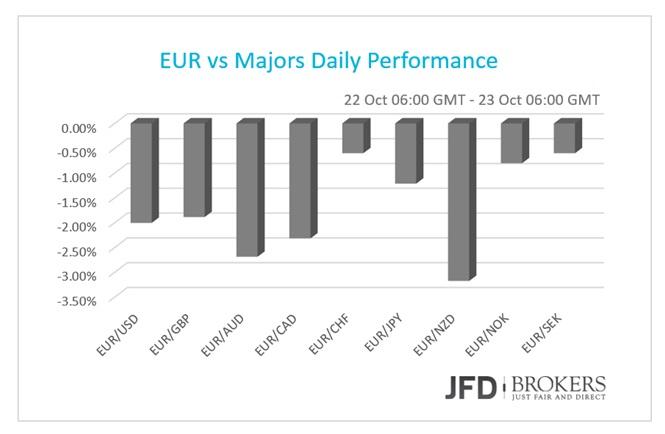

The euro tumbled against all the major currencies after the ECB policy meeting and plunged to a two-month low against the U.S. dollar at 1.1200 our suggested target and at Thursday’s morning report, “ECB Policy Meeting Arrived! More Stimulus Actions to Take Place? BoC Main Rate on Hold” - a profit of 150 pips.The euro suffered the heaviest losses versus the commodity currencies, New Zealand dollar, Australian dollar and Canadian dollar. Against the New Zealand dollar, the shared currency plunged more than 3% while it generally depreciated nearly 400 pips against each commodity currency.

European Central Bank left its monetary policy unchanged but to restore the confidence the ECB representatives believe the Greek program needs implementation and they lowered the Greek ELA ceiling to €86.9bln from €87.9bln before.

Even though the QE programme remained unchanged, a while later at the press conference the ECB president Mario Draghi announced that more stimulus measures to boost the economy will be examined before the end of the year, as the economic growth is still meager. A possible option is also to cut the deposit rate however he said more specifically that the QE scope will be revised in December 2015 on the weak economic growth. Moreover, he expects the inflation rate to remain low for the next months. The flash preliminary consumer confidence for October plunged to a nine-month low.

EUR/USD – Technical Outlook

The EUR/USD pair dropped significantly against the greenback after yesterday’s speech by Mario Draghi. The ECB head said that the Central Bank is going to reconsider its QE program and this is a hint that the monetary easing will continue during 2016. On top of that, there has been a discussion about a cut of the deposit rate that has been the key market mover. The situation for EUR/USD is tricky because despite the huge drop, the pair is still traded above a main ascending support and as long as the prices are traded above 1.1000 and there isn’t a daily close below it, we consider the main bullish channel structure active. On the contrary of most market expectations, we think that the pair will retrace the yesterday’s drop and will head towards the upper channel boundary.

EUR/JPY – Technical Outlook

The euro plunged to fresh monthly lows and tested the critical 134.00 mark versus the yen. The EUR/JPY fell more than 1.5% ended the day around the 134.00 level. The pair is set to deliver a second consecutive negative week, -1.13% so far, following a -0.78% the previous week. With the above in mind, I would expect the selling pressure to continue and the pair to test the 133.40 level (intraday), with a break below to point towards 133.15 (interday) and then to 132.30 (short-term).

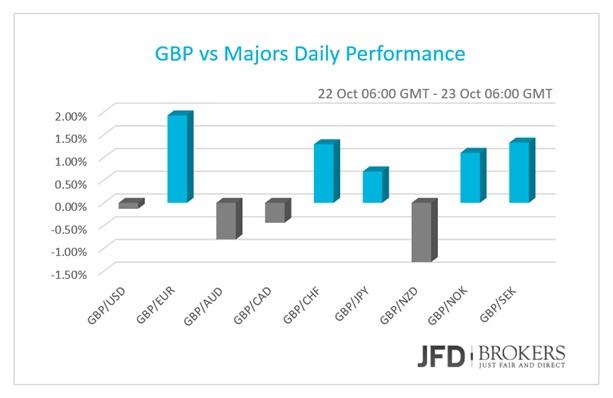

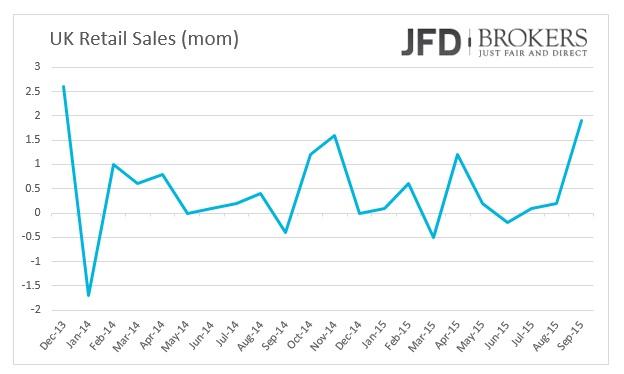

GBP mixed despite the record growth of Retail Sales

The British pound was traded mixed against its major peers despite the better than expected retail sales. Retail sales are always a useful gauge of how well the US recovery is doing since consumer spending is such a large part of the economy. In September, the month-over-month retail sales grew by 1.9%, the steepest pace since December 2013.

GBP/USD – Technical Outlook

The GBP/USD pair is currently traded above the key support level of 1.5350. On a daily basis, we expect the prices to form a short-term trading range between the 1.5350 support and the 1.5500 resistance. As long as the pair is traded above 1.5350, we consider that the bulls are the dominant party and we expect them to be able to push the upper boundary of the trading range and target the next important resistance at 1.5650. Today’s daily close will be very important and the higher it is the better for the bulls and vice versa.

EUR/GBP – Technical Outlook

EUR/GBP plunged more than 1.5% during the ECB meetings and closed the day in red 1.88% following the ECB decision and the press conference, as well as the upbeat macroeconomic data from the UK. The pair violated the key support level of 0.7300, as well as the 0.7240 level. It finished the day at 0.7200, with the pound adding more than 150 pips against the euro during the US session. I would expect the pair to consolidate, temporary at least, around the 0.7230 – 0.7240 area, and then the pair to move south again.

Gold - Bulls are able to take a grip over the trend!

As we expected in our prior’s analysis the gold has been able to keep up the bullish structure and the prices rebounded from the key support at $1170.00. Since the early Asian session, we observe a strong bullish push and if this continue throughout the E.U. and the U.S. session’s it will be a strong confirmation that the prices are likely to rally towards $1205.00 resistance as a close above that level will be a signal for further price appreciation towards $1230.50. On the other hand, if today the prices close below $1165.00, the scenario turns bearish and we will expect a test of the main ascending support close to the $1120/30 zone.

Brent Crude – The prices are building a consolidation triangle structure

After the Brent Crude Oil hit the lows at $42.20, the bulls took an upper hand and pushed the prices up to $54.20. From there we observe a range trading pattern between the support at $46.20 and the last mentioned resistance at $54.20. On top of that, we can spot that the prices are building a triangle pattern. Technically, we expect the big range trading to be sustained and most likely the prices will head towards the upper boundary of the structure and test the $53.40 resistance. On the other hand, if we see a daily close below $46.20, the scenario turns bearish and we will expect further declines towards the $42.20 support.

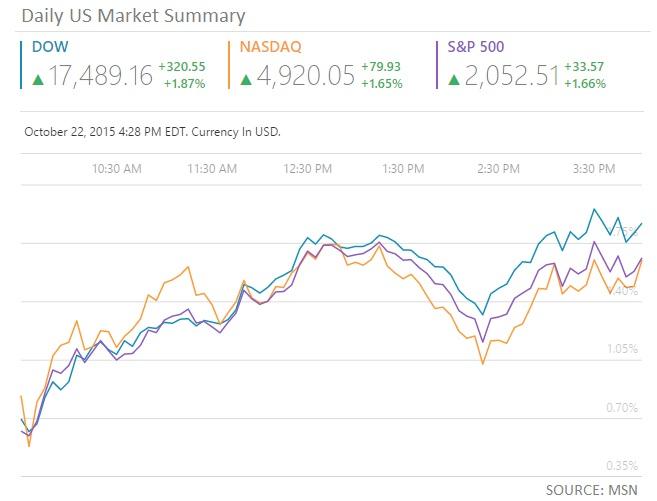

U.S. Indices are about to close a positive week

The U.S. indices covered all the previous losses of the week and are heading to close a well positive-performed week, the fourth in a row. The Nasdaq gained 1.65% while the S&P500 rose by +1.66% on Thursday’s trading session. The Dow Jones industrial average elevated by +1.87%. The McDonald’s Corporation (NYSE: MCD) dragged the Dow Jones higher, as it rose jumped by +8.33% after the surprisingly better than expected Q3 earnings. The revenues of the company were $6.62B versus the $6.44B expected while the EPS has been announced to be $1.4 from the forecasted $1.27. On the negative performed columns, there were only four of the DJIA stocks, one of them was the American Express Co (NYSE: AXP) that lost more than 5% of its value, followed by UnitedHealth Group Inc. (NYSE: UNH) with losses of 3.56%.

DAX Stock Index benefited from Draghi's speech

The speech of Mario Draghi has been quite positive for the DAX Stock Index and we have seen a very strong rally that pushed the prices above the key resistance at 10500. On top of that, on a daily basis the index is traded way above the 50-SMA – a strong signal for a bullish trend. We assume that the bearish correction that started from 11700 and pushed the prices as low as 9325 is over and in the near term future the bulls should push the prices towards the 11000 level break through it and target the prior highs around 11700/800.

Economic Indicators

On Friday morning, the preliminary October’s Markit services, manufacturing and composite PMIs for France, Germany and Eurozone are coming out. All of the economic indicators for Germany and Eurozone are expected to show a slowdown. Later in the day, the focus will turn into Canada that publish its September’s final inflation rate which is anticipated to attract considerable attention amid the CAD traders. The flash Markit manufacturing for October in U.S. is also coming out.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.