Post:

It was perhaps a surprisingly strong start to the week for the U.S. Dollar, especially given the way that given the meltdown in equities, and the relatively soft to mixed Non Farm Payrolls for January at 152,000, one might have expected the greenback to be on the back foot.

Presumably, the wait for the forthcoming speech from Fed Chair Janet Yellen has the market going for the idea of at least one more interest rate rise later this year.

Cable: Below 50 Day Line Risks $1.4150

The points to note here on the daily chart are the way that this market missed hitting the 50 day moving average now at $1.4684, with the initial journey for Monday back to the 10 day moving average at $1.4410. The risk now is that an end of day close back below the 10 day line later today could lead this cross back to the last January support at $1.4150 as soon as the end of this week. This is especially so given the loss of the neutral RSI 50 level to leave it at 46.

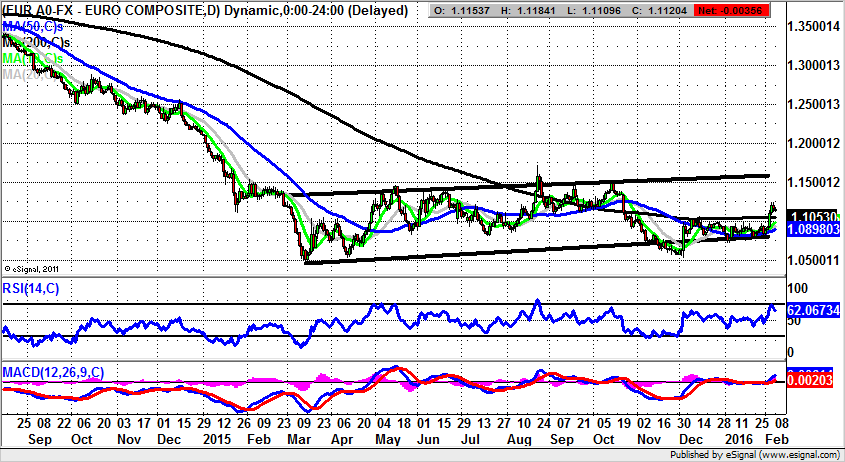

Euro/Dollar: Test Of 200 Day Line Ahead Of $1.15 Plus

It really does look as though the move by the Bank of Japan to reduce interest rates to a negative level was the last throw of the dice as far as getting growth / inflation back into the economy. However, the sharp decline in Dollar / Yen from above 120 and the 200 day moving average at 121.43 implies that traders have picked on this desperate move as suggesting that the much vaunted Three Arrows strategy to stimulate the economy is all but out of momentum. This leaves the cross starting the main 115.50 – 116 support zone of the past year and more in the face, with the likelihood being that as little as an end of day close back below 115.57 – the December 2014 low could trigger a multi Yen move to the downside.

On this basis former October 2014 resistance at 110 looks to be the best that the bulls may get away with over the next 4-6 weeks.

Only back above the 10 day moving average at 118.55 would even begin to delay the breakdown argument.

We are not authorised by the Financial Conduct Authority of England and Wales. The information and/or data on this website is provided by us and any data providers which may be used by us for your general information and use only and is not intended for trading purposes or to address your particular financial or other requirements. In particular, the information and/or data on the website:

(1) does not constitute any form of advice (financial, investment, tax, medical, legal, spread -betting or otherwise); and (2) does not constitute any inducement, invitation or recommendation relating to any of the products listed or referred to; and (3) is not intended to be relied upon by you in making (or refraining to make) any specific investment, placing any bet or making any other decision; and (4) has not been issued or approved by Tip TV for the purposes of section 21 of the Financial Services and Markets Act 2000 (as amended from time to time).

Opinions expressed by speakers in the videos, writers of the blogs are only opinions and not expert advice. These opinions do not necessarily agree with those held by Tip TV, its directors, agents or employees who disclaim any intent to make betting, securities or securities markets recommendations. The value of investments and the income derived from them may fall as well as rise. APPROPRIATE EXPERT INDEPENDENT ADVICE SHOULD BE OBTAINED BEFORE MAKING ANY INVESTMENT, PLACING ANY BET OR MAKING ANY OTHER DECISIONS.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.