Market Overview

Markets are becoming increasingly cautious as the key FOMC meeting begins to dominate the thoughts of traders. It is notable this time around though that in the past few trading sessions as we approach the meeting, the US dollar has been under a little more pressure this time around. The negotiations between Greece and the Eurozone have also taken a turn as Greek prime minister Tsipras made changes to the negotiation team, widely seen as a move to reduce the influence of Yanis Varoufakis (the Greek finance minister) who has been seen as being fairly obstructive to progress. On Wall Street there was a cautious mood with the S&P 500 which was 0.4% lower. In Asia, markets were again fairly mixed, with the Nikkei slightly higher by 0.4% despite Japanese retail sales disappointing markets. The European markets are just giving back some of yesterday’s gains in early trading today.

In forex trading there is a slightly mixed look to trading today after the dollar negative moves of yesterday, without any real stand-out performer. Traders will be increasingly looking to position themselves for the FOMC tomorrow. Before that though, UK traders will be watching for the first look at UK GDP for Q1. Expectation is for the preliminary number to see a slight dip to +0.5% from last quarter’s +0.6%, with sterling a likely mover on the news. US Consumer Confidence is also out today with the expectation of a further improvement to 102.5 from 101.3 last month.

Chart of the Day – AUD/USD

It would appear that in front of the FOMC meeting, the dollar is under a little corrective pressure. The moves seen on major pairs such as the Aussie show that there is a medium term choppy consolidation for the US dollar rather than any more significant yet. The Aussie for example has rallied in the past two weeks from a position of seemingly being ready to break lower with downside support levels from several years ago, to now be within striking distance of the range high at $0.7937. Recent daily candles have been positive without being spectacular, but the price is creeping higher nonetheless. Interestingly, the RSI is now at its highest level since June, however I would want to see the RSI over 70 on a breakout to suggest really strong momentum in the move. Don’t forget, a break is not a break until it is confirmed. The hourly chart is positive with an uptrend in place, positive hourly momentum with hourly RSI, MACD and Stochastics in positive configuration. Support is now beginning to form around the range $0.7840/50. The key low is now in at $0.7790. At this stage I am not anticipating an upside breakout, so that could mean limited upside potential.

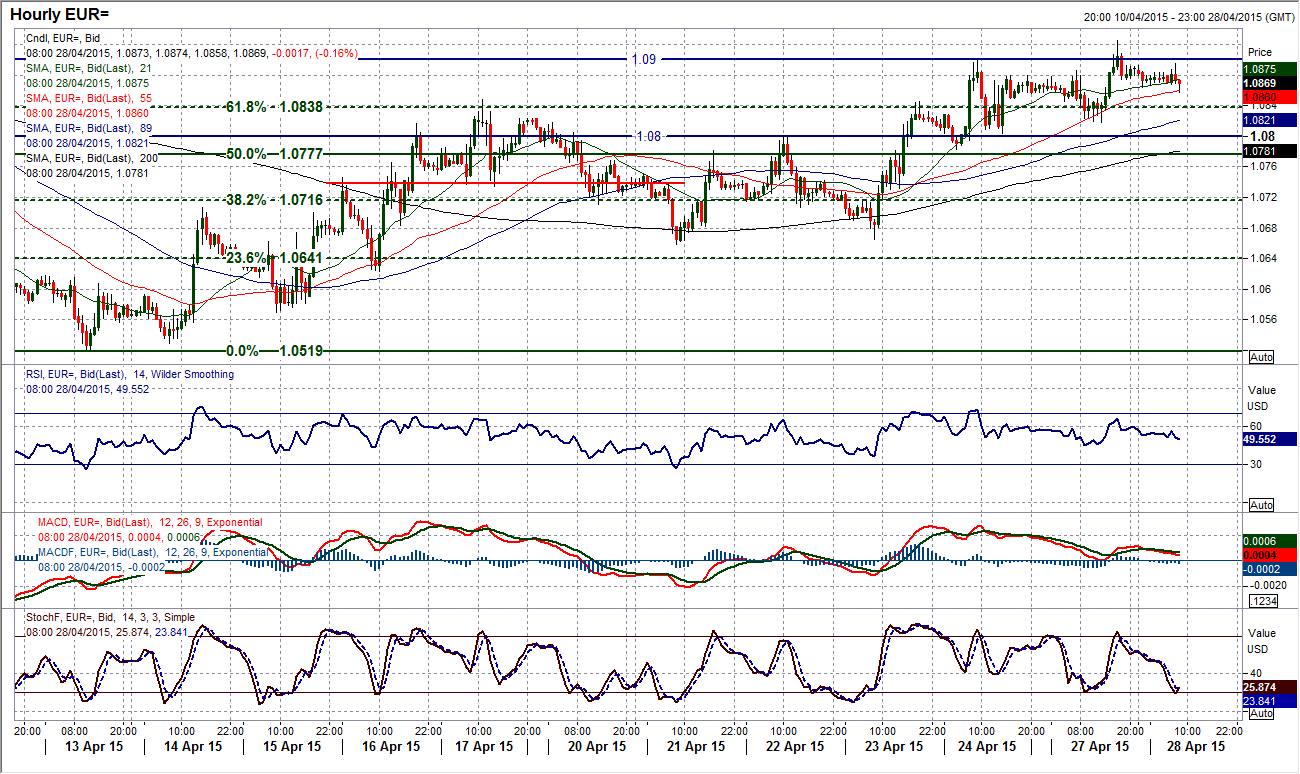

EUR/USD

After the strong rebound of Thursday, the gains are beginning to slow in front of the key Federal Reserve meeting announcement on Wednesday. With just a mild gain yesterday (and a fairly neutral candle) the consolidation seems to be continuing today. The euro is now trading with a slightly positive outlook within a broad range. It would appear that for now at least, the selling pressure has been averted, with the 21 day moving averages flattening off. The daily momentum indicators are near term encouraging but this chart does not have the look of one that is ready to break decisively higher. The intraday hourly chart shows the sequence of gains in the past week, whilst the pivot level around $1.0900 again seems to have been an area of resistance. A decisive breach of $1.0900 would open the range highs at $1.1035/50. Support continues in the range $1.0775/$1.0800. Although near term dips could be seen as an opportunity to buy the upside is fairly limited as I do not see a breakout above $1.1035/50, whilst also being counter to what I also see as a continuing bearish medium term trend.

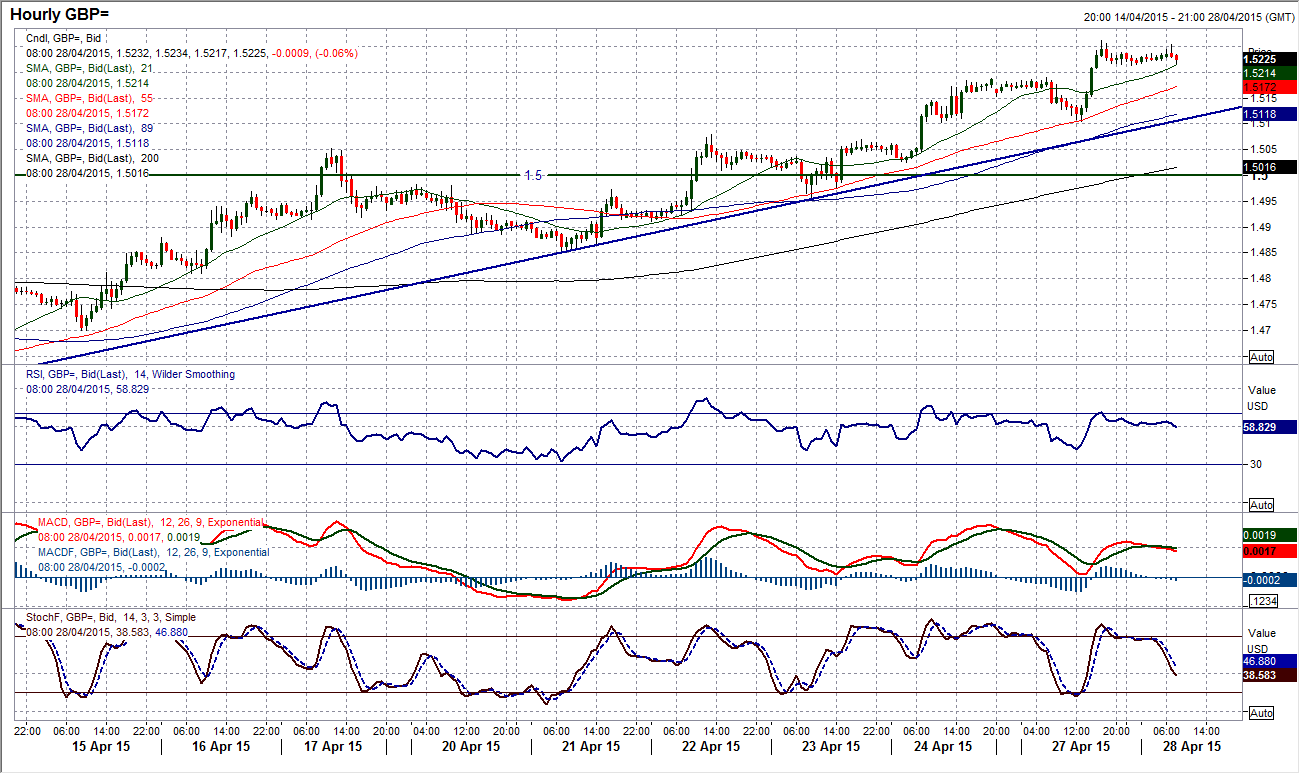

GBP/USD

The rally on Cable in place since the 13th April has been impressive. It has been one which has enormously improved the near to medium term outlook and has added over 650 pips to the price. In front of such an uncertain election this was not meant to be like this, however ultimately, this is still counter to the longer term bear trend. The near term technical upside target from the flag breakout above $1.5053 has given an implied target of c. $1.5340, which is only around 10 pips away now. The pair is also now close to the next band of resistance round $1.5315. The intraday hourly chart shows a strong uptrend has formed which today is providing support around the key reaction low from yesterday at $1.5110. Back the bulls for now with the recovery trend in play still.

USD/JPY

With this sideways trading range play continuing, it is difficult to get any real traction in positions that are left open for longer than a day or so. The daily chart from yesterday has shown a fairly weak candle with a minor recovery that was choked off. I still find the intraday hourly chart far more insightful with the pivot level at 119.40 once again acting as a barrier for a rally. I must have said that countless times over the past few weeks, but it continues to be the case. Whilst below 119.40 the bulls are struggling to gain a foothold. The near term momentum is rather neutral now as the latest rally has lost its way. With another lower high in place around 119.40 the pressure remains to the downside on support at 118.50 and possibly 118.30. The truth is that the pair is likely to remain fairly subdued in front of the FOMC now after which we may be able to muster some direction.

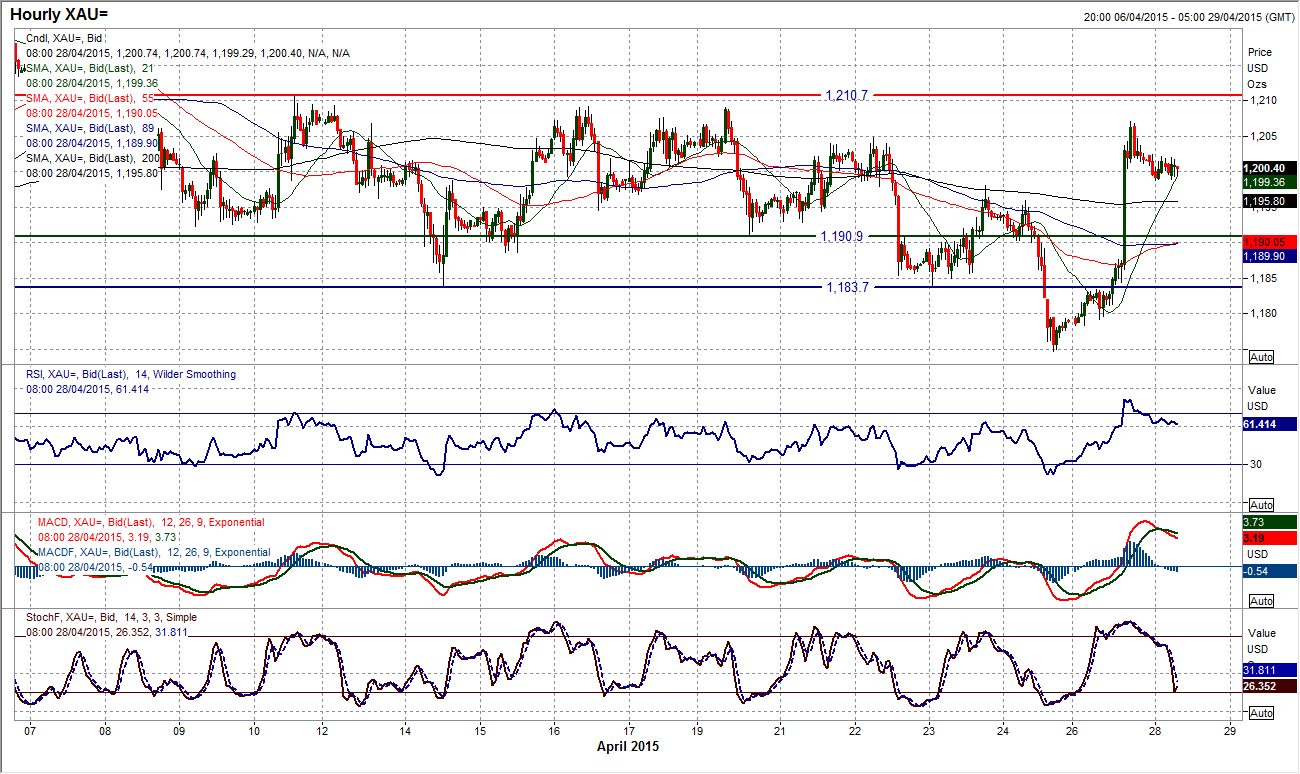

Gold

A huge bullish candle posted yesterday on the daily chart has improved the outlook significantly, but only within the confines of the range that has been in place for the past few weeks. The move has maintained the support of the range low which now stands at $1174.75. The momentum indicators took an improvement from yesterday’s price action but in truth they have only reaffirmed the range that is in place. Interestingly if you look at the hourly chart, the move came almost all in one hour, subsequently consolidating, whilst also failing to break above the resistance at $1210.70. In effect then this move has done very little in my eyes to change anything other than to continue to play this range. With the rally falling over at $1207 it will be interesting to see if support can form in the band $1190/$1195 which has previously supported within the range.

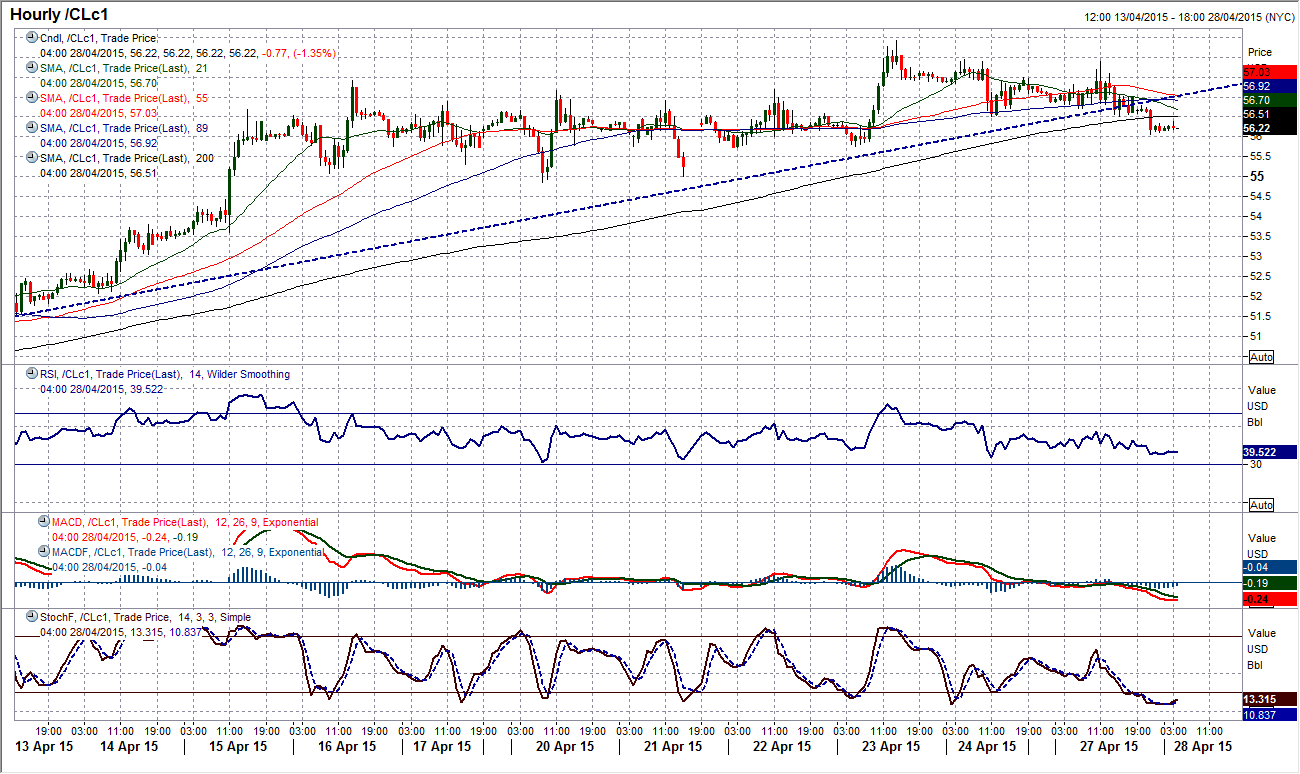

WTI Oil

The consolidation in WTI over the past few days has still got its slightly bullish bias. The oil price has now been trading for the past 2 weeks above $54.24 which was the key upside breakout. This would suggest that the bulls have accepted the new expectation of the price. The pressure continues to be put on the next resistance at $59 as WTI begins to move towards its upside implied medium term target of $65.00. The intraday hourly chart shows that the outlook remains strong but the support of the uptrend since mid-March is being tested. However, this indicator is not vital, as this could just be the continuation of more of a consolidation move. The initial support at $56.50 has been breached which opens the near term reaction low at $55.75. The key support that needs to ideally hold is now in at $54.85.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.