Market Overview

The forex markets seem to be increasingly forming a consolidation in front of a significantly important meeting of the Federal Open Market Committee in the next couple of days. The outcome of this meeting is expected to remove “patient” from the statement which would being another big step towards a rate hike. However there was a small move away from the dollar yesterday as even more US data painted a slightly deteriorating picture for the US economy.

The dollar strength has been of significant concern to equity investors on Wall Street in recent days and this slight decline on the dollar allowed for a near term boost for sentiment. Wall Street closed in positive territory with the S&P 500 up 1.4%. Asian markets were also up overnight with the Nikkei around 1% higher in the wake of the Bank of Japan holding steady on monetary policy. European markets are trading flat to slightly lower in early exchanges.

In forex trading, the major pairs are showing a continuation of this very slight dollar weakness today but as we move ever closer to the FOMC meeting outcome, expect the pairs to consolidate increasingly. There is no significant standout, although the New Zealand dollar and the euro are the best performers so far. Gold and silver prices are also fluctuating around flat today.

There is some economic data to focus on today though, with the Eurozone final CPI inflation reading at 1000GMT, which is expected to come in line with the flash reading of -0.3%. The German ZEW economic sentiment, also at 1000GMT, and is expected to continue to improve again to 58.2 (from 52.7) which would continue the recent trend. Then into the afternoon there is the US housing data at 1230GMT with the Building Permits (1.07m expected) and the Housing Starts (1.05m expected).

Chart of the Day – EUR/GBP

Since mid-January, Euro/Sterling has been trending lower. This has been characterised by a sequence of selling phases and then consolidations back to the downtrend before the selling pressure resumes. That is exactly what the latest move seems to be. There has been a sharp bounce on Thursday last week but since then the rate has broadly consolidated and seems to have stunted and real sign of a continued rally. The momentum indicators show no real suggestion that this is anything more than a bear market rally and something that should be sold into. The RSI has just unwound quickly back to 30 and is stalling, whilst the MACD lines show almost no reaction. The hourly chart shows that the Fibonacci retracements of the £0.7300 to £0.7010 sell-off are playing an interesting consolidation role, with the 50% level at £0.7154 especially acting as a ceiling. The downtrend is now closing in at £0.7170 and the sellers look ready again. A retest of the £0.7010 low is likely in due course.

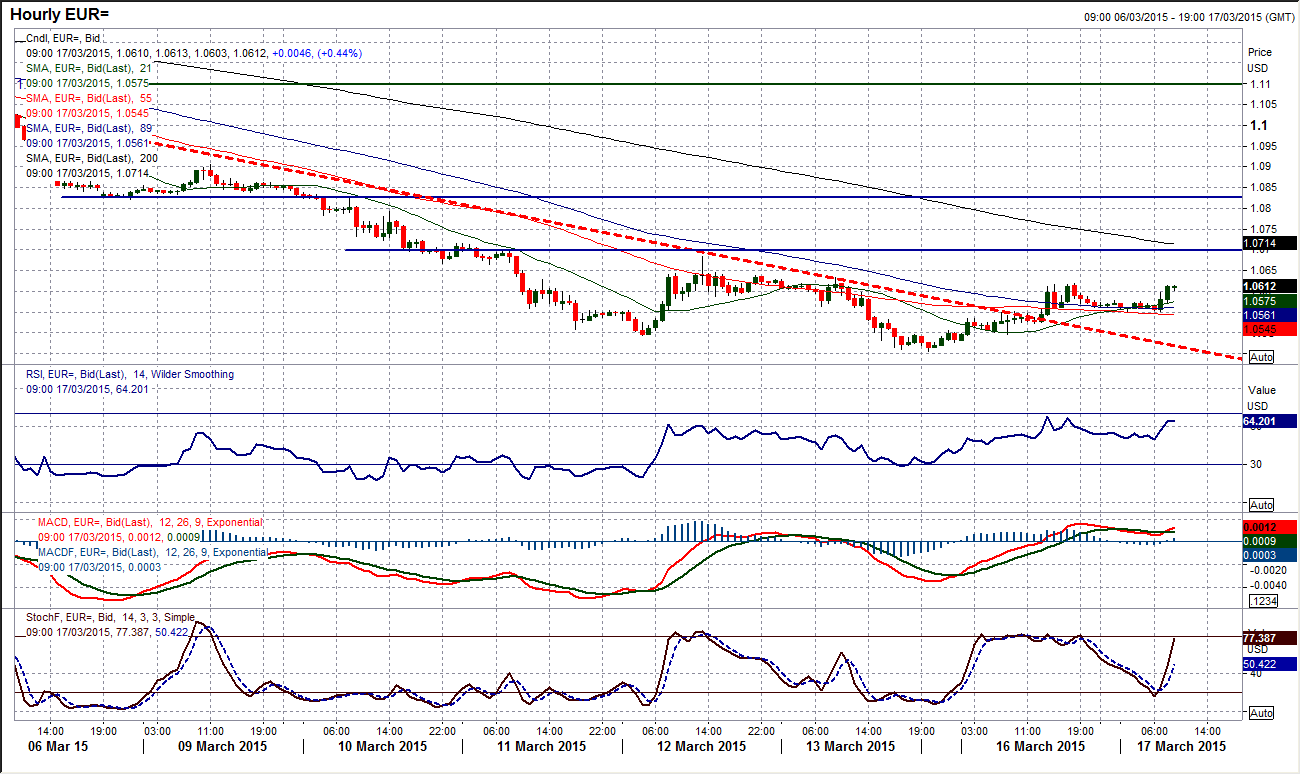

EUR/USD

The daily chart shows a green candlestick which of late are few and far between. However this is in effect merely just a consolidation move on the euro. I spoke yesterday about the euro beginning to trade clear of the 61.8% Fibonacci projection level around $1.0620, but the intraday rebound dragged the price back to the resistance of the Fibonacci level at which point the rally was limited. This reflects the consolidation over the past few days (in front of the uncertainty of the FOMC meeting). There is a slight improvement in the RSI in recent days (and also the Stochastics) which I think at this stage is more a case of unwinding the hugely oversold momentum rather than any real bullish divergence. When markets begin to consolidate after such a huge sell-off this will often happen. The consolidation is reflected on the hourly chart as the downtrend that had consistently been dragging the euro lower in the past 9 days has now been breached. However the sellers remain firmly in control until at least the breach of the first real resistance around $1.0700 whilst yesterday’s reaction high at $1.0619 also becomes noteworthy. On a technical basis this remains a consolidation that will be seen as a chance to sell for a retest of $1.0456. The one big caveat is the uncertainty of the FOMC so this consolidation may just continue for the next 36 hours.

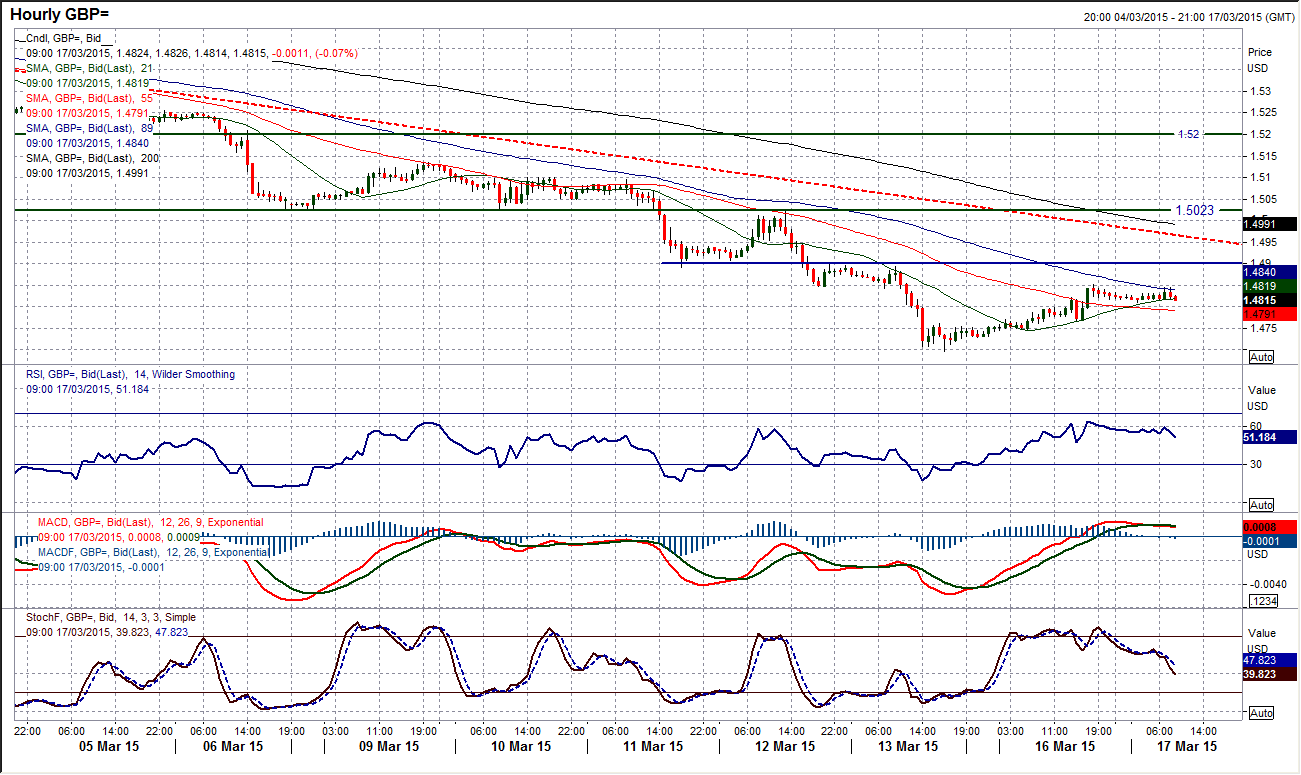

GBP/USD

In isolation, you would say that a rally of well over 100 pips from the low at $1.4697 would be seen as the basis of a potential recovery, however the sell-off has been significant over the past couple of weeks and this is currently just a minor blip for Cable. The bears are fully in control still and are likely to view this as another chance to sell. The overhead resistance at $1.4950 will now be eyed as an ideal technical sell-zone as this unwinding rebound has taken hold. However, looking at the hourly chart the unwind may have already have happened. The falling 89 hour moving average has been a very good basis of resistance through this decline and that is around $1.4840. Also the hourly momentum indicators have unwound to levels at which the selling tends to resume. There is overhead resistance also around $1.4900 to contend with. It therefore looks as though the sellers will be ready to move soon to retest the lows again. As with the euro though, the big caveat to the technical picture in the next couple of days is the FOMC meeting which could see traders sit on their hands for now.

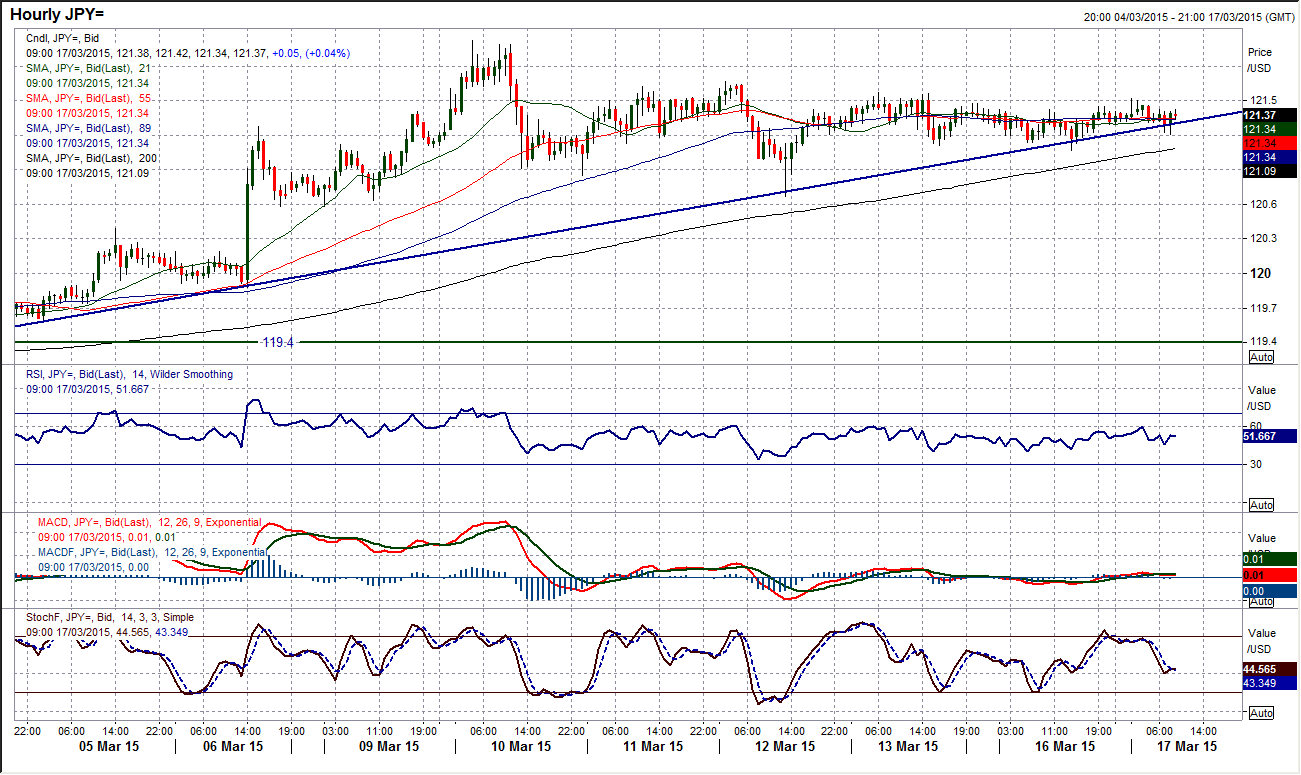

USD/JPY

Dollar/Yen is settling into a consolidation and maybe, looking at the daily chart, it has been doing so for the last few days. A series of tight, uncertain candles has been posted in recent days, which do not do much for gauging direction. This is meaning that the momentum indicators are flattening off and we must wait for direction. The trend is certainly still with the dollar bulls, so convention would tell us that this is likely to continue. The hourly chart shows that the support is still being formed at the uptrend that has been in place since 26th February. However that uptrend will be seriously tested if this consolidation continues today. There is a tight band of support/resistance now with 121.07 as the low up to 121.67 as the high. A consistent break either way would begin to show for direction. The key support comes in at 120.60 still, with a close above 122 re-opening the bull run. For now we wait though.

Gold

As with many instruments in the past couple of days there is an element of consolidation that has taken over the gold price. This comes as the price has now basically traded sideways for four days. The outlook remains weak with the downtrend channel still in place and the momentum indicators all in negative configuration. The key factor on the daily chart is also that the price has failed to reclaim a position above $1168.25 which is a key old support. This would suggest that there is still a likelihood that gold will continue to retreat back towards $1142 and $1132 in due course. The hourly chart shows the consolidation that has continued the sequence of lower highs, with the latest at $1166.20. There is though very much a lack of direction in the hourly momentum indicators which have all unwound to neutral, whilst the 21, 55, 89 hour moving averages are all flat. The gold price is waiting for direction and it is likely that the FOMC will provide that direction.

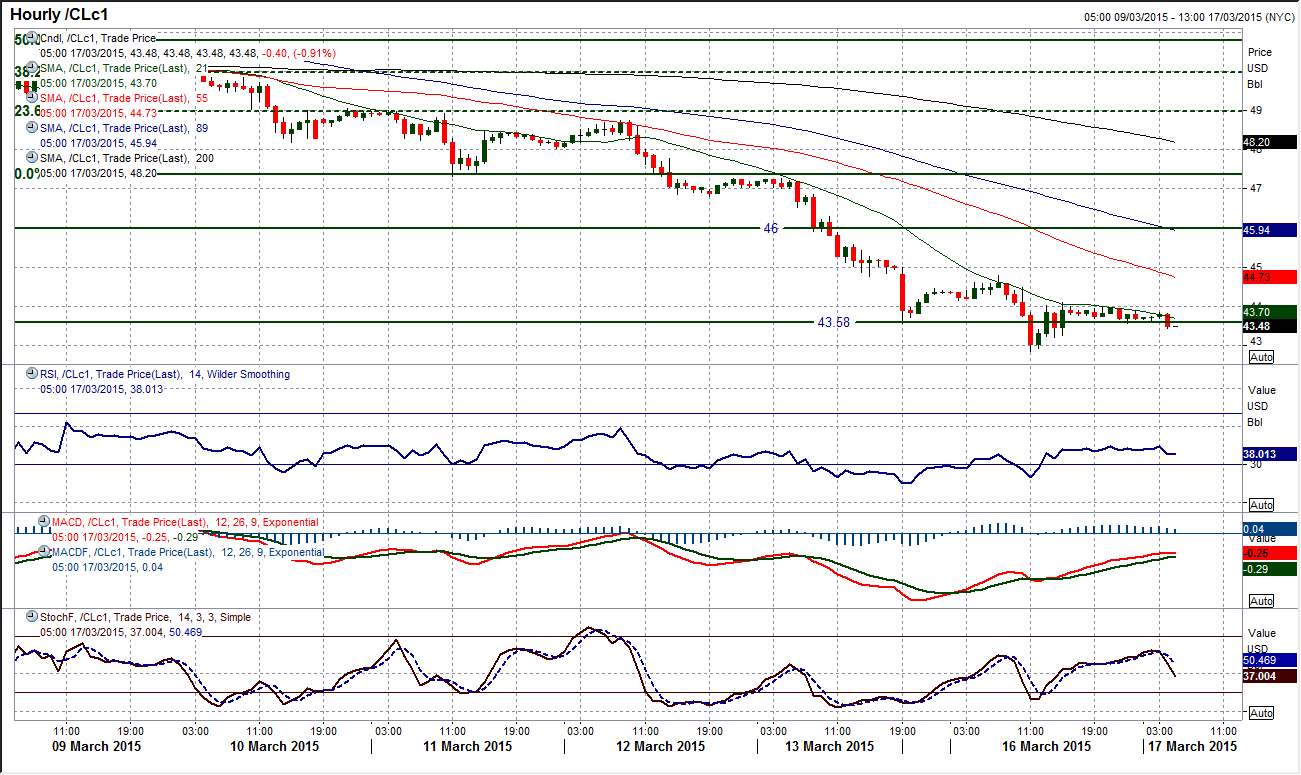

WTI Oil

The weakness of the WTI price in the past 8 days has been incredible, losing 16% in that time is a huge fall. The momentum is very negative but also has significant further downside potential. Yesterday we also saw the oil price fall to a new 6 year low dating back to February 2010 on a move below $43.58. After an intraday rebound, we are now still looking for a close below the support to confirm the breakdown. The intraday hourly chart has taken to using the 21 hour moving average (c. $43.80) as a decent basis of resistance in the past few days. The hourly RSI is firmly in bearish configuration and showing that any rallies are seen as a chance o sell. The rally high from yesterday at $44.78 becomes the initial resistance, whilst during the original bear market run there was a pivot level that formed around $46 and could also be a barrier for a recovery.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.