Technical Bias: Bearish

Key Takeaways

US dollar traded lower recently against a basket of currencies, including the Euro, British pound and Canadian dollar.

US dollar index is around a major level signaling bearish continuation in the short term.

US durable goods orders report is a critical release lined up later today having a potential to ignite swing moves in the US dollar.

Recent failure to break the 88.40-50 area in the US dollar index ignited downside reaction which might continue if the US dollar sellers remain active.

Technical Analysis

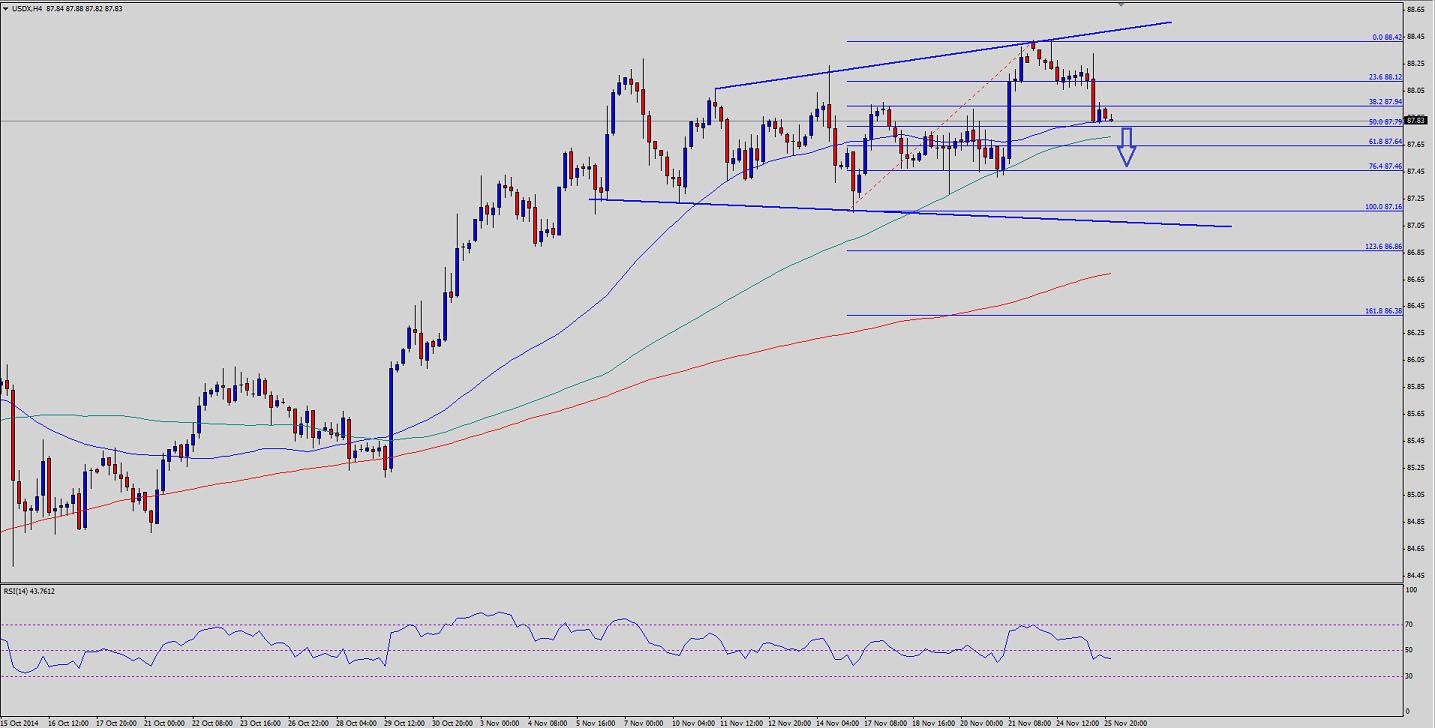

There is a monster triangle formed on the 4 hour chart of the US dollar index, which recently acted as a resistance at 88.50. After a failure to break above the triangle resistance the US dollar index moved mover and yesterday challenged the 50% Fibonacci retracement level of the last leg from the 87.16 low to 88.42 high. One key point to note here is that the mentioned fib level was sitting around the 50 simple moving average (SMA) – 4H, which also acted as a support in the near term. However, the most important support is seen around the 61.8% fib level, which is around the 100 SMA (4H). A break below the same might take the US dollar index towards the triangle support trend line where the US dollar buyers could be tested.

On the upside, a critical resistance is around the 88.10 level. Any further strength might take the US dollar index towards the triangle resistance area where it might struggle again. We need to see how it behaves during the coming sessions.

US Durable Goods Orders Data

Later during the New York session, the US durable goods orders report will be released by the US Census Bureau. The forecast is of a minor decline in October 2014, compared with the preceding month. If the outcome misses the forecast and registers more than the expected decline, then the US dollar might come under pressure in the near term.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold shines amid fears of fresh escalation in Middle East tensions

Gold trades in positive territory near $2,380 on Thursday after posting losses on Wednesday. The precious metal holds gains amid fears over tensions in the Middle East further escalating, with Israel responding to Iran's attack over the weekend.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.