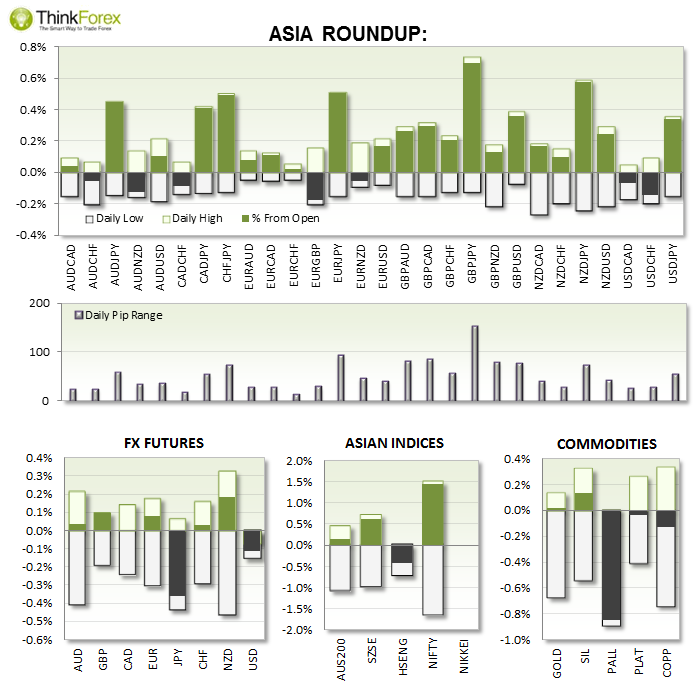

NZD: GDP q/q beat expectations by 0.1% to sit at 0.7%. This saw minor profit taking from NZDUSD shorts.

GBP: Traders are beginning to take positions in the lead-up to Scottish Referendum. This makes GBP crosses ones to consider before these events begin (GBPJPY in particular).

JPY: The weakest G7 currency and providing the cleaner trends during Asia. The question is whether this trend will continue during Europe and US session.

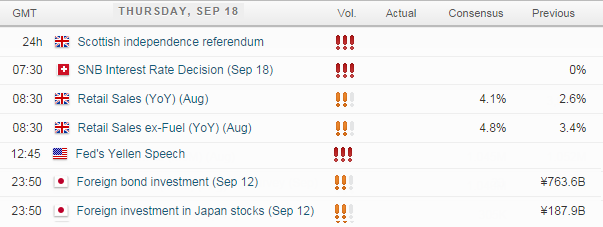

UP NEXT:

EUR: The ECB reveal how much money they are going to create as part of the LTRO program so volatility can be expected from the Euro crosses. If we are lucky this will be combined with directional moves too (as volatility and direction aren't always correlated)

GBP: Retail sales can be expected to take a back seat as all focus is on the Scottish Referendum. Please view the visual guide and webinar for a detailed trade plan for this historic session.

CHF: There is talk of SNB announcing negative interest rates. Whilst this should cause money to flow out of CHF, we could find it flowing back in again in the event of a Scottish YES.

USD: With FED Chair Lady Yellen speaking again tonight it will be interest to see if she elaborates further on the FED Dot Plot, lowered growth forecasts and forward guidance following yesterday's volatile session.

TECHNICAL ANALYSIS:

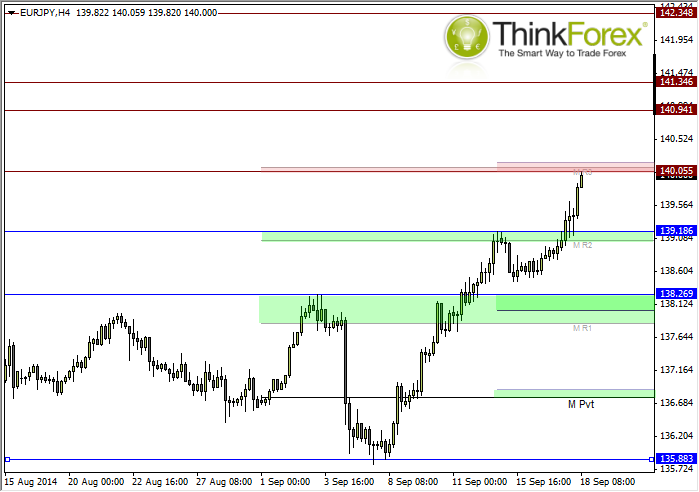

EURJPY: Bullish trend (For now)

Plenty of volatility on Euro crosses tonight so no directional bias is provided. However there are clear levels of S/R to consider to use for targets/stop placement/reversal patterns.

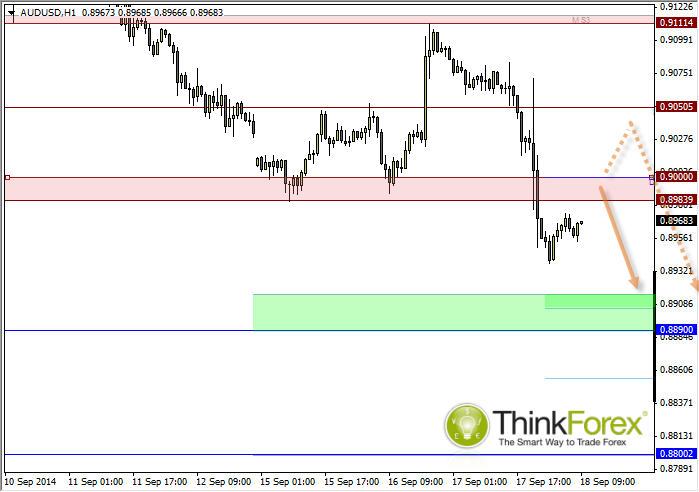

AUDUSD: Seeking to sell into any weakness below resistance levels

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.