Technical Bias: Neutral

Key Takeaways

- Euro is consolidating in a range against the US dollar and waiting for a catalyst for a break.

- A break higher looks more feasible in the short term considering the EURUSD pair is trading above a key moving average.

- EURUSD support seen at 1.3350 and resistance ahead at 1.3420.

The Euro despite weak economic releases during this past week managed to hold ground against the US dollar which increases the possibility of a move higher in the short term.

Technical Analysis

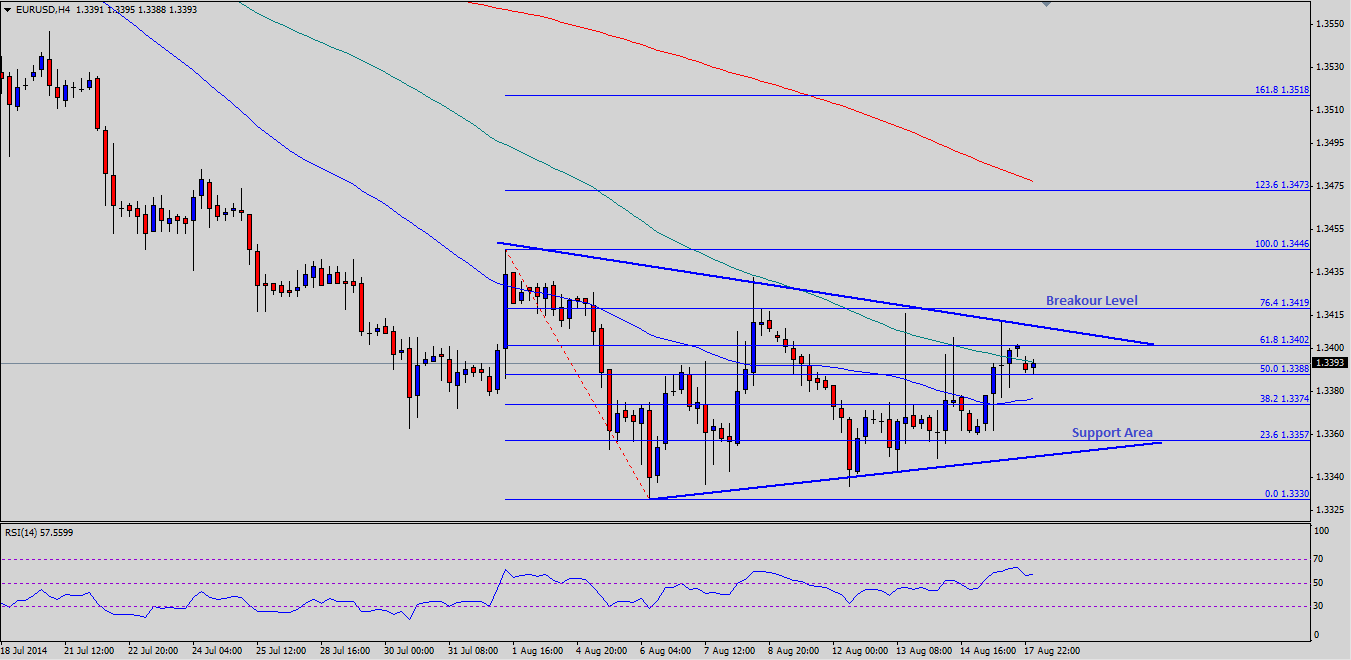

There is a very critical triangle forming on the 4 hour timeframe for the EURUSD pair, which is respected by the pair time and again. Recently, the pair climbed towards the triangle resistance area, but failed to break the same and headed back towards the 100 simple moving average (4H). The most important point to note here is that the pair has managed to close above the 50% Fibonacci retracement level of the last drop from the 1.3446 high to 1.3330 low. Moreover, the pair is trading above the 50 SMA (4H), which might provide a reason for the Euro buyers to take the pair higher in the short term. If the pair breaks the triangle resistance area, then ideal target after the break should be around the 1.236 extension level at 1.3473. Any further gains should see sellers around the 1.3510 resistance area.

Alternatively, there is a chance that the pair might drop from the current levels. In that situation, the 50 SMA (4H) could provide support, followed by the triangle support area around the 1.3350 level. If the pair breaks the triangle and moves lower, then a new low below the 1.3330 low would be possible.

Euro Zone Trade Balance

The Euro zone trade balance data will be published later during the London session by the Eurostat, which might impact the Euro moving ahead.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.