The U.S. Dollar has outperformed this week against a basket of major currencies, including the Euro, New Zealand dollar, Australian Dollar and Japanese Yen, as the recent economic data exceeded the Forecasts.Following better than expected retail sales data, it was the turn of CPI to come in stronger than consensus had hoped for, to help the U.S. dollar to recover some ground. The CPI figures exceeded the forecasts to register an increase of 0.2 percent in March.

The U.S. dollar traded higher against the Euro, British pound, Australian Dollar and Japanese Yen after the release. There was a noticeable shift in the market sentiment, which suggests that the recent rally in the dollar might have legs, but it faces a major hurdle on the way up.

Technical Analysis

U.S. dollar index recently found support around a critical area at 79.31 level.There is a major bullish trendline connecting all recent lows, sitting around the mentioned level. The most significant thing to note here is that the current rally faces a monster hurdle at 80.0 level, which represents 50.0% Fibonacci retracement level of the recent drop from 80.63 high to 79.31 low. A key simple moving average (50-day) also lies around the same level. So, sellers are expected to appear at 80.0.

There is a possibility of a break higher considering the sentiment shift, which might open the doors for a test of a crucial trendline connecting previous major highs at 80.60. It is very interesting that 200-day SMA waits around the same area to inspire sellers.

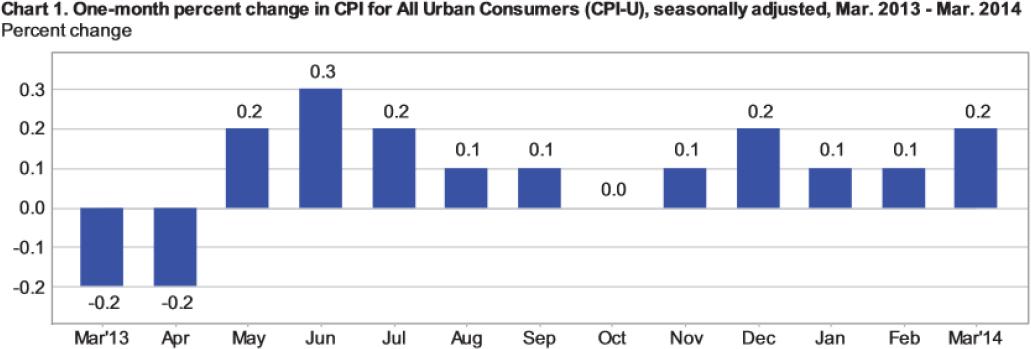

U.S. Inflation Report

Yesterday, the U.S. Consumer Price Index (CPI) figures were released by the US Department of Labor Statistics. The report suggested that the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in March on a seasonally adjusted basis, and over the last 12 months, the all items index increased 1.5 percent before seasonal adjustment. A key point to note from the report is that the higher housing and food costs helped lift overall consumer prices last month, which could encourage some Federal Reserve officials to continue backing tapering.

The report also highlighted that “the index for all items less food and energy has increased 1.7 percent over the last 12 months, as has the food index”. This suggests that core inflation continue to strengthen this year.

Overall, back-to-back improved economic data would certainly encourage the dollar bulls, and as long as the market sentiment remains intact, aggressive buying might be a possibility.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.