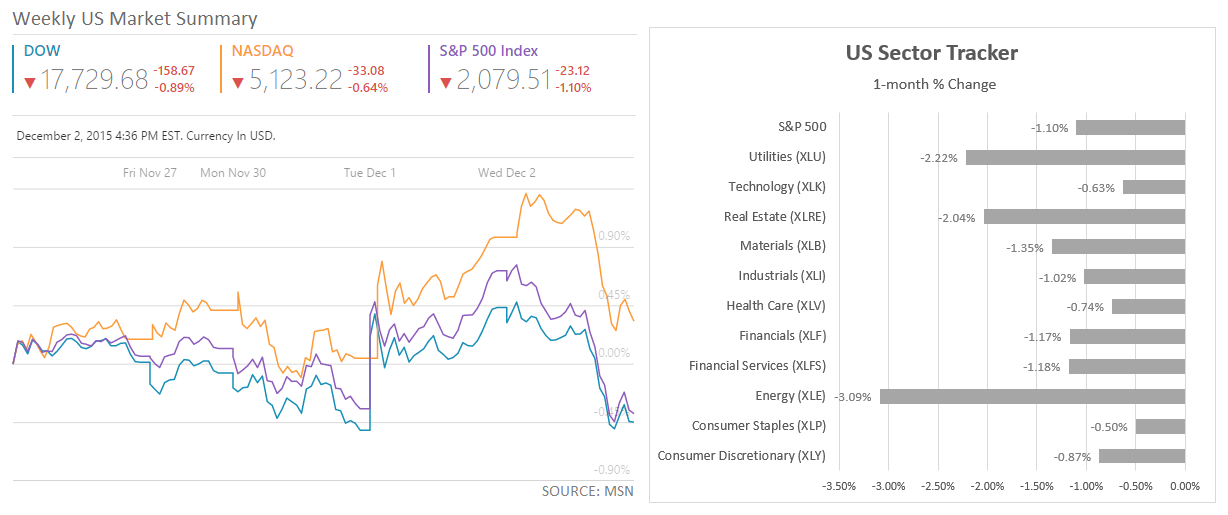

The majority of the US stocks fell on Wednesday as the data converges to the first Fed rate hike in nearly a decade looms. The oil and the energy in general plunged pushing extra downward pressure to the stocks. The Dow Jones fell nearly 160 points to 17,730 with just one of its stocks posting gains, UnitedHealth Group Inc. (NYSE: UNH). The worst performed stock was Exxon Mobil Corporation (NYSE: XOM) with losses more than 2.80%. S&P500 dived more than 1% as energy sector lost more than 3% of its gains ahead of the OPEC meeting today. The NRG Energy Inc (NYSE: NRG) lost nearly 13% of its value. Nasdaq also edged lower by 0.64% to 5,123.

Economic Indicators

A big day for the Eurozone today as the time for a fresh economic stimulus arrived. Thursday is also a PMI day and we will see Italy, France, Germany and England to release their Markit Services PMI figures. These will be followed by Eurozone Retail Sales report for October and the awaited ECB Policy meeting and the Monetary Policy Statement accompanied from a press conference. The central bank is expected to ease further the monetary policy, by cutting further the already negative deposit rate or by expanding the Quantitative Easing program.

During the US session, the Initial and Continuing Jobless Claims will be monitored. Fed Chair Janet Yellen will have its testimony. The Markit Services PMI for November, the ISM Non-Manufacturing Index, as well as Factory Orders, will be released.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

EUR/USD steadies above 1.0600, awaits German ZEW and Powell speech

EUR/USD is holding above 1.0600 in the European morning on Tuesday, having hit fresh five-month lows. The pair draws support from sluggish US Treasury bond yields but the rebound appears capped amid a stronger US Dollar and risk-aversion. Germany's ZEW survey and Powell awaited.

Gold price holds steady below $2,400 mark, bullish potential seems intact

Gold price oscillates in a narrow band on Tuesday and remains close to the all-time peak. The worsening Middle East crisis weighs on investors’ sentiment and benefits the metal. Reduced Fed rate cut bets lift the USD to a fresh YTD top and cap gains for the XAU/USD.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Key economic and earnings releases to watch

The market’s focus may be on geopolitical issues at the start of this week, but there is a large amount of economic data and more earnings releases to digest in the coming days.