Yesterday, the US dollar traded lower against other major currencies, such movement is caused by the publication of economic data for the US, which were lower than expected, which reduced investor confidence in the fact that the economy will begin to recover in the 2nd quarter. Sales of existing homes fell to a level of 5.04 million homes per year with expected to grow to 5.24 million homes a year, and the index of business activity in the manufacturing sector from the Philly Fed fell to 6.7 in May, remember, that the April figure was 7.5.

Today, it's going to be a press conference of the Bank of Japan, which will illuminate the further course of monetary policy, most likely the Bank of Japan will leave the current policy of increasing the money supply by 80 billion yen per year. Later is expected to publish the base Consumer Price Index for the United States, if the data is worse than expected, there is no doubt that the pair will continue to decline.

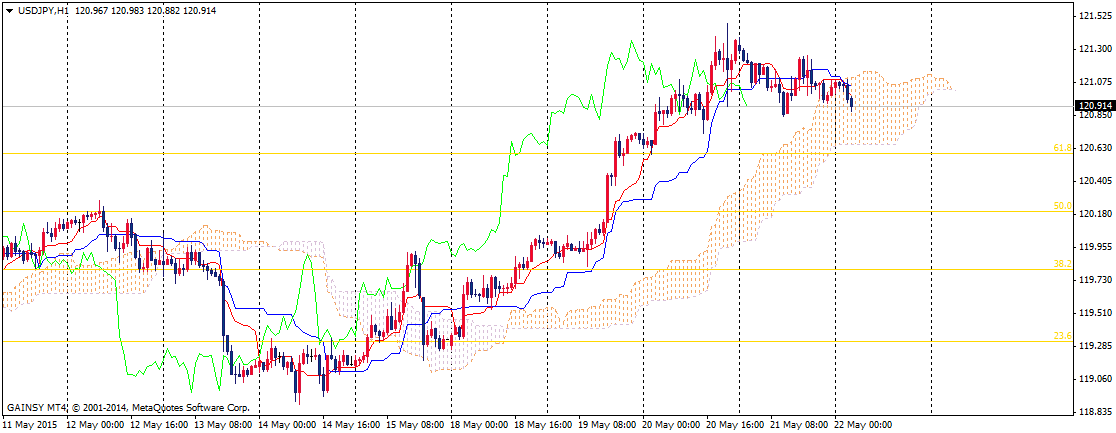

I am considering to sell the currency pair from the resistance level of 121.10, with the objectives of profit 120.90; 120.65; 120.40.

If the pair breaks and consolidate above 121.10 resistance level, then it is paving the way for the following levels of 121.50; 122,00.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.