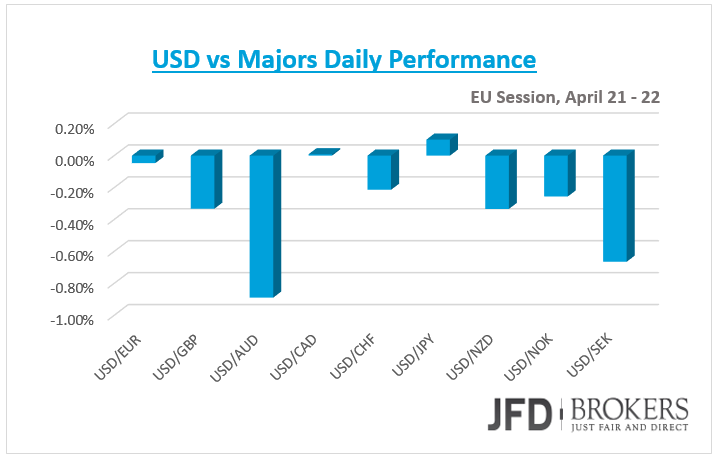

During yesterday’s session the dollar continued to weaken against most of its G10 counterparts. The only exception was the yen which fell against the dollar.

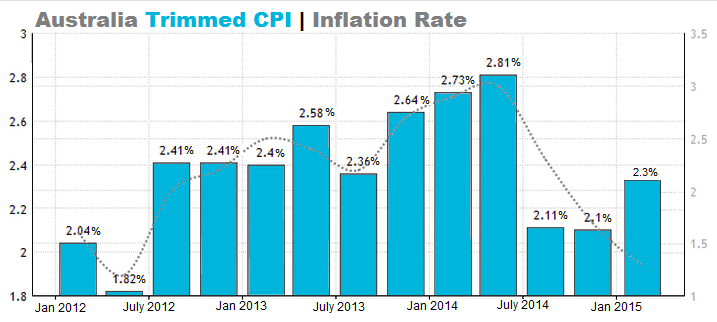

The big winner was the Australian dollar, driving the AUD/USD currency above the psychological level of 0.7700. This level is significant since it coincides with the 50-period SMA as well as the 200-period SMA on the 4-hour chart, therefore, short-term traders should watch that closely. The Australian Dollar strengthened against the dollar after the RBA Trimmed CPI, the CPI without food and energy prices and unusual changes in the month, for the first quarter outperformed expectations. The Trimmed CPI, rose to 2.3% yoy from 2.2% expected while the general domestic prices increased by 1.3% yoy for the first quarter, in line with the expectation, and lower than the previous three months figure of 1.7%. Despite that Inflation Rate decreased for the third quarter in a row, from 3.0% in Q2 2014, the above expectations number has seen as positive for the AUD. The RBA target of Inflation is between 2% and 3% annually. Technically, the AUD/USD pair is trading in a sideways channel the last couple of weeks between the 0.7560 barrier and the psychological level of 0.7900. A clear break outside the pattern would enforce the pair’s new directional movement.

Not far behind the Swedish krona was the second biggest winner against the dollar as the SEK enjoys a second consecutive winning session, however, the 50-period SMA on the daily chart and the 200-period SMA on the 4-hour chart are supporting the uptrend which started back in February 2014. However, I am looking out for the creation of a lower high, below the psychological level of 8.5000 to give me more confidence of the pair pushing lower in the coming days.

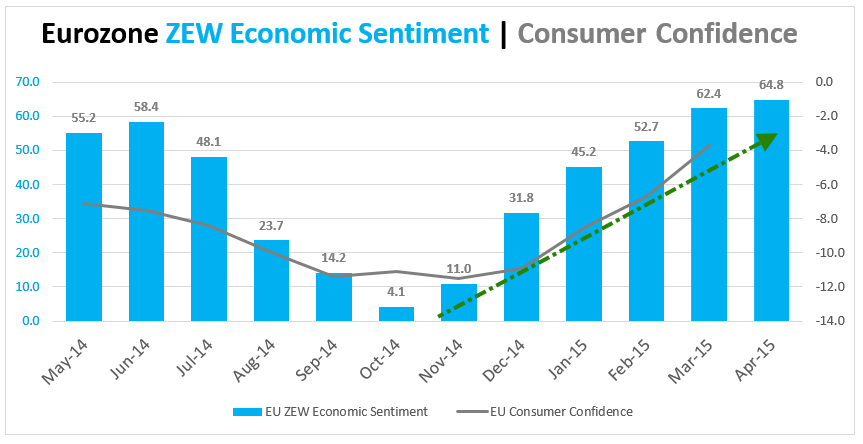

EUR/USD was effectively unchanged from early European levels after Economic Sentiment dropped unexpectedly to 53.3 in April despite the forecast that would increase to 55.3 from 54.8 before. Probably this dent after five months of continuous growths related to the fears for the Greek economy. Contrary, the same Survey showed that Current Situation reached a climax at 70.2 versus expectations of 56.0 from 55.1 in March. The highest figure since July 2011. Overall the German economy is proceeding at a steady pace. The single currency is trading in a tight range against the dollar the last couple of days between the 1.0660 and 1.0780 levels, which coincides with the 50-period SMA and the 200-period SMA on the 4-hour chart. There is very little Eurozone data on the calendar for the rest of the week and for this reason investors have shifted their focus on Friday’s Eurozone Finance Ministers meeting. From a fundamental perspective, this is what would likely drive the markets in the next few days and especially the euro crosses.

The pound continued to hover below the psychological level of 1.5000 ahead of the BoE MPC meeting. If we do not see a reaction above that level in today’s session then I would expect the GBP/USD pair to continue moving between the latter level and the 1.4800 barrier as we are now 15 days away from the UK general election. Yesterday, the pound bounced from the 200-period SMA around the 1.4850 region and approached once more the 1.5000 level.

In other currency trade, the US dollar rose against the Canadian dollar to 1.2310 Wednesday morning, following the aggressive sell-off below the 1.2400 level few days ago. The USD/CAD plunged below 1.2400 following the BoC policy meeting. The pair is trading below the psychological level of 1.2300, which includes the 23.6% Fibonacci retracement level. However, I would expect the pair to pick up some momentum and to test the 1.2300 and 1.2350 levels before resuming downwards again.

The ICE U.S. Dollar Index (DXY), a measure of the U.S. currency against a basket of six major rivals failed to hold above the 98.50 level and retreated. However, the dollar index closed positive during yesterday’s session and is now ready to record its fourth consecutive positive day, if it close above 98.15.

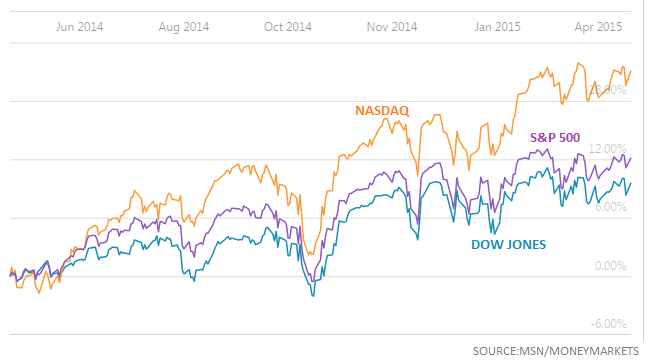

At the close of U.S. trading, the Dow Jones Industrial Average fell 0.47% at 17,950 and the S&P 500 Index fell 0.15%. On the other hand, the technology-heavy Nasdaq Composite Index edged higher 0.39% at 5,014. Technically, the Dow Jones index is finding strong resistance from the short-term descending trend line which started back in March 2015. On the downside, the 200-period SMA on the 4-hour chart is ready to provide a significant support to the index in case of further fall, therefore, short-term traders should watch that closely, as a break below here, could prompt a more aggressive move towards the 17,850 level.

Economic Indicators

Today, we expect the release of Bank of England minutes. At the last minutes released, policymakers flagged their concerns that the stronger Pound will affect negatively the current deflationary climate. Further to the upbeat data announced in the UK the last weeks, traders will keep an eye for any signal for a rate hike in the BoE minutes. Meanwhile, the Monetary Policy Committee of BoE are expected to vote unanimously to keep rates on hold at its April meeting. In Eurozone, the only indicator will be released is the Preliminary Consumer Confidence for April.

In US, the Existing Home Sales and the Housing Price Index for March and February respectively are coming out and will be looked by investors for additional clues to gauge the strength of broader U.S. economic recovery from the housing sector. In addition, the results of ZEW Survey for Switzerland's Expectations in April will be published.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.