Technical Bias: Bearish (Short-term)

Key Takeaways

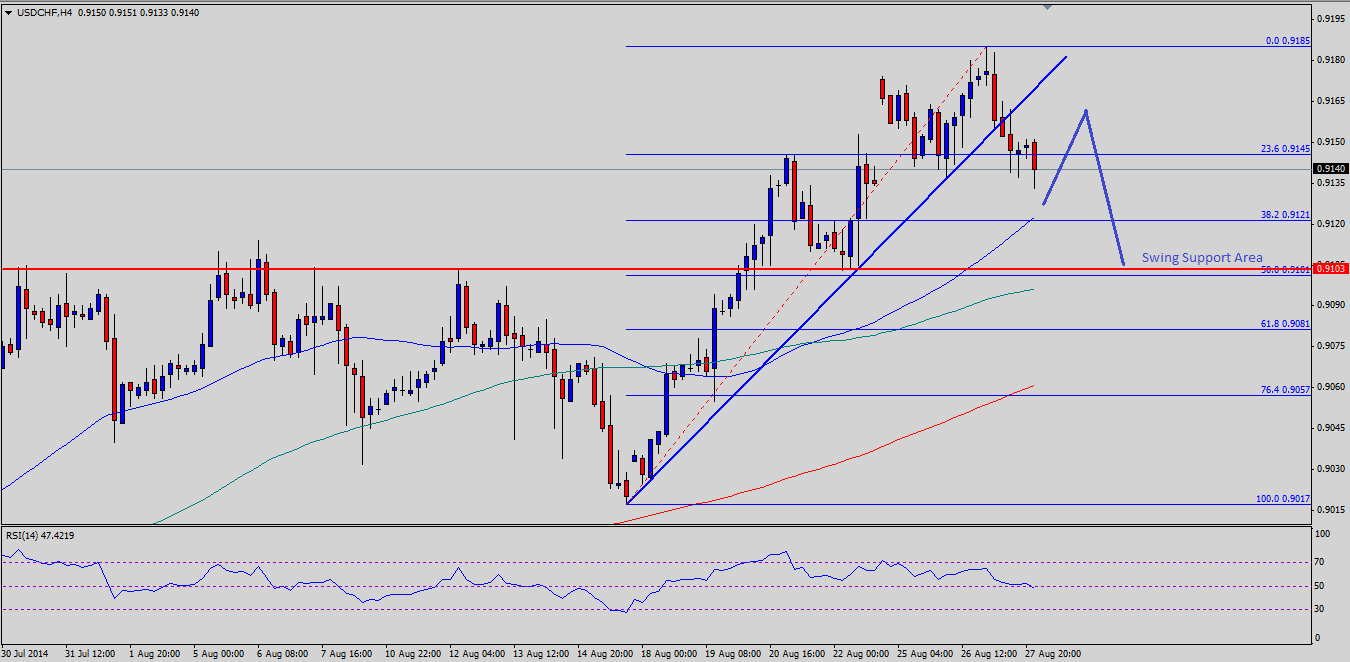

- US dollar traded lower against the Swiss franc yesterday and broke an important support area.

- If buyers step aside, then a short-term correction is possible.

- USDCHF support seen at 0.9105 and resistance ahead at 0.9170.

The US dollar resiliency against the Swiss franc was jolted yesterday, when there were signs of sellers emerged during the New York session.

Technical Analysis

There was a major bullish trend line on the 4 hour timeframe for the USDCHF pair, which was broken during the NY session yesterday. This break might provide a reason to the US dollar sellers in the short term to ignite a larger correction. Currently, the pair has managed to close below the 23.6% Fibonacci retracement level of the last leg higher from the 0.9017 low to 0.9185 high, and heading towards the 50 simple moving average (SMA) - 4H, which also coincides with the 38.2% fib level. So, there is a chance that the pair might bounce from the current or a bit lower levels, but could find resistance around the broken trend line area. If the pair fails to break higher, then a move towards the 50% fib retracement level is possible, which is just above the 100 SMA (4H) at 0.9105. The mentioned level acted as a resistance earlier, and is likely to provide support to the pair in the short term.

On the other hand, if the USDCHF pair continues higher, then a break above the 0.9170 level might call for a retest of the recent high at 0.9185. Any further gains could push the pair towards the 0.9200 resistance zone. The 4H RSI is flirting with the 50 level, and if it breaks down, then it would open the doors for bears to control in the near term.

Moving Ahead

Overall, buying dips still remains a good option in the short term as long as the pair is trading above the 0.9100 level.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.