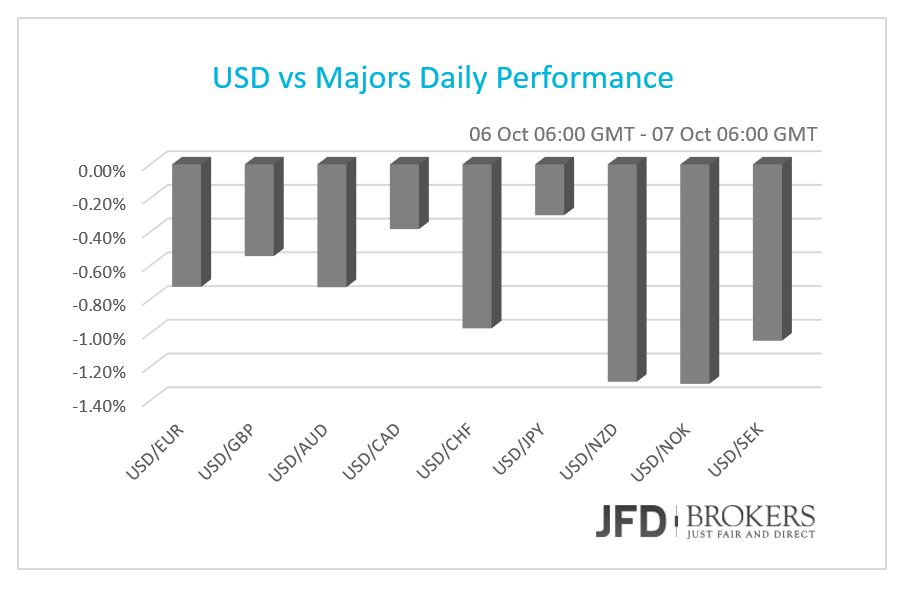

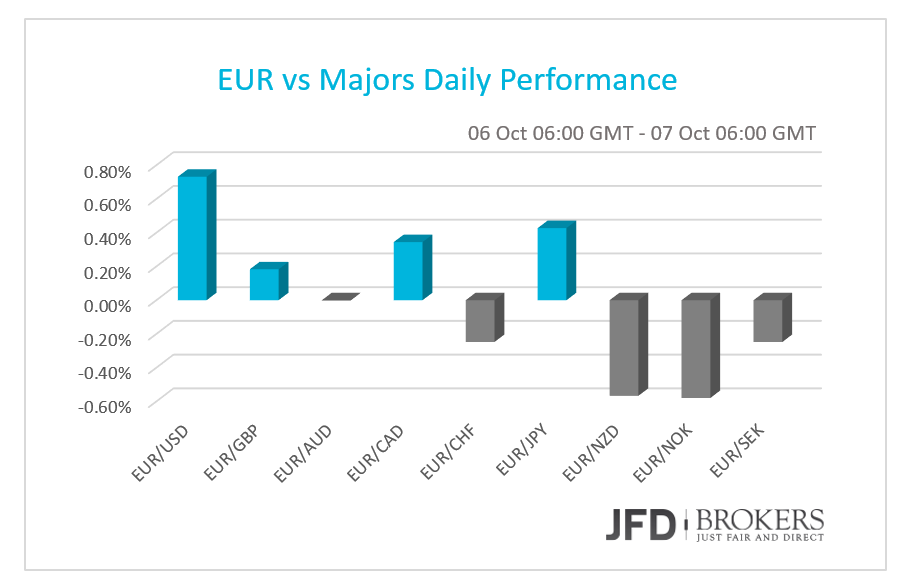

The International Monetary Fund meeting starts on Friday, however, the international organization warned for a global recession and has downgraded its forecast for the global economic growth on Tuesday. Global expansion has been downgraded for one more time to 3.1% from 3.3% that revised in July. This is the fifth downgrade in a row, based on China’s turmoil and the plummet of commodity prices. For 2016, the forecast for the economic growth was also downgraded to 3.6% from 3.8% before. The sharpest downgrades have done in emerging economies which are decreased by 4% this year. Eurozone growth remained unchanged from IMF, however, the U.S. economy forecasted that will grow 2.6% from 2.8% the prediction before, plunging the dollar. The greenback depreciated considerably against all of the major currencies on Tuesday and early Wednesday.

EUR/USD posted its largest daily gain in three weeks!

The shared currency was traded mixed in the absence of economic news. The ECB President Mario Draghi didn’t mention anything regarding economic growth or QE on his speech yesterday, instead he spoke about Art and its importance in the European history.

The euro rose 0.78% against the dollar in yesterday’s session to trade above the 4-hour 200-SMA, its largest daily gain since September 17, when it surged 1.31%. The EUR/USD pair is now testing the key resistance level of 1.1300, where it coincides with the 23.6% Fibonacci retracement level. A break above here would be very significant as it will open the door for a run towards the 1.1350 area. For the short term, a retracement could be likely, yet I expect that would be capped around the 1.1230 level and ultimately I am bullish unless it moves back below 1.1180.

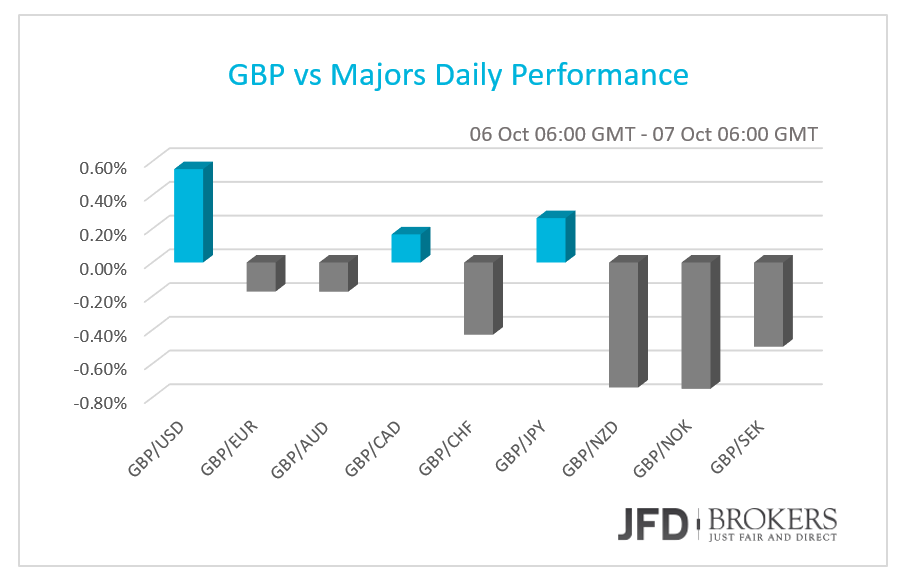

Sterling traders expect GDP and BoE Policy Meeting!

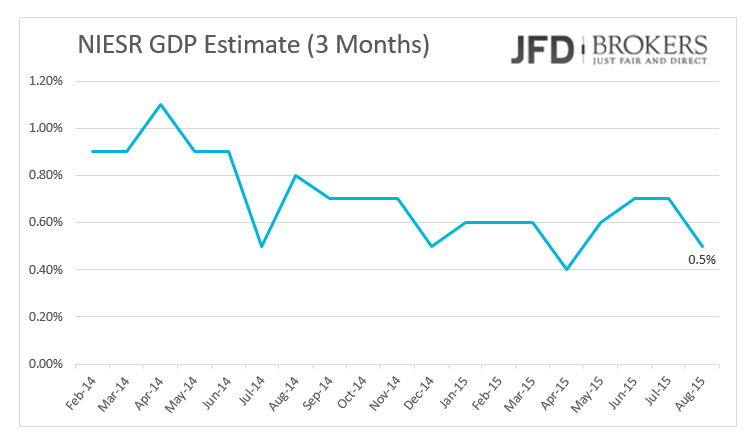

The British Pound was traded lower versus most of its G10 counterparts, however, not market-driving news were out yesterday. Today, the GBP traders expect the NIESR GDP Estimate for the three months to September that will impact the currency. Tomorrow the Monetary Policy Committee of Bank of England has a policy meeting. The minutes of the meeting are expected to be very interesting as many economists believe the BoE will raise interest rates sooner than Fed!

The GBP/USD pair jumped above the 1.5235 level after rebounding from the 1.5140 barrier a few days ago. The pair is currently testing the significant level of 1.5250. Going forward, there is a clear battle going on around the psychological level of 1.5250 and if the bulls manage to maintain the price above the aforementioned levels could show some further bullish signs, prompting a more aggressive move towards the psychological level of 1.5300. The 50-SMA and the 200-period SMA on the 4-hour chart and the 1.5200 level are continuing to provide support below. For the medium term holders, even though the outlook is negative for the pair, I would expect the price to test the 1.5360 barrier, which coincides with the 200-SMA on the 4-hour chart.

USD/JPY – Technical Outlook

The USD/JPY pair is still traded in a perfect triangle pattern that has not been completed by a breakout. For the moment, we expect the prices to be traded in a tight range between the key support level of 118.50 and the 121.75 barrier. Both the MACD and the Momentum lie near their neutral levels confirming the validity of the formation, while the stochastic is moving near the 50 level, reaffirming the disagreement between investors.

Gold and Silver – Technical Outlook

Gold surged during yesterday’s session and added more than $15 to its value. As we said yesterday, we feel that there is no room for short opportunities and therefore, having in mind that the precious metal is receiving support from several indicators, I will remain bullish on gold with the next target being the $1,165, which includes the daily 200-SMA, and then the $1,190 barrier, which coincides with the descending trend line, that started back in mid-2013.

A similar picture prevails in silver as it edged higher Tuesday, extending its gains from earlier in the session, recording a 4.80% gains so far this week. If it manages to maintain these gains will be its largest weekly gain since May 10, when it surged 6.70%. Moreover, the metal rose for a fifth consecutive session on Tuesday to hold around a three month high. With the above in mind, the next target for the XAG/USD will be the $16.45.

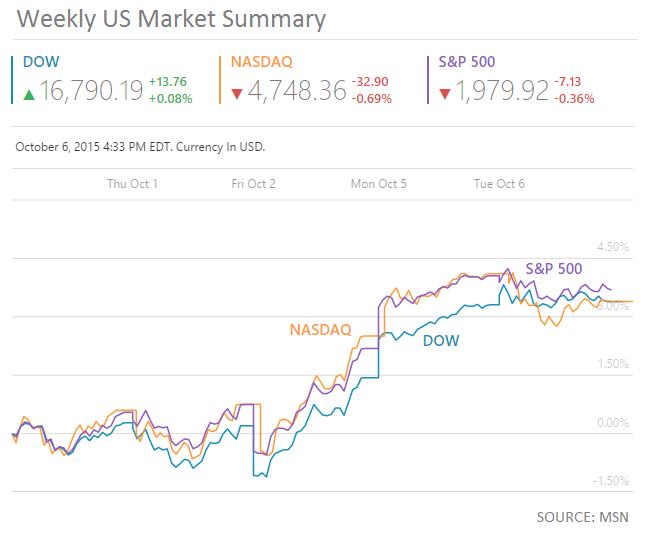

U.S. Indices

The three most popular U.S. Indices closed Tuesday trading session mixed with Dow Jones the only one that recorded gains. However, DJIA posted marginally positive performance of +0.08%, basically just hold its gains from the days before. UnitedHealth Group Inc. was the top loser company that lost more than 3.0% of its value after five consecutive daily closes! Nasdaq and S&P500 decreased by -0.69% and -0.36% respectively, with Nasdaq to continue to be the only one of the three indices that keep its yearly performance positive, by +0.96%.

Economic Indicators

Early today, the German Industrial Production will be out. In Eurozone, non-monetary ECB policy meeting will take place in the morning. In UK, the Manufacturing and Industrial Production for August will be eyed. Traders will also watch closely the NIESR GDP Estimate for the three months to September (Jul - Aug – Sep). Later in the day, in Japan, Machinery Orders for August will be released.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.