Market Overview

With signs of some stabilisation in the price of oil and the continued reassurance of the Federal Reserve, sentiment on the markets has changed significantly in the past few days. Janet Yellen suggesting that it would be unlikely that the Fed would be raising rates at least until after the next two meetings has certainly been the major boost. Equity markets have soared higher in the past couple of days with the S&P 500 closing 2.4% higher, Asian markets strongly higher overnight (with the Bank of Japan standing pat on monetary policy allowing further weakness on the yen and subsequently strong Nikkei gains) and European indices set for further gains today. It will be interesting to see if the oil price begins to fall away again whether sentiment will remain upbeat.

In forex, after a big jump in the value of the US dollar on Wednesday, the outlook has become more of consolidation again. Having said that, with the euro and the yen close to key levels, the dollar could be set to break higher once more.There is little in terms of economic announcements to really impact on sentiment, with the possible exception of Canadian CPI which is due at 13:30GMT and is expected to grow by +0.1% month on month.

Chart of the Day – NZD/USD

Despite the rebound we saw on the Kiwi yesterday, the US dollar strength remains a key feature of this chart and the outlook remains negative. Over the past month there has been a very well defined downtrend linking a sequence of lower highs, with the latest reaction high coming at 0.7848, whilst the downtrend today comes in at 0.7825. Interestingly also the falling 55 day moving average has been a good basis of resistance with 9 intraday moves above the moving average in the past month but no daily closes above it. The momentum indicators remain in bearish configuration and continue to suggest that rallies are a chance to sell. Expect further downside pressure in due course on the Kiwi and further pressure towards the 0.7606 recent low.

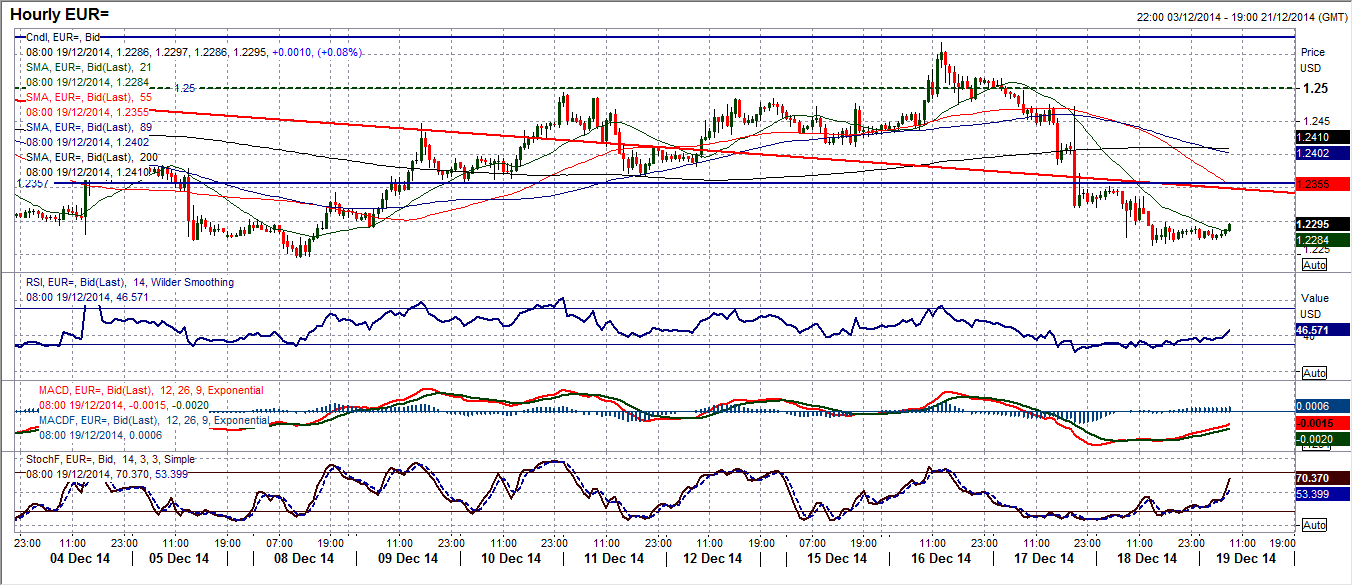

EUR/USD

After the volatility of that was seen on Wednesday there was an element of calm that returned to proceedings yesterday. However the outlook is under pressure once more for the euro as the key support at $1.2245 is back within range for the sellers. If this key support is broken then once more the way is open back towards a test of the crucial July 2012 low at $1.2040. The price action of the past few weeks does not suggest that the downside move is unlikely to be a one way move and rallies should be seen once more as a chance to sell. The intraday hourly chart shows that the old support at $1.2357 has once more become a basis of resistance and should now be considered to be a near term ceiling, with further resistance at $1.2415.

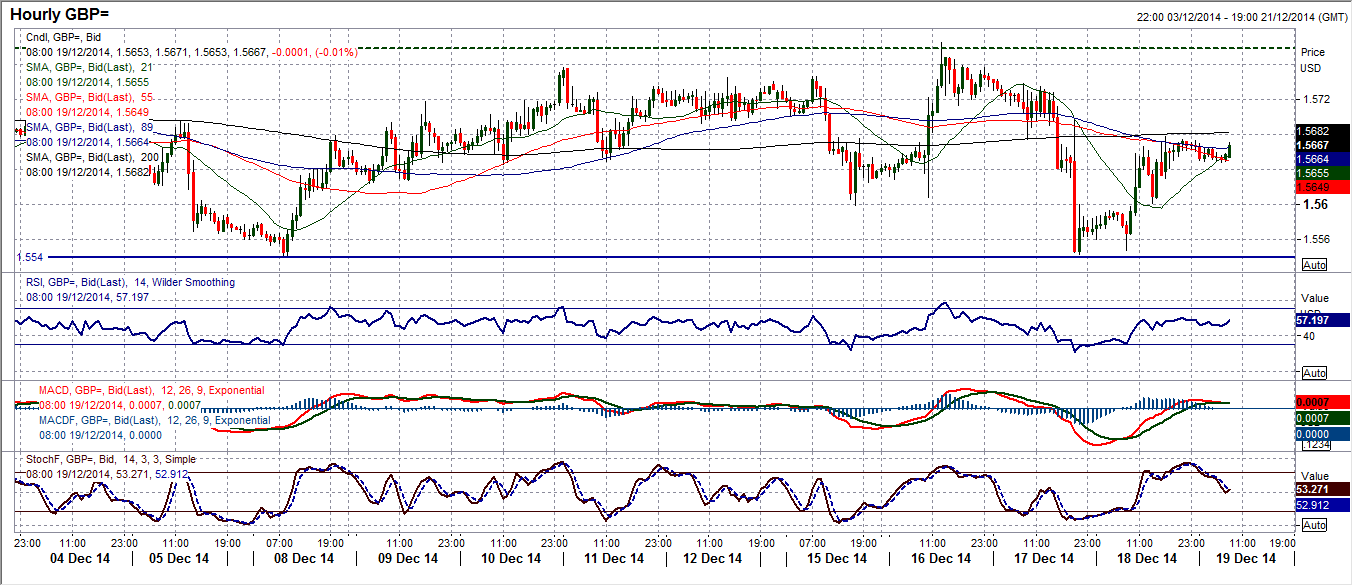

GBP/USD

There was an interesting dichotomy between Cable and the euro yesterday (due to the strong reading of UK retail sales), however this gain for sterling could just provide another opportunity today to sell within the range once more. I continue to see Cable as a range trade and I believe that focusing on using the RSI on the hourly chart to generate the signals remains a good strategy. Any move towards 70 on the hourly RSI continues to result in Cable falling over and retrace back towards the lows again. There is a basis of resistance around $1.5720/$1.5730 has also been a consistent stopping area for these rallies within the range. The weak outlook on the daily chart suggests that selling into strength for continued pressure on the lows around $1.5540 remains the best way to play Cable. The key near to medium term resistance remains $1.5825.

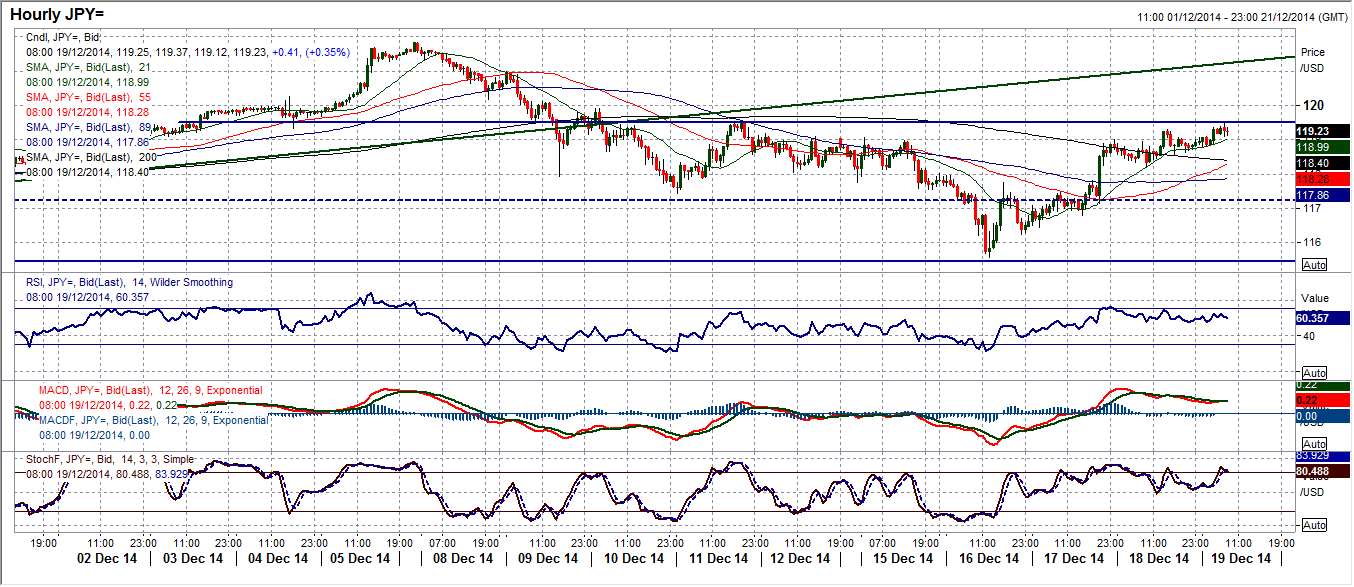

USD/JPY

Whilst they are not back in control yet, the bulls are gradually winning the battle slowly but surely as the US dollar regains its lost ground. The rally that has been inspired by the renewed appetite for risk and the fallout from the FOMC meeting on Wednesday continues to leave a series of higher lows over the past couple of days. The move above resistance at 119.00 was another mini victory, but the real blow would be a move above 119.55. This is the 11th December high and marks the peak of the right hand shoulder of the big top pattern. A move above here would confirm that the pattern has been aborted and the prospect of a correction has been deferred once more. The fact that this was a bull market corrective pattern also suggests that this is a signal to change outlook to bullish once more. We are on the brink of the break now. The support of the latest high low is at 118.25. The next upside resistance above 119.55 comes in at 120 and then 121.

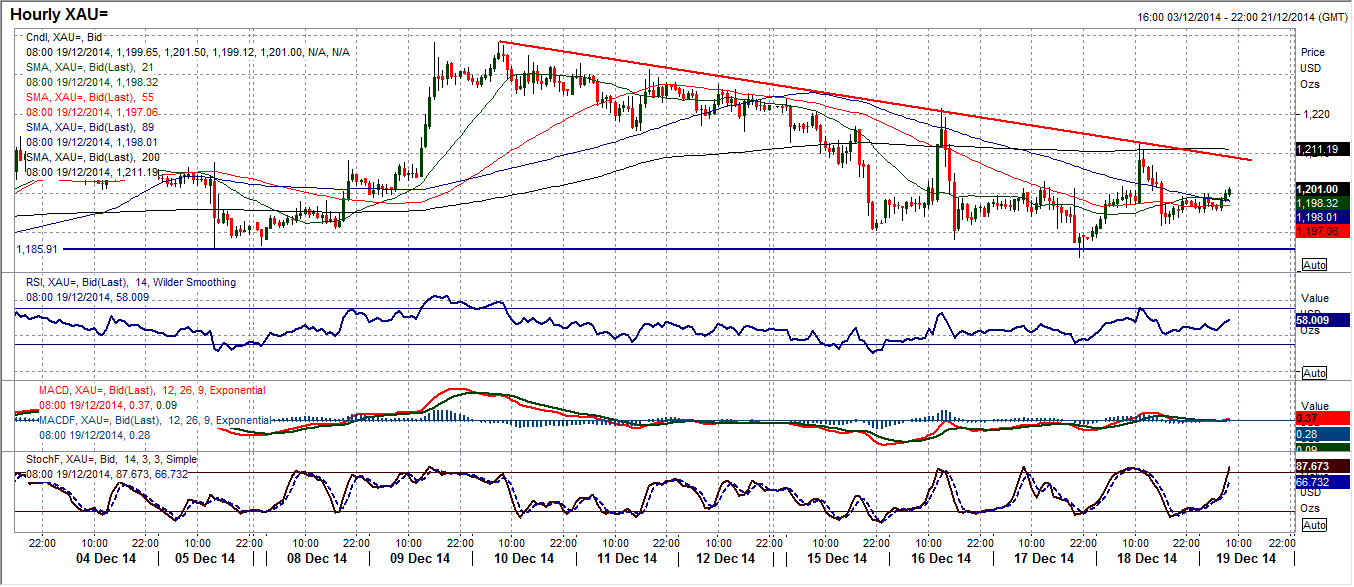

Gold

The volatility in the gold price remains high, as for the second time in 3 days there is an intraday rally that is rejected to leave a rather weak candlestick. Not only that, but on the intraday hourly chart there is now the formation of a rather well defined downtrend over the past 8 days as a series of lower highs has been left, the latest being at $1212.80 and $1221.40. The downtrend resistance currently comes in at around $1209. I an increasingly convinced that there will be further downside pressure on the old key low at $1180.70 and a move below there would confirm a top pattern that has been threatening to take hold throughout this week. Selling into the intraday rallies seems to be a viable strategy once more.

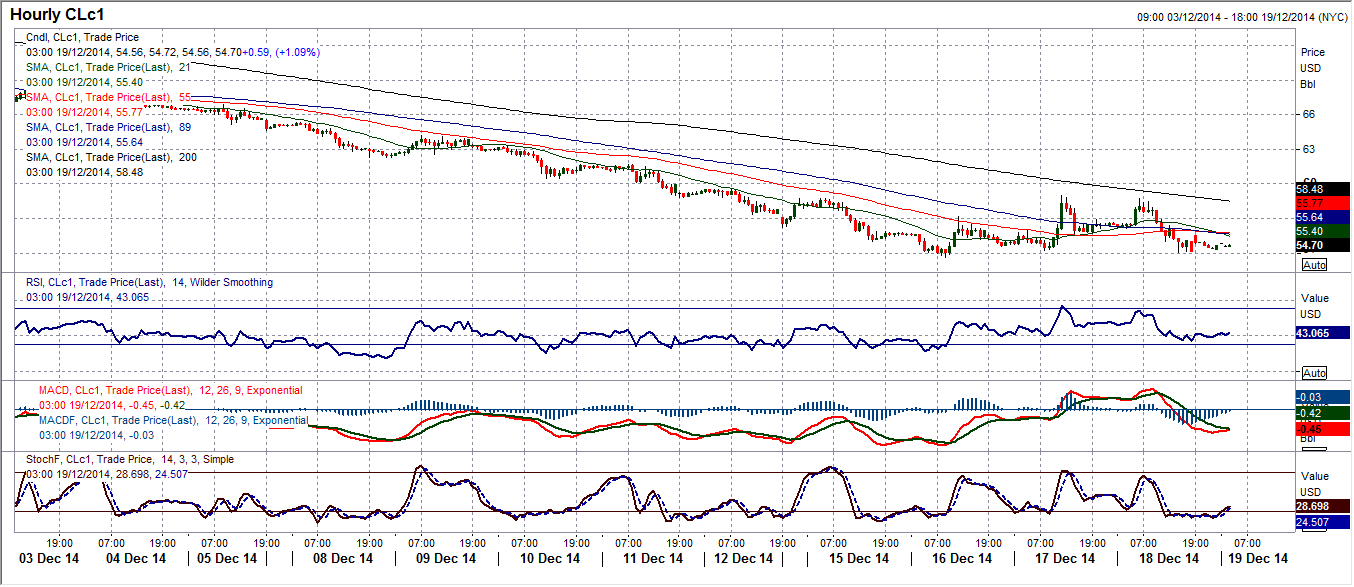

WTI Oil

I say this almost every day now, but intraday volatility remains high with a high/low daily range over 8% on Wednesday and over 8% yesterday. The problem is that while the last two days have seen Tuesday’s low at $53.60 maintained, the closes are coming towards the low of the day – which is a weak signal. This suggests that the bulls are unable to get any real traction to the upside before the gains are being capped. Technical indicators remain very stretched but still there is a weakness in the momentum which is holding back a rally. However, the reaction low from Tuesday at $53.60 remains intact (for now) so the bulls will be pointing to the fact that there is the possibility of a floor in place, at least for the near term. This consolidation in oil could still prove to be just a near term situation while overstretched indicators play catch up. Batting against the bigger downtrends could still prove to be extremely costly and for now in the absence of any real reversal signals this consolidation continues. Key near term resistance is now at $59, Wednesday’s high.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.