Brief History

The Greek Government debt crisis is a chapter of the ongoing European debt crisis started by the turmoil of the Great Recession. A bad combination of the huge pre-existing deficits and debt-to-GDP levels on government’s accounts with the Great Recession’s effects raised concerns in late 2009, whether Greece was able to meet its debt obligations. On the top of that, Standard & Poor’s, one of world's three leading rating agencies downgraded Greece's credit rating. The Greek Prime Minister in order to face the situation, applied a policy of stringent public spending cuts. In the years followed, Greece accepted a number of rescue packages from Eurozone, International Monetary Fund (IMF) and private lenders through bonds out of fear for default or running out of cash. As part of the deals, the Greek Parliament had approved tougher austerity measures and speeded up their reforms, including new taxes, higher VAT rate, pension cuts and job cuts. Meanwhile, all three main credit rating agencies downgraded Greece to a level of substantial risk of a default and a couple of months later decreased the credit rating of eight Greek banks. It’s notable that, back in 2011, Eurozone leaders has written-off 50% of Greek debt and later signed off further parts of the debt to help Greece get its finances back on track. In 2013, unemployment climbed to 28% but the narrowed government’s deficit was considered the first sign of recovery after six years of recession. Greece issued nearly €3 billion long-term government bonds for four years. In January 2015, Alexis Tsipras became the Greece’s Prime Minister of the radical leftist Syriza party and started negotiations for anti-austerity measures.

Current Situation

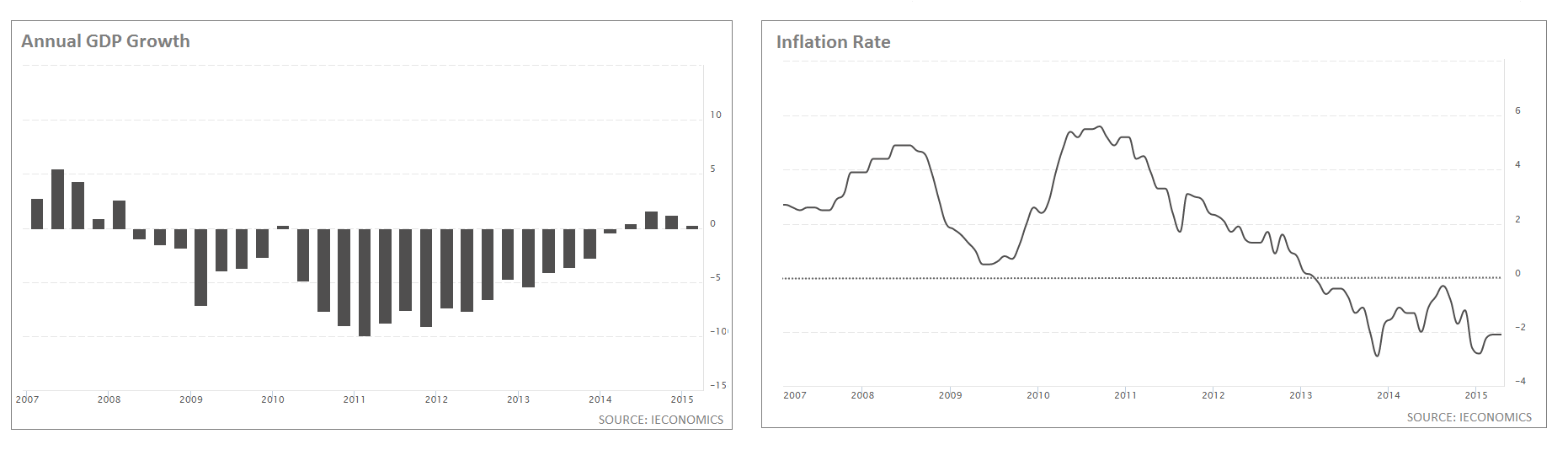

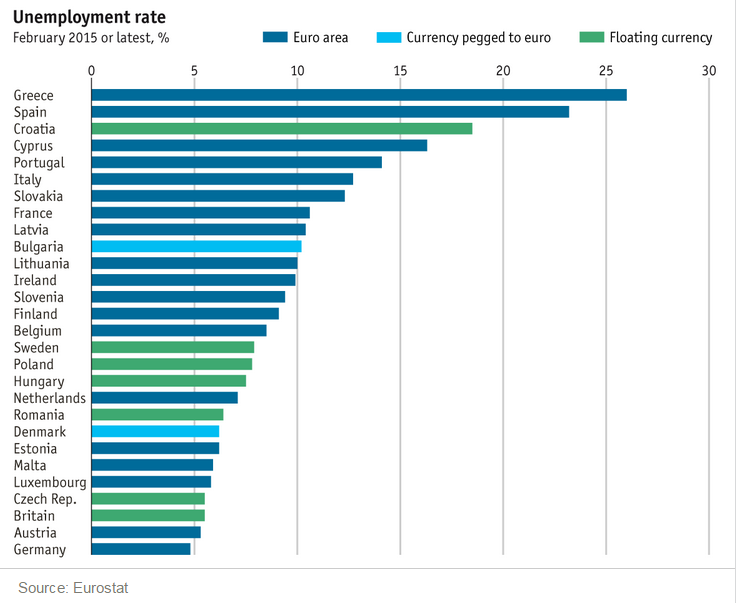

Greece became the epicenter of Europe as it is struggling to pay its debt. The Government’s Debt-to-GDP culminates at 177.10%. The Greek economy has a meager Annual GDP growth of 0.3% in the first quarter of 2015 and is not far away from the greatest deflation the country ever had since the records began. Currently, the inflation rate is at -2.1% versus -2.9% the lowest ever existed. The people are suffering from suffocating austerity measures with the unemployment rate being the higher in Eurozone at 25.4%, which means one person out of four is unemployed and the youth unemployment rate is 50.1%.

Recently, Greece confirmed €750 million debt repayment to IMF using mainly money from a buffer account held at the IMF for emergency cases (€650 million). After the repayment, the Greece Finance Minister Yanis Varoufakis keeps saying the liquidity situation is “terribly urgent” and the country faces a cash crisis in the next couple of weeks if no deal is reached with its creditors to unlock the last tranche of aid funds. The warnings that Greece will run out of money had been stated many times in the past and had not been proven right. But, now the situation is desperate as there are no new incomes from the nation’s lenders since August 2014 and Europe refuses to permit Greece to use temporary options of liquidity such as the Greek banks issuing short-term treasury notes.

Upcoming Deadlines

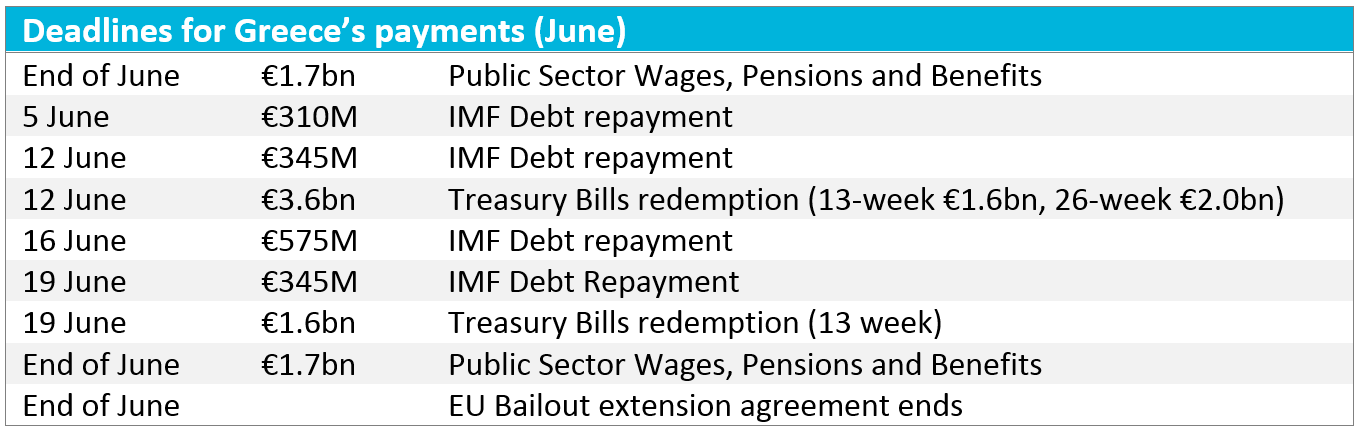

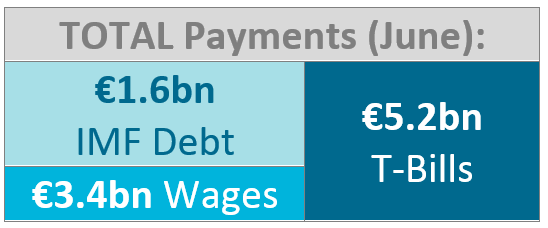

Since spring of 2010, Greece is heading toward bankruptcy which is being pushed away by receiving more rescue packages. At this point, Greece owes €320 billion and faces a long list of deadlines. Greece in the next six months is forced to pay about €20 billion.

Greece has to pay €3.4 billion to salaries and pensions at the end of May and €1.6 billion for its June debt repayment to IMF. The big problem arises later when the Greece’s extension bailout agreement with Eurozone expires.

As time is running out, every day new ideas are suggested to help Greece relieve some of the pressure. The current Greece's left-wing government refuses to tolerate more austerity measures and the foreign creditors are unwilling to provide more funds without painful reforms.

The Major Greek Dilemma

The big dilemma for Greece is to continue receiving bailout packages from their lenders which will drive to a partial or a total default if the government do not give up to appalling austerity measures or the ultimate option to leave from Eurozone and go back to drachma, a solution that repeatedly came on the table. But what happens next?

Stay in Euro and Seek Help

Even if a deal will be reached with their creditors, the problem would not be solved completely. If the Greek government officials convince the creditors to release €7.2 billion to meet their looming debt payments, this would only buy them time until autumn. Then the history will repeat itself with more payments to come, more aid for rescue packages will be needed, the government will be under pressure to cut down its spending and accept draconian austerity measures.

Some optimistic people believe that, in the end, the lenders will compromise with a more relieved referendum. The Greek GDP possesses less than 2% of the Eurozone’s as a whole GDP, which means that more concessions to Greece could be afforded. But this would lead other European countries with similar financial problems to demand the same treatment. These countries are Italy, Portugal, Ireland and Spain, with the problem getting more serious as Italy and Spain are larger economies than Greece. Italy is officially the fourth larger economy in the Eurozone followed by Spain.

During the period of 2010 until 2014, Greece has taken rescue packages of €240 billion while most of the money went on debt repayment and €40.6 billion were used for the debt interest rates repayment. A bigger amount of money was used for the banks’ recapitalization (€48 billion). Thus, they ended up using only a very small part of the amount for the nation’s cash needs. Basically, the bailout money goes toward paying off Greece’s international loans, rather than making its way into the economy.

As the time passes and the negotiations do not reach a deal, Greece may be forced to give in to extremely tough reforms or eventually default.

A second thought, in order to avoid Greek total debt-default, is the partial default. Firstly, it must be noted that the Grexit and the default are two distinctive scenarios. Greece can default or partially default without necessarily leaving the Eurozone.

The partial default is to write-off a part of the Greek debt. As mentioned above, in 2011 Greece partially defaulted, as ECB written-off 50% of its debt. This happened to help Greece put its finances back on track and stay in Euro. It prevented the country from a total debt-default that would expose the related banks and Economies to big financial losses. However, the government needed more rescue money to meet their debt obligations and the partial default didn’t work out effectively.

Consequently, as the crucial dates of repayments are approaching, economists started to reconsider the possibility of a total default. If a total default occurs, Greece will be released from its loans but will face serious negative consequences. The country’s GDP will suffer a tangible contraction which is difficult to quantify while from 2010 to 2014, Greek GDP had already narrowed by 24.7%. The unemployment rate may rise to more than 50% which will lead young people leave the country for a better future, a phenomenon that is already a concerning issue.

Grexit - Back to Drachma

The Greek Finance Minister Yanis Varoufakis stated that Greece should not have entered the Eurozone in the first place. But why is Greece avoiding Grexit?

The plan for Grexit is Greece goes bankrupt on its debt and leaving the currency union. If this happens, instability will be created in the country that will be transmitted globally. Many economists claim that Greece bankruptcy may even trigger a new financial crisis.

Some other economists claim that if Greece leaves the Eurozone now, it wouldn’t be a tragedy as Greece is a tiny part of the total puzzle and Europe took precautionary measures to prevent Greek problems from spreading to other European countries. Another opinion is that Eurozone may actually be stronger without a country that constantly seeks for its neighbours’ support.

Consequences for Greece

First of all, Greece will have financial autonomy to manage its own economic problems. It will be forced to print its own currency, maybe they will use Drachma, the currency they had before entering the Eurozone and convert to euro. Meanwhile, the International value of the new Greek currency will be extremely low.

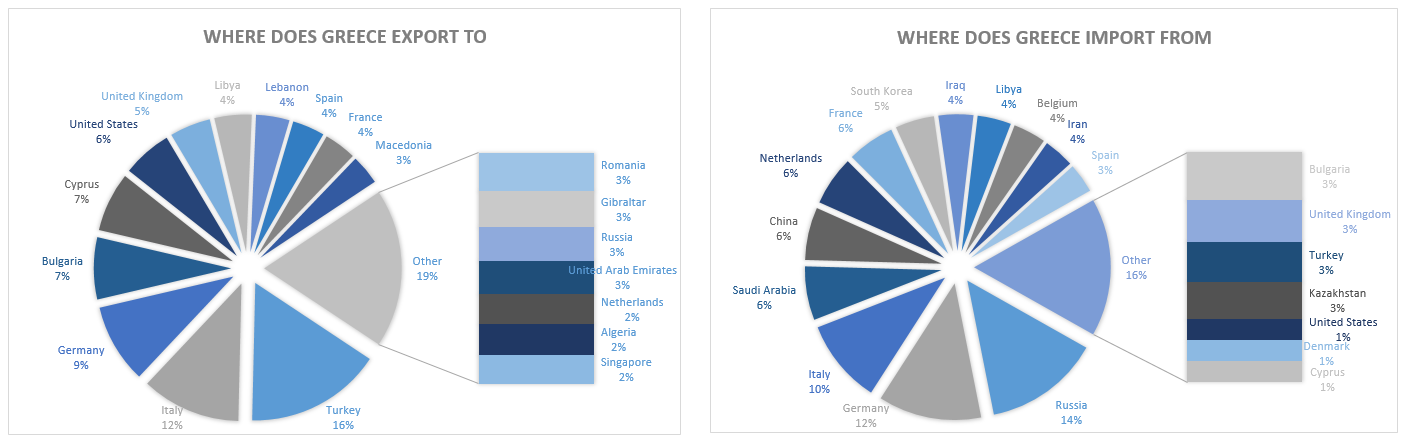

This means that the Greece standard of living will slump. The nation will be unable to import anything from other countries as the import prices would be extremely high based on the foreign exchange value of their new currency. If Greeks have foreign debts, they would struggle to repay them and as a result, a number of private defaults will follow. Moreover, the Greek Banks’ collateral will be rendered worthless and will be impossible for them to obtain any loans, not even emergency funding, which will trigger a disorderly collapse of the Greek banking system.

On the other hand, the new currency’s low value will increase steeply the tourism, one of the main income sources for the country. The Greek exports will rise since their cheaper prices would be preferred. However, these “positive” consequences are highly uncertain if they will be enough to eventually drive Greece to recovery.

Consequences for the Rest of the World

Greece is not the only country that is being concerned for its possible default. The Greek debt, as well-known, is held from a range of European Institutions including the European Central Bank, the European Financial Stability Facility (EFSF), the International Monetary Fund (IMF) and other Eurozone governments through short-term loans. By Greece’s bankruptcy, these institutions will lose significant amounts of money and this may be accompanied with the Grexit and a strong devaluation of the euro.

Furthermore, a sovereign default produces an increased systematic risk which is transmitted to other countries through the balance of payments as the trade is stopping and the capital is getting lost. The directly affected countries in this case will be Eurozone countries, Russia and the Middle Eastern oil and gas exporters.

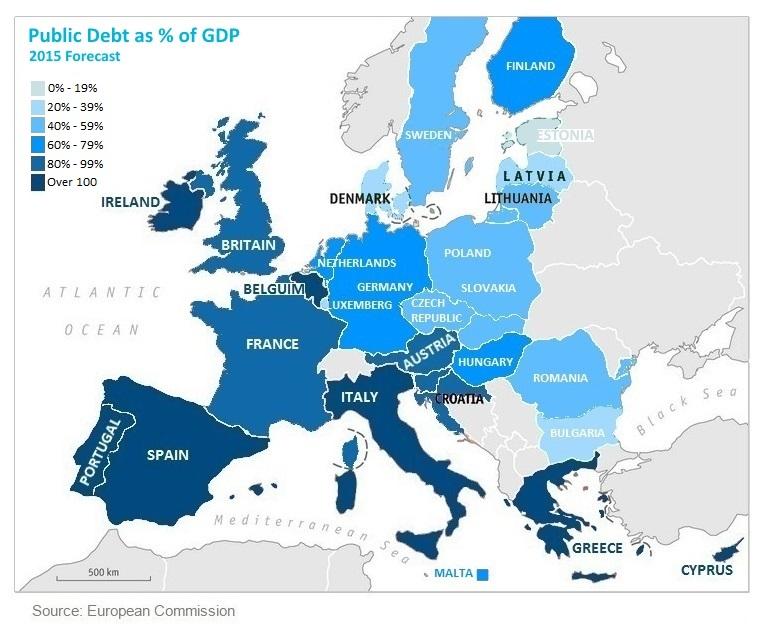

If Greece recovers after plunging into a recession following the Grexit, periphery countries with similar financial problems will follow the Euro exit as they are seeking a way to austerity alleviation. There are other European countries with rising fiscal deficits and soaring debt-to-GDP that would not accept to be imposed to further austerity measures. Italy’s government debt-to-GDP climbed to 132% and its economy shrank 1.4% in 2014 while it is being flat in 2015. Portugal follows with government debt-to-GDP 130% and minimal annual growth.

EUR/USD Analysis

EUR/USD tumbled more than 20% after the European Central Bank introduced a negative interest rates of 0.1%. The pair came under heavy selling pressure following its peak in May near the psychological level of 1.4000. However, the euro managed to recover, somewhat, against the dollar, following the strong rebound from the key support level of 1.0465, and more recently from the 1.0520 level.

We could now see a bit of a pullback before the pair breaks the aforementioned levels, having already rallied more than 700 pips since the pair moved above the key level of 1.0500. Going forward, by adding a Fibonacci retracement to the chart can give an idea about where the pair will retrace to, with the next level being the 38.2% Fibonacci level around 1.1800, which includes the 200-period SMA on the daily chart. The next major level will be the 1.2200 level, which includes the 50% Fibonacci level.

On the downside, the short-term ascending trend line (4-hour chart), as well as the 50-period SMA on the daily chart, are ready to provide a significant support of the price action. In terms of levels, the 1.1000, 1.0800 and 1.0500 will be key levels for the bulls. A break below of these obstacles, it could open the door towards 1.0450, and then towards the psychological level of 1.0000!

Conclusion

Greece, by choosing to stay in Eurozone and continue to seek help, will suffer from endless austerity measures for a long time ahead. The recent reached “deals” were not permanent solutions but just temporary attempts to prolong the inevitable. By exiting the euro, they are increasing the possibility for an economic collapse and a disorderly decline in their living standards.

But, as we all know, “the phoenix must burn to emerge”, Janet Fitch, White Oleander.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.