Market Overview

The election of the anti-austerity Syriza party in Greece has failed to dampen the spirits of investors still rising on the ECB’s QE wave. Sentiment does not appear to have been too significantly impacted either by the credit downgrade of Russia by ratings agency S&P which now places it as junk status. However, the positivity is impacting on Eurozone markets far more readily than the FTSE 100 and the S&P 500, with the latter having been bogged down by corporate results again (Microsoft disappointed yesterday). After a choppy day, Wall Street closed with slight gains with the S&P 500

Overnight Asian markets were a mixed bag, with the Nikkei 225 benefiting from a weaker yen earlier in the session (although the yen has subsequently reversed) whilst the Shanghai Composite was off well over a percent after Chinese Industrial Profits fell by 8.0% last month. European markets are though making further gains in early trading.

In forex trading there is an element of consolidation early in the European session, although the yen has started to strengthen once again within its tight range on the dollar. There is much for traders to consider today. Starting with UK GDP at 0930GMT, the expectation is for a slight dip in the quarterly growth to +0.6% (down from +0.7% last month, and judging by the recent deterioration in PMIs this is not to be unexpected. Then we move on to the US durable goods orders at 1330GMT which is due to come in at +0.6% on the month, although this is historically a spikey number, so be careful trading around it. We then have the US Consumer Confidence at 1500GMT, which is expected to improve to 95.3 which would be the highest level since 2007. Also at the same time there is the New Home Sales data which is expected to show a slight improvement to 452,000 (from 438,000) which would come after three months of deteriorating numbers.

Chart of the Day – Silver

After such a strong run perhaps traders are feeling it is time to take the money off the table and take some profits. Yesterday we saw a bearish key one day reversal daily formation which suggests the rejection of an attempted upside break, subsequently followed by a decline that closes below the previous low. It is also interesting that this reversal has happened just under the resistance of the old critical lows of 2014 around t $18.50. This is a strongly negative signal near term and suggests a loss of control for the bulls and a loss of upside momentum. This has also come at the same time as a take profits signal on the RSI (move back below 70) a deteriorating MACD (a falling histogram) and declining Stochastics. Interestingly the intraday chart also shows a small top pattern completed below $17.90 which implies a correction back towards $17.35 whilst the 89 hour moving average which had been a great basis of support during the rally is now falling at $18.13 and the hourly momentum indicators have taken on more of a corrective outlook. A move above $18.15 would abort the corrective outlook for now.

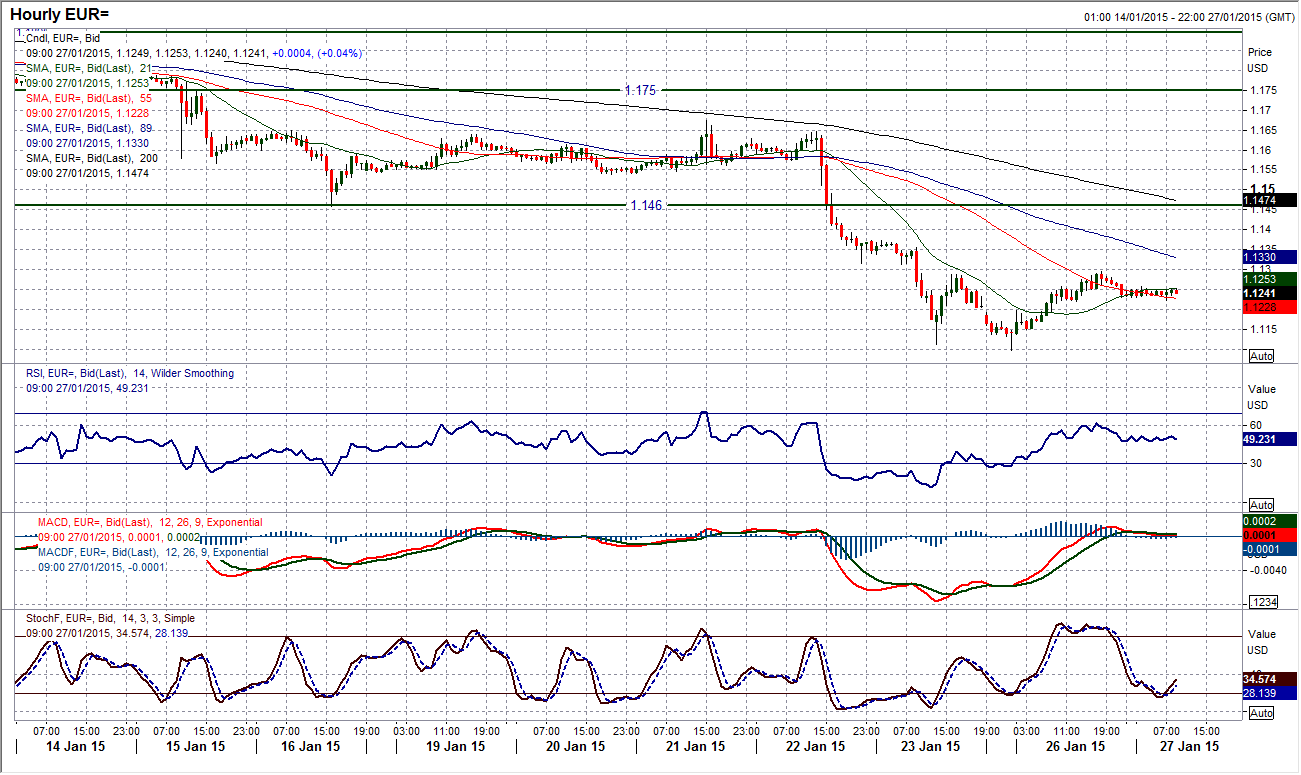

EUR/USD

Yesterday was a day of curious reaction on the euro. It was almost as though the bulls wanted to engage a rally but could not quite get going. That is not to say that the prospects of a rally are over. With a daily range of almost 200 pips the rebound potential is certainly there as the euro looks to unwind over 500 pips of losses from just Thursday and Friday alone. This leaves the intraday hourly chart close to forming a small base pattern. There was an attempt yesterday to breach $1.1290 but it could never quite confirm the move as a failure at $1.1295 resulted in a drift away. A decisive move above $1.1288 (several hourly closes above) would suggest further rebound back towards the first important resistance at $1.1460. However, I believe that this move has simply been unwinding some of the oversold momentum and the sellers are going to be tempted in once more. If $1.1290 is not retested soon the temptation of the sellers will result in a retest of yesterday’s low at $1.1098 once more.

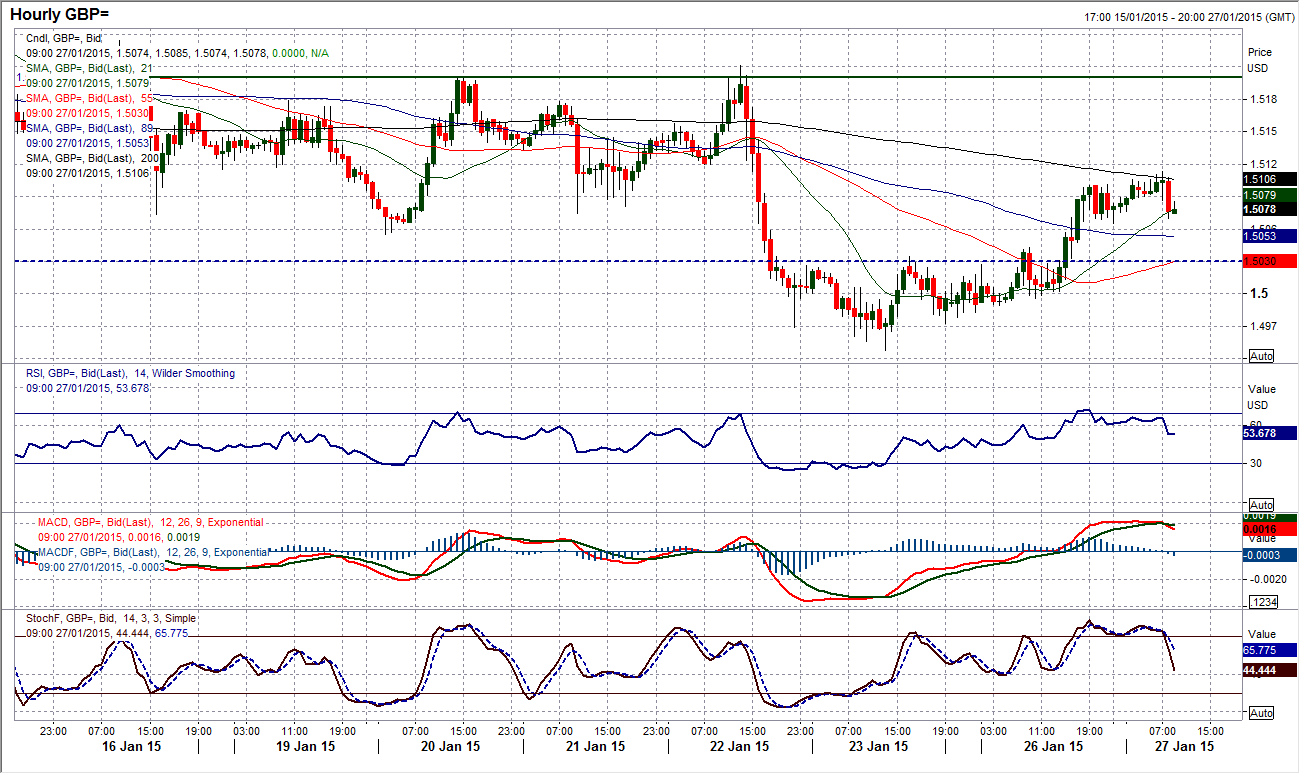

GBP/USD

We have seen a small technical rally take shape on Cable, however looking at the daily chart this is still simply counter trend and is likely to be seen as a chance to sell. The daily technical indicators have unwound slightly but the RSI is again into an area where the sellers have tended to resume control. Also the falling 21 day moving average (currently $1.5200) which has been a consistent barrier to gains in recent months is also close overhead. The intraday hourly chart shows that a small head and shoulders base pattern, completed above the $1.5030 old support area, has now hit its implied target of $1.5110 and this should enable the bears to regain control once more. The hourly MACD lines have crossed lower again and the RSI is dropping away so this could now be the extent of the rebound near term. A move back below the overnight low at $1.5065 could usher the sellers back in again. $1.5030 is a near term support again. The bulls have still got $1.5200 resistance to negotiate.

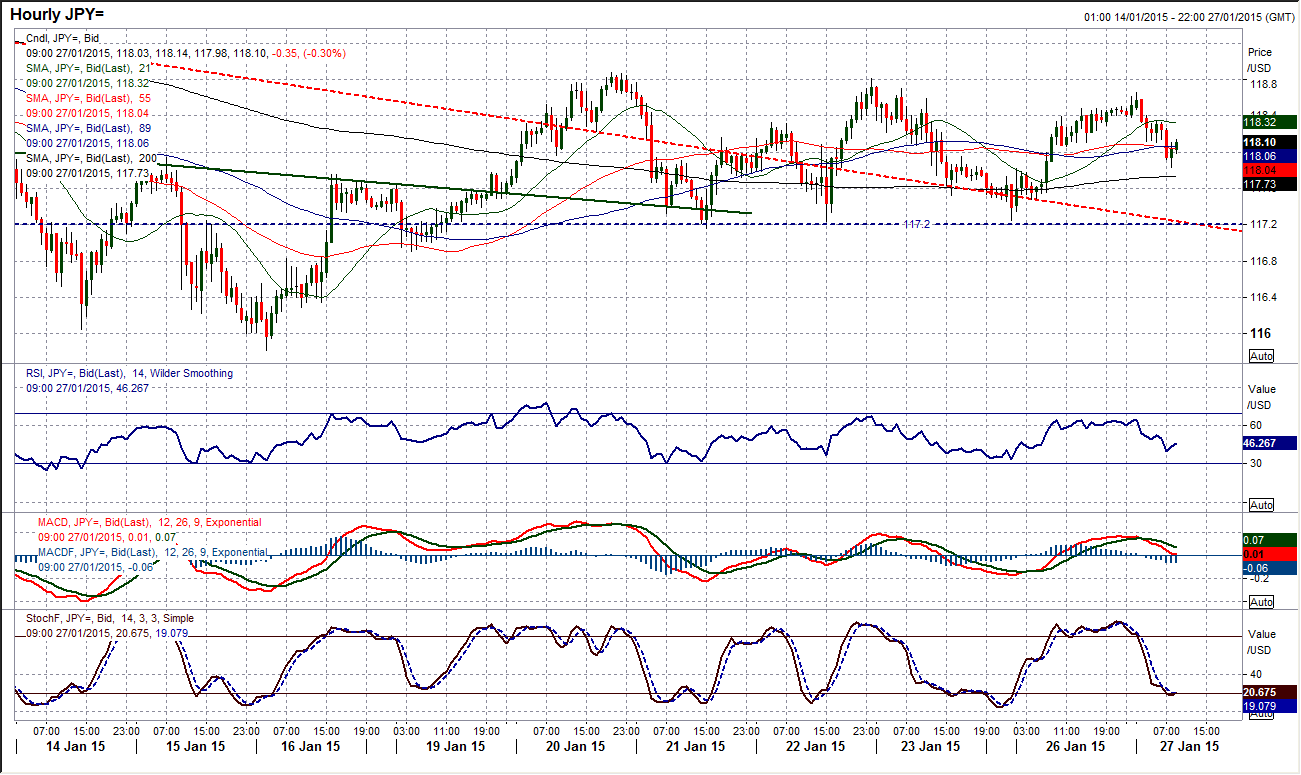

USD/JPY

The consolidation on Dollar/Yen continues as the daily chart remains stuck in the middle of the trading range 117.20/119.00. Technical indicators are becoming increasingly marooned in a neutral state with RSI MACD and Stochastics almost entirely neutral now. Looking on the intraday chart, once again yesterday’s rally within the range failed towards the highs (at 118.65) and has backed away again towards the 118.00 pivot level. In these instances, whilst the pair continues to range it is possible to play the classic overbought/oversold RSI signals (buying around 30/selling around 70). Other than that, stand aside and wait for a decisive move either above 119 or below 117.20.

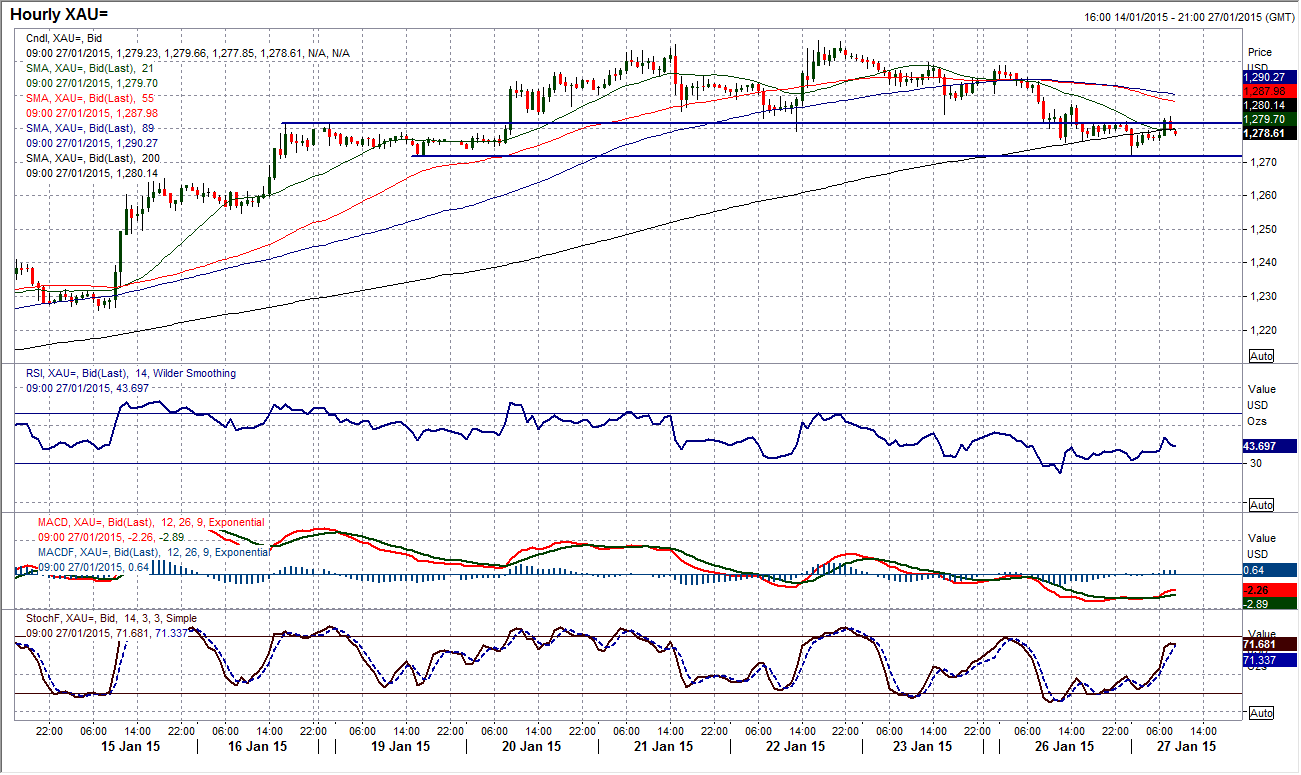

Gold

During my analysis video of gold yesterday I almost talked myself into believing in a near term correction and that is what seems to be increasingly threatening as the gold price appear to have rolled over. The daily chart shows momentum has been lost and a correction is threatening. The intraday chart shows a small top pattern has formed below the support at $1279 but I believe that the support of the reaction low at $1271.85 is now key. If that support is breached it would confirm the loss of a higher reaction low within the bull run and suggest a correction. This would then open the way for a move back towards the $1255 key old resistance which is now supportive. Overnight today the support at $1271.85 has just remained intact (today’s low is at $1272.30) and for now the bulls are hanging on to the strong rebound. However beware because there has been a significant shift in the past 24 hours where momentum is no longer as positive as it has been through the last couple of weeks. Gold could be in the process of building for a correction and the bulls must be careful. Resistance is now $1287.20 and $1300.

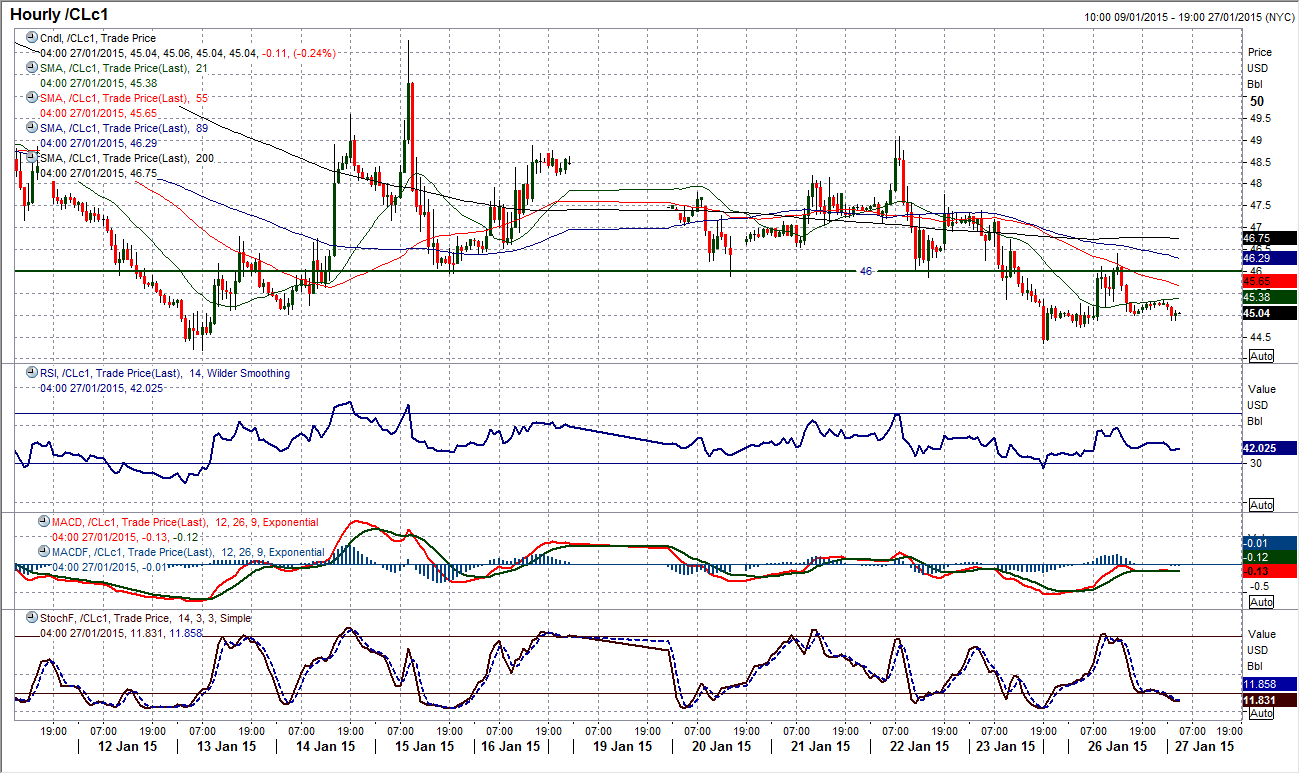

WTI Oil

WTI is trying its best to hang on to the support at $44.20. Another test of the support brought the buyer back, but the pressure is growing. Near term, a pivot level has formed around $46, which was the old floor from last week. An attempted break back above it yesterday afternoon has failed (at $46.40) and the pressure remains on. I remain concerned that the daily chart shows that resistance continues to come in around the underside of the old downtrend channel (currently $48.50), whilst the falling 21 day moving average (currently $48.75) is a basis of daily resistance too. The intraday chart shows the lower reaction high at $49 is the first important price barrier to overcome. The next support if $44.20 is decisively breached comes in at around $40.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.