In advance of a FOMC meeting

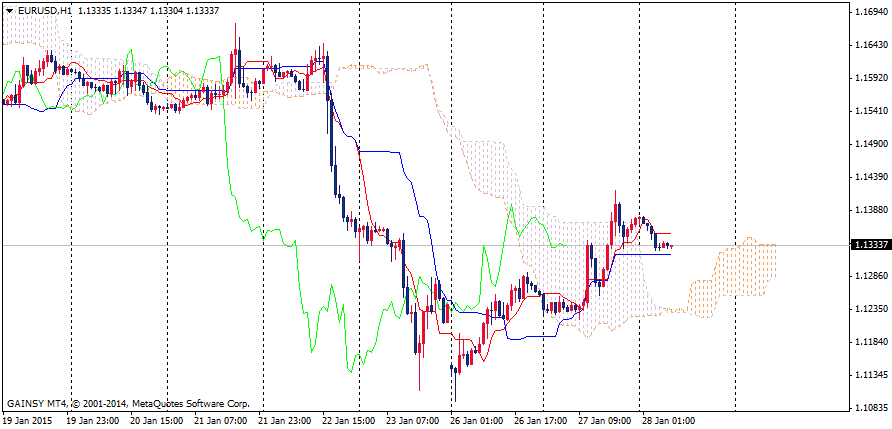

Against a backdrop of announce of the Swiss National Bank representative Mr. Dantin about a overestimated rate of franc and readiness to carry out currency interventions, the pair has been quite choppy in the past two days and growth to the level of resistance 1,1400 has been observed. This level is considered as a quite good position to enter a SELL order.

Main movement

The pair remains inside a bearish price channel, the last few days correction has been observed and that is natural after so strong descending movement. Tenkan and Kijun lines move in parallel, the price moves between them and also above the descending cloud, continuation of the downtrend is predicted. It's advisable to place sell orders lower than a level of resistance 1,1375, to fix profit at the levels of support 1,1320, 1,1280, 1,1230.

Alternative movement

If EUR/USD manages to break through and get fixed higher than a level of resistance 1,1375, continuation of the uptrend to the following levels of resistance : 1,1400, 1,1450 will be possible.

Level of resistance: 1,1375; 1,1400; 1,1450.

Level of support: 1,1320; 1,1280; 1,1230.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.