Market Overview

From the reaction on the forex markets in recent days, it would appear as though there is not a great deal of confidence in the Federal Reserve moving further down the road towards monetary tightening today. The US dollar has come under considerable pressure recently and again this was ushered by a Consumer Confidence figure yesterday that was far worse than had been expected in falling to a four month low. However, trading sentiment has been fairly muted in the early Asian session and this could be a theme of today as traders look towards the key FOMC tonight.

Wall Street was fairly lackluster yesterday, although bounced back from earlier weakness to leave the S&P 500 closing 0.3% higher. The notable disappointment came with Twitter which fell around 20% after results sharply missed estimates, which dragged the tech heavy NASDAQ lower on the day. Asian markets were also fairly mixed overnight, with the Nikkei 225 just 0.4% higher as traders get ready for not only the FOMC tonight but also the BoJ giving monetary policy too. European markets are also trading mixed in the early moves today.

Forex trading shows a similar theme as the European session gets underway, with little trend emerging so far. The only real mover has been a slight correction on the Aussie dollar after the huge gains from yesterday.

Before the Federal Reserve announces monetary policy at 1900BST there are several other economic releases that traders will need to focus on. Euro and DAX traders will be looking at the release of the German CPI data throughout the morning. Then at 1330BST the advance reading of US GDP for Q1 is released. The expectation is for the annualised data to drop from a final reading of 2.2% in Q4 to just 1.0% in Q1. Any miss of this would put more pressure on the US dollar with the FOMC announcement the big focus for today. There is also the US pending home sales at 1500BST which are expected to slide back to a growth of 1.0% (from 3.1% last month). The US oil inventories are announced at 1530BST and are expected to drop to 2.3m (from 5.3m last week).

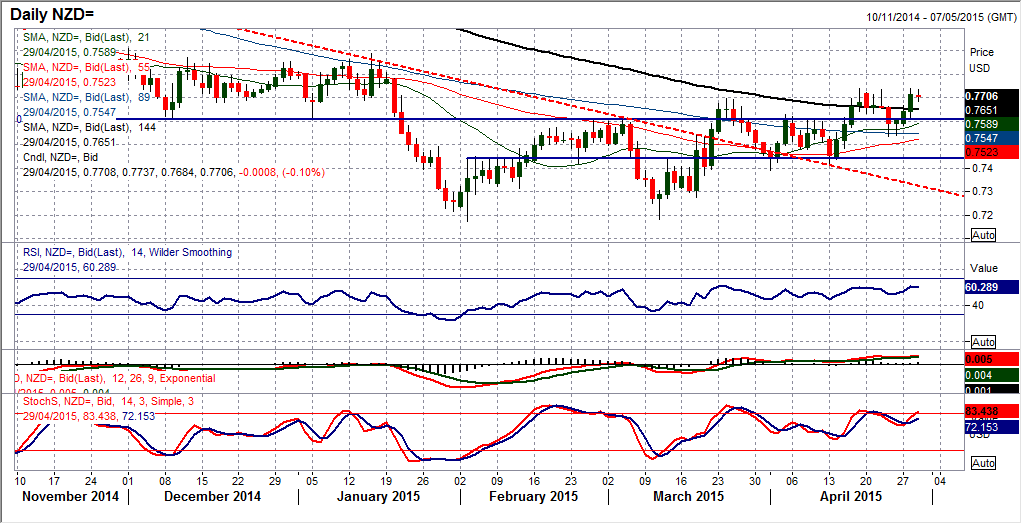

Chart of the Day – NZD/USD

The last couple of days of trading shows that there is clearly a resistance that has built up at $0.7740. This has capped the rally in the past two weeks and is holding back a move towards the key January high at $0.7890. Unlike the Aussie which exploded higher yesterday, the Kiwi seems to be a little more constrained. The daily momentum indicators cannot quite seem to breakout either with the RSI bumping its head up against the 60 level repeatedly. It also seems as though the MACD and Stochastics cannot break the shackles either. Even though the near term outlook is positive, this still leaves me concerned that this remains a bear market rally that is likely to be sold into. I would therefore look at playing small near term long positions but ultimately be ready for a bigger short position should a medium term sell signal come through. The intraday chart shows the hourly RSI consistently coming back to 50 in the past few days and has been a signal to buy, with near term support at $0.7655. Key near term support comes in at $0.7600.

EUR/USD

The euro has continued to rebound against the dollar and has now closed higher in 8 of the past 11 sessions. The interesting feature now is that the upside target from a near term bull flag pattern has now been achieved at $1.0990. This comes just as the rate is coming close to the key overhead resistance from the March and April highs between $1.1035/$1.1050. The euro has taken a pause for breath during the overnight Asian trading session, but I am still of the opinion that this remains a bear market rally. However it is clearly running higher ahead of the Federal Reserve meeting, with the market apparently taking a view that the Fed will not be able to make any hawkish hints in the statement. I would not see this as a surprise though and I see much of any dovish reaction has probably been played out not in recent days. I still see the dollar as a long term bull market and this move on EUR/USD is simply counter to that trend. It is just a matter of how far the euro rallies before the sell signals come through again. I see the overhead resistance at $1.1034/50 and the resistance of the old key low at $1.1100. The intraday hourly chart shows the support of the $1.0900 and $1.0800 pivot levels should be watched for any dollar rally today.

GBP/USD

The upside bull flag/wedge pattern target at $1.5340 has now been achieved as Cable has rallied now for 6 straight days and 11 days out of the past 12. Not only that, this incredible rally has added just over 750 pips in that time, a time where sterling was expected to have been coming under pressure due to the uncertainty that continues from the UK election. This move has taken the daily RSI towards 70 and also the highest since July, which is a big achievement for the bulls. The question is though, can the bulls continue to make a real breakout? The rally has made some real progress, but despite the breakout through $1.5000 (which was a big near term breakout), there has not been any major medium term breakout. That would need to come on a move above the February high at $1.5550, so around another 200 pips. It is also still trading under the falling 144 day moving average. The FOMC meeting today could be pivotal and I believe that a sizable portion of the rebound has been due to the market pricing in the Fed not being able to make any hawkish move today. Buy on rumour, sell on fact? Maybe. Cable is now into the resistance band $1.5315/$1.5550, with the intraday chart showing the initial support around $1.5260. Also note that the 55 hour moving average (rising at $1.5245) has become a very good support in the past week.

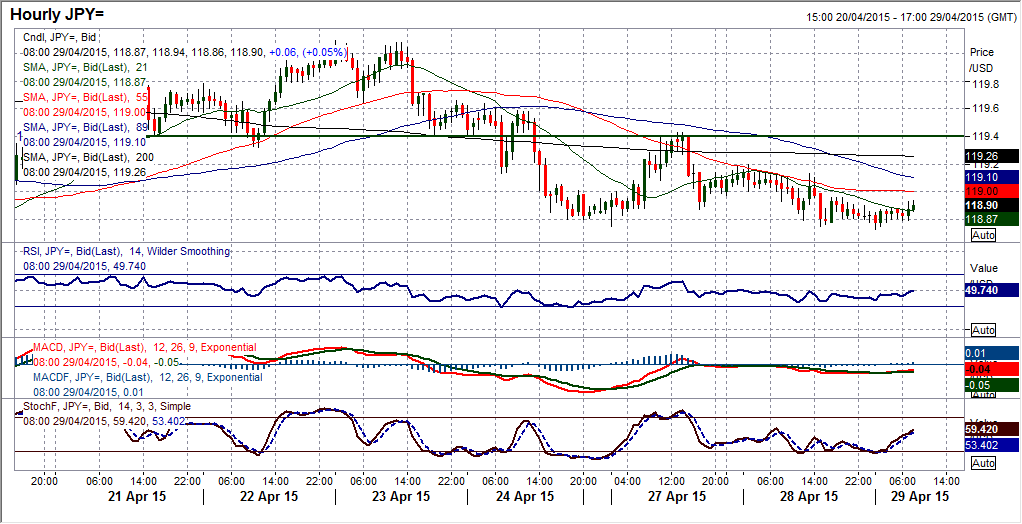

USD/JPY

In the context of the dollar weakness in the past few days, perhaps it is an impressive achievement that the key support at 118.30 on Dollar/Yen remains largely untested in this trading phase. The strong moves on other forex pairs have not been replicated on this chart, which remains fairly dull by comparison. The daily momentum indicators remain rather benign, although they have a slightly negative slant to them which would come with the territory of trading towards the lows of a range. There is no real sign of any imminent breakdown of the key 118.30 support. The intraday hourly chart shows a sequence of lower highs in the past few days whilst support continues to hold around 118.70. There is also a support at 118.50 to help protect the key low at 118.30. I sense that if the bears have not been able to break 118.30 by now, they are unlikely to now in front of the FOMC. I would still be tempted to play this as a rangeplay where you could add stops below the 118.30 support. The 119.40 pivot level is still the initial overhead barrier to overcome.

Gold

With a second positive candle in a row the outlook within the range has improved. Two positive candles in a row have not been seen in four weeks, and the bulls will be encouraged by this. However there is still not really too much that has been achieved. The rally has countered some of the slight bearish slant in the price in the past three weeks, also moving above the resistance at $1210.70 for the first time since early April. However essentially this remains a range play and will do until a breach of $1224 resistance. An upside breakout would imply an upside target of $1273. There has been a slight pick-up in daily momentum (notably in the Stochastics) but nothing too serious to get the bulls excited yet, and it is unwise to call a breakout until it has been seen. With the overnight Asian session suggesting consolidation early today, the rebound high at $1215 becomes the initial resistance. Support is at $1198 before $1190.90.

WTI Oil

With a slight concern of a corrective drift, the bulls have come in once more to support WTI. This left us with a fairly neutral, but supportive, candle on the daily chart yesterday which importantly is coming above the key support at $54.85. Whilst the consolidation continues, the sellers are not able to seize control, however there is the threat of the bulls becoming stale. The daily momentum indicators remain strong, but there is just a slight rolling over of the Stochastics and the MACD lines, which could begin to show through with some fatigue in the price. There is nothing to worry about yet, but it is wise to consider the potential. The intraday hourly chart shows that the price has been broadly consolidating for the past two weeks which has now broken the uptrend. I see this more as a range play near term now and the support just above $56 and below $58 has contained the last 3 days. A confirmed breach either way could hint at the direction of the next decisive move. Key resistance remains the rally high at $58.40.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.