Avon Rubber (AVON): Intermediate Rally To 870p Expected

Avon Rubber is an interesting play, as it has been mentioned on TipTV several times in the recent past, as a stock which may be one with potential. This was said both on a technical and fundamental basis. Alas, the early 2016 volatility on the stock market rather spoiled the bull scenario, with Avon Rubber shares suffering the “baby thrown out with the bath water” syndrome. This took the stock back down to the 700p zone for February on a brief basis, noticeably marginally higher than the former 2015 floor at 687p intraday.

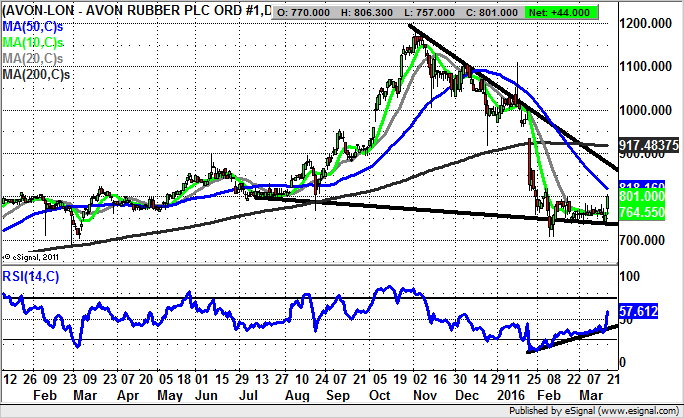

All of this suggests that we should go with the idea of at least an intermediate recovery here, especially given the way that it is possible to draw a multi tested uptrend line in the RSI window from as long ago as the end of January, well before the shares bottomed out. Also helpful is the way that the RSI now at 57 has pushed back above neutral 50 for the first time since early December, a decent leading indicator on further upside.

The message now is therefore that at least while there is no end of day close back below the 10 day moving average at 764p we could be treated to at least a decent intermediate rebound. The favoured destination at this point is the November resistance line projection at 870p, a target which could be hit as soon as the next 4-6 weeks given the latest pace of recovery here so far.

Gulf Keystone (GKP): Outside Chance Of A Dead Cat Bounce

Given the way that even the greatest fan of Gulf Keystone would admit that this is company where practically everything that could go wrong has gone wrong, to see the shares still with us is something of a result. Nevertheless, it is difficult to pretend that the position here is not precarious, and that at any time the worst could happen.

But at least from a technical perspective one can say we are looking at a situation where there is an outside chance of an intermediate recovery – IF – we see a continued reaction off an August support line currently running at 6p. The implication is that provided there is no end of day close back below this number there may be a test of former 10p zone support from January on a 1 month timefame – as much as on the basis that the RSI at 24 is in the oversold zone as anything else.

The best case scenario on offer at the moment would appear to be a move to the area of the September resistance line projection / 50 day moving average at 13.46p, but it has to be admitted, this does feel as though it is a long way away.

Otherwise, below 6p on a weekly close basis and one would be fearful that the slow death experience here continues as it has done for the past 2-3 years.

We are not authorised by the Financial Conduct Authority of England and Wales. The information and/or data on this website is provided by us and any data providers which may be used by us for your general information and use only and is not intended for trading purposes or to address your particular financial or other requirements. In particular, the information and/or data on the website:

(1) does not constitute any form of advice (financial, investment, tax, medical, legal, spread -betting or otherwise); and (2) does not constitute any inducement, invitation or recommendation relating to any of the products listed or referred to; and (3) is not intended to be relied upon by you in making (or refraining to make) any specific investment, placing any bet or making any other decision; and (4) has not been issued or approved by Tip TV for the purposes of section 21 of the Financial Services and Markets Act 2000 (as amended from time to time).

Opinions expressed by speakers in the videos, writers of the blogs are only opinions and not expert advice. These opinions do not necessarily agree with those held by Tip TV, its directors, agents or employees who disclaim any intent to make betting, securities or securities markets recommendations. The value of investments and the income derived from them may fall as well as rise. APPROPRIATE EXPERT INDEPENDENT ADVICE SHOULD BE OBTAINED BEFORE MAKING ANY INVESTMENT, PLACING ANY BET OR MAKING ANY OTHER DECISIONS.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.