Content:

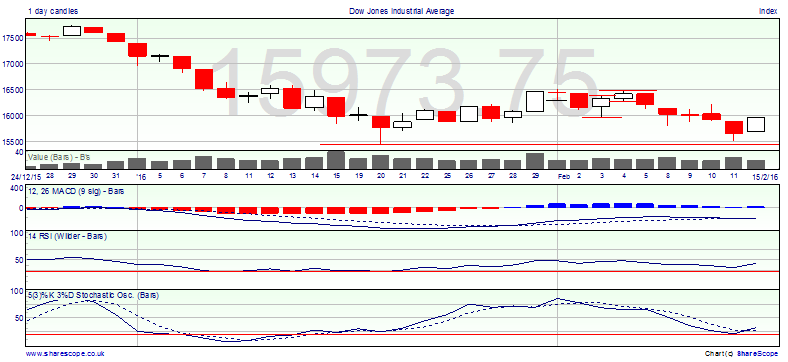

The technical indicators in the DJIA remain on the 'buy' bandwagon, but the US market equity index has seen its share of false signals in the past. We look at the possible trend ahead in the Dow Jones.

Momentum:

MACD: Positive

RSI: Neutral Trend

Stochastic: Buy

Daily Price Action Trend: Negative

Last relevant high: 16,485.8

Last relevant low: 15,503.0

Comment:

Oil rallied Friday and helped drag the Dow higher (which in turn helped lift all major markets), not to look like we are repeating ourselves from the FTSE report… the way to trade this market will come down to personal preference, but let’s look at the facts:

A buy pattern has been formed, which will remain in play unless by the close of trading 15,691.5 has been broken without 15,974.0 being bettered.

We have a buy on the MACD and a new buy signal on the Stochastic, so two out of three momentum indicators are positive.

Due to the odd session on the 10th, we could argue that a break above 16,202.0 could indicate a change of trend, that is just over a 200 point upward move from here which could easily be completed in a single session.

With the Dow, we have had so many false signals in the past couple of weeks it may be tempting to simply follow this candlestick move, after all they can’t all cost money, can they?!

The technical setup is more positive than the FTSE, but it was only last week it looked as if we had the four riders of the market apocalypse on the horizon… We at tiptv are old enough to know to ignore the majority of news flow and just follow the charts but we generally agree that a gentle approach should be taken when buying into this market whilst the daily trend remains negative.

We are not authorised by the Financial Conduct Authority of England and Wales. The information and/or data on this website is provided by us and any data providers which may be used by us for your general information and use only and is not intended for trading purposes or to address your particular financial or other requirements. In particular, the information and/or data on the website:

(1) does not constitute any form of advice (financial, investment, tax, medical, legal, spread -betting or otherwise); and (2) does not constitute any inducement, invitation or recommendation relating to any of the products listed or referred to; and (3) is not intended to be relied upon by you in making (or refraining to make) any specific investment, placing any bet or making any other decision; and (4) has not been issued or approved by Tip TV for the purposes of section 21 of the Financial Services and Markets Act 2000 (as amended from time to time).

Opinions expressed by speakers in the videos, writers of the blogs are only opinions and not expert advice. These opinions do not necessarily agree with those held by Tip TV, its directors, agents or employees who disclaim any intent to make betting, securities or securities markets recommendations. The value of investments and the income derived from them may fall as well as rise. APPROPRIATE EXPERT INDEPENDENT ADVICE SHOULD BE OBTAINED BEFORE MAKING ANY INVESTMENT, PLACING ANY BET OR MAKING ANY OTHER DECISIONS.

Recommended Content

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD clings to moderate gains above 1.2450 on US Dollar weakness

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold price shines amid fears of fresh escalation in Middle East tensions

Gold price rebounds to $2,380 in Thursday’s European session after posting losses on Wednesday. The precious metal holds gains amid fears that Middle East tensions could worsen and spread beyond Gaza if Israel responds brutally to Iran.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.