Market Overview

FOMC members are garnering attention now and Dennis Lockhart’s hawkish comments have driven some direction for traders. Lockhart has historically been towards the dovish end of the spectrum and his comments yesterday suggested that the US economy was ready for a September rate hike. It has been a feature of the markets in recent days in that the dollar has been unable to gain any real traction. This has come as Treasury yields have continued to fall back, a sign of concerns over future growth. However overnight there has been a turnaround in the yields (which have pushed higher again) and this has brought the dollar bulls out of their shells once more as the dollar looks to test key levels across the forex major pairs.

Across forex pairs, the dollar strength seen into the close last night has continued, albeit only slightly. Market sentiment is fairly stable, for now, with Wall Street rather solid despite a third straight day of losses, the S&P 500 was 0.2% lower. Asian markets have been stable overnight, trading mixed to slightly higher. The China Services PMI jumped to 53.8 (from 51.8 last month) and is supportive for risk appetite. European markets are marginally positive in early trading.

Traders will be focused on the services PMIs that are released throughout the day. The Eurozone PMIs comes out early in the European session, but the UK PMI is released at 0930BST and is expected to dip slightly to 58.0 (from 58.5) which is still a strong number. The US ISM Non-manufacturing is at 1500BST and is expected to improve to 56.2 (from 56.0). The other data includes the ADP Employment report at 1315BST which is expected to dip slightly to 215,000 (from 238,000) and the US Trade Balance at 1330BST which is expected to deteriorate slightly to -$42.8bn (from -$41.9bn).

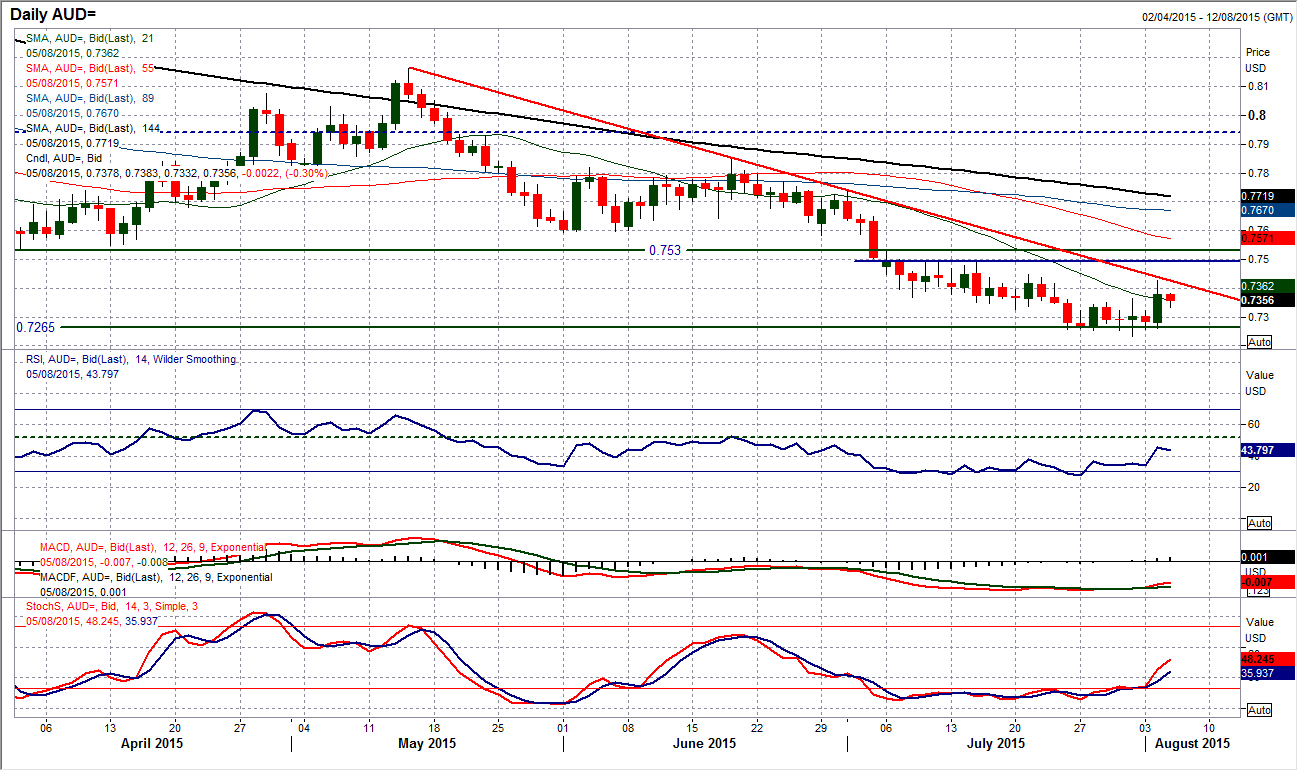

Chart of the Day – AUD/USD

The shift in the rhetoric of the Reserve Bank of Australia yesterday drover a rebound, but as yet there has been nothing to change the technical outlook. The downtrend in place since the sell-off began at $0.8162 in May continues to be a negative influence on the chart. The momentum indicators have ticked higher with the Stochastics and MACD lines improving, however the RSI needs to push into the mid to high 50s to suggest momentum was sustainably improving. The strong bull candle of yesterday has reversed at the downtrend and needs to be followed up by a second positive candle to suggest the bulls are serious in this recovery attempt. Otherwise it will be seen simply as just another rally within the bear market that will be sold into. The initial resistance at $0.7450 remains intact and there has been no really significant technical improvement yet. The hourly chart shows that the price has been in near constant decline since the peak of $0.7430 yesterday. If the Aussie cannot hold up in the support band $0.7320/50 then a retreat back to $0.7260 could quickly be seen.

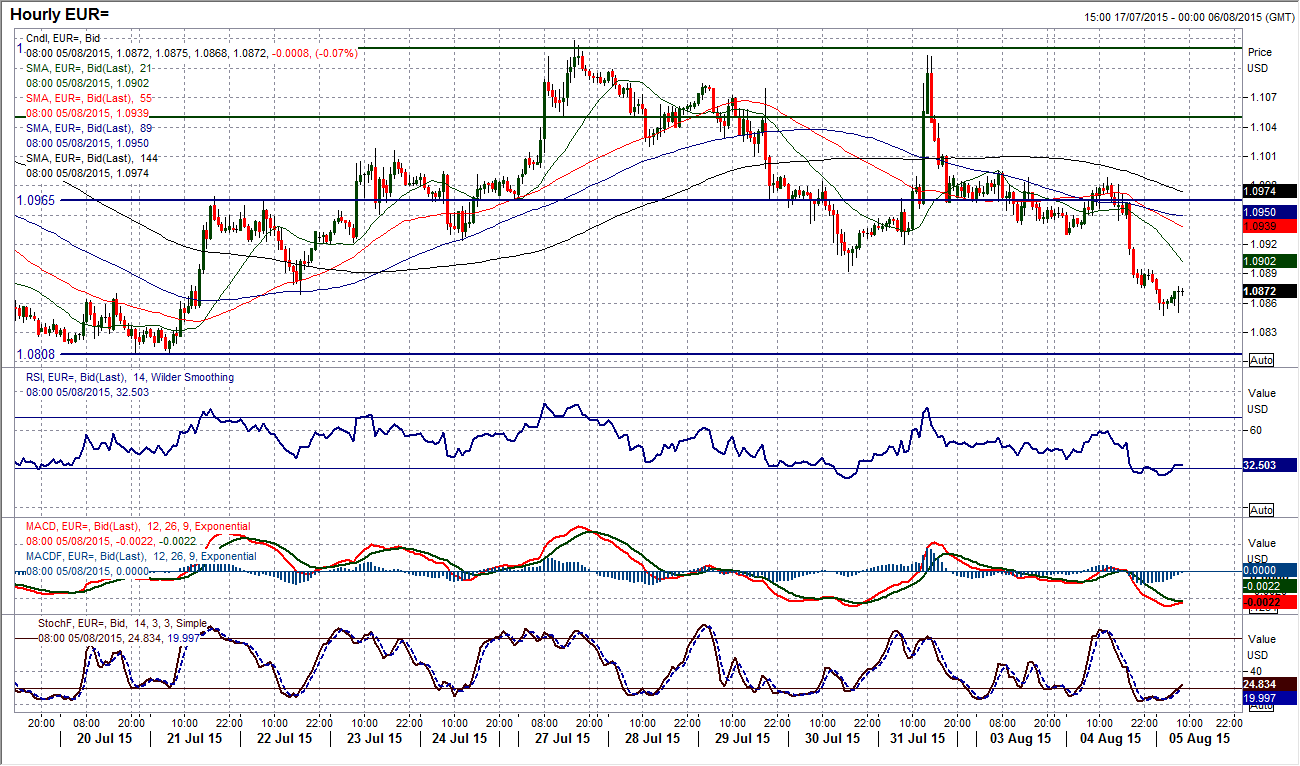

EUR/USD

The bearish drift is once more taking its toll on the euro as late in the US session yesterday the dollar bulls started to gain control once more. The momentum indicators are now starting to pull lower and a test of the key $1.0810/$1.0820 support band now seems imminent. A breach would take the euro to its lowest level since April and bring back into play the reaction low at $1.0520. I remain a seller into strength and with the hourly chart showing the momentum slightly stretched near term there could be a slight unwinding technical rally before further downside is seen. The hourly RSI is under 30 which has previously driven minor rebounds. The initial resistance comes in the band $1.0890/$1.0930.

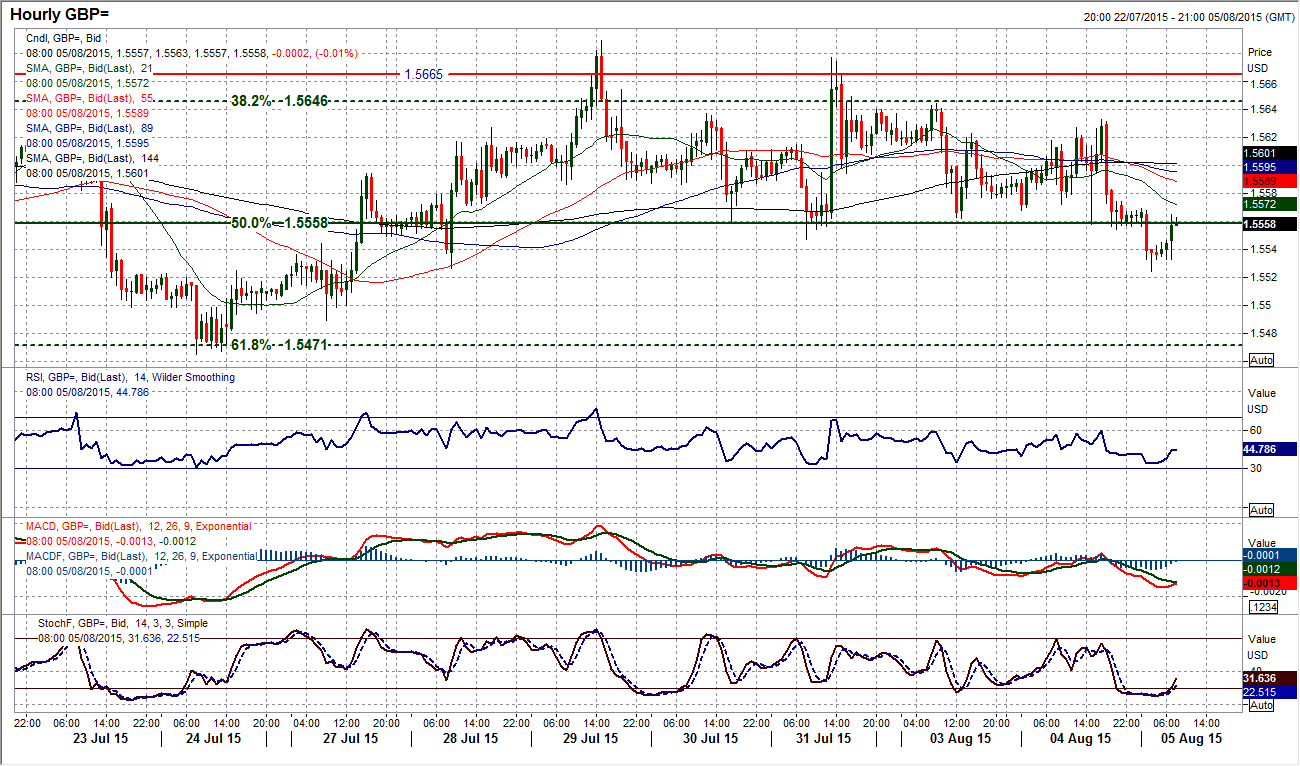

GBP/USD

The pull of dollar strength is also being seen across Cable which has fallen away in the past 24 hours and this is beginning to see the downside pressure mount. The Stochastics are the most sensitive of the momentum indicators I use and with Cable completing a second straight bearish candle the momentum is gathering to the downside. A 3 week low on the Stochastics suggests the potential for a test of the recent reaction low at $1.5465 is growing. I spoke yesterday about the growing importance of the 50% Fibonacci retracement of $1.5188/$1.5928 at $1.5558 which was providing a consistent level of support. This has been breached decisively for the first time in just over a week and could be a key near term development. Watch now for the hourly RSI breaking below 30, as if this happens then it would be the first time in over 3 weeks this would have happened and would be a signal that the bears are gaining control. For now though the support at $1.5525 is holding and the outlook is not decisively determined yet. However, the sellers are mounting. Resistance initially comes in at $1.5570 and then $1.5633.

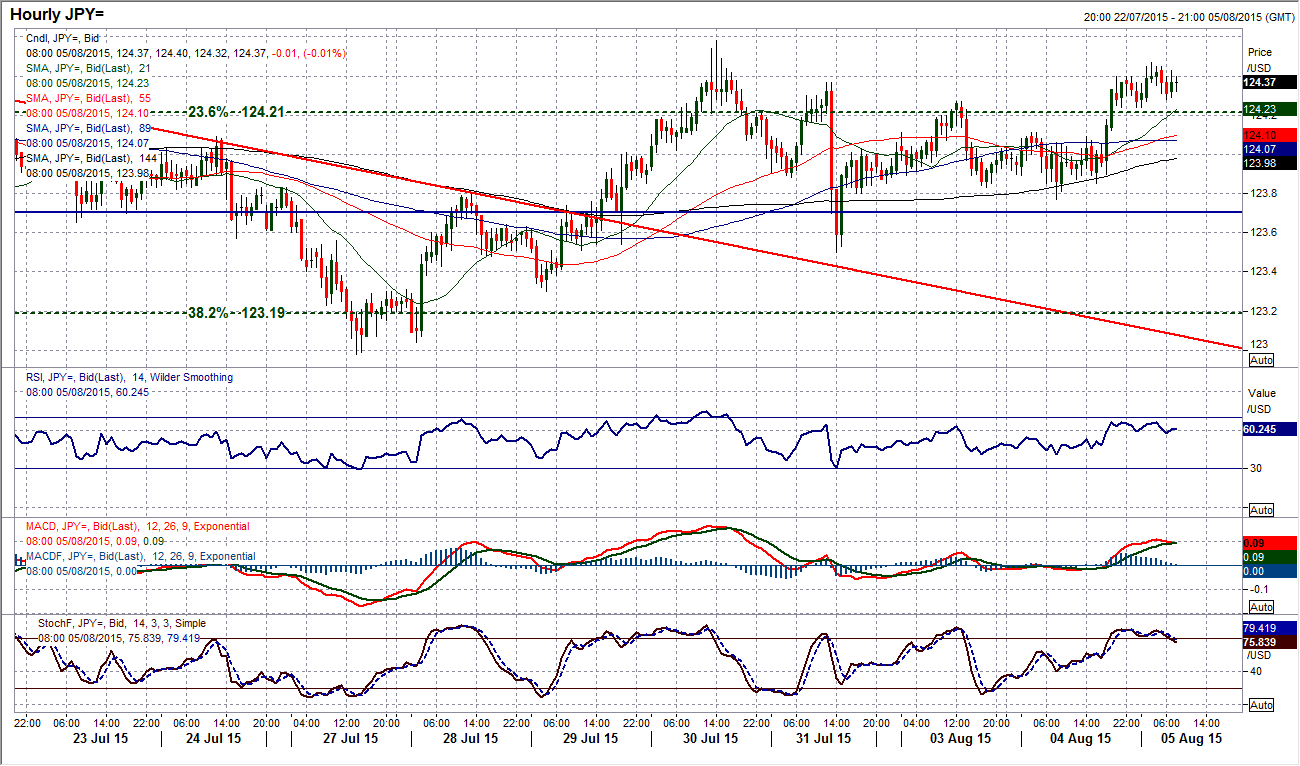

USD/JPY

There is a theme of gradual dollar strength returning to these forex majors charts today and this means that Dollar/Yen is once more straining at the resistance once more. The barrier between 124.40/124.60 has held the pair back for several weeks and a series of attempted breakouts have been rebuffed. Once more we see the move back higher testing, but for now the resistance is intact. The strength of yesterday’s candle was such that the closing price was at the high of the day and sets up the bulls nicely for today. The RSI is again butting up against the 60 level that I see as crucial to the momentum of a breakout, in that the RSI needs to push and hold above 60 with strong momentum for a breakout to be sustainable. The hourly chart shows a strong move higher and is now holding above what is now a support band 124.00/124.20 however there is not yet the bullish hourly momentum to reflect a build-up of buying pressure. Even now also the hourly momentum is beginning to tail off again. The key near term support is at 123.80 now, with a move below 123.50 turning the outlook negative. A closing breakout above 124.60 opens 125.85 the multi-year high.

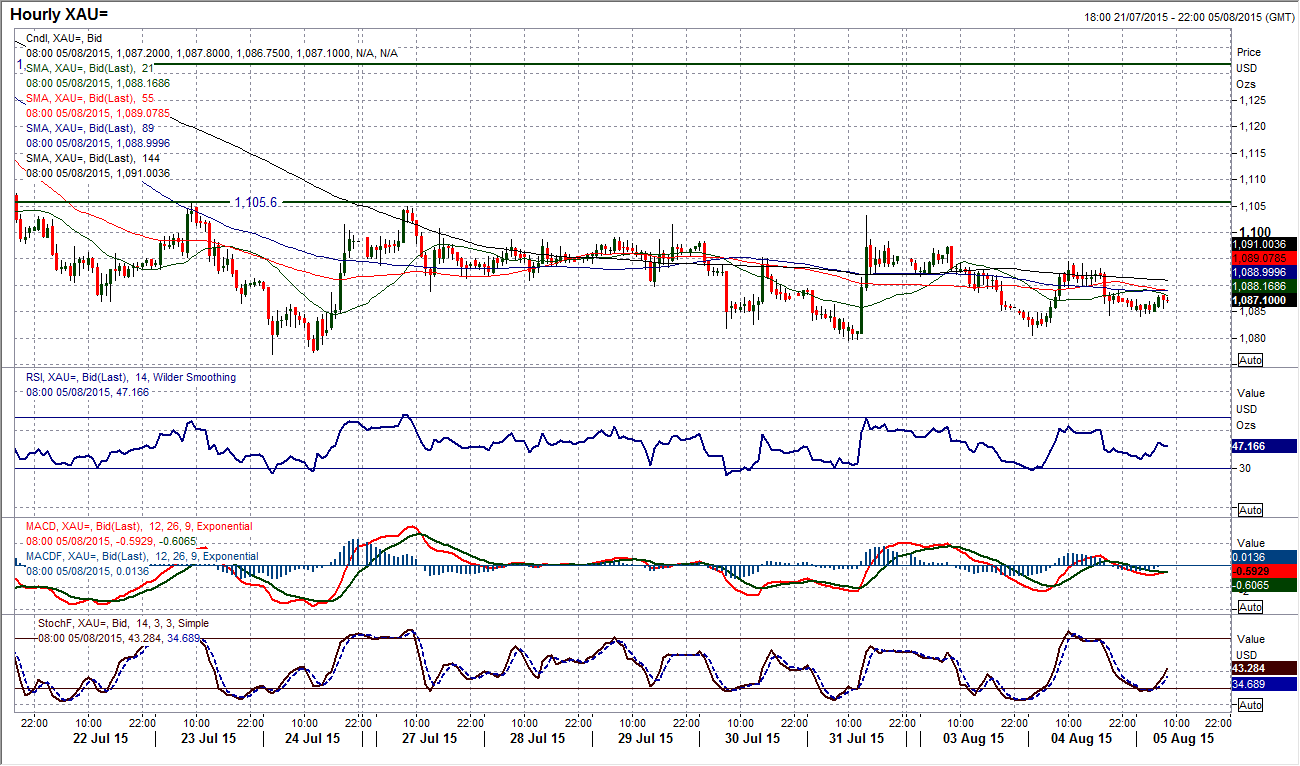

Gold

The consolidation continues. A candle that pretty much formed a doji (open and closing prices the same) was posted yesterday to again reflect the lack of direction. Momentum indicators are beginning to settle down now as the unwinding has brought the RSI back to 30. I still do not expect this to be anything more than a near term consolidation that is sold into (remember the trend is your friend) but for the time being the consolidation continues to play out. There is little real indicators either on the hourly chart although support has been left from yesterday’s low around $1080 above the key low at $1077. The hourly RSI suggests a continuation of the rangebound conditions for now but I continue to prefer using the rallies as a chance to sell. Initial resistance is at yesterday’s high of $1094.60 with the key near term resistance in the band remaining at $1105.60. Sub $107 opens 1043 the 2010 low.

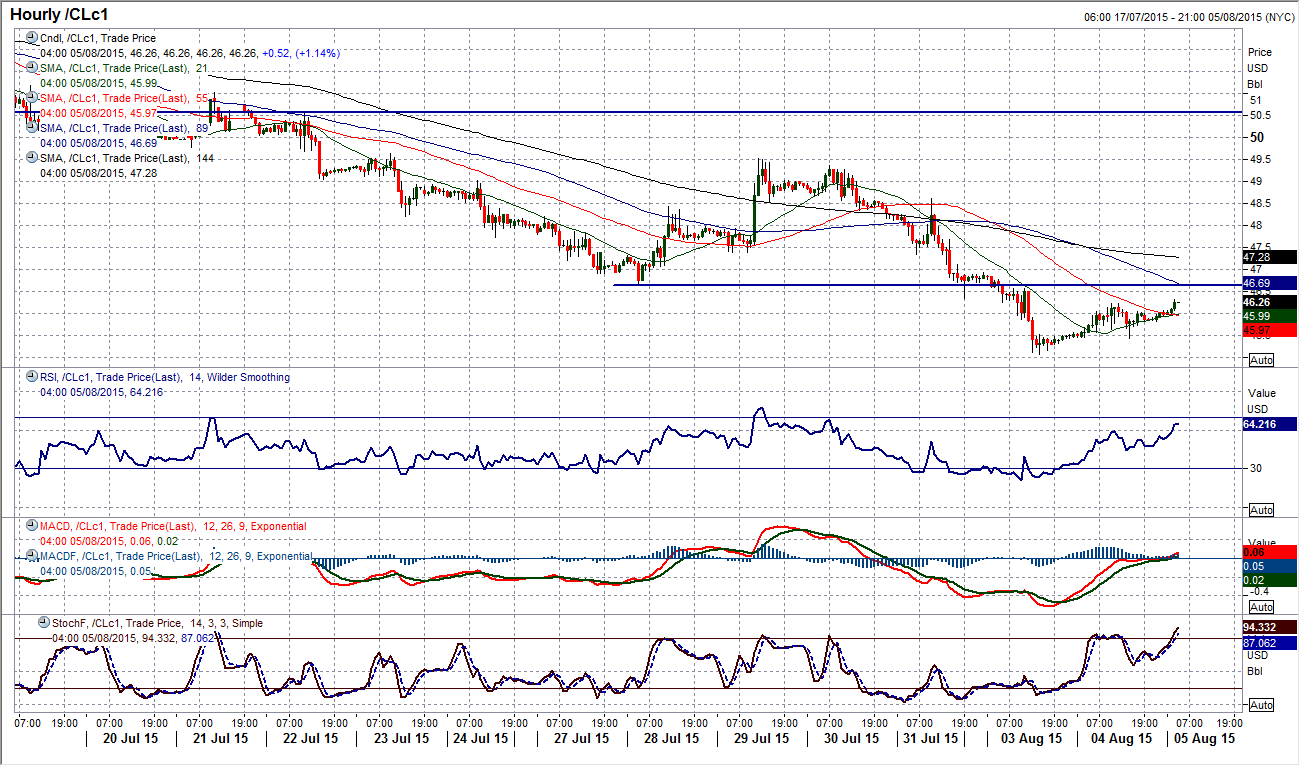

WTI Oil

In a downtrend/bear scenario prices do not tend to go exclusively lower. The selling tends to be interspersed with the odd technical rally that is subsequently seen as a chance to sell. The selling phase that WTI has been in since the end of June continues. Last week there was a bounce of 6% but this was once more simply within the downtrend and the sellers subsequently took over again. Having hit a low at $45.08 the oil price spent yesterday in rally mode. However I see this as another chance to sell. The initial resistance comes in at $46.70 giving us an ideal selling window of $46.70/$47.50 today. The momentum indicators retain a bearish configuration and rallies continue to be seen as a chance to sell for further downside pressure on the key March low at $42.03. The intraday hourly chart simply shows the near term momentum having unwound, with a near term resistance band $46.70/$47.30.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.