Market Overview

Mario Draghi has fired his bazooka and the markets have taken the news well. The euro is lower, sovereign bond yields are lower and equities are higher. A €60bn per month programme of asset purchases (corporate and sovereign debt) for at least until September 2016. In other words the ECB is going to increase the size of its balance sheet by €1.1 trillion. There is a vast array of reports arguing what the QE might achieve (or not), however the Federal Reserve has ultimately increased its balance sheet by $3 trillion (c. €2.6 trillion) but arguably it has been shale oil that has put the US economy in the recovery position as opposed to the QE. It is all open for debate, but apparently the Germans (ie. Jens Weidmann the president of the Bundesbank) are not happy and it will be interesting to see how they react in the coming days. So the With little time to reflect for too long, the Eurozone moves from one hotly debated topic to another, with the Greek elections on Sunday. The anti-austerity party Syriza continues to lead the polls and it could be a case of out of the frying pan and into the fire for the Eurozone. A Syriza victory (if they can then form a government) would take the country several steps closer to a “Grexit”. Expect volatility to remain high as a result.

In the meantime, the equity markets have rallied strongly on the back of the ECB’s actions, with Wall Street strong into the close as the S&P 500 jumped 1.5%. Asian markets have also been strong overnight as the have played catch up and the European markets have started on the front foot in early trading today.

Forex trading shows that the dollar bulls have remained in control today with the greenback stronger against all major currencies, with the one exception of the yen which is still fluctuating with the Dollar/Yen bulls unable to gain any real traction. Traders will be watching throughout the day for the flash manufacturing PMIs. China has already announced a slight improvement to 49.8 (49.5 expected) which will also help to give risk appetite a slight nudge in the right direction. However through the morning the Eurozone numbers will come out and could dampen enthusiasm if they continue to struggle. The US flash PMI is released at 1445GMT and is expected to improve slightly to 54.1. There is also US retail sales at 0930GMT (a drop of 0.6% is expected month on month) with Canadian CPI inflation at 1330GMT (-0.3% month on month). Finally there are the existing home sales for the US at 1500GMT with an improvement of 3% expected to 5.08m annualised.

News has also filtered through overnight that the king of Saudi Arabia has passed away. This caused a brief push higher on oil prices as traders speculated on whether this would change the country’s stance on oil production. However with minimal change likely the move has begun to settle down.

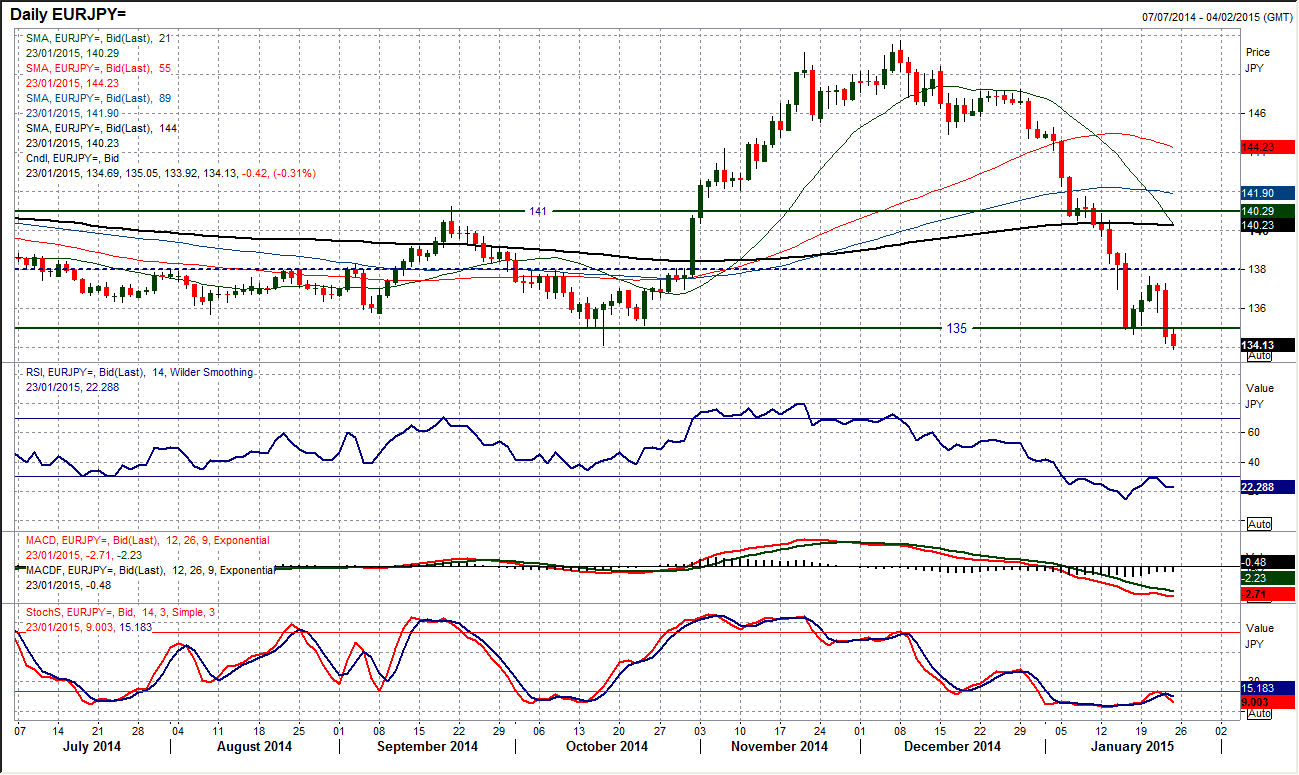

Chart of the Day – EUR/JPY

I spoke last week of the floor of support which came in around 135 on Euro/Yen. For several days this support held firm, but the advent of ECB QE has driven the euro weaker and the rate has closed below 135 for the first time since November 2013. The absolute support comes in at 134.10 which was an intraday spike low in October and this is also breaking down. The outlook on momentum indicators is very weak with the RSI only managing to unwind to 30 before falling away again (a sign of a limp bear rally) and MACD lines also confirming weakness. Even the move overnight reflects the breakdown as the support at 135 was breached yesterday afternoon only for this level to be turned into a basis of resistance overnight. Looking at the intraday hourly chart there is a fairly strong near term resistance band 135/135.80 to use as a basis of resistance for a technical rally. The breakdown has opened the next key low of the November 2013 low at 131.20.

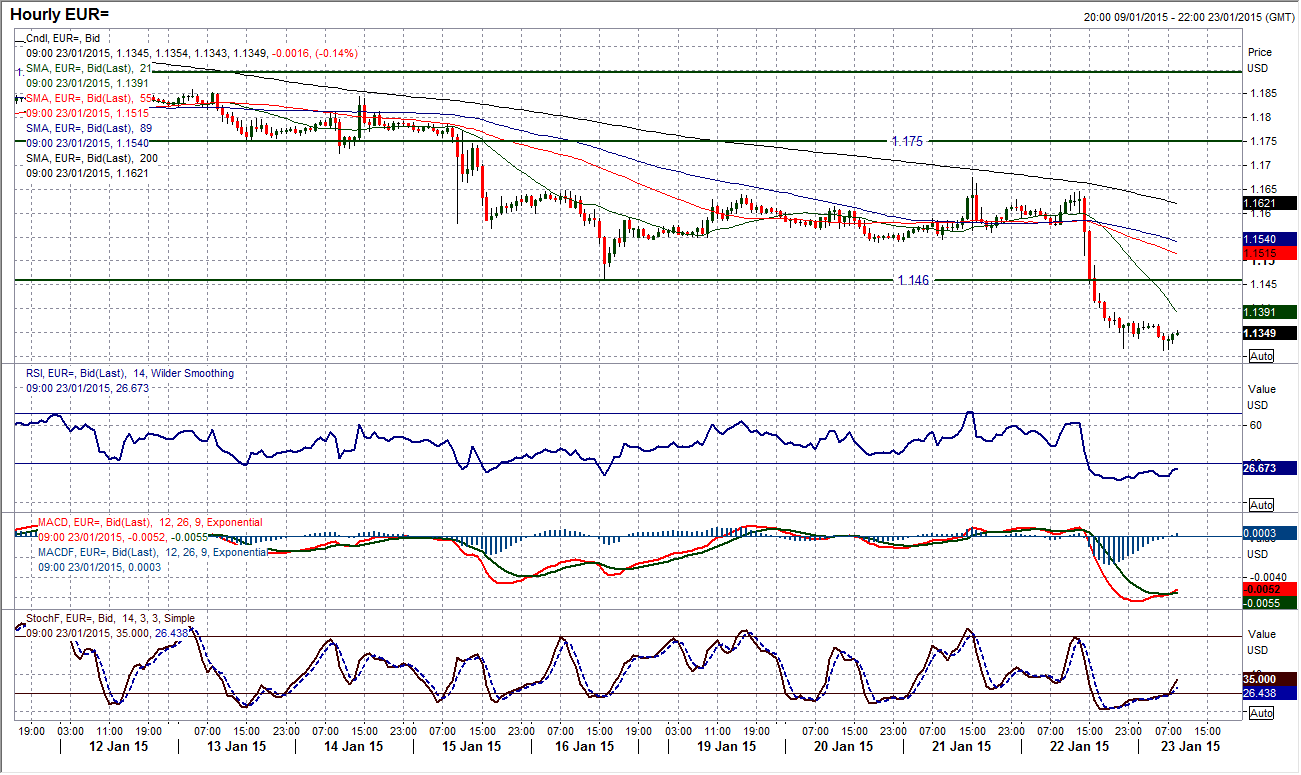

EUR/USD

With a daily range of well over 300 pips from high to low and closing sharply lower the euro has once more lurched to the downside. The trigger this time around has been a massive package of quantitative easing from the ECB which should now continue to add negative pressure on the euro in the coming weeks and months. The euro has dropped below the November 2003 low and on price support there is nothing now really until the September 2003 low at $1.0760. I am more mindful of the Fibonacci retracement of the huge decade long bull run from $0.8225 to $1.6038 which comes in at $1.1210 as the next potential support. The euro is oversold near term though, with the intraday hourly chart showing minor resistance overnight at $1.1373 under the breakdown resistance at $1.1460. Selling into any rallies remains the order of the day.

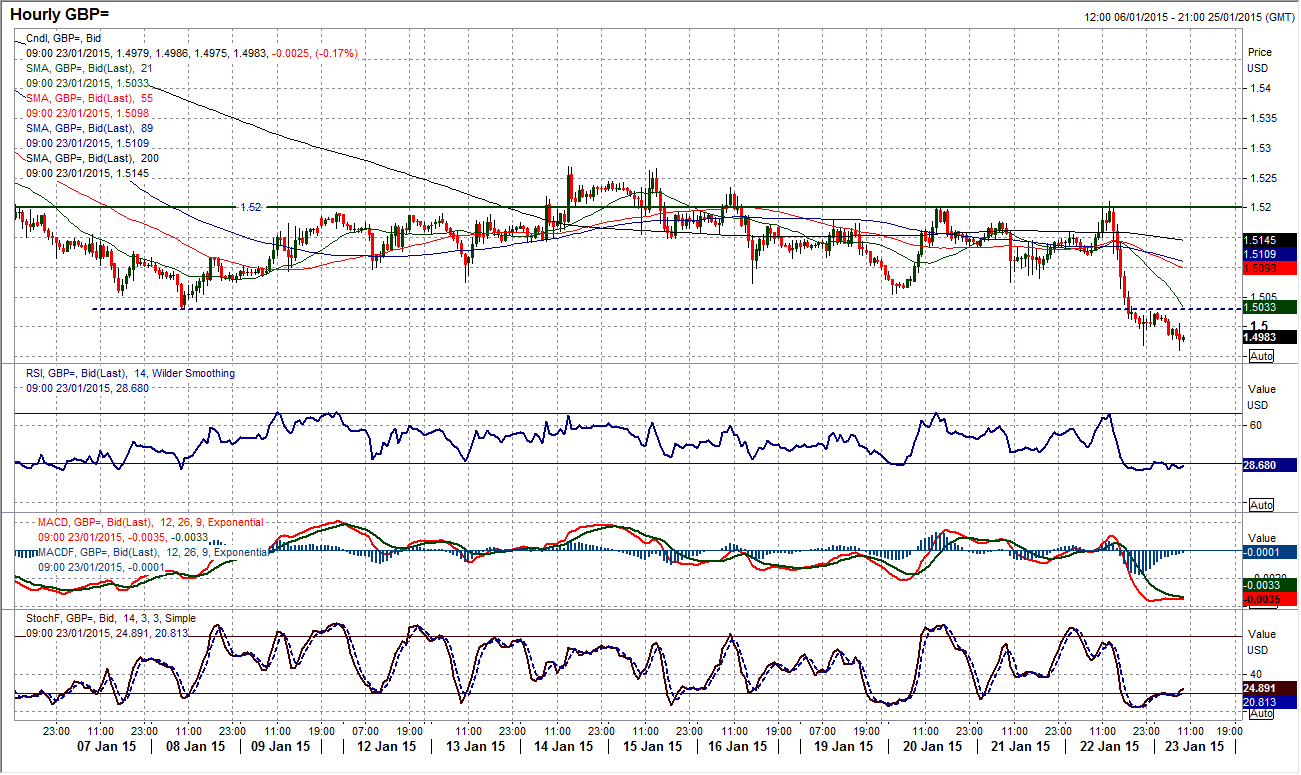

GBP/USD

I was watching sterling yesterday afternoon and it was trying to hold on to the support at $1.5032, but eventually it gave way and Cable has now followed the euro lower and dropped to its lowest level since July 2013 as it moves back towards a test of the key low at $1.4810. The posting of a bearish outside day yesterday is clearly a negative signal and ends a period of consolidation. Interestingly the breakdown of the range below $1.5032 gives an implied target of $1.4800, so this adds weight to the downside test. The RSI has just dipped back below 30 once more whilst the MACD and Stochastic lines are also looking negative again. The intraday hourly chart shows that Cable has struggled overnight with the old support at $1.5032 becoming resistance near term, with further resistance around $1.5080. Look to sell into any intraday rally today.

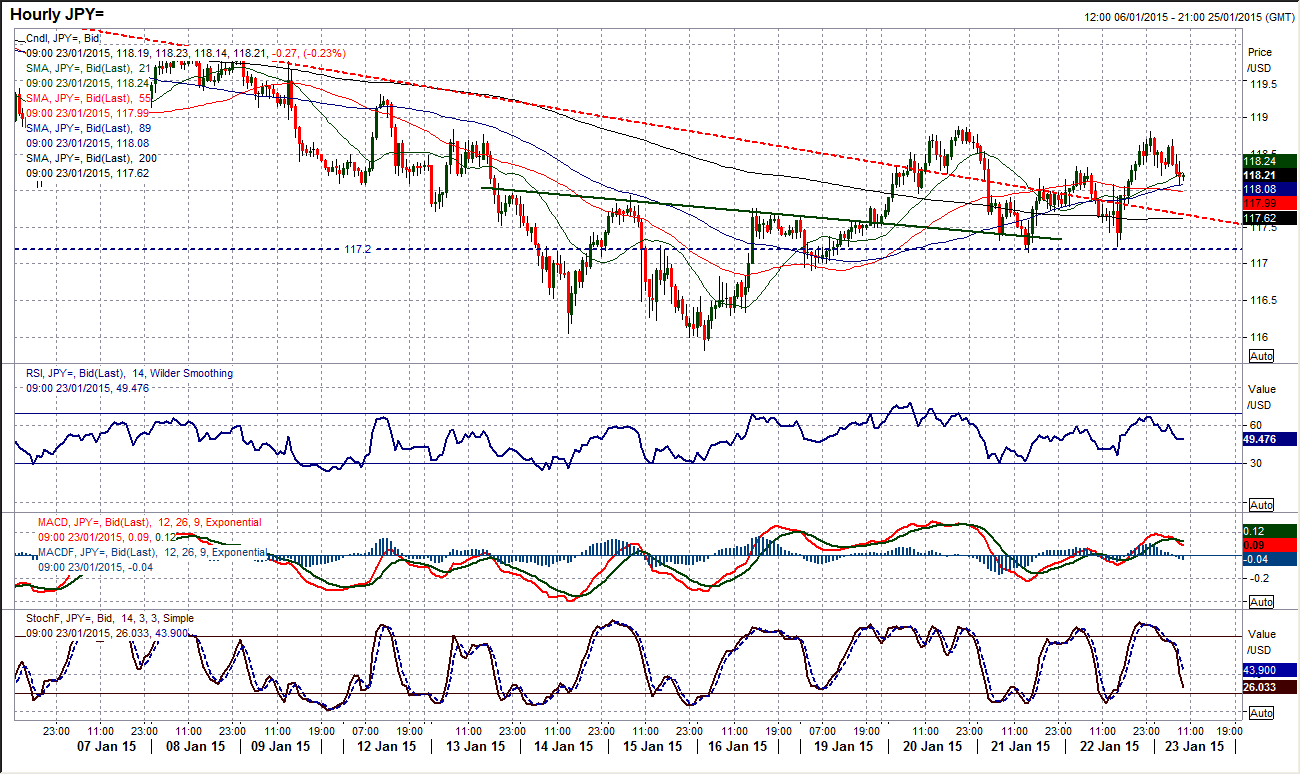

USD/JPY

The daily chart shows a medium term outlook of uncertainty as the rate has been unable to break back above the resistance around 119. However the intraday hourly chart shows in better detail that the bulls are still trying to regain the initiative after a corrective phase at the beginning of January. The support around 117.20 (which is a historic pivot level) has continued to hold the dollar up well, whilst the rate is once again trading above the old downtrend. The base pattern that formed (I am taking it as a head and shoulders base with a slanting neckline) gives an implied target of around 119.60 and although there is a near term struggle to break through the resistance around 119 the outlook with hourly momentum and moving averages is improving. Whilst the support around 117.20 remains intact I am on the recovery tack.

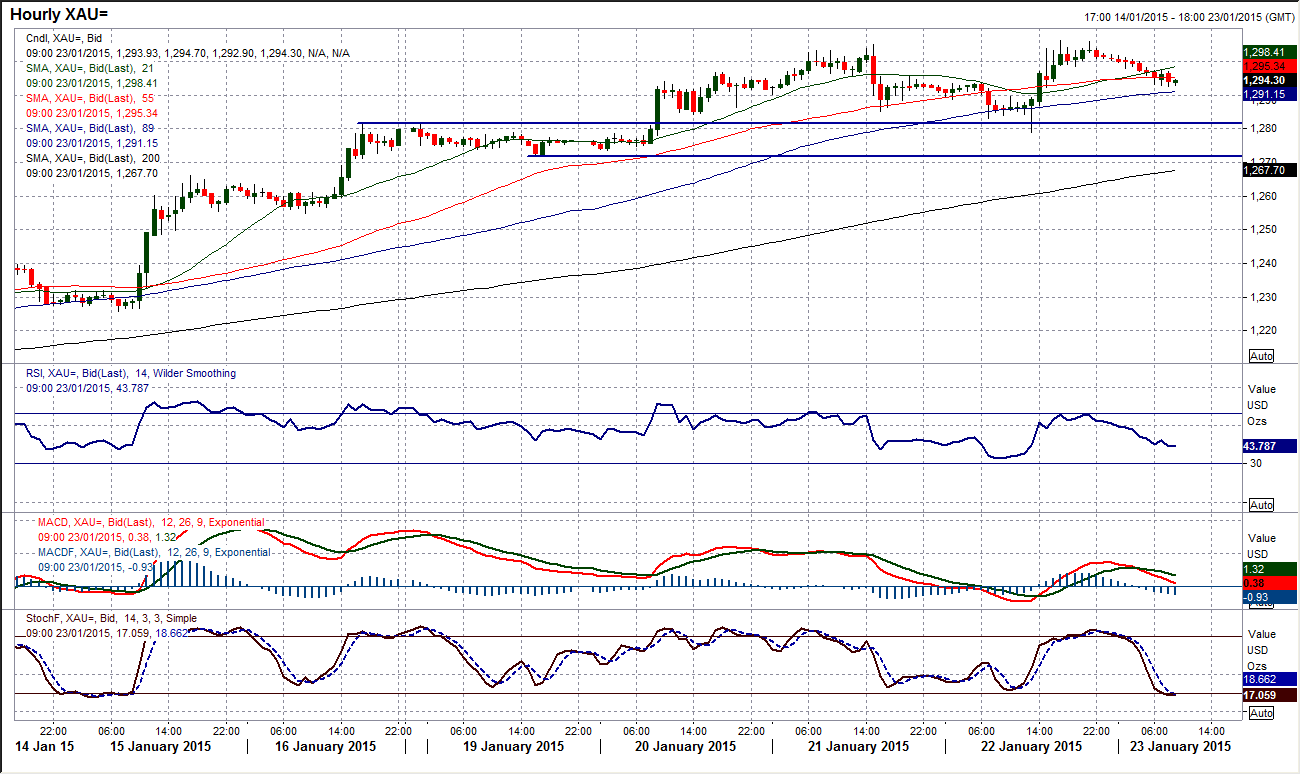

Gold

I have been speaking for the past few days about the well-defined stepped advance on gold, where old resistance becomes new support. Yesterday’s move was this case in point once more. The intraday correction in the price formed good support in the band between $1271.85/$1281.50 which looks ready to leave another higher low at $1279. The hourly RSI has once again signalled a low in the mid-30s before pushing back towards &0 (and hopefully above) which indicates a strong bull run. Furthermore, the rising 89 hour moving average also continues to be the basis of support, around $1291. The daily chart shows a continued run higher which is now open for a test of the next resistance at $1322.60 (August high) prior to the $1345 July high.

WTI Oil

Yet again the WTI price has a big intraday swing and the consolidation on the daily chart continues. There just cannot be any traction made to the upside as a move to $49.10 failed and the profit takers set in (the reversal was triggered by the announcement of a surprise increase in US crude inventories). The concern is that once more the resistance has been formed around the underside of the old downtrend channel. Also, the 21 day moving average (currently around $50) which has been a good basis of resistance in the past few months. So we continue to wait for the WTI price to link a sequence of days in one direction, which would begin to suggest a breakout from this consolidation. At the moment, two days in a row would be a start. Near term support remains around $46 (which has been bolstered slightly overnight by the slight gains on WTI on the news of King Abdullah of Saudi Arabia’s passing) and then $45 before the key low at $44.20.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.