ASIA ROUNDUP:

Despite falling below estimates of 2.8%, Tokyo Core CPI has grown the fastest pace since 1992 coming in at 2.7% vs 1% last month.

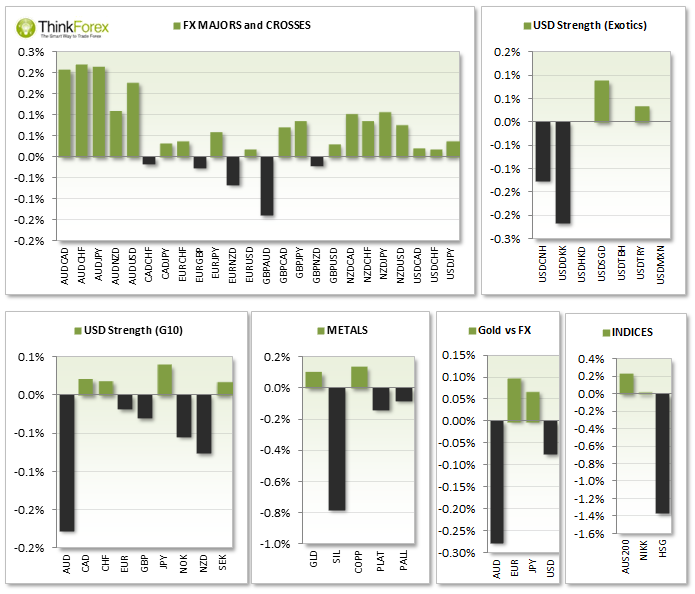

JPY is strengthening due to unwinding of carry trades and flow into safe havens before the weekend due to Ukraine Tensions

AUD and NZD retreated sheepishly from their recent losses, more likely fueled by profit taking than fresh buying

UP NEXT:

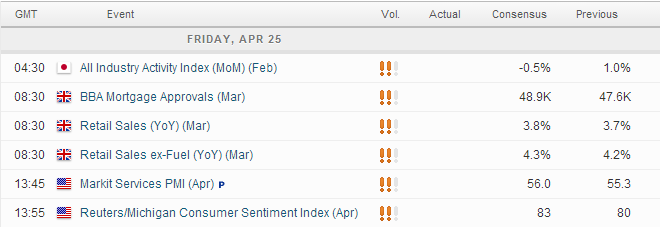

Retail and housing data for UK released simultaneously today should see some life in GBP pairs.

GBP Retail sales is forecast lower at -0.4% - this is a volatile release which should be positive for GBP if it comes in above expectations, particularly 0.1% or above

GBP mortgage approvals is within a strong uptrend but last month’s release was the 1st decline 4 months. However today's forecast of 48.9k is above last month's, so a bad number could cause fears of a larger pending downturn in mortgage approvals.

US Services PMI and Consumer Sentiment finish the week off with any numbers below expectations could help the near-term USD bearish bias

Markets to Monitor: DXY, USDJPY, USDCHF, EURUSD, NZDUSD, DAX, GBPJPY, GOLD

TECHNICAL ANALYSIS:

EURUSD: Above 1.3825 targets 1.3855-62

Whilst the price action is messy the bullish bias today is mainly driven by the bearish reversal candles below 80 on DXY (which is 57% weighted to EUR).

1.38225 is a good confluence of support as it comprises of weekly/daily Pivots and the horizontal level itself of 1.3825

A break below here would favour bearish signals below the daily pivot,

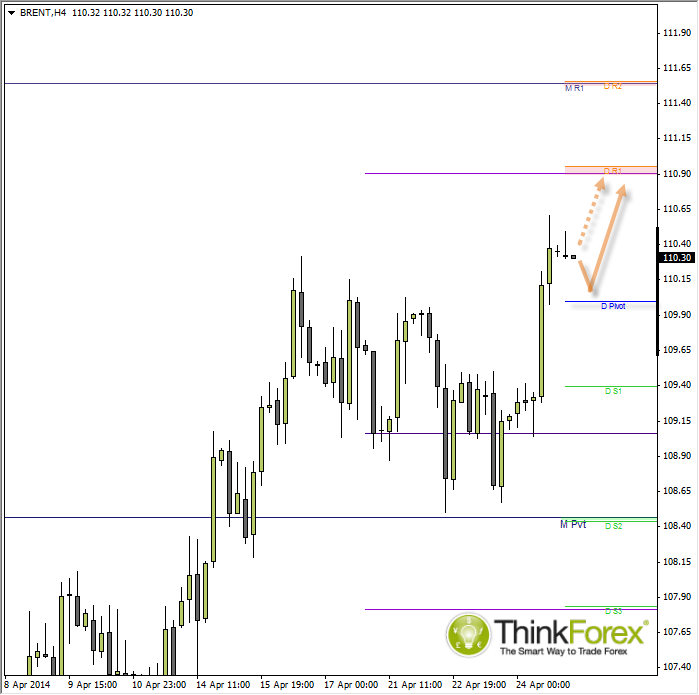

BRENT: Onwards and upwards - Targeting $110.90

Yesterday's analysis played out very well although it did fall just short of our $110.80 target. This has now been raised slightly after the daily pivot points have been recalculated.

The bullish bias remains the same but hopefully we will see a retracement towards the daily pivot at $110 before the next leg up.

Due to the bullish momentum of yesterday's move it strongly favours a continuation over a deeper retracement (or reversal). A break below $110 will call for different trading (preferably lower timeframes on the bearish side) as we will then be back within the messy correction, so expect some whipsaws below here.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0650 after PMI-inspired rebound

EUR/USD loses traction and retreats to the 1.0650 area after rising toward 1.0700 with the immediate reaction to the upbeat PMI reports from the Eurozone and Germany. The cautious market stance helps the USD hold its ground ahead of US PMI data.

GBP/USD fluctuates near 1.2350 after UK PMIs

GBP/USD clings to small daily gains near 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling stay resilient against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.