Last week all traders expected specifics of terms of interest rate increase of Fed U.S., however, Janet Yellen didn't mention exact dates in her speech. It caused a panic in the currency market as expectations of a great many of people weren't satisfied, as a result the raised volatility has been lasting till current week, as a consequence the currency pair EUR/USD passed 200 pips. However, you shouldn't forget that the panic is a temporary phenomenon and everything will calm down soon and will resume its normal course, and here everyone will remember "the quantitative easing program ", and that the destiny of Greece is still not decided. Therefore further decrease in couple of currencies is expected.

Main movement of currency pair

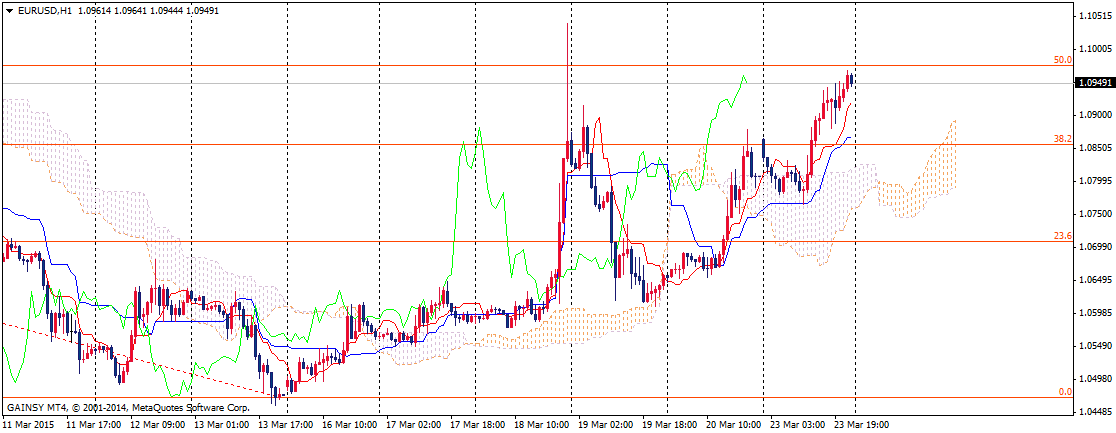

EUR/USD pair switched into ascending movement, Tenkan and Kijun lines are below the price curve, the price moves above the descending cloud, the descending movement of currency pair from the level of resistance 1,0975 is predicted. Traders should take “sell” positions below the level of resistance 1,0975, to fix profit at the levels of support 1,0915, 1,0860, 1,0820.

Alternative movement of currency pair

If EUR/USD pair manages to break through and get fixed above the level of resistance 1,0975, continuation of the ascending movement to the following levels of resistance 1,1000, 1,1040 will be possible.

Level of resistance: 1,0975; 1,1000; 1,1040.

Level of support: 1,0915; 1,0860; 1,0820.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.