AUD: CB Leading Index rises to 0.4% vs 0.2% expected but did little to help slow down the AUD declines.

CNY: Manufacturing PMI fell short of expectations at 50.3 vs 51.5 forecast, making it a 3-month low and adding further bearish sentiment to AUDUSD for intraday traders.

JPY: Manufacturing PMI fared better to beat expectations and sit at

NZD: Credit Card spending y/y has slowed growth to 4.5% vs 6% previously.

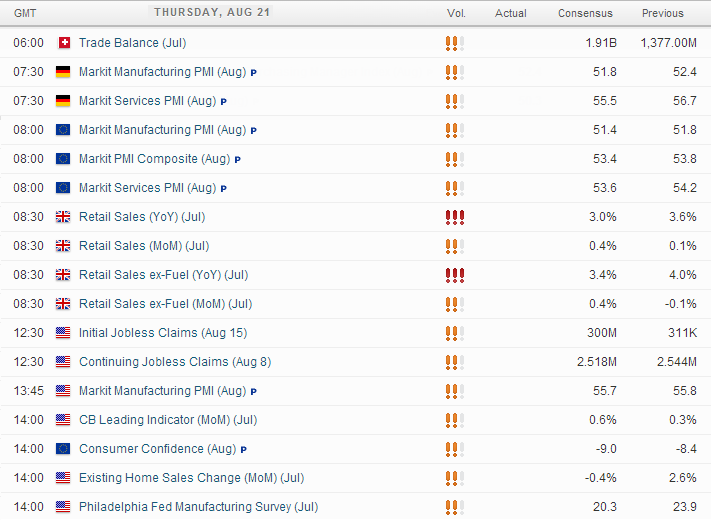

UP NEXT:

EUR: The Eurozone is all about PMI data tonight with manufacturing and services out for France, Germany and Eurozone. The German economy had continued to cool off and struggling to prop the Eurozone up. Previously I had suspected EURUSD would form a base at 1.33 and see gains with positive news but due to a shift in sentiment from FOMC the Euro crosses remain in 'sell the rally mode'. It would take particularly good data from France, Germany and Euro tonight to shift this sentiment, as the Greenback remains very much in the driving seat.

GBP: The UK is in need of some good data to help slow the bleeding as it continues to print fresh new lows. A similar case with Euro, it would take particularly good data to stop the bearish trend on GBPUSD as Greenback remains to take control of FX. Even under this scenario, it is more likely to be corrective over a complete reversal.

USD: Can tonight's data add to the bullish fire? Quite possible if we see enough of it coming in on (or above) target. However also keep in mind that as we approach the weekend that traders may hang back awaiting comments from Draghi and Yellen so if we see continued gains, they may not be at the same rate seen for the previous 3 sessions.

TECHNICAL ANALYSIS:

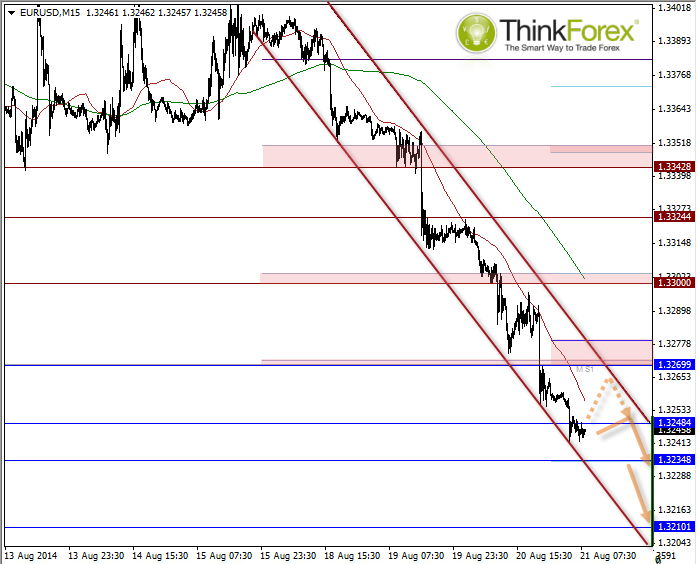

EURUSD: The trend is clear - will Eurozone data dump back it up?

The intraday timeframes are within a bearish channel and in the event of modestly positive news from Europe tonight we may see a retracement towards resistance and provide yet another opportunity to get short. As long as we remain below 1.327 then short positions are preferred to target 1.320.

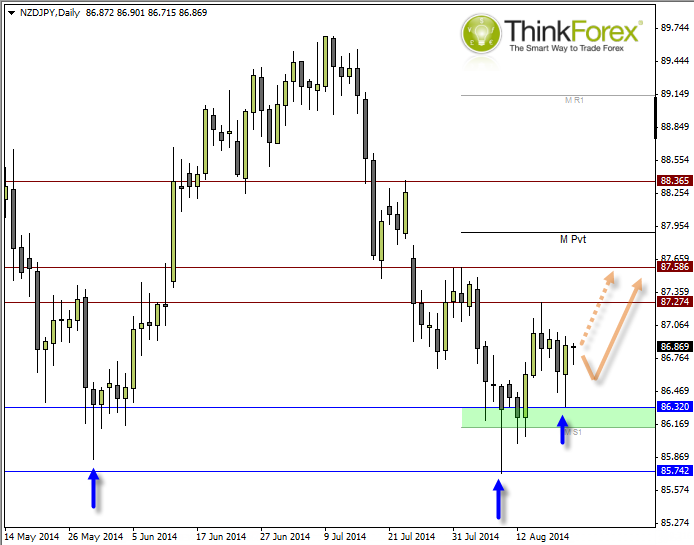

NZDJPY: May provide clues for the falling Kiwi

It is no secret that the Kiwi Dollar has been having a tough time of late. However I am suspecting that NZDJPY may provide clues that the Kiwi Dollar sell-off (across the board) is a little overdone and may provide bullish opportunities in NZDJPY, or other kiwi pairs.

If you think of an Index such as the Dow Jones Industrial pick a day when a market bottomed (such as 2010 post-GFC) then explore which stocks bottomed on the same day, you will discover that some came earlier, some on the day and other later. Forex is the same - not all currencies top/bottom at the same time.

With NZDJPY producing higher highs/lows on smaller timeframes and producing bullish candles on D1, H4 and H1 we can consider bullish trades on lower time’s frames or seek a buy-limit on D1 to trade up to next resistance. It can also be used as a clue for EURNZD and AUDNZD shorts (although these may require a little more patience).

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.