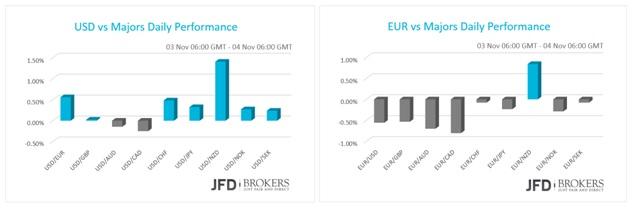

The U.S. dollar was traded on a low profile for the second day in a row on Tuesday as investors await the Fed Chair Janet Yellen’s congressional testimony later in the day. Traders expect Fed Chair to reveal how the economy is getting ready for the first interest rate hike in nearly a decade. Although, the economic optimism among consumers lost its strength in November and came out below 50 for the seventh consecutive month!

Euro falls on Draghi’s comments

The euro depreciated against most of the G10 currencies on Tuesday due to the speech of the ECB president Mario Draghi. The president expressed its willing for further economic stimulus and reminded the re-examination and evaluation of the current stimulus program in December.

Even though we have seen a strong bearish pressure yesterday, the EUR/USD pair has not been able to break through the main ascending support and the bullish channel structure is still kept intact. Today, we expect the prices to test again the support and probably rebound with bulls taking the upper hand and push towards the 1.1050 resistance. On the other hand, a drop below the ascending support will be a strong sign for further declines.

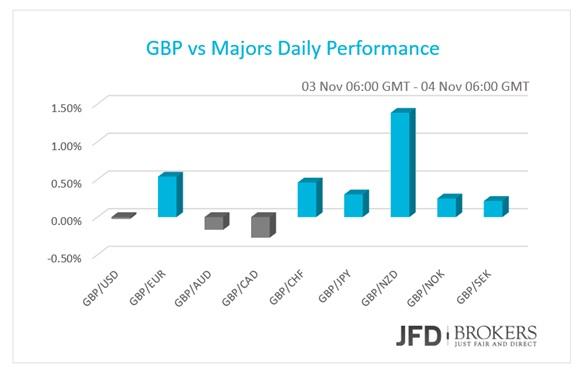

GBP – intraday volatility despite the absence of economic news

Despite the lack of news in the macroeconomic front, the sterling has faced intraday volatility versus the majors and closed slightly higher its opening levels. The PMI Construction slowed down in October as expected but remained above 50, indicating growth.

Even though, the prices for GBP/USD dropped down to 1.5360, the bulls were able to take control and reverse the initial bearish movement. However at the end, the prices closed near the opening of yesterday’s daily bar. We take this as a bullish signal and from a technical point of view, the prices may rally and test again the resistance at 1.5550.

NZD drops on Dairy Product prices and downbeat Employment Data

The most volatile major currency on Tuesday was the New Zealand dollar that plunged versus all of its other counterparts due to the disappointment delivered from the country’s employment report and the sharp decline of the dairy product prices. The unemployment rate for Q3 rose to the highest figure of the last six quarters while the participation rate decreased to 68.6% of the labour force from 69.3% before. Employment change contracted by 0.4%, the worst rate since Q3 2012. On the top of that, the dairy priced dropped by 7.4%, the largest decline in three months.

The US dollar has been regaining some of the ground lost in the last two days of the previous week against the New Zealand dollar and ultimately challenged the crucial 0.6620 support level this morning. TheNZD/USD has fallen for a second consecutive day, retreating from the 38.2% Fibonacci level, as well as from the key resistance level of 0.6800. On the daily chart, the bulls failed to go over the aforementioned obstacles and the price continues to move inside a formation which started after the pair peaked at 0.6900.

That being said, I think we could see the dollar continue pushing towards the 0.6580 level, which coincides with the 23.6% Fibonacci level, as well as the 200-SMA on the 4-hour chart. However, the 0.6620 support level seems more likely to take on a reversal point. If we see a close below the latter level, it would be very bearish, prompting a more aggressive move towards the 0.6500 hurdle. If, as expected, we see a break below here, the next target will be the 0.6460 level. Alternatively, a failure to break below the aforementioned levels could provide an opportunity to retest the key resistance level at 0.6700, which coincides with both the 50-SMA and the 200-SMA on the 1-hour chart. The MACD oscillator indicates negative momentum, but a correcting wave in the near future should not be ruled out. In addition, the Relative Strength Index alongside the Stochastic Oscillator fell in an oversold territory, suggesting further weakness.

AUD/USD – Technical Outlook

The AUD/USD pair has rebounded from a key ascending support and the bulls are currently the dominant party. We expect the pair to rally towards the 0.7250 resistance. The dollar strength is losing momentum and we expect that the AUD/USD pair will follow and appreciate. On the other hand, technically a drop below 0.7100 would be very clear that the bears are in control of the trend again.

Gold may stop its losses amid important support!

Even though the gold has been traded in a very strong bearish pattern, the prices are close to the main support level. We expect the precious metal to drop towards the 1111.00 support rebound from it and take a bullish approach in a short-term perspective. The drop is way too overextended on a daily basis and we expect a retracement close to this support zone.

Brent Crude in a bullish run!

The Brent Crude Oil is in a strong bullish run since the prices have rebounded from the main support at $46.50 per barrel. Currently, the commodity is traded right below the $50.77 resistance and we expect the bulls to face some bearish pressure. The prices may retrace down to $50.00, but we expect the uptrend to remain and the bulls are likely to push forward.

DXY keeps up the bullish structure!

The US Dollar Index has been able to keep trading above the key support zone at 96.70 and now the bulls have an upper hand. We expect the prices to rally and test the main resistance at 97.85 as a 4-hour close above that level will be a signal that the bulls will continue to pressure. On the other hand, a drop below the 96.70 support zone will be a sign that further declines are going to take place.

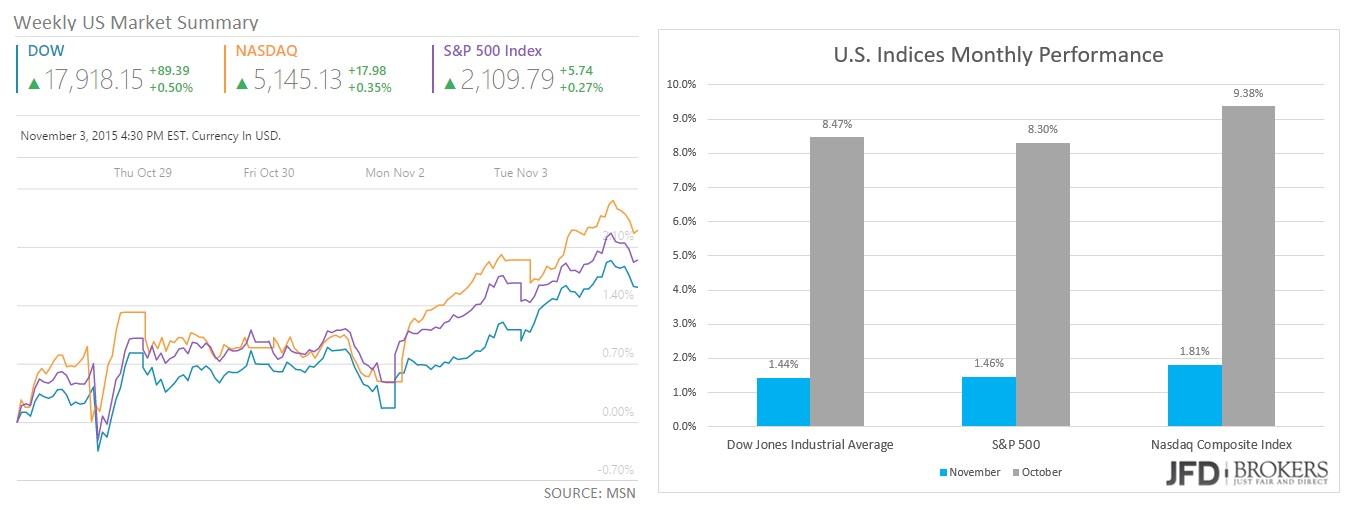

U.S. Indices rally for second consecutive day

The U.S. indices continue to rally upwards for the second consecutive day led by the energy sector. On Monday, the Dow Jones Industrial Average managed to turn its annual performance positive while Nasdaq jumped to a 15-year high. In addition, the S&P500 had topped at 2,100 reversing its losses since Chinese yuan devaluation. On Tuesday, all the three indices performed positively and maintained their gains. Nasdaqrose by +0.35% while S&P500 registered gains of +0.27%. The US 30 closed +0.50% up at 17,918.

It’s best-performed stock was Visa Inc (NYSE: V) which rose more than 3% following its earnings report and the announcement of a major deal. The company’s revenues surpassed expectations while the EPS reported earnings of 62 cents per share, as expected. The company announced that that its plans to buy the subsidiary Visa Europe for $23.3 billion. Visa will issue $16 billion in debt in order to fund the deal.

Economic Indicators

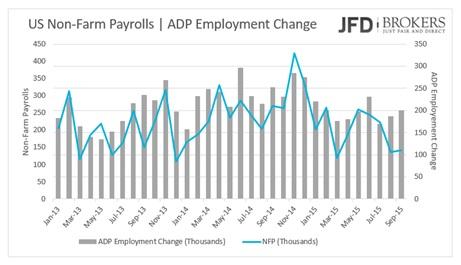

Today, the Markit PMIs for services sector in various countries for October will complete the data needed for the Markit Composite PMI to be calculated. In US, Eurozone, Germany, UK, France, Spain and Italy both the Markit services and composite PMIs will be out. Most of them are expected to have remained on the same level of growth. In US, the non-manufacturing PMI will also be out and is forecasted to have risen slightly. The ECB will have its non-monetary policy meeting. Eurozone’s producer price index for September will be out. Traders will keep a tab for October’s ADP employment change which will give a clue for the NFP number two days ahead.

The Fed Chair Janet Yellen will have a testimony in Washington. Later in the day, the RBA Governor Glenn Stevens will give a speech and is expected to comment further on RBA’s interest rate decision. During the night, the Bank of Japan monetary policy meetings minutes will be published.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.