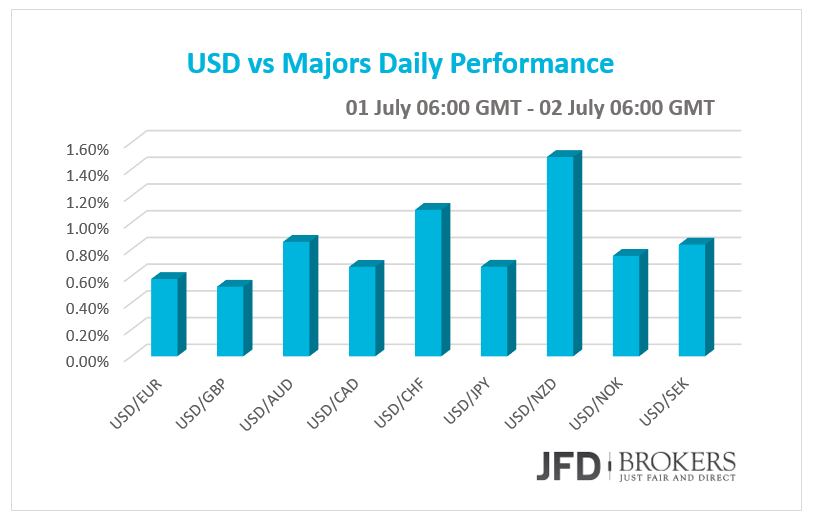

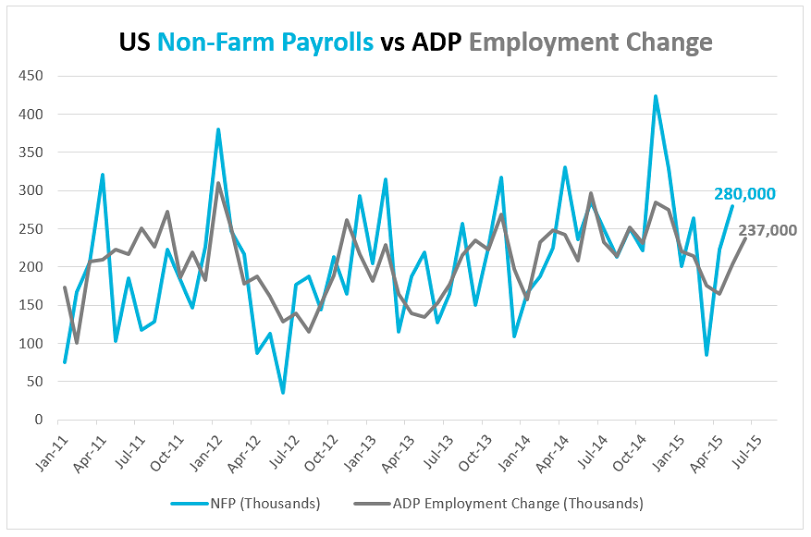

The dollar was broadly stronger against the other G10 currencies on Wednesday and Thursday morning ahead of the all-important Non-Farm Payroll (NFP) report. The ADP Employment Change released yesterday was the highest number of hired workers for the last six months. The private sector has employed 237,000 people beating expectations of 218,000.

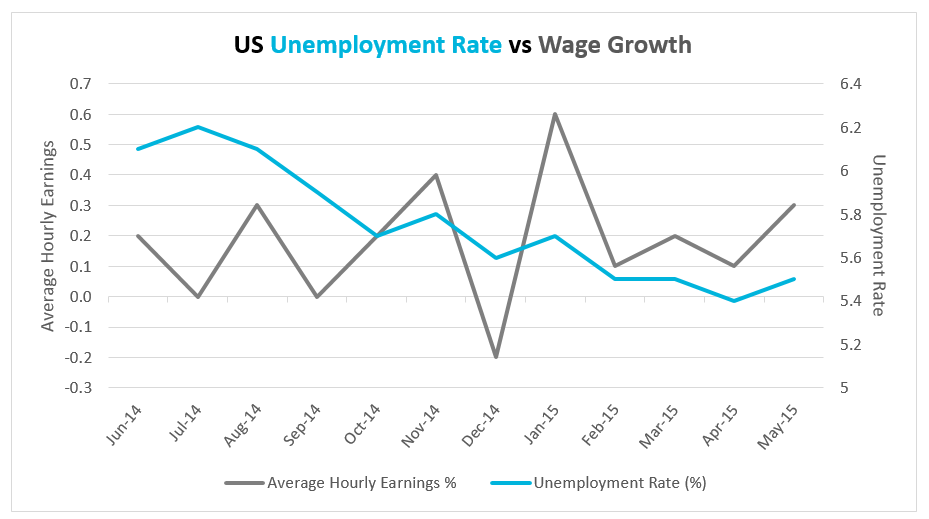

The Non-Farm Payrolls report today is expected to show that the number of jobs added by the US government have decreased to 230,000 in June from 280,000 prior. However, if the number is above 200,000 will be a sufficient rose. The Unemployment rate is foreseen to have dropped to 5.4% from 5.5% before and the Average Hourly Earnings to have slowed down marginally to 0.2% from the four-month high of 0.3% in May. In general, today’s NFP report is likely to have limited impact on the dollar, especially compared to the previous releases, as we are ahead of a holiday weekend and the traders are reticent on their positions because of Greek developments. If Greece default or leave the Eurozone traders will turn to the dollar as a safe-haven currency. Furthermore, all the economic indicators coming out for the US and especially from the labour sector will be taken into consideration on next Fed policy meeting to raise its interest rate.

Why didn't Greece default after it missed its IMF debt repayment?

After Greece failed to meet its debt obligation of €1.6 billion to IMF and countless negotiations, some European Officials and German Chancellor Angela Merkel stated officially that there is no deal for Greece before the referendum. Though, the Greece didn’t default on its IMF debt repayment as IMF is not a commercial lender and the rating agencies cannot consider it as formal default. Beyond that, the IMF usually give to the countries a grace period of a month before they notify the fund’s board that the repayment has officially missed. After the Sunday’s referendum on 5th of July, the next key date for Greece and euro is on 20th of July when Greece has to pay €3.5 billion euros to ECB for bond redemption. If Greece miss this deadline, the European Central Bank can rule out Greece from emergency loans and the whole country will be out of cash.

The sell-off seen the last couple of days in the EUR/USD pair has brought us back into a key support level which coincides with the short-term ascending trend line, which started back in early March.

Today’s US NFP might be the catalyst EUR/USD needs to make a move below the significant trendline near the psychological level of 1.1000. Therefore, for the greenback to rally on the NFP report, we need job growth to exceed 200k and it will be even better if it exceeds the consensus which is at 230k. Furthermore, average hourly earnings will need to rise by more than 0.2%. If any part of this equation is off, investors will be reluctant to buy dollars.

On the upside, the euro could find resistance in the area between 1.1130 and 1.1150 which includes the 50-period SMA and the 200-period SMA on the 4-hour chart while on the downside the psychological level of 1.1000 which coincides with the rising trend line is ready to provide a significant support to the price action in case of a pullback.

BoE Governor warned on Greece impact on the UK economy

The British Pound remained marginally unchanged against most of its G10 peers and fell considerably against the greenback on Wednesday and early Thursday after the BoE Governor Mark Carney warned that Greece affects the Financial Stability of Bank of England. The Governor said that the general UK economic outlook consolidated since December but the Greek clouds started to appear the last few days. The Greek Banks in UK is a tiny part of the UK whole economy, but the economic and financial risk to the euro area is substantial. In addition, UK will not be immune on Grexit. It’s noteworthy that the UK currency suffered some losses on the back of the weak Manufacturing sector data before the release of the Financial Stability Report. The Markit Manufacturing PMI was anticipated to accelerate in June but instead, it fell to the lowest level of the last two years at 51.4. The pullback in demand that dragged down the Manufacturing sector most probably is related with the global uncertainty for Greece and Eurozone as a whole.

GBP/USD plunged more than 1.5% the last two weeks following the aggressive sell-off seen below the key support level of 1.5670 during yesterday’s session after the disappointed Manufacturing PMI figure. The ascending trend line, dating back to 9 April is currently providing strong support for the pair, which could prompt a short-term correction of some kind, especially if we fail to get a daily close below here. However, I would expect the pair to test the 1.5540 – 1.5550 area before it resumes upwards towards the 1.5660 – 1.5570 zone. The 1.5550 it’s a significant level as it includes the 200-period SMA on the 4-hour chart as well as the 50-period SMA on the daily chart.

U.S. Dollar Index

The dollar index eased slightly after hitting its highest in around two weeks early Thursday ahead of the NFP report. The DXY extended gains into a second session on Thursday and is now trading above the key support level of $95.75 which includes both the 50-period SMA and the 200-period SMA on the 1-hour chart as well as above the psychological level of $96.00. The index violated the $96.20 barrier but the rise was halted by the previous high around $96.65. With the above in mind, if the bulls fail to push the index above the $96.65 barrier, I would expect the sellers to take control and to push the index down towards the psychological level of $96.00 while a break above the $96.65 should challenge the next resistance level at $97.00

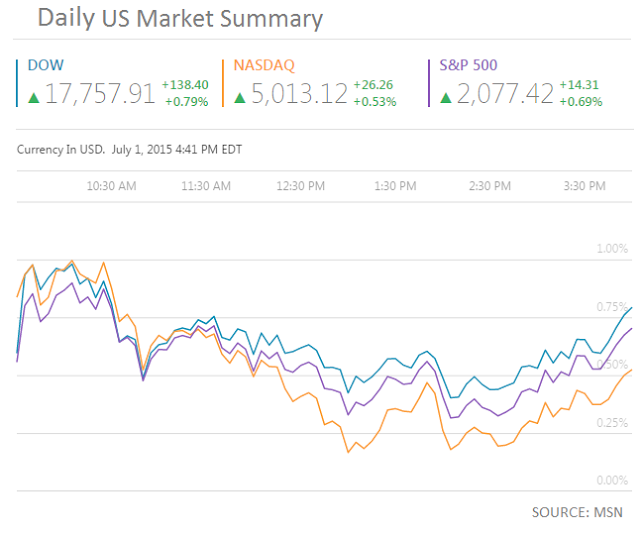

Dow Jones rebounds from a key support level; US 500 recovers above 2070

Despite the mixed messages from Greece, the US indices were optimistic on the expected NFP report and closed higher on Wednesday. The Dow Jones Industrial Average rose by +138.40 points, +0.79% while the S&P 500 was added +0.69% to its value. The Nasdaq Composite Index edged 0.53% higher, +26.26 points.

Dow Jones found strong support at the 17580 level and more recently at the 17668 barrier and rebounded higher moving aggressively above the 17760 level. In addition, DJIA managed to move above the 50-period moving average on the 1-hour chart, suggesting further upside momentum in the short-term. Furthermore, the last sharp move above the key support level of 17580, shows that it is still not time for a break lower. Therefore, if the bulls hold the index above the aforementioned level, it may suggest that traders are still bullish on this index, prompting a move higher towards the strong resistance level of 17877.

The S&P 500Index fell below the key support level of 2070, recording a fresh monthly low at 2054.

However, the US 500 index managed to recover quickly all of its losses and came back above the 200-period SMA on the daily chart as well as above the 2070 level. This is a significant move and I would expect the bulls to continue adding pressure above the aforementioned levels, prompting a more aggressive move towards the 2095 level which coincides with the all of the three SMAs, the 50, 100 and 200.

Economic Indicators

Today, ECB will publish the Monetary Policy Meeting Accounts. In US, the NFP report will be out, with the number of jobs added in both the public and private sector in June to be the headline of the report. The Report will be eyed from the investors as it is one of the main data Fed will take into account to raise its Interest rates. The market forecasted the US economy to have added 230,000 jobs, below the last month’s number of 280,000. The number is also very strong despite the small expected decline. The Unemployment Rate is expected to drop further to 5.4%. The Average Hourly Earnings projected to have increased by 0.2%, a smaller pace than May’s 0.3% increase.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.