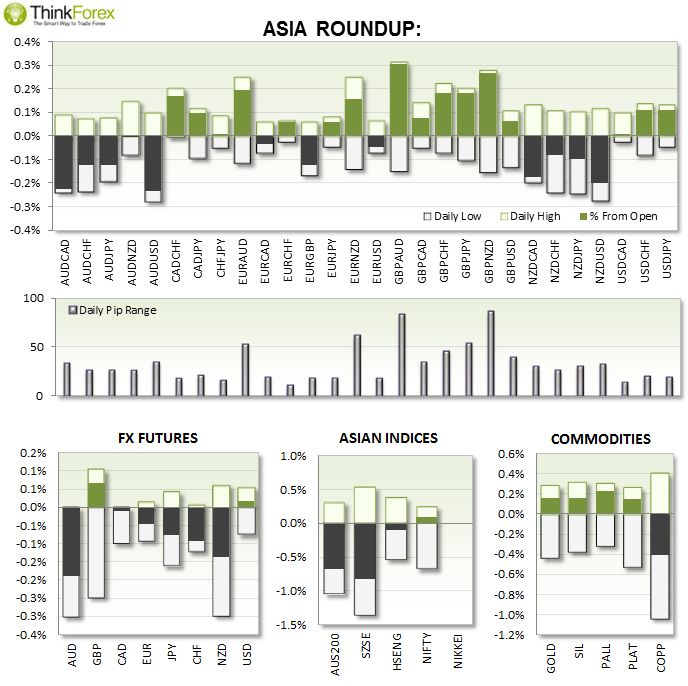

NZD: Current Account returns to deficit and below expectations at -1.07bn; Global Dairy Prices remain stable at 0%;

AUD: Leading indicators suggest consumers are more likely to to pay off debts and save instead of spend over coming years.

CNY: China injects $81bn (500 bn Yuan) into Banking system

UP NEXT:

Register for today's webinar for a breakdown of these key events.

TECHNICAL ANALYSIS:

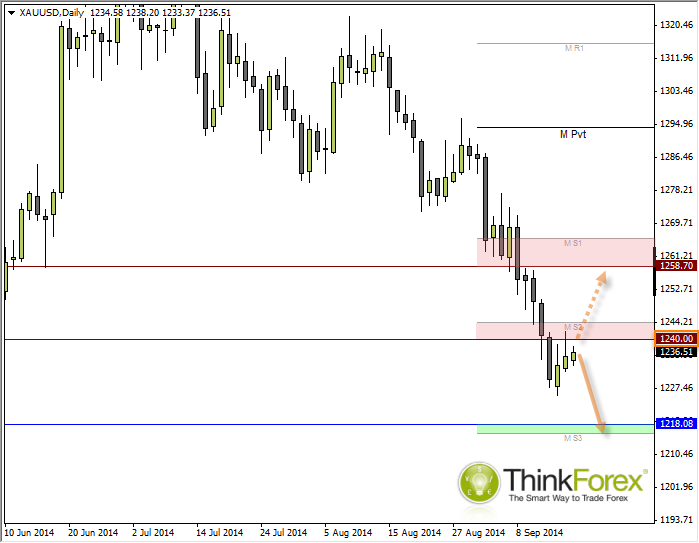

GOLD: $1240 is the key level to watch

Whilst this analysis may seem overly-simplistic, from a price point of view it is a very simple setup. Bullish above $1240 and bearish below. We just need the FED to make or break the Greenback tonight to provide the directional bias for Gold (and anything else in USD).

Yesterday's Shooting Star Reversal saw a high at the resistance zone and price now hovers around the midway point of yesterday's range. Leading up to tonight's FOMC/FED meetings if we see clear USD strength then we can expect $1240 to cap as resistance.

A clear break above $1240 would open up $1258 as a bullish target.

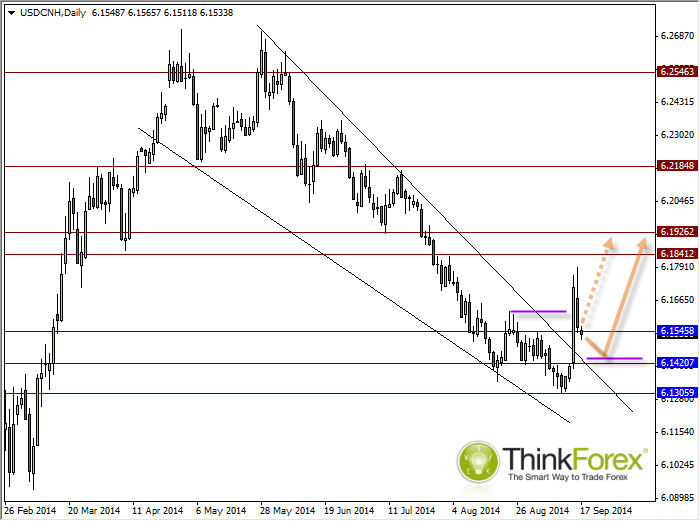

USDCNH: Breakout confirmed; Seeking buy setups

This was originally highlighted on Monday's Daily Insight, just prior to the bullish breakout of the potential bullish wedge.

If you missed it do not fret, as I tend to find breakouts more reliable to enter following the breakout itself. We can see that price has closed with a Dark Cloud cover to suggest a deeper retracement may be on the cards. However because the initial breakout was well clear of a prior swing high (purple lines) I am assuming we are at the beginning of a new trend and seeking to enter long if I see bullish setup at support levels.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.