JPY government sees FY14 economic growth of 1.2%, down from 1.4% projected earlier.

CNY leading Index m/m is nearly double the previous month, at +1.3% vs +0.7% in June, making it the highest anticipated rate of growth this year.

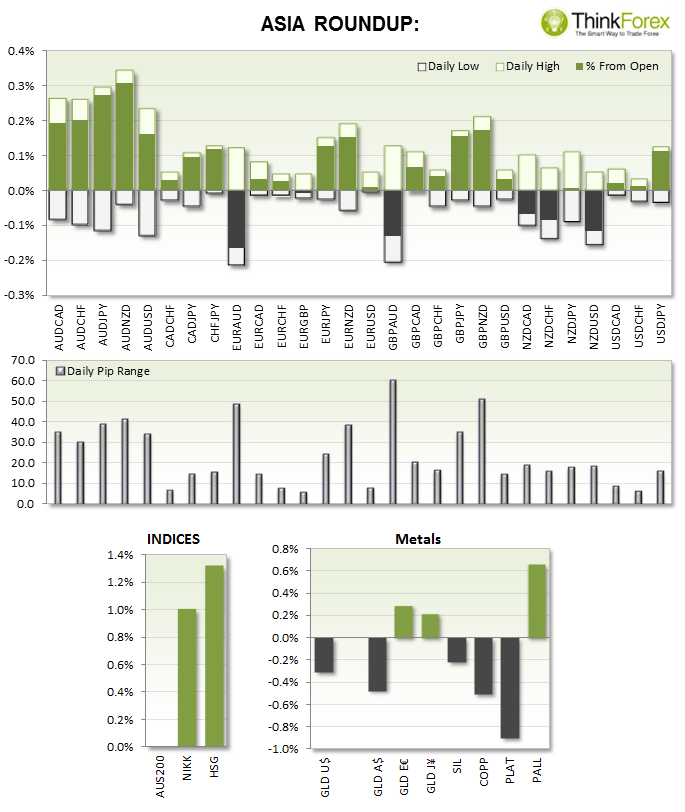

RBA Glenn Stevens said in a speech today it is impossible to judge if QE was worked. AUDUSD gained due to the lack of jawboning, spiking up to 0.9394

Russian Ambassador tells Malaysia that Rebels are not behind the downing of flight M17; It is too soon to tell who was responsible for the crash; Rebels do not possess any defence air systems capable of hitting on elevation at 10,000m; Ukrainians do possess these kind of systems.

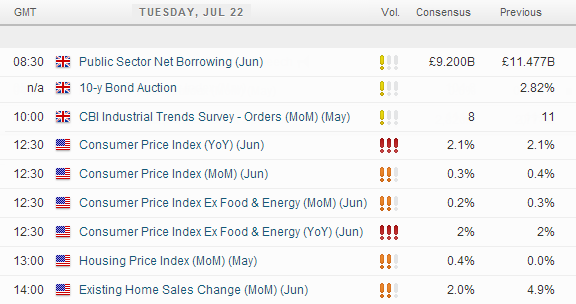

UP NEXT:

The US provides headline figures tonight with CPI y/y. Positive numbers should see the greenback (DXY) remain above 80.50 support and bring downward pressure on AUDUSD, GBPUSD and EURUSD. However with USD remaining above 1.07 it may provide decent long opportunities up towards 1.080 resistance.

TECHNICAL ANALYSIS:

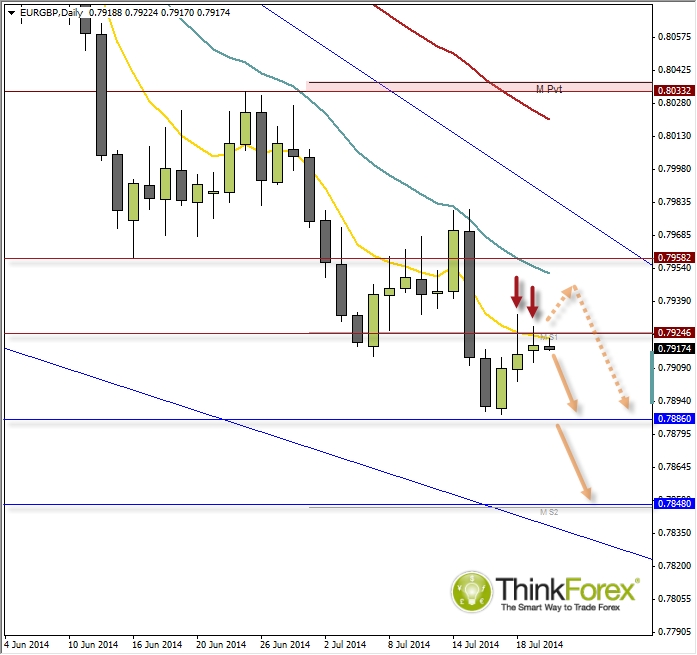

EURGBP: Setting up for a swing trade short?

To continue from yesterday's analysis we have now produced an 'inside' candle which is also a spinning top, below resistance. The fact it has respected resistance and failed to take out the high of the Shooting Star adds extra confidence we may be aligning up for anther leg down.

GBPCHF: Seeking buy setups above 1.53

There is potential for a double bottom to form and target the 1.54 swing highs. I have highlighted 2 key candles which have respected support levels on relatively high volume, to suggest buyers propping up price above support.

The more significant clue of the two is the 2nd candle, as it is the highest volume candle since price rejected 1.53 and the open and close are at the same level (bullish pinbar) to suggest a 'change in hands' during the decline.

We may see a retracement back within the green buy zone, but overall the bullish bias remains as long as we remain above 1.53.

With Swiss Trade balance tonight, a poor number should help GBPCHF bullish bias along the way.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.