Federal Reserve Meeting

The most important event of the week is the two‐day Fed Monetary Policy Meeting. The market remains anxious that Fed will change the “patient stance” and raise the interest rates sooner than expected, six years after the last rate cut. Most economists expect an initial interest hike in June.

The US labor market is on a robust expansion. The last NFP release was by far better‐thananticipated and the Unemployment rate edged down to 5.50%, the lowest record since 2008. Furthermore, both the Initial and Continuous Jobless Claims have decreased, indicating once more the steady strengthening of the US economy. However, some other economists prefer to keep a more conservative stance and wait a little more time for rate hike since the US is in a slight deflation and oil prices are keep falling. Therefore, a soon interest rate hike will increase the fears that the strong recovery achieved during the last years will be inverted.

The question is what is the stance will the Fed keep? The Monetary Policy Statement and the Press Conference will be scrutinised to decipher what the Fed plans are.

Currently, the EUR/USD pair is challenging the 1.0550 level, which coincides with the 50‐period SMA. If we fail to see a break above that hurdle, I expect the price to move further up towards the 1.0640 barrier. In addition, I would expect the pair to consolidate between the 1.6050 and 1.0500 zone before the Fed meeting, which could determine the long‐term trend for the EUR/USD pair.

Bank of England Minutes

On Wednesday, the release of the BoE MPC (Monetary Policy Committee) Minutes is another one event that will keep the investors anxious. The MPC will vote whether they will keep the interest rate unchanged or not. The market expects UK to fall into deflation the next months but, as the BoE governor said in his last speech, UK is on a solid expansion and strong domestic demand growth, thus the inflation benchmark of 2.0% can be achieved in the next two years. Moreover, UK unemployment rate records a seven years low at 5.70% and the wage growth has not showed any sign that is affected by the dropping prices.

The British pound has reached a more than seven‐year high against the euro following the break below the 0.7050 level few days ago. The pound heads toward four consecutive monthly gains against the euro after breaking below the psychological level of 0.7800, which coincides with the 200‐period SMA on the daily chart. Currently, the EUR/GBP pair found a strong support slightly above the 0.7000 level and is trading back above the key support level of 0.7100. A decisive break above the 0.7160 barrier, which includes the 50‐period SMA, could drive the battle towards 0.7250.

On the other hand, the pound suffered against the dollar, following the aggressive sell‐off after the price reached 1.7200 back in early September 2014. Since then, the pound in depreciating against the dollar, marking the largest fall since July 2008. In mid‐2008, the pound collapsed from 2.0000 to 1.3500 in January 2009. Currently, the GBP/USD is trading near the psychological level of 1.4800. A decisive break above the 1.4810 level, which coincides with the 50‐period SMA on the 1‐hour chart could prompt a move towards the 1.4900 level.

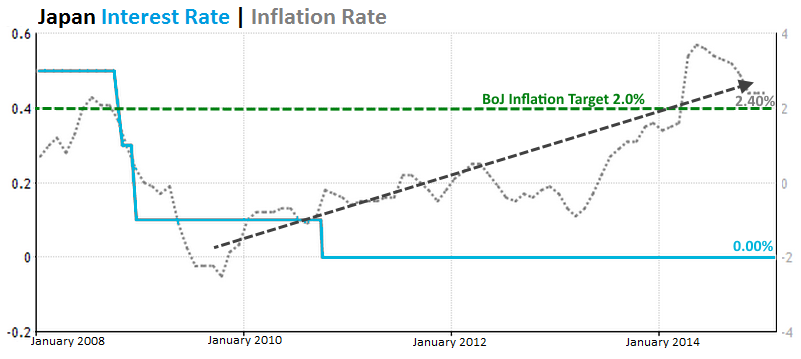

Bank of Japan Meeting

The market, does not expect the Bank of Japan’s policy meeting to have a major impact on the JPY currency pairs. The market expects BoJ to hold the interest rates at 0.0%, after the rate cut in October 2010. However, Policymakers remain confident that will approach the Central Bank’s Inflation Target of 2.0% soon. It is notable that their inflation rate is already in the acceptable interval between 1.0% and 3.0%.

The USD/JPY pair is struggling in a battle between both market forces (bulls and bears) as it remains stuck in a range between the 120.80 – 121.80 levels. The last couple of days we saw a break attempt on both sides but without any success, highlighting the fact that the investors are cautious ahead of the BoJ and Fed meetings.

On the other hand, the euro plunged on heavy selling following the failed attempt above the 134.00 level. Furthermore, the 130.00 is a significant level since it coincides with the 38.2% Fibonacci retracement level. The euro remains under heavy pressure, sinking to the weakest level in 9‐months against the Japanese yen.

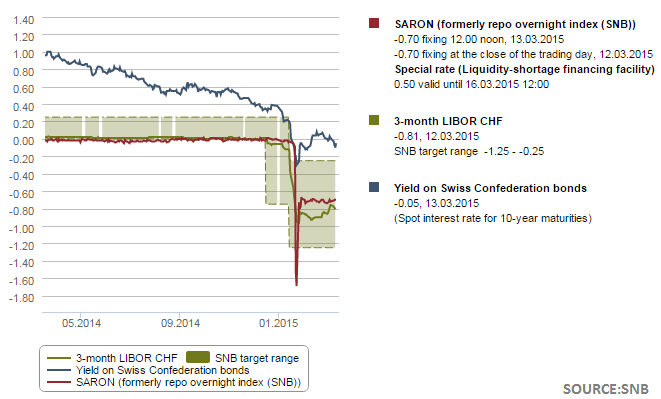

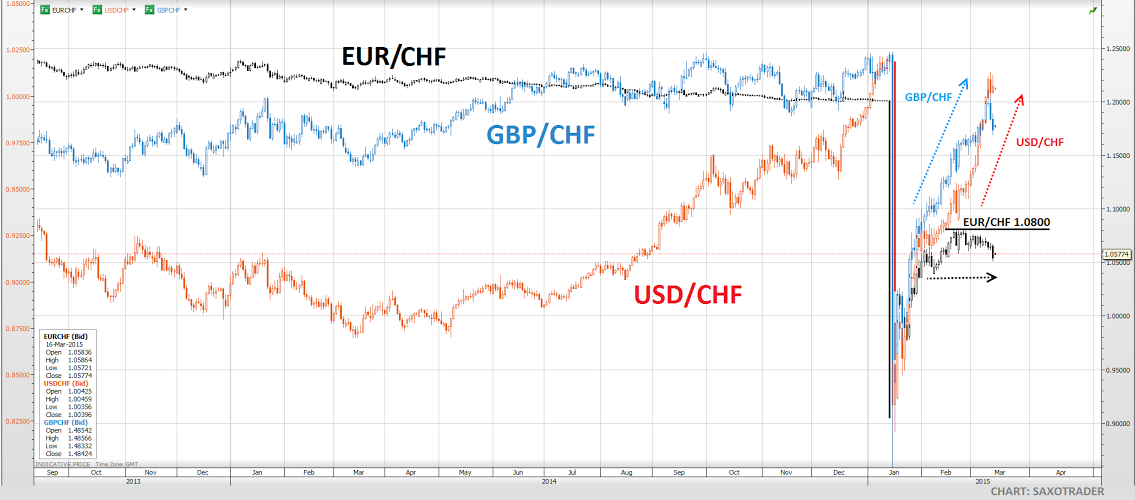

Swiss National Bank Meeting

At 8:30 GMT the Swiss National Bank (SNB) is expected to announce its decision regarding borrowing costs. The benchmark interest rate in Switzerland is at ‐0.75%. The CHF soared heavily after the SNB decided on January 15th to scrap the minimum exchange rate of CHF 1.20 per euro and to push rates below zero in an effort to fight the appreciation in the Swiss Franc. However, the Swiss Franc reversed much of it gains it made against its major currencies since the announcement, except the euro, which it struggles near the 1.0800 region.

The SNB lowered its interest rates significantly to ensure that the discontinuation of the minimum exchange rate does not lead to an inappropriate tightening of monetary conditions. The bank has therefore decided to start charging on Swiss Franc deposits, as opposed to earning interest rate on deposits.

The EUR/CHF pair is trading slightly below the 1.0600 level. However, the upward advance which started above the 1.0500 was halted by the psychological level of 1.0800. From there, the price retraced more than 10%, currently moving below the 200‐period SMA on the 1‐hour chart. The strength of the Swiss Franc versus the euro in the past few weeks has raised the possibility of a further cut in interest rates at the SNB policy meeting due on Thursday.

On the other hand, the US dollar and British pound, both dominated against the Swiss Franc. The dollar is continuing to push higher against the Swiss franc after recording a two consecutive month of gains after the SNB announcement back in January 2015. If we see a monthly break above the 1.0000 USD/CHF, then we could see a more aggressive buy towards the 1.0400 level.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.