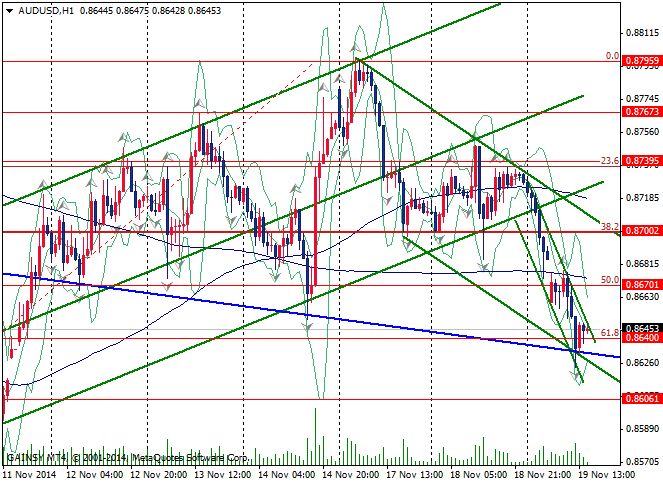

On the H1 chart the descending trend was formed, it got stuck into the lower line of the channel and slowed down its movement. Such a movement can be a proof of the turning tendency of the trend, that is a good sign to open long positions.

Main movement

The movement of the pair would be targeted at the 0.87394 and 0.87959 levels. These lines can be an impulse to a new lasting trend, but at the same time one should not ignore strong resistance at the 0.86701 and 0.87002 levels, that can slow down the movement of the impulse. In order to gain profit, one should buy from the 0.86400 level.

Alternative movement

If the currency pair breaks through the 0.86300 level and gets fixed below it, then the further descending movement targeted at 0,85400 should be considered. One should pay attention to the fact, that there is a strong 0.86061 support level. Testing of the current level may take more time and provide traders with an opportunity to add short positions.

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats to 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated to the 1.0700 area. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 with first reaction to US data

GBP/USD declined below 1.2500 and erased a portion of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold falls below $2,330 as US yields push higher

Gold came under modest bearish pressure and declined below $2,330. The benchmark 10-year US Treasury bond yield is up more than 1% on the day after US GDP report, making it difficult for XAU/USD to extend its daily recovery.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.