Technical Bias: Bullish

Key Takeaways

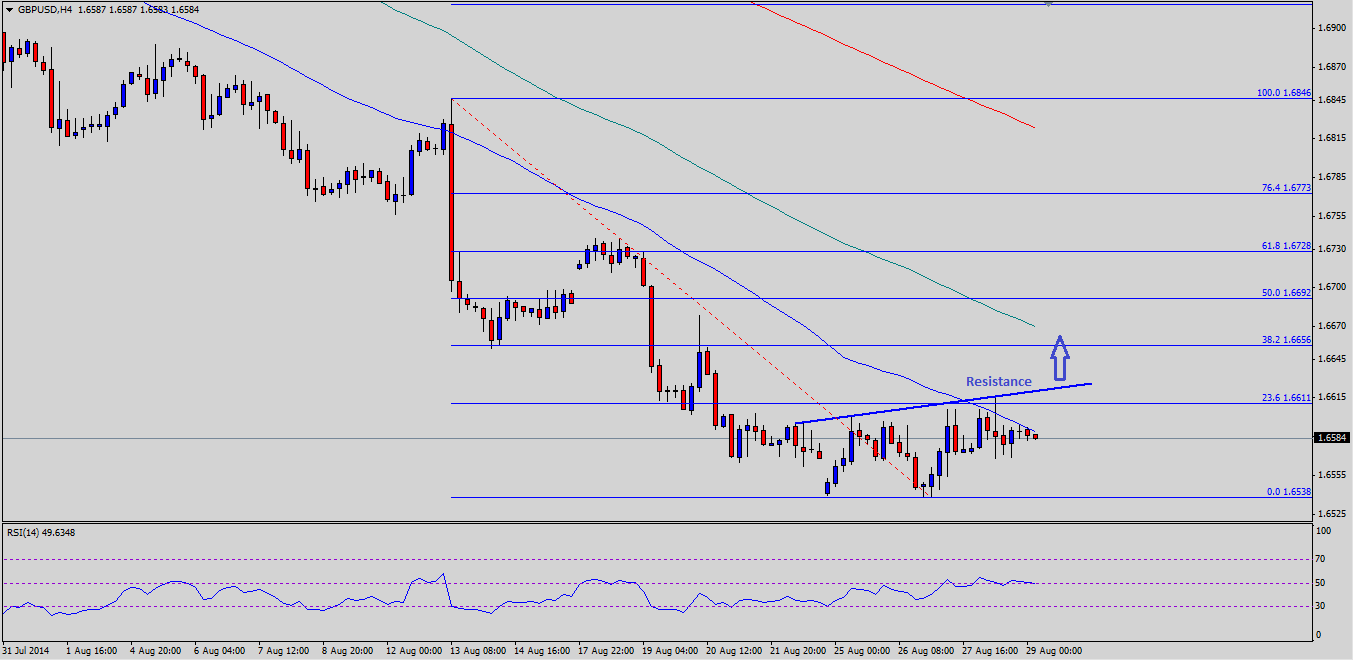

- British pound likely to trade higher against the US dollar as the GBPUSD pair formed a double bottom pattern.

- As long as the pair is trading above the 1.6538 level gains are favored.

- GBPUSD support seen at 1.6538 and resistance ahead at 1.6618.

The British pound weakness might take a pause against the US dollar, as there is a strong chance of a break higher if the GBPUSD pair manages to settle above the 1.6620 level.

UK Gfk Consumer Confidence

The UK Gfk Consumer Confidence was released by the GfK Group earlier during the Asian session. The forecast was of a small rise from -2 to -1. However, the outcome was better than expected, as the UK Gfk Consumer Confidence came in at 1.

Technical Analysis

The GBPUSD pair recently fell towards the 1.6540 support area and failed twice to break the same, which has raised the possibility of a double bottom pattern. There is a major bearish trend line formed on the 4 hour timeframe for the GBPUSD pair. Moreover, the 23.6% Fibonacci retracement level of the last drop from the 1.6846 high to 1.6538 low is also around the highlighted trend line at 1.6620. So, if the pair trades higher, and manages to close above the mentioned resistance level, then there might be a chance of the pair heading towards the 100 simple moving average (SMA) – 4H. The 50% fib retracement level also sits around the 100 SMA (4H). So, the British pound sellers could appear around the 1.6692 level.

On the other hand, if the GBPUSD pair fails to break higher, then a retest of the previous low of 1.6538 is possible. If sellers take control, then a break below the last low might call for more losses in the pair moving ahead.

Overall, as long as the pair is trading above the 1.6540 level buying dips might not be a bad option in the near term.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0600 as focus shifts to Powell speech

EUR/USD fluctuates in a narrow range above 1.0600 on Tuesday as the better-than-expected Economic Sentiment data from Germany helps the Euro hold its ground. Fed Chairman Powell will speak on the policy outlook later in the day.

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

Gold price remains depressed near $2,370 amid bullish USD, lacks follow-through selling

Gold price (XAU/USD) attracts some sellers during the early part of the European session on Tuesday and reverses a major part of the overnight recovery gains from the $2,325-2,324 area, or a multi-day low.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

Canada CPI Preview: Inflation expected to accelerate in March, snapping two-month downtrend

The Canadian Consumer Price Index is seen gathering some upside traction in March. The BoC deems risks to the inflation outlook to be balanced. The Canadian Dollar navigates five-month lows against the US Dollar.