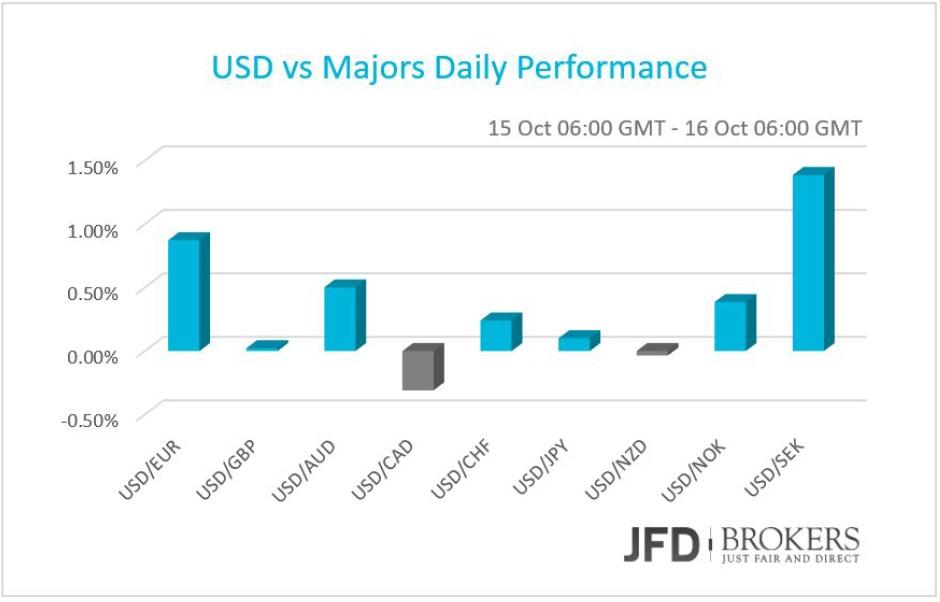

The U.S. dollar gained against most of the other G10 currencies on Thursday and early Wednesday on the back of the better than expected inflation rate, the 40‐year record low jobless claims and the narrowest U.S. monthly budget deficit since 2008!

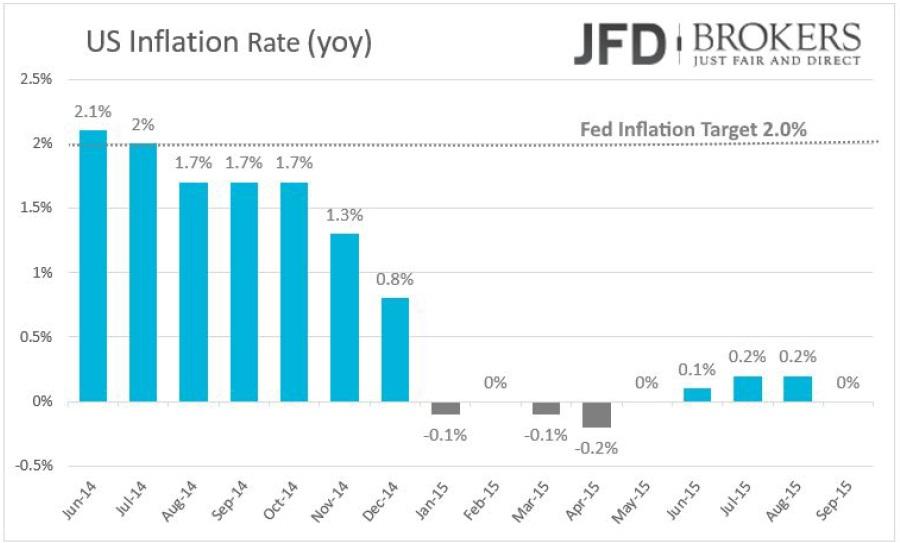

The initial jobless claims plummet to the lowest since November 1973 and dragged down the 4‐week average to 265,000. The U.S. inflation rate, on a yearly basis, revealed that the consumer prices remained stagnant in September, beating expectation to have decreased by ‐0.1%, while the consumer prices for the core products, ex food and energy, picked up by 1.9%, surpassing forecasts. The month‐over‐month inflation rate met market’s expectations of ‐0.2%. Even though the inflation rate is well below the Fed’s 2% target, the U.S. economy has prevented the deflation for the fourth consecutive month.

The currency was beaten meanwhile by the Philadelphia Fed Manufacturing index that dropped to ‐ 4.5 compared to ‐1.0 expected but picked up by September’s Budget release. The U.S. budget deficit in fiscal 2015, dropped to $439 billion, the lowest level since 2008, according to the Treasury department and the deficit‐to‐GDP ratio fell to 2.5% the lowest since 2007 and less than the 40‐ years average.

Today’s news to reassert if QE extension is needed – Discussions in progress!

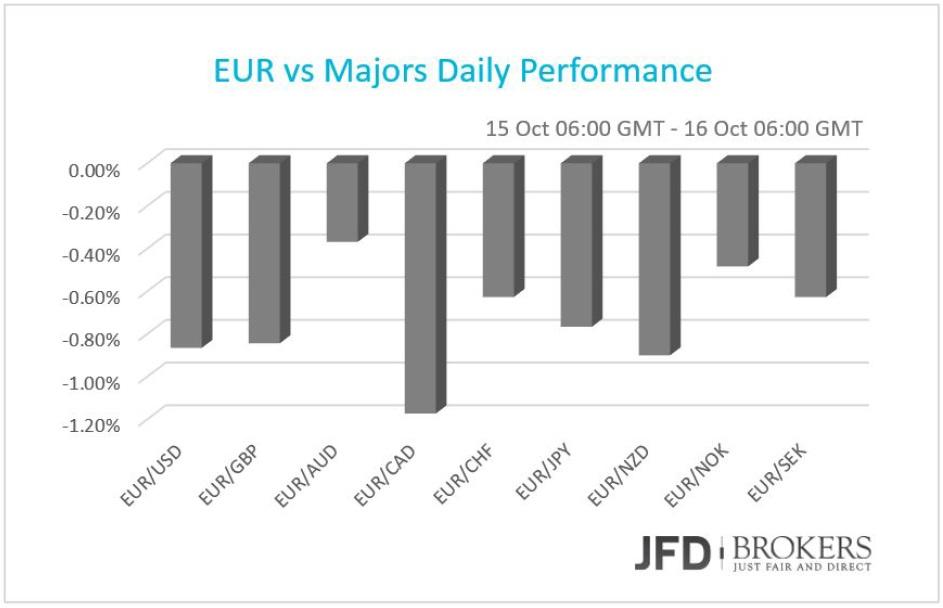

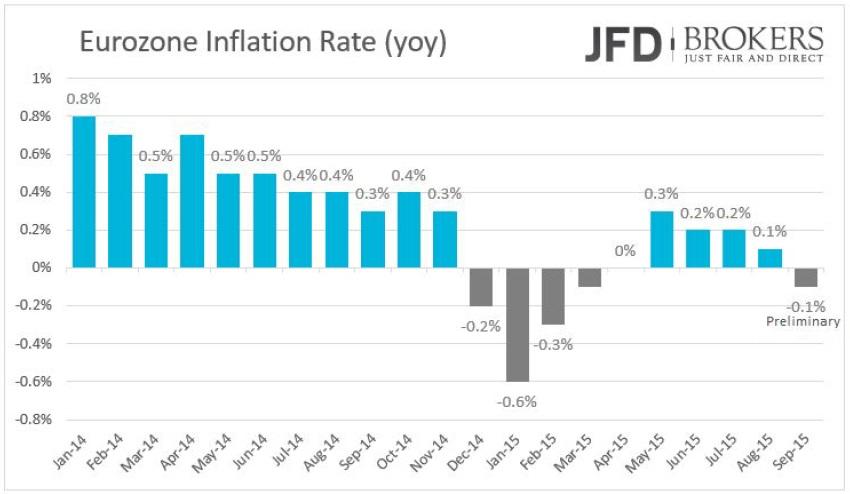

The shared currency fell versus all of the major currencies on Thursday and early Friday, as ECB policymakers are talking about the need for further economic stimulus, a week before October’s ECB policy meeting. The low inflation rate and the weak growth are the main drivers of the discussion for QE extension. The final September’s inflation in Eurozone and the trade balance report, that will be released today, will reassert whether further actions need to be taken for the current situation.

The dollar has recovered all of the losses seen earlier in the day, now trading again below the key support level of 1.1400 against the euro. The EUR/USD pair recorded a fresh 1 ½ month high slightly below the psychological level of 1.1500, yesterday’s suggested target, but the move appeared to be nothing more than a false breakout above the key level of 1.1462, September’s high. Following yesterday’s and Wednesday’s roller coaster move in the pair, I would be fairly neutral on any directional move, especially after the failed attempt above the 1.1500 barrier.

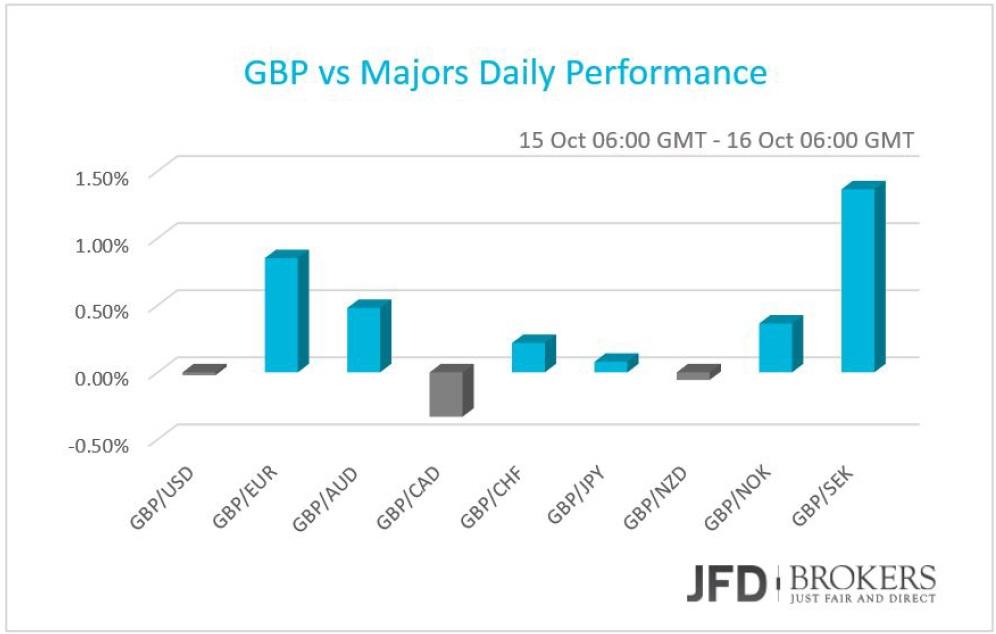

GBP/USD retraced despite the no news day

Following a trading session with no economic news, sterling was traded broadly higher against the other G10 currencies. Following the aggressive buy in the GBP/USD which started after the strong rebound from the psychological level of 1.5200 where the pound added more than 250 pips in a day, the pair has been stuck in a brutal range roughly around the 1.5450 area. A clear battle is taking place above the key support zone of 1.5450 – 1.5480, where it coincides with the medium‐term descending trend line which started back in mid‐August. Both the 50‐SMA on the 1‐hour chart and the 1.5415 are ready to provide a significant support to the price action in case of a pullback. Furthermore, the 50‐SMA crossed above the 200‐SMA on the 4‐hour chart, a move that could change the medium term to bullish. Going forward, I the bulls manage to maintain the price above the aforementioned zone, as well as, above the 1.5415, then I would expect the bulls to drive the battle to the next resistance level of 1.5500 and then most probably to end the day near the 1.5550.

Today’s U.S data might be the catalyst GBP/USD needs to make a move above the descending trend line.

AUD falls on Financial Stability Review; Possible rate cut in November

The Australian dollar plunged below 0.7300 against the US dollar following the RBA's Financial Stability Review, following the aggressive buy few days ago where we saw the AUD/USD gaining more than 100 pips, taking advantage of a broadly‐weaker U.S. dollar. The AUD came under selling pressure after the country's central bank issued its Financial Stability Review that pointed to higher risks in housing and mortgage markets. The AUD/USD closed the day in red 0.40% following a negative Wednesday 0.77%, hovering above the 1‐hour 50‐SMA. In the Financial Stability Review, the Reserve Bank of Australia said that lending standards for home loans had been looser than first thought, adding to the risks of an eventual downturn in the housing market. Meanwhile, the Australian Bank Westpac announced on Wednesday that will raise interest rates as the markets are expecting a rate cut from the RBA in the next month. Technically, the AUD/USD it is moving in a trading range between the levels of 0.7380 and 0.7200. Overall, we maintain our negative view on the exchange rate and seek sell opportunities in the fall.

USD/JPY – Technical Outlook

Volatility compared to just a few days back is very mild, as the yen made a so‐called fake breakdown below the 118.66 and rebounded sharply to end up inside the channel. Lots of late shorts are probably caught and eventual stop loss hunting will lead prices higher, well above 119.00. The USD/JPY pair has been moving in a trading range seen mid‐August and it seems it will continue to move sideways for the rest of the day. The performance of the pair also agrees with the recent ‘no trading mode’ of the pair since the weekly the monthly, as well as the year‐to‐date is below 1%.

Gold – Technical Outlook

On a daily basis, the price of Gold has been in a bullish run that took the prices as high as $1190.30 breaking the main resistance at $1170.00. Today is the last trading day of the week so we expect the bulls to gather profits and there is very high chance the prices to drop towards the prior resistance current support at $1170.00. However, we expect the main bullish trend to be kept and after the support is tested most likely we will see a rally that will be confirmed in the case of a daily close above $1190.00. The prices are way above the 7‐SMA and the last cross of the long‐term 50‐SMA with the other two shorter – the 14‐SMA and the 7‐SMA is clearly bullish.

Brent Crude Oil – Technical Outlook

On a daily basis, the Brent Crude has been able to go for a third consecutive day of appreciation after the prices rebounded from the 50‐period SMA. Overall, the bulls are in charge since the commodity hit a bottom at $42.15. We expect the uptrend to continue and a 4h close above $50.70 will be a signal for further price appreciation towards the $53.00 level. However, technically, a drop below $48.50 will indicate that the bears will pressure towards $47.00. The recent spike in the Oil Prices has supported the commodity currencies such as AUD, NZD and CAD. We observe that these currencies have appreciated not only against the USD but against all of their other counterparts from the G10 basket.

U.S. Indices had the greatest volatility in 10‐days!

On Thursday’s trading session, the U.S. indices had the greatest volatility in the last ten days. The three popular indices rallies upwards more than 1% overnight on the rear of financial news that shows stagnant inflation rate that will delay the Fed rate hike and weak earnings reports released yesterday. The Dow Jones index enjoyed a triple‐digit increase by +217 points, +1.28% up. The two best‐performed stocks that dragged the index higher was the pharmaceutical corporation Pfizer (NYSE: PFE) and the Goldman Sachs Group (NYSE: GS) that edged higher +3.27% and +3.16% respectively.

The Nasdaq composite index rose by +1.82% while the S&P500 reached an eight‐week high driven from better than expected bank data and pharmaceutical companies stock pick‐up. The index rose up to +1.49% with BAXALTA (NYSE: BXLT) and Alexion Pharmaceuticals (NASDAQ: ALXN) adding +7.54% and +5.51% at their share values respectively. The Citigroup (NYSE: C) rallied +4.42% on the better‐than‐expected earnings report released on Thursday.

Dow Jones Industrial Average ‐ Technical Outlook

As we expected in our articles the DJIA took a bullish approach. On a daily basis, the Index has confirmed a major support at 17000 and the yesterday the prices registered a new high on a weekly basis. On top of that, the yesterday’s daily candlestick represents a strong bullish engulfing pattern and this along with the confirmed support Is a signal that the rally will continue towards the 17550 where is situated the closest resistance. On the other hand, if we see the prices traded below 16980, technically the scenario turns bearish.

General Electric ‐ Stock Analysis

General Electric (NYSE: GS 28.00) is due to announce its 3Q 2015 earnings today. The stock closed the previous week with huge gains 10.21% following two positive weeks of 2.60%. It’s remarkable that the stock rose more than 11% so far in October and if the bulls manage to maintain these gains they would be the higher since October 2013. The stock is also up 11% the last month and 13% yearto‐ date.

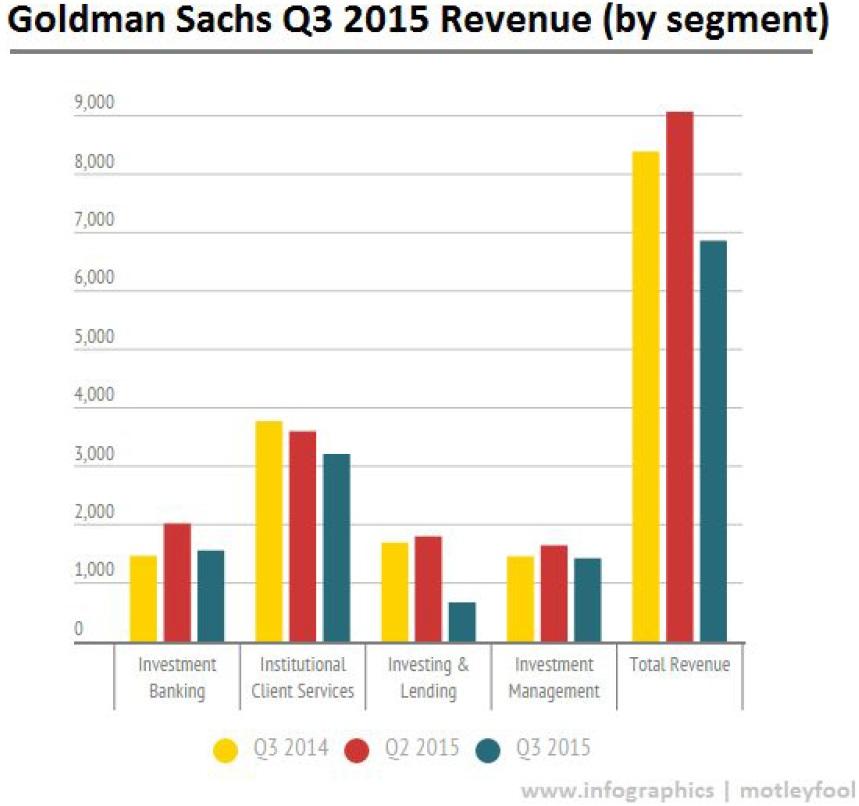

Goldman Sachs – Stock Analysis

During yesterday’s earning releases, the U.S. banking giant Goldman Sachs (NYSE: GS 185.11) has reported a sharp fall in profits as trading activity slowed due to concerns about global economic growth and the uncertainty of the timing of a Fed interest rate hike. Net profits for the three months to end of September were $1.43bn, down more than a third on a year earlier. Revenue fell almost 20% to $6.9bn. The bank was expected to deliver a quarterly earnings per share of $2.91 on $7.13 billion in revenue. Following the earning’s report, the Goldman share price fell more than 1%, however, in mid‐session it gained momentum and surged above the key level of $180.00, closing the day in green +3.12%.

Economic Indicators

The focus of attention during Friday’s European morning will be on Eurozone, which will release CPI figures. The Eurozone CPI is expected to stay at ‐0.1% yoy, with the core rate also forecast to remain at 0.9% yoy. Normally no change from such a low rate could be expected to weaken the euro, but with the ECB likely to be on hold, inflation would have to change dramatically in order for it to be market‐affecting. During the same time, Eurozone will announce its Trade Balance for August.

On a quiet day in terms of economic data in U.S., figures on Industrial Production will be released at 13:15 GMT and while these numbers are not the most closely followed by markets, they have reflected some interesting developments in recent months. U.S. Industrial Production plunged 0.4% in August, a sign domestic economic growth could slow in the final months of the third quarter. The Industrial Production for September is expected to have fallen 0.2% mom. Later in the day, the preliminary University of Michigan Consumer Confidence index for October is forecast to be revised up to 87.5 from the preliminary 87.2. The U.S. Capacity Utilization is also coming out. Finally, the Job Offers and Labor Turnover Survey (JOLTS) will give further insights into the U.S. labor market pulse.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.