UK Interest Rates are Likely to Remain Low "for Some Time"; US GDP Outperformed in Q3

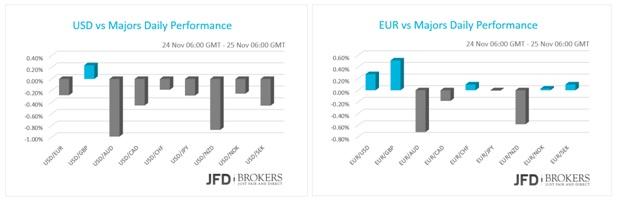

The U.S. dollar was traded lower against all of the major currencies on Tuesday with the exception of the British pound. The second estimate of the US GDP came out to 2.1% from 1.5% the first estimate, beating expectations the economy to have grown by 2.0%. However, the consumer spending flash estimation revised to 3.0% from 3.2% prior.The Consumers morale decreased to 90.4 from 99.5 expected! Even though the above surprised the economies on the downside, will not stand in the way of Fed to raise interest rates in mid-December, if they want to, as the headline GDP gave a strong positive figure.

German data prevented euro from further losses

The shared currency was traded mixed against its other G10 counterparts and ended the trading day virtually unchanged versus various currencies. For a second consecutive day, the upbeat German data came out prevented the single currency for further losses. The German business confidence has risen to its highest level for nearly 18 months, despite the Volkswagen scandal, China’s slowdown and the recent Paris attacks. The IFO’s Business Climate elevated to 109.0 in November from 108.2 the month before, while Survey’s Expectations indicator lifted considerable, as well, to 104.7 versus the slow down to 103.5 expected.

The euro is trading slightly higher today against the dollar, currently testing a key resistance level at 1.0660, which includes the 4-hour 50-SMA. The ability for the EUR/USD pair to hold above the key support level of 1.0600 would bring a more bullish outlook for the short-term and subsequently I would be looking for a move higher towards the 1.0700 level – intraday levels. Alternatively, a failure to break back above the 1.0660, I would expect the rate to challenge the psychological level of 1.0600 and a clear break above that level would drive the rate towards the 1.0525 barrier.

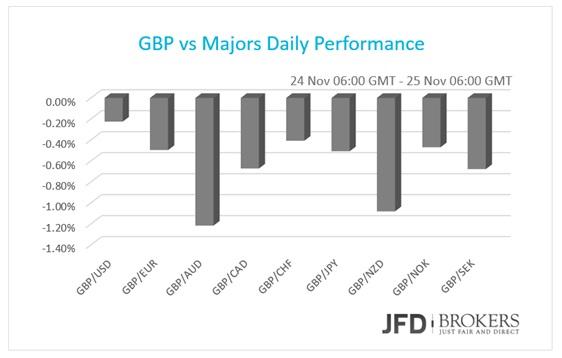

Carney: UK interest rates are likely to remain low “for some time”; GBP plunged

The British Pound plunged against all the major currencies due to the cautious stance the BoE Governor Mark Carney kept at his speech on Tuesday. The governor stated that he sees “the balance of risks aroundUK GDP growth and inflation as skewed materially to the downside, more so than embodied in the November 2015 Inflation Report.” The UK economy is growing fast and the scenario of BoE to raise interest rates after Fed is in the play. However, UK officials worry over the low inflation and how higher interest rates could affect consumption. It’s notable that consumer spending is one of the main engines of growth in the UK. Moreover, the strength of the sterling pressures inflation downwards and hurts the countries’ exports. The UK faces a trade deficit for more than 15 years and despite the efforts to narrow it, the exports slashed severely in the second half of the year. Taking all that into consideration Carney stated thatUK interest rates are likely to remain low “for some time”.

The GBP/USD pair continues to drift higher in early Wednesday, in what looks a lot like a short-term retracement following the drop after the pair tested the 1.5160. The instrument has a 50 – 50 chance of a recovery above the psychological level of 1.5100 or a fall towards the 1.0500 in the coming session. Relying on short-term oscillators does not seem a solid strategy since they lie near their neutral levels. We need to hold for today’s session as we want to see the final reaction of the price near the ascending trend line.

AUD: The best performed currency on Tuesday

The best-performed currency among the majors on Tuesday was the Australian dollar led by the speech of the RBA Governor Glenn Stevens. The Governor appeared optimistic for the economy despite the softer data, the lower commodity prices and the absence of the mining sector. Furthermore, the Australian firms accelerated hiring.

The AUD/USD pair recovered and surged above the 0.7250 level, following the rebound from the 50-SMA on the daily chart, as well as from the 200-SMA on the 4-hour chart. The US dollar is down more than +1% for the month and at +0.37% for the week after falling more than 7% the previous 3 months. The level of 0.7280 is key to understanding whether we are watching for a further continuation, with the next obstacle to be the 0.7360 barrier. Alternatively, if the pair begins to edge lower, having failed to break back above the 0.7280 – 0.7300 zone, it should find support around 0.7200, a previous level of support.

USD/CAD Technical Outlook

The USD/CAD pair extended its losing streak to two days on early Wednesday and in the process broke and closed below the key level of 1.3270. If a break occurs, then I would be looking for a further retracement towards 1.3215 and then to 1.3150 level, which includes the 4-hour 200-SMA. Technical indicators are providing mixed signals. RSI has flattened out just around the mid-point at 50, while the stochastic has entered its overbought territory, warning of a possible correction to the downside. Furthermore, the MACD oscillator fell below both its trigger and zero lines indicating some slowing in the upside momentum.

USD/TRY climbs into European morning

The USD/TRY pair has been gradually moving higher this morning, extending its winning streak to three days after Turkey shot down a Russian warplane near the Turkish-Syria border. The US dollar is up 1.67% so far this week against the Turkish lira. The USD is trading 30% higher against the TRY since January 2014. Technically, the daily 200-SMA supports the whole uptrend, which started back in 2011, however, the pair retraced more than 20% after its peak around 3.0700. As it stands, I would expect the US dollar to move higher and to test the daily 50-SMA around the 2.9000 level. Further advance will open the door towards the psychological level of 2.9500.

USD/JPY – Technical Outlook

Not much movement in USD/JPY with prices trading within 122.15 – 123.60 in the past 2 weeks. This is in stark contrast to what we’ve seen in the previous 3 weeks where pair surged above the key level of 121.75. Below the latter level, both the daily 50-SMA and the 200-SMA are ready to provide a strong support to the price action in case of a pullback while. With the above in mind, we could see further consolidation in the coming days, with the reaction above the 121.75 level recently, suggesting it is not quite time yet for a break lower. Therefore, as far as the pair remains above the latter level I remain bullish on this pair, looking at 123.00 and then at 123.40.

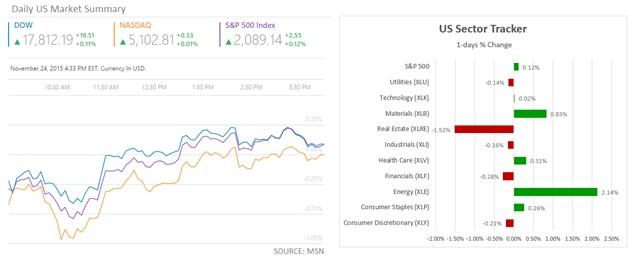

U.S. Indices had driven higher by Energy Sector

After Turkish downed a Russian warplane the energy stocks surged, preventing US indices from recording losses. On the other hand, Real Estate sector decreased on the S&P Case-Shiller Index that unveiled a larger than expected increase of house prices in October. The Dow Jones edged +0.11% higher to 17,812 with Pfizer Inc (NYSE: PFE) to extend its gains by +2.11% following the merger announced. The second best-performed stock was Exxon Mobil Corporation (NYSE: XOM) with gains near 2% on the broad pick-up of the energy related stocks. It’s worth to mention that the top loser stock was Walt Disney Co (NYSE: DIS)! The more visited theme park in Europe, the Euro Disney Park which located near to the center of Paris faces significant profit decline after the Paris terror attacks nearly a month before the Christmas. The S&P500 rose by 0.12%, also led by energy stocks while Nasdaq was virtually unchanged, 0.01% higher.

Economic Indicators

Today, no significant news from Europe are scheduled on Economic Calendar, therefore all eyes will turn to US. Out of Personal Spending and Personal Income that are expected to rise up to 0.3% from 0.1% and 0.4% from 0.1% respectively, October’s Durable Goods Orders will be watched closely. The Durable Goods Orders are monitored by investors as are sensitive to the US economic situation. For October, they are expected to have increased by 1.3% from a slowdown of -1.2% before. Going forward, the preliminary Markit Services PMI for November is predicted to advance up to 55.0 from 54.8 the previous month.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.