Market Overview

Geopolitics in Russia and Ukraine are once more a concern for investors and is holding back risk sentiment once more. Despite upbeat economic data including an upward revision to US growth and positive housing data, Wall Street was dragged back from its highs and index volatility indicator, the VIX, jumped over 2%. The concern also drifted into Asian trading which saw another mixed session, although shares were also held back by disappointing Japanese household spending. European markets have opening mixed to slightly higher.

The big focus for today will be the flash Eurozone HICP data that is announced at 10:00BST. Yesterday’s Spanish and German inflation readings were fairly supportive of Eurozone inflation, so even though the expectation is for further dip to 0.3% from 0.4% last month, there is a slight possibility of an upside surprise (of maybe 0.4%). The data could be key as to whether the ECB feels the need to step up its monetary easing programme at next week’s ECB policy meeting.

Forex trading remains fairly mixed in front of the key Eurozone data. Although the euro is trading slightly weaker against the dollar, other major currencies are broadly flat. In other data, Canadian GDP will be released at 13:30BST with 3.0% expected (Year-on-Year).

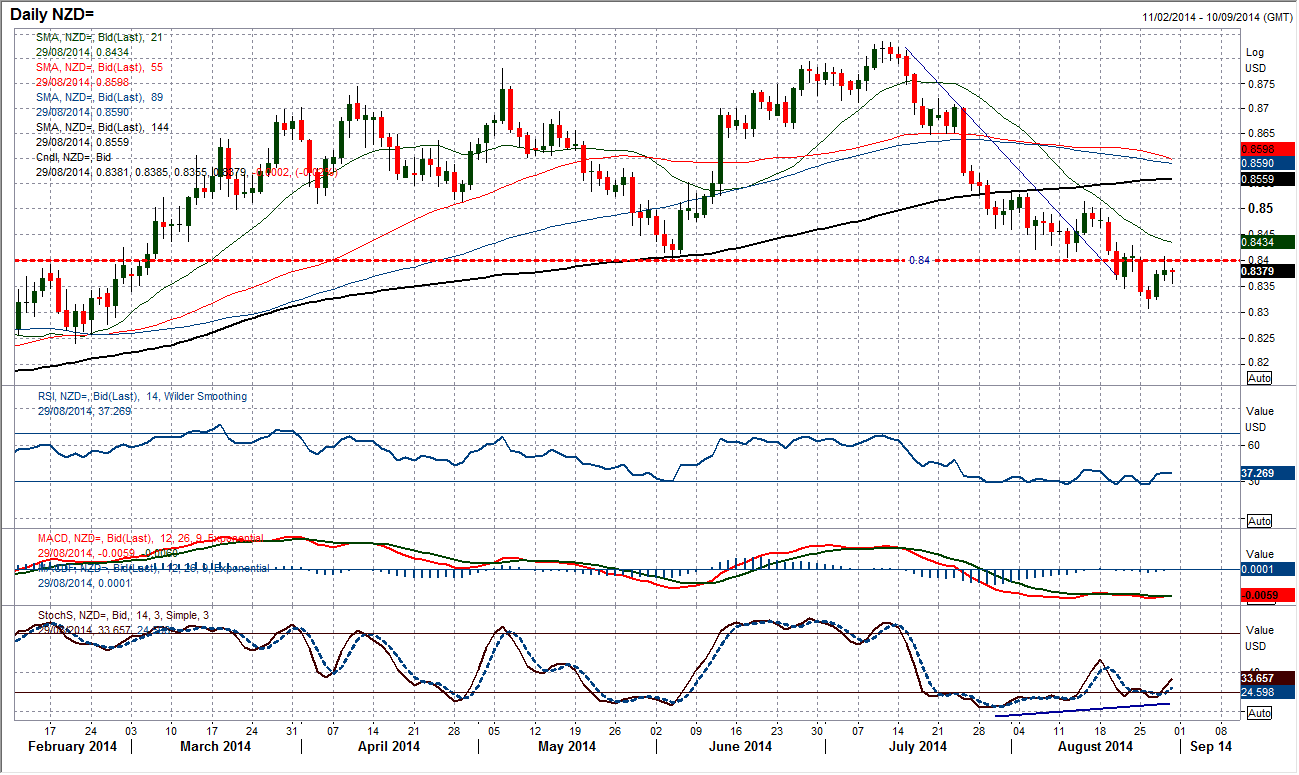

Chart of the Day – NZD/USD

The breakdown of the support at 0.8400 was a key move. Breaching the support of the June low completed a large top pattern and now suggests that there is the prospect of a major correction back towards the November 2013 low at 0.8050. The momentum indicators are all very weak now and suggest that any rallies are seen as a chance to sell now. The RSI has been bumping along around 30 for over a month now and every time there is a near term pop higher this is jumped upon and sold once more. The last couple of days has seen a minor rally, but this move has simply been back towards the neckline resistance of the top at 0.8400 and the intraday hourly chart shows the recovery is falling over once more. This rally looks to be a chance to sell for a retest of the 0.8308 low. A move above the minor reaction high at 0.8430 would improve the near term outlook.

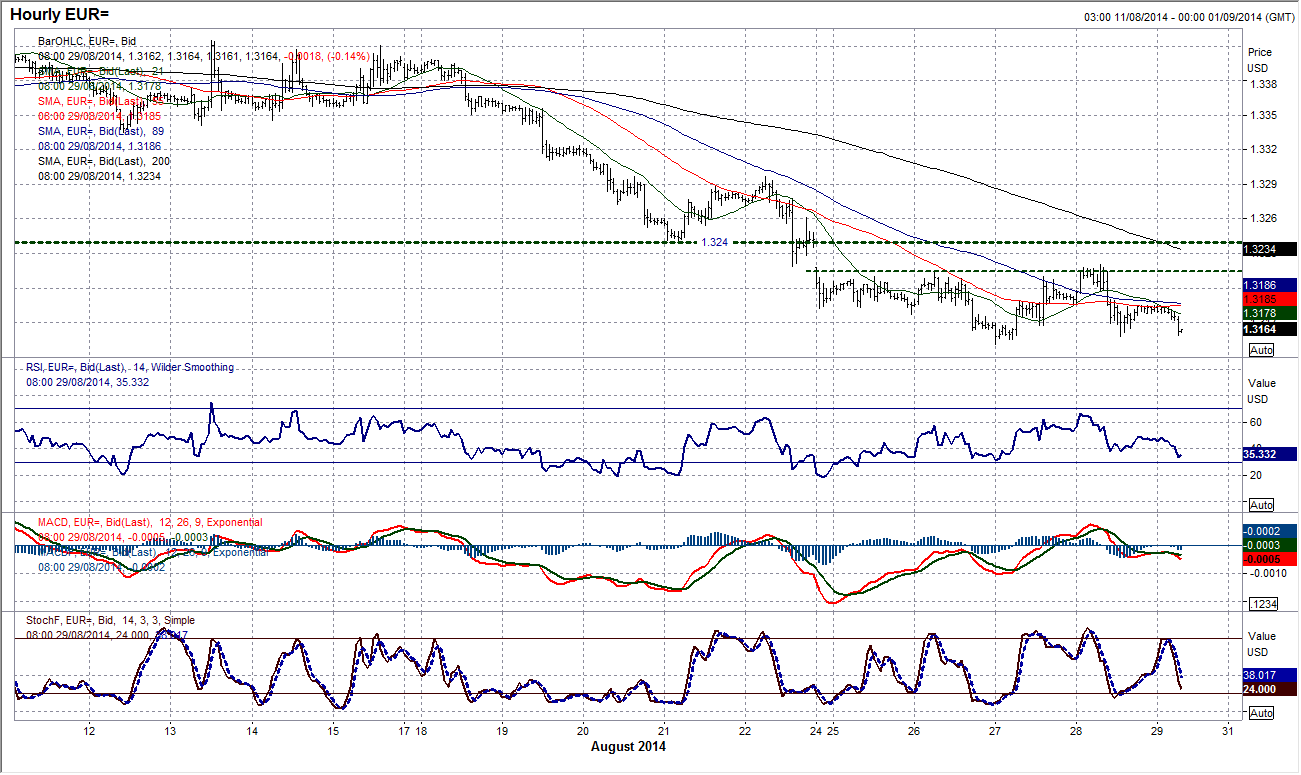

EUR/USD

Despite the wider daily range from yesterday, essentially it was just another day of consolidation (as we wait for the crucial Eurozone inflation data today at 10:00BST). A technical rally on the euro remains a possibility as the sellers have been held off in the past few days but if one does come through then it would likely be just near term respite before the sellers regain control. The intraday chart shows there is overhead resistance at $1.3215/20 that is holding back the rally. A breach would complete a near term base pattern that would imply $1.3280, however that is where the resistance really begins to kick in. The bulls will be looking to protect the low at $1.3150 which guards from a continued sell-off towards the key September 2013 low at $1.3103.

GBP/USD

Although the sterling recovery bulls will have been disappointed by the price shying away from the key resistance around $1.6600, the prospect of a near term base pattern is still on the table. Cable has been trading sideways now for 6 days and the resistance at $1.6600 is key as to whether this is just another consolidation or whether there will be a near term bounce. A move above $1.6600 would imply a rebound to $1.6675, however the longer the consolidation has gone on, the more the 6 week downtrend has caught up and is now ready to once more limit any recovery. The downtrend currently comes in at $1.6640. Momentum indicators remain bearish and do not suggest any imminent prospects of a rally that will be anything more than simply another chance to sell if it is seen at all. With the configuration of the technicals, I expect further weakness towards the March low at $1.6460 in due course.

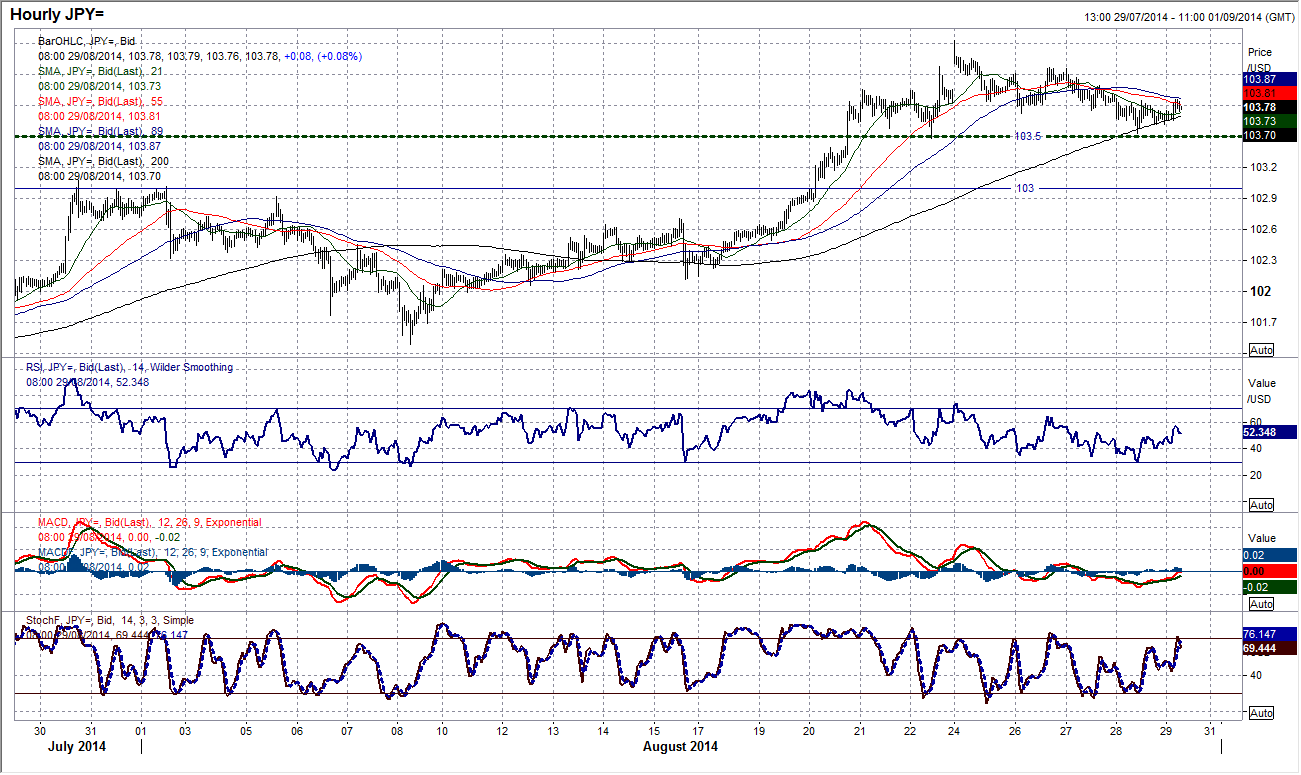

USD/JPY

The longer the Dollar/Yen trades above the reaction low around 103.50, the more positive I am becoming. The outlook has been improved significantly in the recent couple of weeks and holding above 103.50 suggests an increasing acceptance of the new level. After a weak day yesterday an element of support has returned, which is helping to bolster yesterday’s low at just above 103.50. The RSI remains stretched and some might argue a sell signal has been given (on a fall below 70), but I do not subscribe to this as I feel that a new bullish outlook is driving this chart. This would suggest that momentum remains strong and is simply being unwound by the consolidation. The bulls are holding on well to their gains and I would be looking for another buy signal between 103.00 and 103.50 to trigger the next up leg to challenge 104.43 and then on towards 105.00 again.

Gold

The recovery in gold may well be tied into the perceived escalation in geopolitical tensions, however on a technical basis there is also grounding in a near term recovery too. In the past 7 weeks there have a series of lower highs and lower lows and, I believe, the latest rebound is just another small up-leg that will eventually end up leaving yet another lower high. The RSI has been continually retreating to just below 40 and then bouncing and the Stochastics have just turned up to give a near term buy signal. I would point out though that buying within bear phase is a risky play. Waiting for the sell signals is my preferred strategy as I see overhead supply that starts at $1295 and then goes up at $5 increments, meaning that the sellers are ready to return. RSI has tended to peak out around 55 in this bear phase and suggests that there could be further upside first. The intraday hourly chart is reasonably positive for the recovery, with the key support at $1280 protecting a retreat back to $1273.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold ascends but remains shy of testing $2,400 amid hawkish Fed remarks

Gold prices edged higher late in North American session, gaining 0.22% following a hawkish tilt by Fed Chair Jerome Powell. Economic data from the United States was mixed, though Monday’s Retail Sales report and Powell’s remarks kept US Treasury yields higher, capping the yellow metal’s advance.

Bitcoin price outlook amid increased demand and speculation pre-halving

Bitcoin price is edging lower as markets count only days to the halving. Nevertheless, the dump has not shaken the faith of large holders as they continue to cling to their holding even after a month of steady dumps.

UK CPI inflation data ahead: Sterling hovering north of key support

Following today's mixed bag of employment and wages data, today’s attention is directed to the March UK CPI inflation release. Both headline and core measures have surprised to the downside in the previous two releases and are expected to demonstrate further evidence of disinflation.