Market Overview

Finally the European politicians have averted a Greek default, but only for now, and only possibly. Friday’s evening’s agreement for a four month extension to the bailout program appears as though the Syriza government in Greece has not won too much. The agreement to the bailout means that they must now come up with detailed reform proposals to satisfy the (former) troika that the conditions of the bailout are being met. This does seem as though the can has been kicked further down the road because in effect not a great deal has changed and perhaps it was what the market was expecting. There is also the impact at home, where there are already cracks forming in Syriza’s government. There has been a slight improvement in market sentiment as equities have rallied this morning, but interestingly the euro has been rather muted in its reaction so far.

Wall Street closed higher on Friday with the S&P 500 rising 0.6%, whilst Asian markets were broadly positive overnight albeit on weak volumes. The European trading session has got off to a positive start and a key feature could be that this may finally be the day that the FTSE 100 breaks out to a new all-time high. There needs to be a move above 6950 to complete the move.

Forex trading has been cautious despite the improvement in market sentiment, with the dollar strengthening today. The euro has fallen back as traders seem to be reluctant to still back a euro recovery despite the agreement reached on Friday. Traders will be watching for the German Ifo Business Climate at 0900GMT which is forecast to improve slightly to 107.4 (from 106.7). This would continue the recent recovery in an indicator which has a decent correlation to German growth data and which would follow the continued recovery in the German ZEW. Later on we also have the US existing home sales data at 15000GMT which is expected to dip very slightly to 5.03m (from 5.04m).

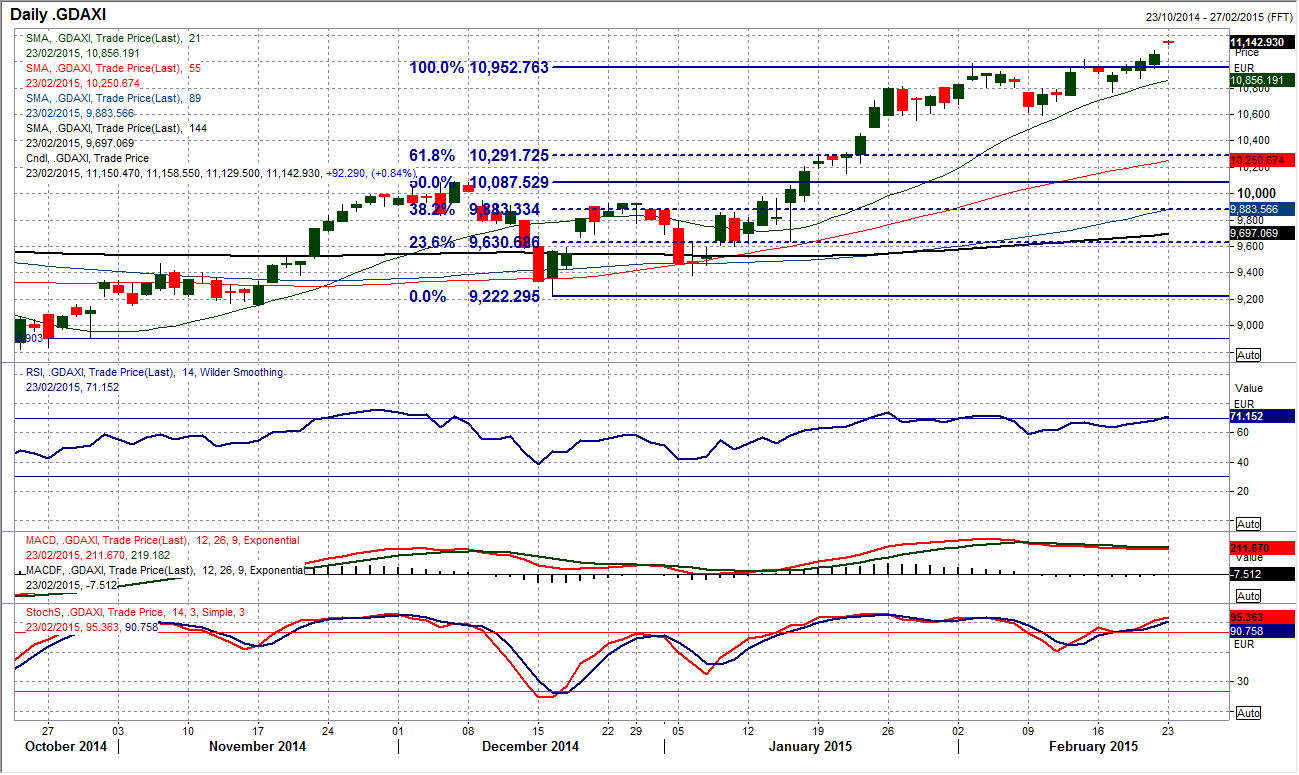

Chart of the Day – DAX Xetra

The DAX has been struggling to make a decisive move through the 11,000 barrier but not it seems as though it is finally making the breakout. The 100% Fibonacci projection level around 10,950 of the October/December rally measured form the December low has been a consistent barrier but now it looks as though the DAX is ready to make the break with Friday’s close at 11,050 a second consecutive close above 11,000 and is being followed by further upside today. This pushes the DAX into new all-time high ground and opens the upside. Theoretically, once the index pulls free of the 100% Fibonacci projection level the next upside target is the 12,020 level at 161.8% projection. The DAX is looking to now leave key supports in place at Friday’s low at 10,875 and at 10,765.

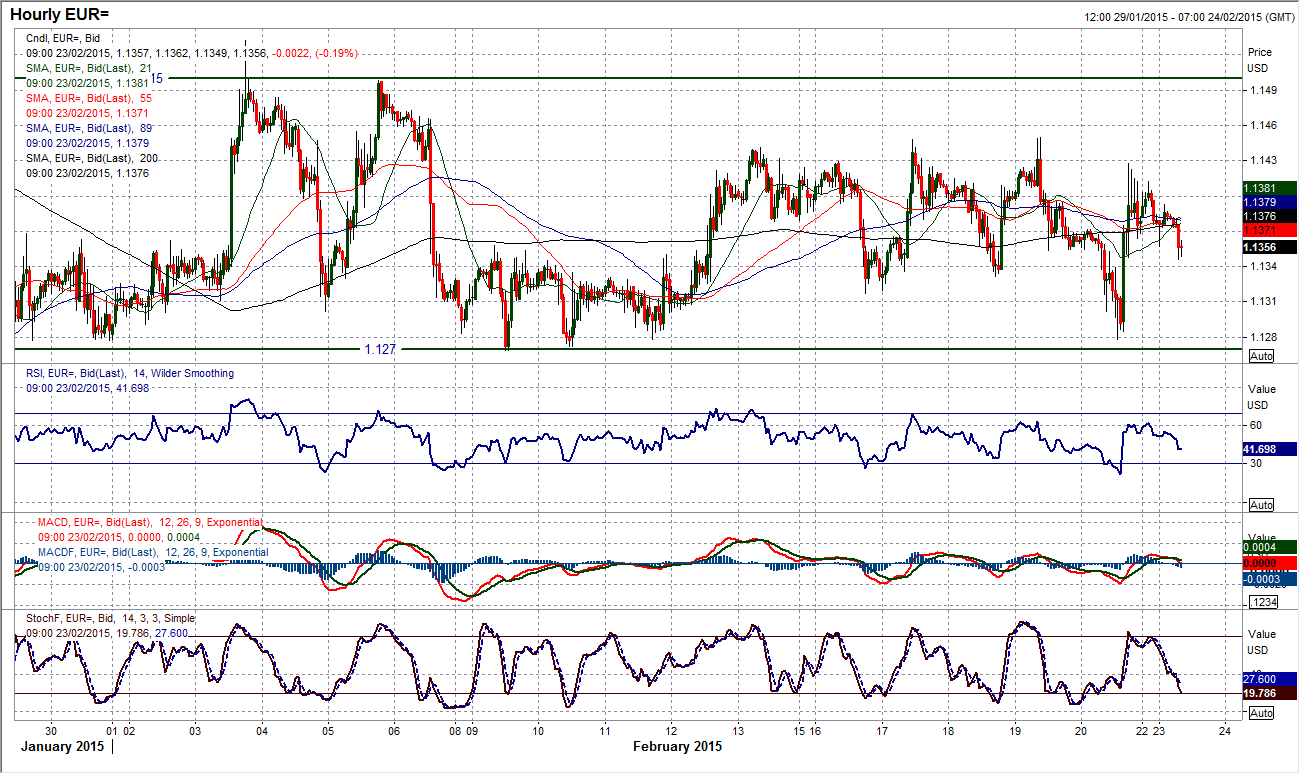

EUR/USD

I have been saying that the euro may begin to find some direction as the agreement between the Eurogroup and Greece has been reached. However for now the market still seems a little reticent to back a sustained euro rally on the news . There was an initial bounce on Friday, but for now the euro remains rangebound between $1.1260/$1.1530, whilst the tighter resistance under $1.1450 also continues. We are therefore still waiting for any decisive signals on the daily chart, which we have not been able to derive from the Asian trading session. The intraday chart shows the strong reaction on Friday afternoon as the euro bounced strongly from $1.1278 (just above the key low at $1.1260) around 150 pips higher to $1.1430, but only to finish with what amounted to little more than a doji candlestick (denoting uncertainty). It appears as though we continue to wait for the decisive move.

GBP/USD

Cable remains in positive configuration with daily momentum indicators still bullish near/medium term and the support of the rising 21 day moving average at $1.5250. A near term consolidation has set in again with a slight drift back into support around $1.5330. This kind of price action has been seen previously following a strong upside breakout, with the bulls happy to settle down for a couple of days before the next push higher. The rising 200 hour moving average has been catching these moves (currently at $1.5375), whilst support around $1.5300 is becoming increasingly important to maintain this recent bull run. A move above $1.5420 would help to reopen the recent high at $1.5478, whilst $1.5200 still represents the point at which the bears would gain control again.

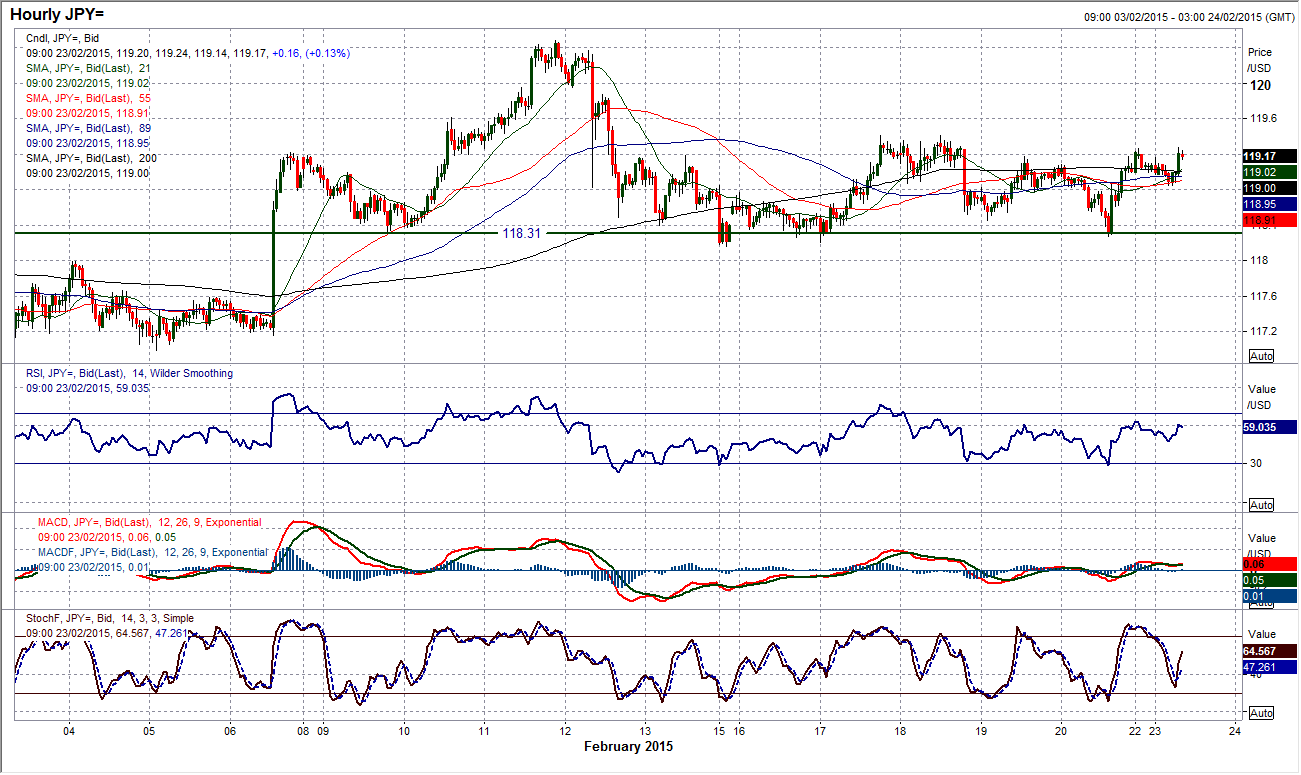

USD/JPY

Despite the lack of any real direction over the past few weeks, the outlook retains a slightly positive bias with the momentum indicators just configured above neutral and the price trading above the daily moving averages. The dollar bulls continue to cling on to the support around 118.30 which remains a key near term pivot level. The gains that we have seen since Friday means that the dollar is now looking towards a test of the resistance around 119.40 again and a confirmed move above 119.40 would re-open the resistance at 120.50. For now though this remains a consolidation play.

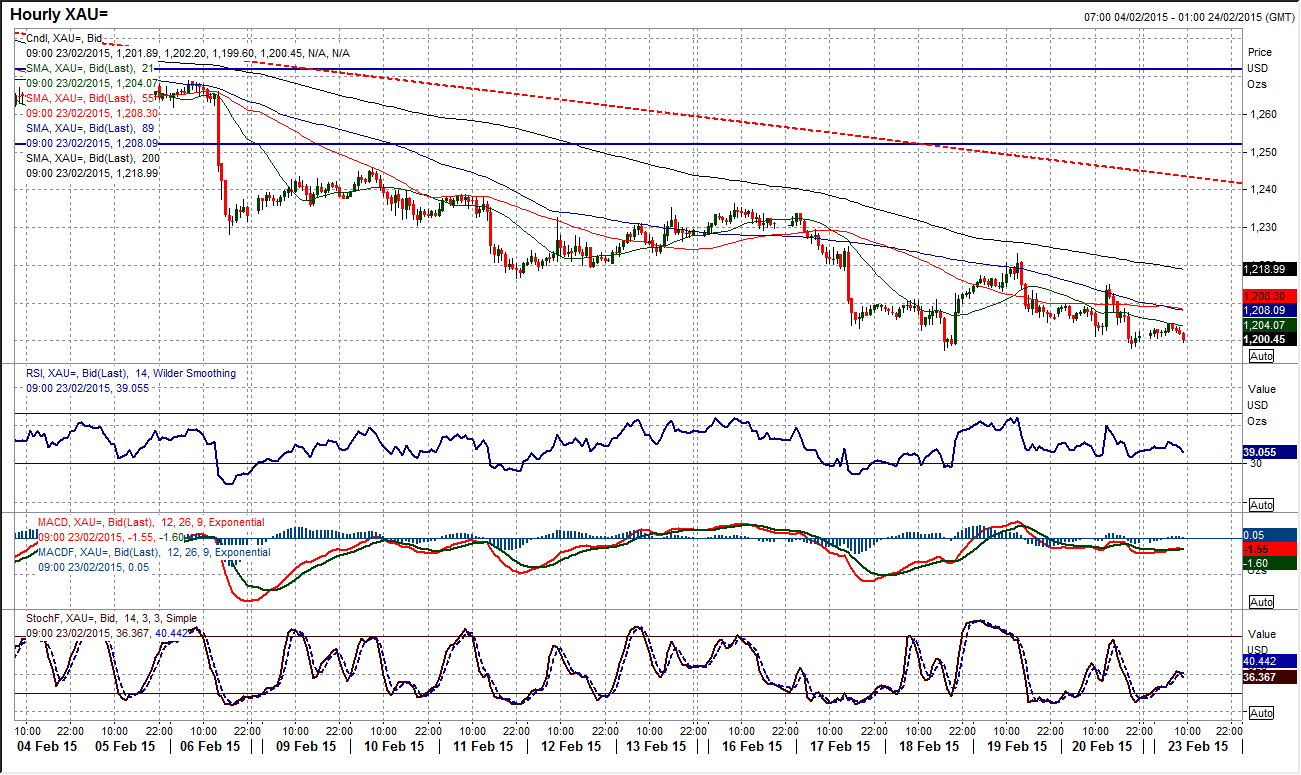

Gold

The sequence of lower highs and lower lows continues as gold has turned lower again and the outlook remains weak for the precious metal. I have been suggesting that the near term outlook has been deteriorating for a while now, but with the consistent downside pressure that has continued for over 4 weeks, the medium term outlook is now also bearish. I am a seller into strength, with the resistance band $1216.50/$1223.10 now in place. With Friday’s peak at $1214.90 the pressure is again to the downside as the peaks come at ever lower levels. Further pressure on the low at $1197.55 continues with a breach opening $1180.70 and then $1168.25 as the next important downside levels.

WTI Oil

I am not getting worried for the recovery outlook, but I am increasingly mindful that the support of the rising 21 day moving average (at $49.60) is being tested. I am also aware that the bulls are nowhere near in control as they are on Brent crude. There is far more of a range phase still playing out on WTI which the intraday chart shows continues to use the Fibonacci retracement levels as notable turning points. The intraday hourly chart shows that the RSI is beginning to take on a slightly bearish bias (consistently dropping towards 30 and peaking around 60), which is a slight concern. Key near term support comes in at $49.15 and $48.05. Thursday’s rally peaked at $52.15 which is now a key near term resistance.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.