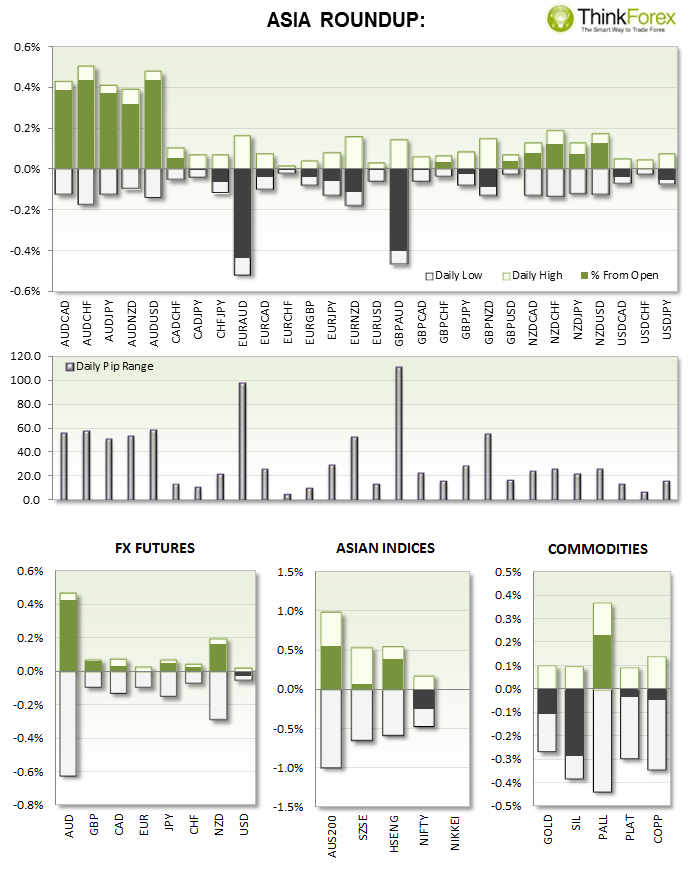

The Australian Dollar stole the show due to inflation figures hitting target, and probably eradicating any fears of a rate cut this year. Had ot not been for the Australian data then the session would have been quiet across the board for FX.

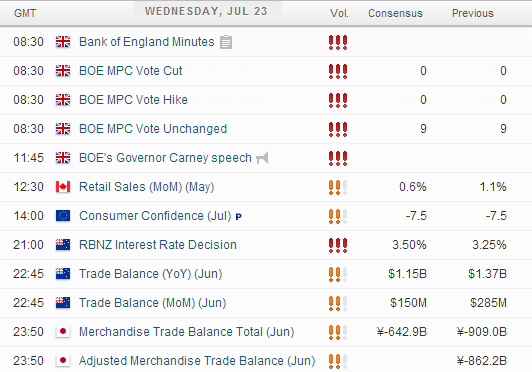

UP NEXT:

BoE MPC Votes: Traders will be looking to see if the last rate decision (to keep on hold) was unanimous, as it has been previously, or if some voting members are beginning to vote for a rate increase. If so we can expect this to be a bullish sign of cable which currently rests above key support.

CAD Retail Sales: Expected to be growing at a slightly slower rate of 0.6%. Anything at or above this level could see USDCAD retrace towards (and possibly below) 1.07 support. However any poor numbers here should be USDCAD bearish and see USDCAD trade closer to 1.080 resistance.

RBNZ Rate Decision: Please view today's post for an overview of this release

TECHNICAL ANALYSIS:

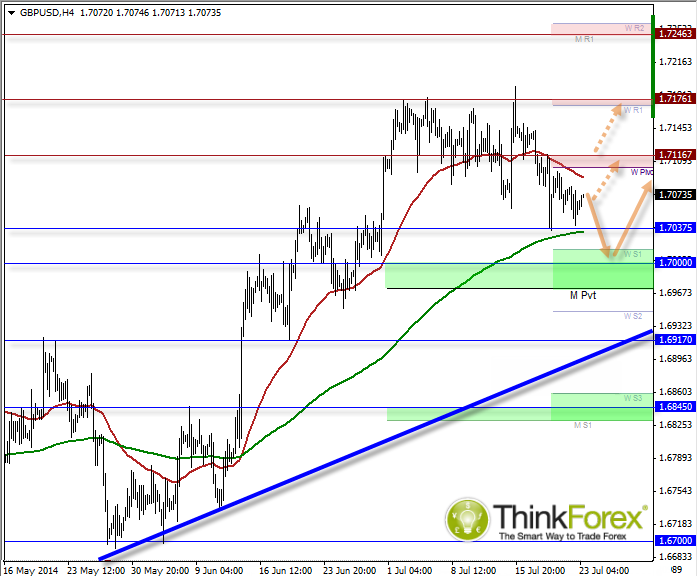

GBPUSD: The voting members should dictate Sterling moves today

The key levels have remained fairly consistent these past few weeks but the daily timeframe is making suggestions of a potential base forming (not pictured). Yesterday closed with a 2nd bullish hammer above 1.704 support to suggest a swing low is forming.

However I am also keeping in the back of my mind for a retest of 1.07 before gains continue. That said for a bullish move we would require some of the voting members to have switched from neutral to 'rate hike'. We can only assume that if they remain unanimous (neutral) then a retest of 1.07 is more likely.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD flirts with 1.0700 post-US PMIs

EUR/USD maintains its daily gains and climbs to fresh highs near the 1.0700 mark against the backdrop of the resumption of the selling pressure in the Greenback, in the wake of weaker-than-expected flash US PMIs for the month of April.

GBP/USD surpasses 1.2400 on further Dollar selling

Persistent bearish tone in the US Dollar lends support to the broad risk complex and bolsters the recovery in GBP/USD, which manages well to rise to fresh highs north of 1.2400 the figure post-US PMIs.

Gold trims losses on disappointing US PMIs

Gold (XAU/USD) reclaims part of the ground lost and pares initial losses on the back of further weakness in the Greenback following disheartening US PMIs prints.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.