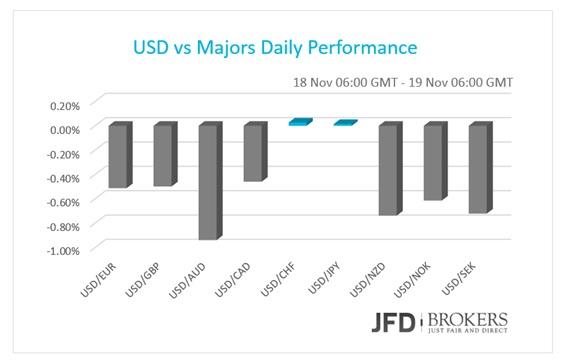

The dollar was broadly lower on Wednesday following the FOMC minutes. The policymakers suggest a smooth start of rate hikes in December if the data do not turn to the worse. This turns all the attention to the next Non-Farm Payrolls report, which will be out on the first Friday of December, and on November’s inflation rate.The inflation rate for November is scheduled to be released on December 15, the day before Fed policymakers announce their interest rate decision. Note that two-day Fed’s crucial policy meeting ends on December 16.

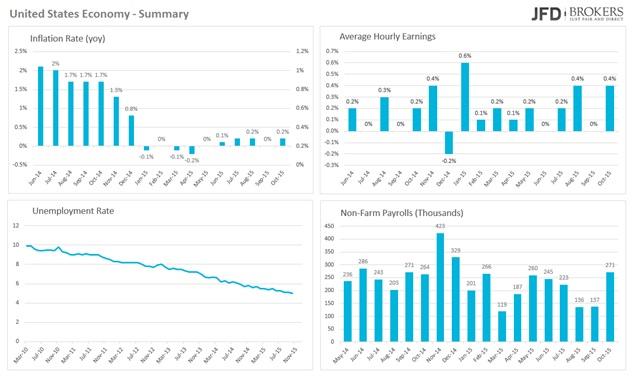

The FOMC minutes highlighted the improvement in labour market and the start of the inflation rate to pick uptowards Fed’s 2% target. The last inflation available figures for October indeed showed an improvement of 0.2% from stagnant consuming prices in September, however from my side of view, this does not prevent it from worsening in December. Behind the 0.2% increase, is the rise of the medical care and the energy prices. Mention that, at the start of the year, the US economy was in deflation but since May managed to exit the negative territory.

It’s noteworthy, that the Fed officials are not worried of any external economic slowdown anymore. In September's and October's policy meetings, further to the weak inflation, another reason that kept Fed away from the first rate hike, in nearly a decade, was China’s turmoil. But now "The US financial system appeared to have weathered the turbulence in global financial markets without any sign of systemic stress," as minutes said. Thereby, something less to worry about before an interest rate hike.

Going to the labour market, even in the weak months past, there was a moderate and stable improvement! The US economy adds a significant number of non-farm jobs on a steady monthly pace leading the unemployment rate lower. The jobless rate is decreasing continuously since 2010, currently being at 5% and categorizes the United States in the countries with the best labour market. After two consecutive months – August and September – when the economy added less than 200,000 jobs, but still above 100,000, the market recovered by adding a surprisingly strong number of 271,000 jobs, surpassing expectations. On the other hand, wages are rising impressively and steadily as well, except two flat months – June and September.

With the GDP averages more than 2.5% in 2015, and the fairly healthy employment report, maybe is the right timing for a rate hike on a quiet and gradual pace.

EUR/USD – Technical Outlook

The EUR/USD pair ended the day up 0.26% following the Fed minutes. The pair spiked after the news, following a rebound from 1.0615, and approached the psychological level of 1.0700 in early trading, although it failed to confirm further gains. The 4-hour 50-SMA acts as a strong resistance near the 1.0700 level while the 1-hour 200-SMA is also appeared to be a significant obstacle above 1.0700. Therefore, the pair needs to actually extend beyond 1.0700 to be able to catch up momentum, eyeing 1.0760 as the immediate short-term target. The downside remains well protected by the 1-hour 50-SMA near the 1.0660 level, as well as from 1.0600, with an unlikely move to the downside favoring a test of the 1.0660 level, the most closely scenario for now.

GBP/USD – Technical Outlook

The pound is looking pretty strong against the dollar at the moment, having broken through the significant zone of 1.5240 – 1.5250, as well as above the daily 50-SMA, near 1.5300. This provided significant resistance yesterday, but we are seeing it tested again today. The 4-hour 200-SMA, is also providing resistance at this level, so a break of all of these levels would strongly suggest there’s been a change of bias in the markets. Therefore, the next target for the pound bulls will be the 1.5350 barrier.

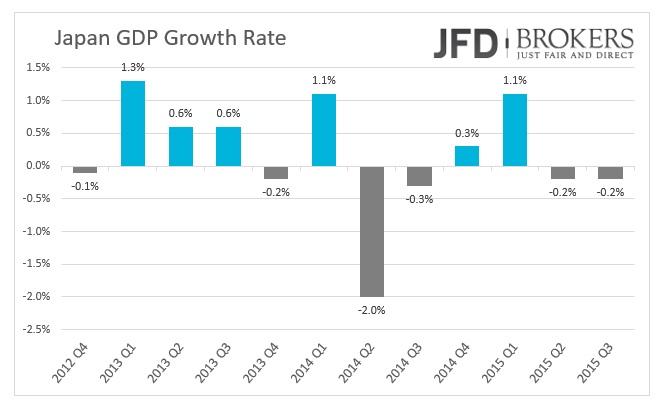

BoJ left Interest rates unchanged

The USD/JPY fell was down 0.4% before the Bank of Japan policy meeting, however, the decision to keep interest rates unchanged has limited impact on the currency pair, as it rose slightly but stills on negative daily performance. The bank’s decision based on the soft exports and production caused by the slowdown in emerging markets that led the country in recession. The world's third-largest economy contracted by 0.2% the last quarter, the second GBP growth decline in a row.

This must have been one of the most boring weeks in the history of the Nikkei index that lacked direction and volume following another non-event Japan meeting. The index is still trapped in a trading range as it did not make any significant moves, continuing to fluctuate between the support level of 18455 and the key psychological level of 18000.

The index continues to increase the rate of attempts to break the upper boundary of the sideways channel, following a failed attempt during yesterday’s session. I think it’s going to take at least 2-3 attempts before we see a break above here. In the 1-hour chart, the index is finding support from the 50-SMA, near the 18250 area, which I consider a rebound zone, alongside with the 18175 level. In the 4-hour chart the index is holding above both the 50-SMA and the 200-SMA, while the technical indicators are holding above their mid-lines, in line with the shorter term picture. All in all, as long as the index remains above the psychological level of 18000, which includes the 4-hour 200-SMA, I remain bullish.

U.S. Indices outperformed following FOMC minutes

U.S. markets all ended in positive territory, with the Dow Jones Industrial Average outperforming to close 247.66 points or 1.42% higher. The Nasdaq Composite closed 1.79% to end the day at 5,075 while the S&P 500 finished 1.62% or 33.14 points up.

The Dow Jones surged above the key level of 17660, yesterday’s recommendation level to go long, and is now approaching the psychological level of 18000, recommended target. Still the index is on track to deliver the third trading session in a row while it managed to gain more than 2.5% the last 2 trading sessions. Therefore, we remain bullish on DJIA!

Economic Indicators

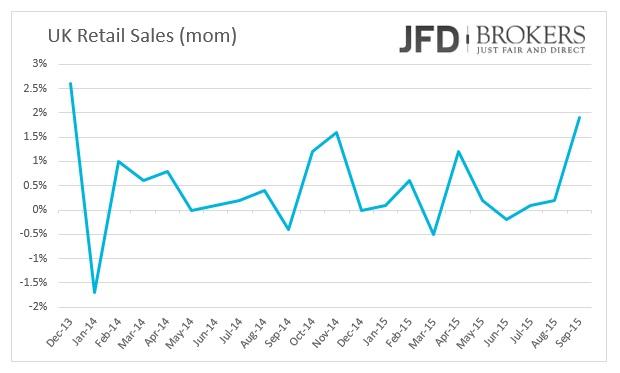

Today, close attention will be paid to the UK Retail Sales and ECB Monetary Policy Meeting Accounts. UK Retail Sales are due to slow down.

The weekly jobless claims are coming out as well as the Canadian Wholesales Sales for September. The US Conference Board leading indicator is coming out for October; while not market affecting, should be worth looking at it.The weekly jobless claims are coming out as well as the Canadian Wholesales Sales for September. The US Conference Board leading indicator is coming out for October; while not market affecting, should be worth looking at it.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.