Technical Bias: Bullish

Key Takeaways

US dollar corrected sharply Intraday which can be seen as a stop hunt for the next trend move.

EURUSD was one of the major gainers as it posted a massive correction of more than 60 pips considering the current market sentiment for the Euro.

USDCHF got rejected around an important fib level at 0.9607.

Looking Ahead, there is a possibility of further retracement in the US dollar which can be considered as a buying opportunity.

Technical Analysis

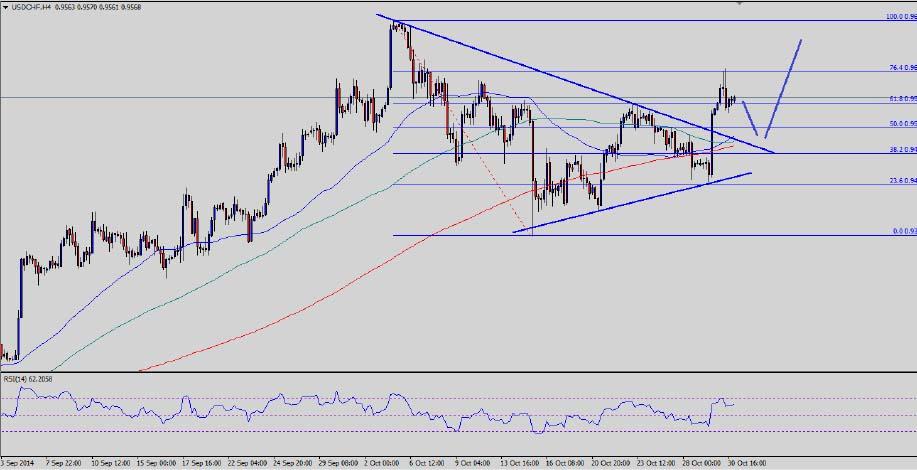

There was a monster triangle formed on the 4 hour timeframe for the USDCHF pair, which was breached earlier during this week. The pair climbed towards the 76.4% Fibonacci retracement level of the last drop from the 0.9683 high to 0.9362 low where it found sellers. There was a solid selling interest noted around the mentioned fib level, as the pair was completely rejected and moved lower. However, if it continues to move lower, then the broken triangle might come into play again. It could act as a support in the near term and the most important point is that the 100 and 50 SMAs are also sitting around the same area. So, the US dollar buyers might appear around 0.9500 to protect further downside and ignite a new trend moving ahead.

On the upside, the recent rejection level might continue to act as a monster resistance for the USDCHF pair. Only a break and close above the same could take it back towards the last swing high of 0.9683. In the medium term, a test of 0.9700 cannot be denied.

Moving Ahead

There are a couple of low-risk events lined up during the NY session today. The chance of a major move is very less and we might mostly witness ranging moves. We need to be very careful, as it is the month end and anything is possible in such conditions.

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold ascends but remains shy of testing $2,400 amid hawkish Fed remarks

Gold prices edged higher late in North American session, gaining 0.22% following a hawkish tilt by Fed Chair Jerome Powell. Economic data from the United States was mixed, though Monday’s Retail Sales report and Powell’s remarks kept US Treasury yields higher, capping the yellow metal’s advance.

Bitcoin price outlook amid increased demand and speculation pre-halving

Bitcoin price is edging lower as markets count only days to the halving. Nevertheless, the dump has not shaken the faith of large holders as they continue to cling to their holding even after a month of steady dumps.

UK CPI inflation data ahead: Sterling hovering north of key support

Following today's mixed bag of employment and wages data, today’s attention is directed to the March UK CPI inflation release. Both headline and core measures have surprised to the downside in the previous two releases and are expected to demonstrate further evidence of disinflation.