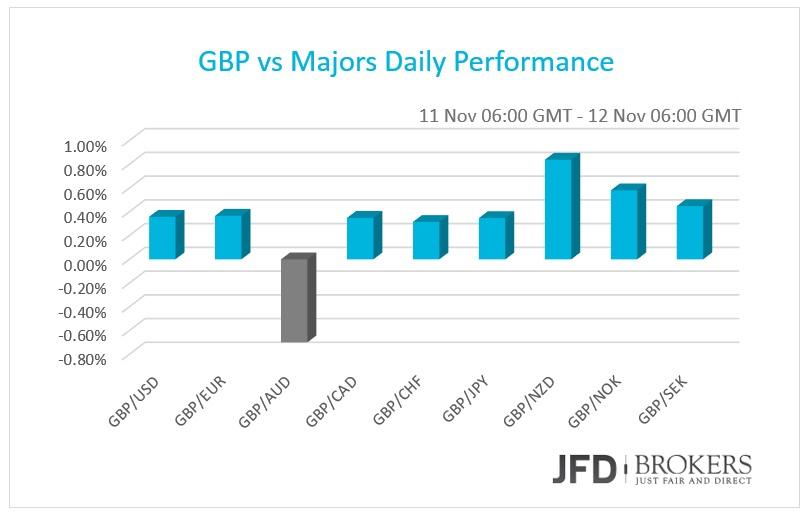

Most G10 currencies were little changed against the dollar during yesterday’s trading session and early Thursday when compared with their opening European levels. The only ones to show a move greater than 0.4% were AUD and GBP on the upside and NZD on the downside. EUR/USD was virtually unchanged during yesterday’s session as well as, CAD, CHF, JPY and SEK versus the USD. I think, these currencies seems to be taking a small rest as it is possible that some investors are securing their short profits.

The best performing major currency was the Australian dollar, which rose against all its G10 counterparts after October labor figures came in much stronger than markets had expected, reducing expectations of another RBA rate cut. The unemployment rate fell to 5.9% in October, the lowest in six months and well below the 6.2% that economists had forecast. Meanwhile, the economy added a net 58,600 jobs in October, far higher than the market forecast of a 15,000 increase. The AUD/USD pair surged more than 1% following the release and the pair is close to deliver its first positive week, currently at 1.28%, after 4 negative weeks in a row.

UK unemployment falls but wage growth disappoints

The second-best performing major currency was sterling, which also rose after the UK unemployment rate fell to a seven-year low of 5.3% in the third quarter. The number of people out of work fell by 103,000 between July and September to 1.75 million while employment jumped 177,000 to 31.2 million.Despite the improvement in the headline numbers, the labour report showed some weakening in the pace of wage growth as earnings excluding bonuses increased an annual 2.5% in the third quarter from 2.8% in the previous three months and missing forecasts for a reading of 2.7%. On the other hand, total earnings of workers, including bonuses, was up 3 percent, thanks to a 15% surge in bonuses.The BoE has said that it’s keeping a close eye on wage growth in considering when to hike interest rates.

The GBP/USD pair retraced to 1.5130 following the labour report, however, it gained traction and surged above the psychological level of 1.5200, (suggested level to open a long position) to end the day near the 1.5250, yesterday’s suggested target for the intraday traders. The short-term traders should watch that level closely since it coincides with the 200-SMA on the 1-hour chart, as well as the 50-SMA on the 4-hour chart.

Euro mixed but remains under pressure!

The euro suffered some losses against the Australian dollar and the British pound, however, it was virtually unchanged against the USD, CAD, CHF, NZD, SEK and NOK. There was little on the calendar to drive the currency yesterday. The EUR/USD moved in a range bound roughly around the 1.0750 level during yesterday’s session, as the pair traded as lows as 1.0705 intraday, but during the US session it managed to surge above the 1-hour 50-SMA to test the 1.0780 intraday level. The short-term picture is neutral-to-bearish, as long as it holds below the 1.0800, given that the 4-hour chart shows that the technical indicators hold below their mid-lines, with no directional strength.

The EUR/GBP pair has been unable to break through the 0.7040 support zone in early trading, but the bearish trend remains. The pair is under pressure to deliver another negative week, -0.92% so far, following four consecutive negative weeks after the bulls failed to sustain their move above the 0.7500 level. Today, we expect the bears to try once again to push through the support zone and probably this time the push will be successful. The next important support zone is located at 0.7025. The downtrend is very strong and for now we do not see any bullish set-up.

NZD/USD - Are bears regaining control?

Yesterday, the NZD/USD pair has not been able to keep up the early gains and the bears retraced most of the rally leaving on a daily basis a long shadow candlestick which is a signal that the overall downtrend is likely to continue. Today, we expect a drop towards the 0.6450 support, however, for the bears to reach that level will need to go through the psychological level of 0.6500, yesterday’s low. The prices are below the 50-SMA which is also a bearish sign. Only a move above 0.6620 may question the downtrend.

USD/JPY Bulls could take the lead above 123.00

In early trading, the USD/JPY has depreciated and fell below the psychological support at 123.00. However, we believe that the depreciation will be short-term and probably the bulls will soon take control over the trend. Today, the chances for a move towards 123.50 are high and a close above that level will be a sign that the rally has begun again with a strong impulse. Alternatively, a movelower should see the pair finding support around 122.20, which includes the 50-SMA on the 4-hour chart.

DXY keeps a bullish structure!

During the last couple of days, the dollar index is consolidating slightly below the psychological level of 100 and despite the slightly negative move yesterday, the prices are in a very strong uptrend that is likely to continue after the consolidation is over. Technically, we expect the prices to move towards 99.50 or even 100.00. We see very strong dollar until December rate decision amid speculation of almost 100% sure rate hike.

WTI Crude may break below a crucial support zone!

Yesterday, the WTI Crude has depreciated towards the $42.50 support zone but has not been able to push through. However, the bearish pressure remains and sooner or later we will expect a move below the $42.50 support. From a long-term perspective, the prices will probably fall towards the psychological support zone at $40.00 per barrel.

Gold continues to decline!

As we expected, Gold continue to depreciate and on a daily basis the bearish movement seems quite overextended. The yellow metal is now hovering near a 3-month low, around the $1,085 level. The bulls are now building a strong short-term support level near $1,082 - $1,085 zone, with decent stop orders developing below. However, from a technical point of view there are no signs which suggest a bullish reversal and probably before a correction takes place, we will see the precious metal sold at $1,077 support.

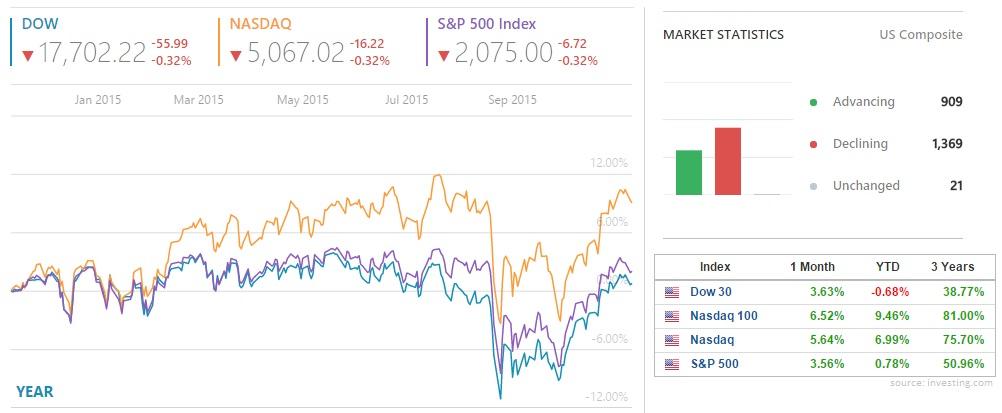

U.S. Indices Outlook!

In the equity market, US stock indexes plunged during Wednesday’s session as declining oil prices worried investors. However, the U.S. stocks ended the day lower, dragged down by weakness in retailers and energy companies. The Dow Jones Industrial Average fell 0.32%, to close at 17,702.22. The broader S&P 500 index lost 0.32% as well, to end the day at 2,075.00, and the NASDAQ slipped 16.22 points to 5,067.02. For the week, the Dow Jones has dipped 208.11 points or 1.2%, the S&P 500 has fallen 24.20 points or 1.2% and the Nasdaq has retreated 80.10 points or 1.6%.

Macy's (NYSE: M 40.41) plunged 14.06% Wednesday after reporting disappointing results and cutting its profit forecast while Alibaba (NYSE: BABA), despite a record sales on a single day of 91.2 billion yuan ($14.3 billion), the stock price plunged 1.99%, to end the day below the $80.00 level, at $79.81. Meanwhile, Nike Inc. (NYSE: NKE 127.40) was the biggest drop of the Dow Jones. The company was last seen down 2% right at the closing bell which technically marks the start of the correction phase, with the next support level to watch to be near mid-October lows at $125.00.

Economic Indicators to watch today:

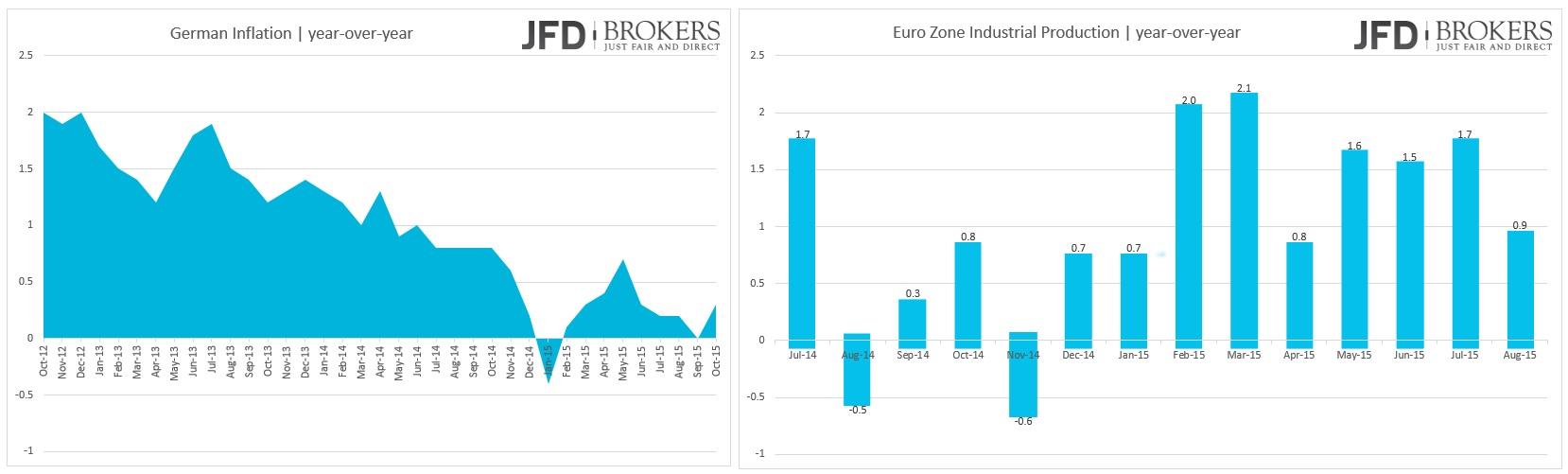

Today, the German inflation rate for October will be released – no major changes are expected. The traders will keep a tab for Eurozone’s industrial production for September as they expect to grow on a steeper pace of 1.7% from 0.9% before, year over year, opposite to the recent ECB move to cut economic growth forecasts. In US, the JOLTS job openings for September and October’s monthly budget statement will be out. During the night, in Japan the capacity utilization and the industrial production for September will be posted.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.