Market Overview

Suffice it to say, we can expect some significant volatility today. A chain of events has played out over the weekend which is now leaving Greece at significant risk of defaulting on its IMF loans totalling around €1.6bn on Tuesday. The fact that Greece has been unable to come to an agreement with its creditors over changes to government spending, VAT and pensions has resulted in the ECB deciding not to raise the ceiling of the European Lending Authority at just below €89bn. Capital has continued to take flight out of Greek banks and has meant that the Greeks have had no option but to declare the banks closed on Monday, with capital controls aimed at preventing further mass outflows.

Market sentiment has taken a massive hit from Greece. Asian markets were all sharply lower with the Nikkei off by almost 600 points (not far off 3%), whilst European reaction has been also severe at the open with DAX and CAC especially under pressure but also FTSE. Safe haven flows have taken hold with assets such as gold, silver and the yen all gaining ground. The one to watch is the German Bund yield which has lost over 200 points so far today, whilst peripheral Eurozone yields such as the Spanish 10 year have spiked higher amid the risk of contagion.

In forex the euro has been smashed, falling by over 150 pips versus the dollar in the Asian session, although it has retraced some of this early in the European session. The reaction on other major currencies has been muted. Aside from the safe haven yen which has strengthened by around 1% against the dollar and a slight weakness on sterling, the major commodity pairs have been well supported as metals prices have rallied.

There is little data to taken traders’ minds off Greece today with the exception of Pending Home Sales at 1500BST which is expected to improve by 1.3% on the month (+3.4% last month).

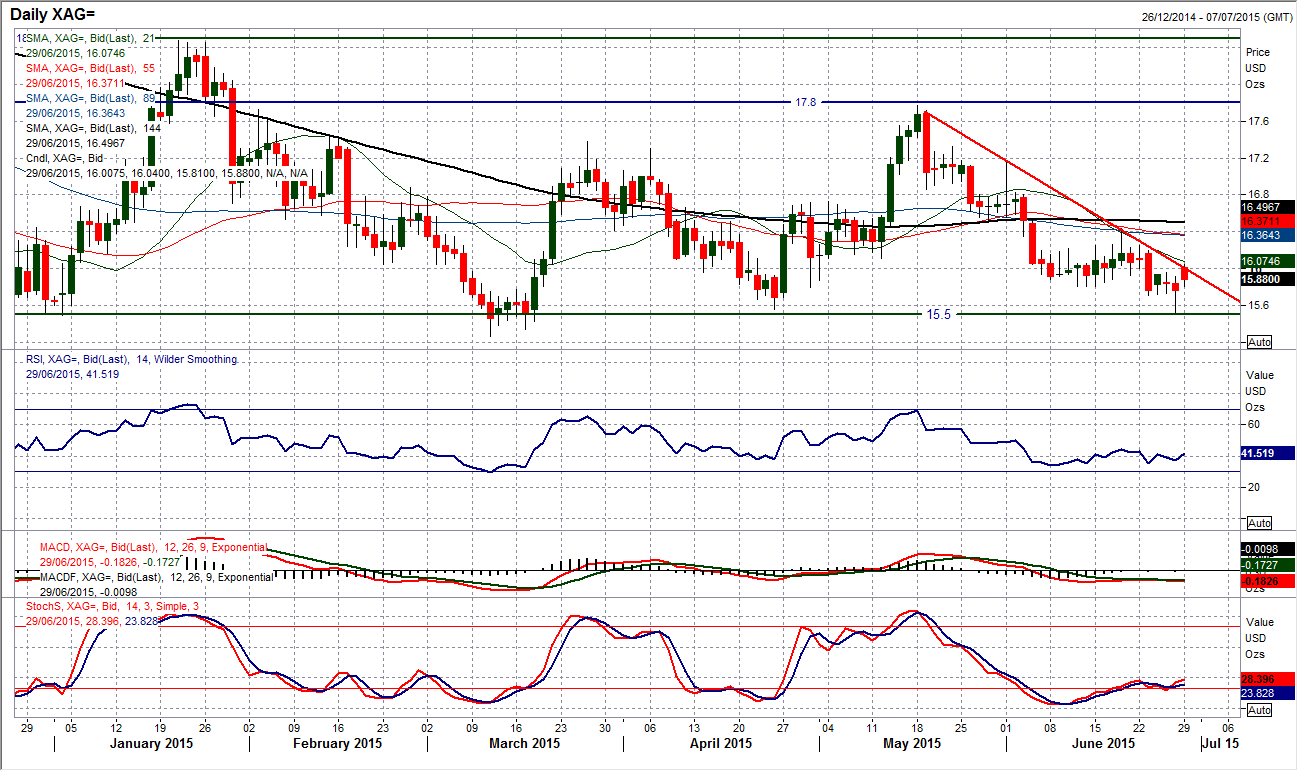

Chart of the Day – Silver

It is times like these you get to see which are the real safe haven plays in the market. With silver also considered to be an industrial metal as well as a precious metal, its safe haven credentials are reduced. And so it would seem with the price action today. The initial gap higher at the open of trading at $16.00 has already filled the gap at $15.90 (compare this with gold and the yen, see both below, which are yet to fill their gaps). Silver has been finding resistance under a 6 week downtrend over the past couple of weeks and once more today this has failed to be decisively breached. Furthermore, silver continues to trade below the resistance of the falling 21 day moving average (at $16.08) whilst an old key pivot level at is also a barrier at $16.04. There is clearly much work to do still for the silver bulls to convince to the upside. If these resistances continue to hold back the rally, it is possible that this will simply be seen as another chance to sell again as the downside drift continues to put further pressure on support around $15.50. The day low at $15.81 is initially supportive today.

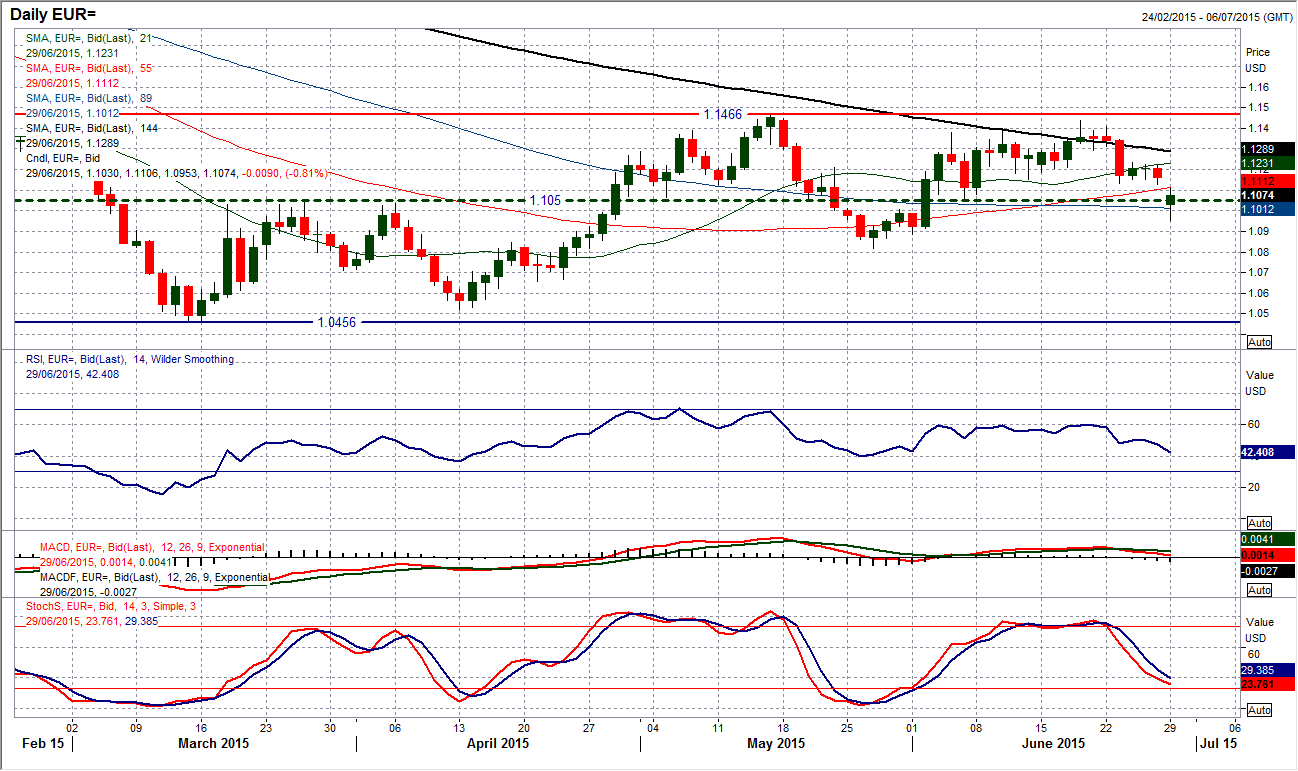

EUR/USD

The immediate reaction following on from the weekend’s developments over Greece has been for the euro to be sold hard at the open. The 100 pip gap lower has left resistance at $1.1130 and although normally the feeling is that gaps will be filled, today there is sizeable doubt that this will happen. This fundamentally driven sell-off leaves technicals very much playing second fiddle, however there has been a significant deterioration in the technical outlook. The decline back below $1.1050 is a key move and if there is a close below there tonight the chart will be in negative configuration as $1.1050 has been a key pivot level in the medium term. The momentum indicators have taken a sharp dip (not to be unexpected) and whilst the situation (and the price) remains volatile it is difficult to give an outlook of any conviction. A retest of the overnight low at $1.0953 could easily be seen amid the volatility. There is now resistance $1.1130/$1.1165. It could be a while before this one settles down so expect high volatility to continue for the time being.

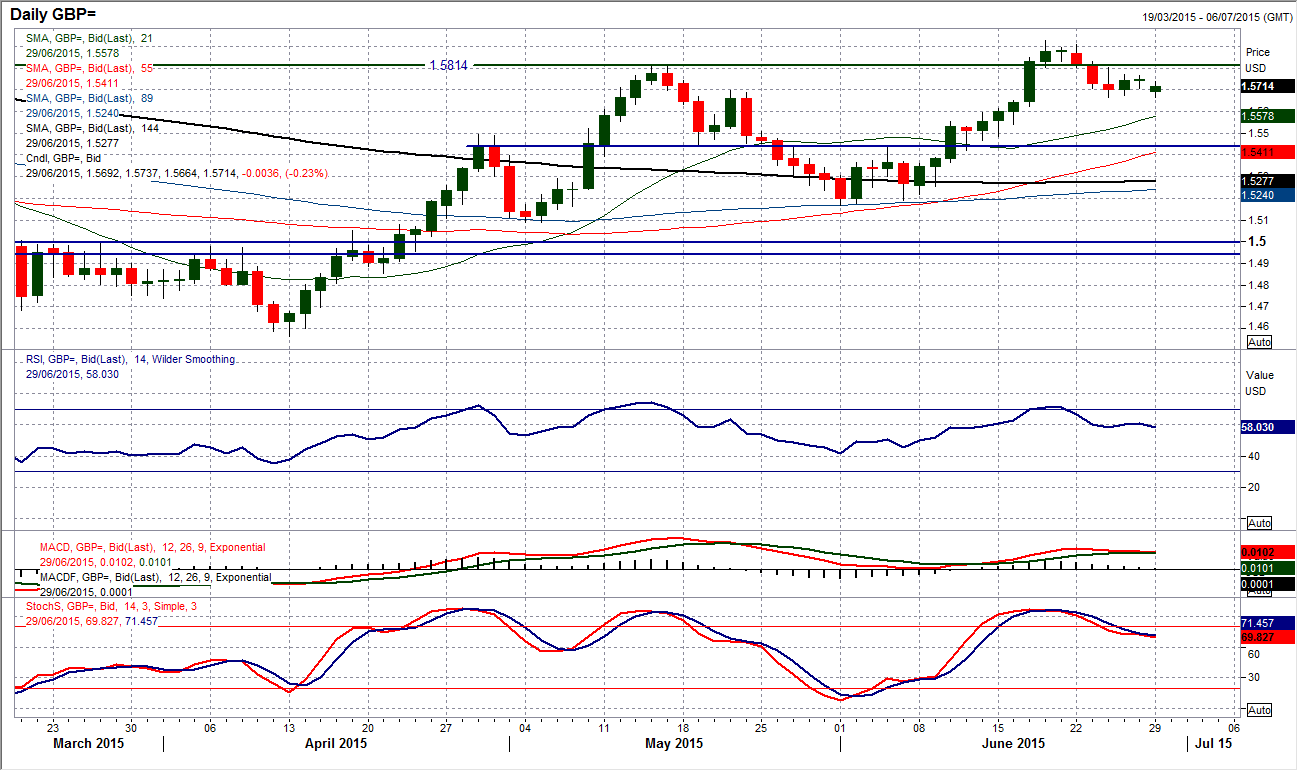

GBP/USD

The fact that Cable has not weakened more than it has (in the face of a massive sell-off on the euro which is driving safe haven plays) is interested in itself. The support around $1.5665 (last Wednesday’s low) remains intact and for now the outlook remains fairly neutral near term (four days of almost going nowhere) within a slightly corrective move. Watch out for how the market treats the $1.5665 support as a decisive breach would see the corrective slant gain traction. The intraday hourly chart is fairly calm currently and the technical outlook on the momentum indicators reflects the slightly negative slant, with the RSI on the negative side of neutral. The resistance for the bulls to target is at $1.5770. A decisive breach of $1.5665 would imply just over a 100 pip downside initial target at $1.5560.

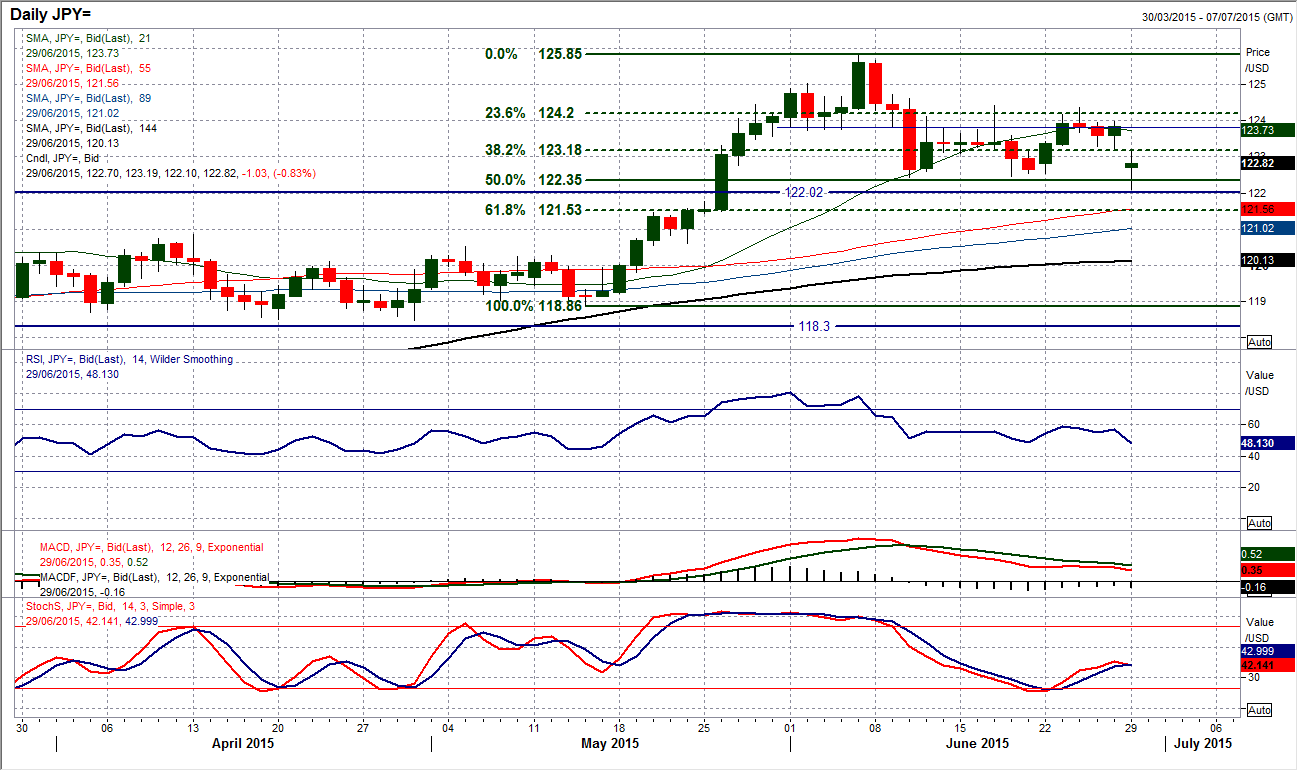

USD/JPY

The classic safe haven of the yen is strengthening. The big question is how far though. I have been talking about whether the correction I have been anticipating back towards the key breakout support at 122.00 had already played out with the lows around the key 50% Fibonacci retracement level of 118.86/125.85 at 122.35. The initial spike low at the open today has been to 122.10, so the sell-off still seems to be in keeping with the correction I have been looking at. The daily momentum indicators have turned lower again (not to be unexpected) with the RSI the lowest since mid-May (in keeping with a fall back in the price). The next negative move would come with a closing break below 122.00. That would be a concern for the bulls and re-open 120.60 support. For now I still see this as a bull correction for the dollar, but there could be some significant volatility to play out until that can be said with any conviction.

Gold

The safe haven flows today have also seen investors piling back into gold. As yet, this is not a stampede, but there has been a gap higher at the open. This gap has left support now between $1178.60/$1174.60. Interestingly also the day low is currently at $1179.60 which is just around the support at $1180 which had been an overhead resistance through last week on the intraday hourly chart. So far the buying pressure has been less than convincing, but during times of significant fundamental uncertainty, there is certainly going to be a preference for assets such as gold. The range play has been subsequently shown to continue. There is near term resistance at $1188.20 before the more important resistance at $1205.50.

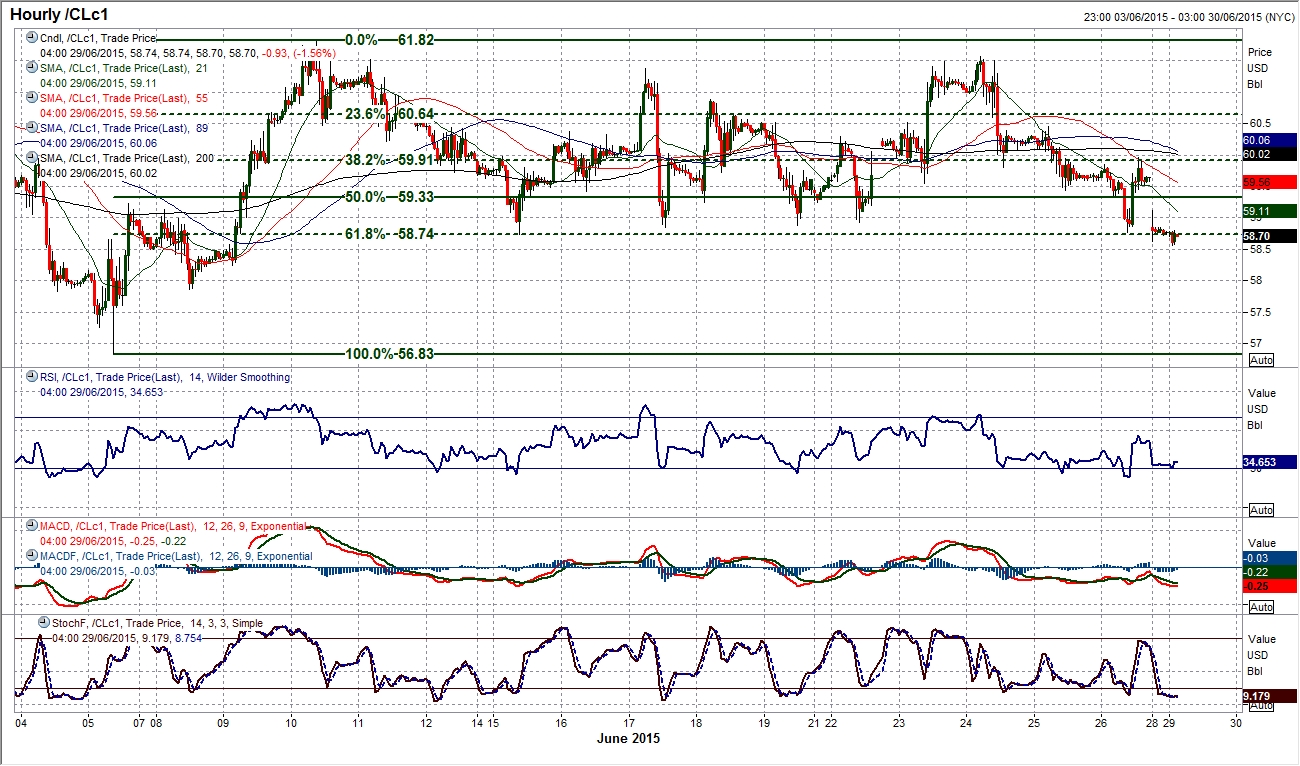

WTI Oil

The volatility in markets on Monday morning has seen a sharp decline back on oil after having looked to have formed support on Friday, the sellers have returned once more and WTI has broken back to a new low dating back to 9th June. This is now beginning to break down a range that has played out throughout the period. I have mentioned the 61.8% Fibonacci retracement of the $56.83/$61.82 rally at $58.74 several times (to say the least) over the past few weeks, but this level is now under serious threat by today’s selling. After 4 times (5 if you include Friday) using this as support a closing breach today would re-open the low at $56.83. Friday’s reaction high at $59.96 is the initial resistance now for a rebound.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.